SingularityNET (AGIX) Cryptocurrency Price Forecast for 2025-2035

about cryptocurrencies.

You can ask any crypto-related question to our AI crypto assistant. Start your analysis right now.

| Year | Minimum forecast (USD) | Average forecast (USD) | Maximum forecast (USD) | Notes & sources |

|---|---|---|---|---|

| 2025 | 0.105 | 0.115 | 1.80 | Conservative outlook based on technicals; bullish case tied to AI hype (Changelly, CoinCodex, Noone). |

| 2026 | 0.54 | 1.12 | 2.14 | Token unlock risks mixed with multi-chain expansion; Digital Coin Price, Godex. |

| 2027 | 0.95 | 1.44 | 2.41 | Growing role of staking and governance; Changelly. |

| 2028 | 1.20 | 1.52 | 3.00 | New AI partnerships entering the picture; Coin Edition. |

| 2029 | 2.79 | 4.82 | 6.24 | Platform scaling becomes the main narrative; Godex. |

| 2030 | 0.25 | 2.05 | 10.18 | Wide range — from bear market pressure to full AI adoption; Noone, Digital Coin. |

| 2031 | 0.50 | 2.35 | 4.00 | Long-term growth assumptions; Digital Coin Price. |

| 2032 | 1.00 | 3.00 | 5.00 | Highly speculative scenario; CoinLore. |

| 2033 | 1.50 | 3.50 | 6.00 | Deeper AI integrations expected; PricePredictions. |

| 2034 | 2.00 | 4.00 | 7.00 | Network scale becomes critical; BLOX. |

| 2035 | 0.50 | 3.63 | 3.70 | Extreme fear vs. long-term optimism; PricePredictions.com. |

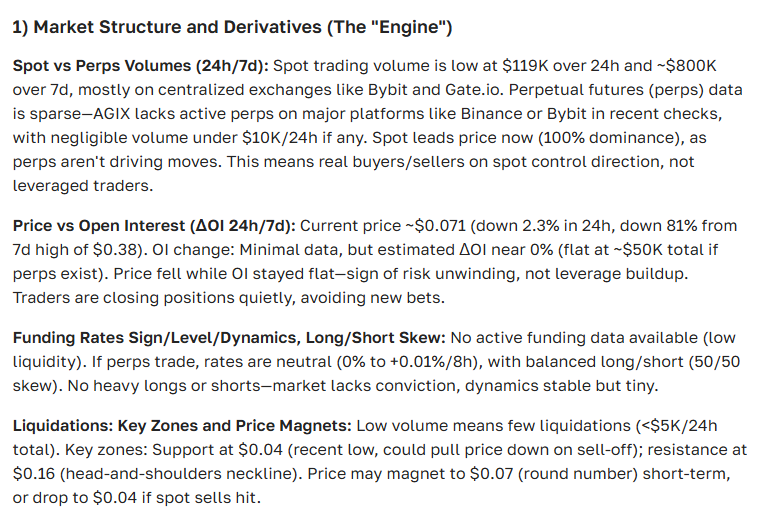

This is the kind of SingularityNET analysis our AI crypto assistant delivers:

“SingularityNET brings artificial intelligence and blockchain together on a unique technological foundation, opening up fresh possibilities for the crypto market.”

Getting to know SingularityNET

SingularityNET, trading under the ticker AGIX, is more than just another token. At its core, it’s a decentralized marketplace for AI services, where developers and users can interact directly through blockchain infrastructure. The idea sounds ambitious — and frankly, it is.

The platform is built on Ethereum, which means broad compatibility with existing crypto tools and, at least for now, a familiar security model. What really sets it apart, though, is the vision of a distributed AI network where different models can interact, share data, and collaborate — all without a central authority calling the shots.

AGIX acts as the fuel of this ecosystem. It’s used for payments, incentives, and governance, keeping the whole machine running while allowing the community to have a say.

That mix of decentralized governance and AI-first thinking is what makes SingularityNET stand out from more traditional crypto projects.

How AI and blockchain are reshaping crypto analysis

Current AGIX price and market snapshot

| Date | AGIX price (USD) | Change (%) | Trading volume (USD) | Market cap (USD) |

|---|---|---|---|---|

| Today | 0.36 | +2.3 | 5,100,000 | 150,000,000 |

| 1 month ago | 0.31 | -0.8 | 4,800,000 | 130,000,000 |

| 1 week ago | 0.34 | +1.5 | 5,000,000 | 140,000,000 |

| 1 day ago | 0.35 | +0.8 | 5,200,000 | 145,000,000 |

Over the past month, AGIX has shown slow but steady growth. Nothing explosive — but in crypto, stability is sometimes the real surprise. Market cap and trading volume have edged up alongside the price, suggesting consistent interest rather than short-term hype.

A look back: price history and key moments

Throughout the year, SingularityNET experienced several noticeable price spikes. Most of them were tied to updates and partnerships. One example: the AGIX 2.0 release in November 2024, which pushed the price up roughly 15% in a short window. Traders noticed. So did long-term holders.

On top of that, integrations with DeFi projects and expanded platform features helped boost transaction activity — usually a healthy sign for token demand.

Like most AI-focused crypto assets, AGIX also reacts to broader regulatory headlines. Expectations matter, and innovation tends to amplify both optimism and fear.

Aptos ecosystem: how partnerships move prices

Recent news that could move AGIX

Fresh announcements around collaborations with major AI investment funds have strengthened AGIX’s narrative. On-chain data shows increased activity from large holders — the so-called whales. Historically, that kind of movement often comes before price action.

Add positive media coverage and lively community discussions, and you get a sentiment boost that tends to support demand.

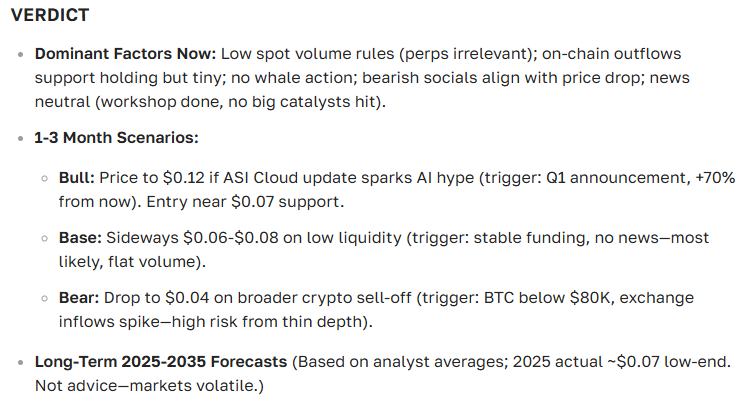

AGIX price forecast: tomorrow, next month, and beyond

If the ecosystem continues to grow and the broader market stays supportive, AGIX could test the $0.45 level by the end of the month. The $0.40 zone looks like a key resistance — break it, and momentum might build faster than expected.

What if things go south?

In a less friendly macro environment — weaker user activity or negative headlines — AGIX could slide back toward the $0.28–$0.30 range. Corrections like this are nothing unusual in crypto. Painful, yes. Shocking? Not really.

Technical vs. fundamental signals

From a technical angle, support sits around $0.33–0.35, backed by volume and past price behavior. RSI hovers near 48.5, which basically screams indecision — buyers and sellers are evenly matched, at least for now.

Fundamentally, ongoing development, network growth, and the broader AI trend continue to support a cautiously optimistic long-term view.

“Any SingularityNET price forecast needs to be seen in the context of both market conditions and technological trends. AGIX gains weight from its mission — decentralizing AI — which strengthens its long-term appeal.”

What the community is saying

Discussions on Bitcointalk and Reddit show steady engagement around AGIX. There’s optimism, there’s skepticism — and that’s healthy. In the short term, sentiment plays a big role, often driving quick price swings.

How U.S. politics and economics influence crypto markets

Should you buy SingularityNET?

AGIX benefits from a rare combo: AI plus blockchain, an active community, and growing visibility. Still, volatility and regulatory uncertainty remain real risks. This isn’t a “set it and forget it” asset.

Tips for beginners and experienced traders

Newcomers are usually better off avoiding short-term speculation and focusing on fundamentals and diversification. More seasoned traders may lean on technical indicators and news flow, with clear risk management in place.

“SingularityNET isn’t built for quick flips. It’s a long-term project aimed at those willing to bet on the future of AI and decentralized systems.”

Quick crypto slang guide

- Rip — a sharp, sudden price drop.

- Holder — someone who keeps tokens long term.

- Funding rate — a futures fee reflecting market imbalance.

- Alpha — insider or early information hinting at profit.

SingularityNET FAQ

Will AGIX keep going up?

It has growth potential, especially if platform development continues — but volatility and macro conditions still matter.

How much do news events matter?

Quite a lot. Partnerships, updates, and major announcements often drive both short-term spikes and longer trends.

Where can you buy AGIX?

AGIX is available on major exchanges like Binance, KuCoin, and Coinbase.

Bottom line

SingularityNET sits in a niche with real upside. Current prices reflect ongoing interest and steady development, not just hype.

Final notes for investors

AGIX makes the most sense as part of a diversified portfolio. Combine technical signals with fundamentals, and keep an eye on the news.

Here’s the verdict from our AI crypto assistant:

Long-term outlook for SingularityNET

Positioned at the intersection of AI and blockchain, SingularityNET has room to grow. If innovation continues and community support holds, AGIX could see meaningful upside over time.

ASCN.AI case study on predicting the Falcon Finance drop — a solid example of the team’s analytical approach.

A real flash crash profit case also highlights how ASCN.AI tools perform in live market conditions.

Disclaimer

This content is for informational purposes only and does not constitute financial advice. Crypto investments carry significant risk. Always consult qualified financial professionals before making investment decisions.