Nexo cryptocurrency forecast: price, outlook, and news for today and tomorrow

about cryptocurrencies.

Got a burning question about crypto? You can ask our AI assistant anything. Jump into the analysis right now.

| Year | Low (USD) | Average (USD) | High (USD) | Key Takeaways & Drivers |

|---|---|---|---|---|

| 2026 | 0.90 | 1.40 | 5.40 | Recovery is the name of the game here. As CeFi bounces back from the 2022–2024 slump and BTC potentially pushes past $150K, Nexo should follow suit. |

| 2027 | 1.10 | 1.80 | 6.50 | Adoption is picking up in Asia and the EU. New features—think stablecoin yields—and a close correlation with ETH 2.0 will likely drive growth. |

| 2028 | 1.30 | 2.20 | 7.80 | Better regulations (like MiCA) and bank partnerships are helping. We’re looking at a steady 25% year-on-year growth on average. |

| 2029 | 1.50 | 2.70 | 9.00 | DeFi goes mainstream, and Nexo acts as the bridge to old-school finance. Expect some volatility following the 2028 BTC halving. |

| 2030 | 1.80 | 3.50 | 10.30 | A long-term peak is on the horizon. Most forecasts, like CoinLore and Changelly, see Nexo focusing heavily on global compliance by now. |

| 2031 | 2.00 | 4.00 | 11.50 | Web3 integration becomes standard. While some conservative estimates place it lower, an optimistic 15% YoY growth feels realistic. |

| 2032 | 2.30 | 4.60 | 12.80 | Market stabilization. By this point, Nexo should be a Top-50 mainstay, though competition from Aave and Compound remains a factor. |

| 2033 | 2.60 | 5.30 | 14.20 | Potential for a new all-time high (ATH). DigitalCoinPrice suggests we’ll see a major global bull run in the early 2030s. |

| 2034 | 3.00 | 6.00 | 14.80 | The focus shifts to sustainability. Predictions average out around $13.08, but the $14.78 ceiling isn't out of reach. |

| 2035 | 3.40 | 6.80 | 16.50 | Looking way ahead, a 10–15% CAGR could push Nexo over the $15 mark. Main risks? Regulation and the next big competitor. |

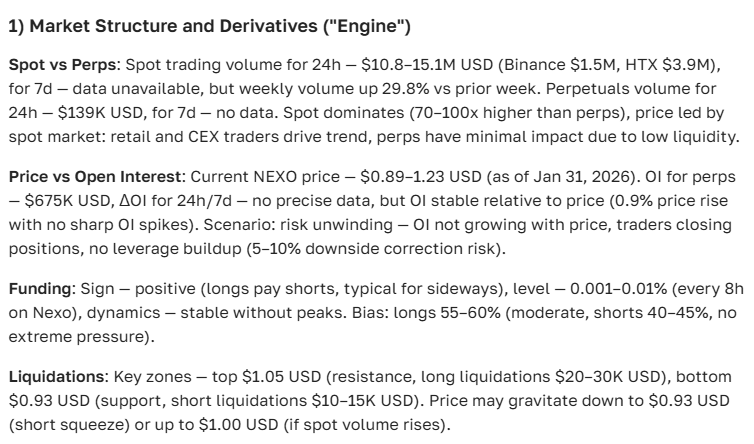

Here’s how our ASCN.AI assistant breaks down the Nexo analysis:

“Forecasting crypto isn’t just about the numbers; it’s about mixing market data, real-time news, and expert sentiment. Nexo has a unique setup that you need to watch closely to see where it’s actually headed.”

Where is Nexo sitting right now?

To figure out where we're going, we have to look at how Nexo has been behaving lately. In July 2025, the token was bouncing between $1.2 and $1.8, showing some real backbone after things stabilized. It even managed to punch through resistance at $1.4 and $1.6—a classic sign that a real uptrend might be brewing. With a market cap hovering near $860 million, it’s clear that investors aren't just sitting on the sidelines.

The vibe right now is one of gradual recovery. It’s moving in sync with the broader crypto market, helped along by some positive DeFi news and the platform's push to add more features for its users.

The Dollar vs. Ruble gap — why it matters

If you're tracking Nexo, you’ve probably noticed the difference between the USD and RUB charts. For local investors, currency risk is a real thing. When Nexo hits $1.7, it translates to roughly 130 rubles (assuming the dollar is around 76).

But here’s the catch: if the ruble gets stronger, the price in your local wallet might actually drop even if the token is "pumping" in dollars. It’s a nuance that often trips people up when they're calculating their actual returns.

| Currency | July Low | July High | Current (August) |

|---|---|---|---|

| USD | $1.2 | $1.8 | $1.7 |

| RUB | 91 ₽ | 136 ₽ | 130 ₽ |

The exchange rate can eat your gains or hide your losses, even if the token itself is doing well. — Crypto vs. Fiat: How AI spots the difference, 2025

What the experts are saying about the immediate future

Looking at the next few days, we’re likely in for a bit of a "sideways" trend. Expect Nexo to hang out in the $1.6 to $1.75 range for a bit. However, if the news stays positive, we could see what traders call a "rip"—a sudden break above $1.8 that settles into a new, higher floor.

We’re basing this on a mix of on-chain metrics, whale activity, and the general mood on crypto Twitter. These things are usually the best "early warning" systems for short-term moves.

On-chain data and market sentiment are your best tools for catching short-term swings. — ASCN.AI: Your personal AI analyst, 2025

Growth potential and the "Rip" factor

In the medium term, Nexo’s success depends on three things: more users, better partnerships, and a stronger DeFi toolkit. If a major announcement drops or smart money starts flowing in—like we saw in July 2025—the price could move very fast. When "Smart Money" gets active, the potential for a pump (or a rip) increases significantly.

So, what actually moves the needle?

The price isn't just a random number; it’s shaped by a few core forces:

- The Bitcoin Effect: If BTC moves, Nexo usually follows. It’s the tide that lifts (or sinks) all boats.

- Regulators: Any news about crypto laws can send the price in either direction.

- Whale Moves: When the big holders make a trade, the rest of the market feels the ripples.

- Tech Upgrades: Changes to the platform’s code or security usually build long-term trust.

- Sentiment: What’s happening on Reddit and Telegram? The emotional "vibe" often dictates the buying pressure.

Bitcoin still calls the shots for the altcoin market, Nexo included. — Analyzing BTC's Ups and Downs, 2025

The latest headlines

Back in July 2025, Nexo inked a deal with a major DeFi platform. This wasn't just PR—it added actual utility and brought in fresh capital. They’ve also been beefing up wallet security and integrating tools from ASCN.AI, which goes a long way in making investors feel safe about their funds.

Does the news actually help?

Analysts are seeing a clear link: positive updates trigger "mini-pumps" on Telegram and Twitter. It’s a feedback loop. But a word of caution—don't trade on headlines alone. You need to combine the hype with actual data to avoid getting caught in a trap.

Social media activity is often the spark that starts a price run. — A Guide to Crypto & Telegram, 2024

For a deeper dive, check out the ASCN.AI News Blog.

The Community Vibe

If you hang out on the forums, most people view Nexo as a "hold." The consensus? It's a solid diversification tool, but you have to be smart about your entry point. The pros are constantly warning against panic-buying. They’re preaching patience and technical analysis over "gut feelings."

Risks vs. Opportunities

Let's be real: Nexo has the same risks as any crypto. Volatility is high, regulators are unpredictable, and DeFi tech can be complicated. On the flip side, a growing ecosystem and the potential for new exchange listings keep the liquidity—and the interest—high.

Volatility and legal gray areas remain the biggest hurdles for any investor. — The 2025 Crypto Survival Guide

Wait, what does "Rip" mean anyway?

In the crypto world, if someone says an asset is "ripping," they mean it’s exploding upward in a very short time. It’s trader-speak for a massive, high-velocity price jump. Knowing the lingo doesn't just make you look smart—it helps you decode what’s actually happening in fast-moving chat rooms.

Is now the time to buy?

Buying Nexo requires a strategy. Don't just go all-in. Use limit orders, set your stop-losses, and for heaven's sake, diversify. Keep an eye on the news so you can adjust your position before the rest of the market catches on.

The bottom line

Nexo looks strong for the long haul. If you’re trading short-term, you need to be glued to the charts. Avoid the temptation to panic-sell when things get red; usually, the winners are the ones with the most patience.

By the way, here’s the final verdict from our AI at ASCN.AI:

FAQ

How do you even predict these prices?

It’s a mix. We take technical analysis (charts), add fundamental data (the project's health), and sprinkle in on-chain info directly from the blockchain. Then, we let machine learning models crunch the numbers to give us a more accurate picture.

What’s the main thing driving the price?

Supply and demand, mostly. But also things like tech updates, whale moves, and what the regulators are up to. Even the global economy plays a role through currency fluctuations.

Is Nexo tied to the US Dollar?

Most of its trading happens against the USD. So, if the dollar shifts, it changes how Nexo is valued in other currencies like the Euro or Ruble. It's a key factor for anyone managing a multi-currency portfolio.

ASCN.AI in Action

Remember when Falcon Finance (FF) took a nosedive in 2024? ASCN.AI caught the warning signs early by scanning on-chain data and news feeds. Users who listened were able to get out or hedge their positions before the worst hit. It’s a perfect example of why having an AI in your corner helps in this market. Read the full story here: The Falcon Finance Case Study.

Disclaimer

This is for informational purposes only. We aren't financial advisors, and crypto is risky. Always do your own research and talk to a pro before putting your money on the line.