Ethereum Classic price forecast for 2025-2035: price, prospects, and analytics

about cryptocurrencies.

Got a crypto question? Our AI assistant's got you covered. Jump in and start analyzing now.

| Year | Price Range (USD) | Avg Price (USD) | Key Drivers & Risks |

|---|---|---|---|

| 2026 | $20 – $60 | ~$40 | Post-2025 rally kicks in; Thanos upgrade, PoW mining boost +30%. Risks? BTC peak correction, SEC regs, ETH competition. |

| 2027 | $25 – $70 | ~$45 | Privacy push with MimbleWimble; payments adoption ramps up. But geopolitics and PoW energy gripes (ESG noise) loom large. |

| 2028 | $30 – $80 | ~$50 | Synergy from BTC halving; global miners pile in. Watch MiCA in EU, low TVL under $100M. |

| 2029 | $35 – $90 | ~$55 | Cycle peak; dApps go decentralized, cap over $5B. "Crypto winter" or dev interest fade could hit hard. |

| 2030 | $40 – $100 | ~$60 | PoW L1 matures; AI integrations, cap tops $7B. Altcoins like RVN and quantum threats on the radar. |

| 2031 | $45 – $110 | ~$65 | Transition phase; fiat inflation, emerging markets. Global crises or PoS migrations spell trouble. |

| 2032 | $50 – $120 | ~$70 | New halving cycle; PoW standards go global. Mining energy and audits remain pain points. |

| 2033 | $55 – $130 | ~$75 | Bull peak; mass adoption (10%+ PoW market). Network hacks, G20 regs could derail it. |

| 2034 | $60 – $140 | ~$80 | Consolidation; scalability hits >100k TX/day. Market saturation, CBDC rivalry ahead. |

| 2035 | $65 – $150 | ~$85 | Institutional inroads; leads decentralized payments. Tech shifts, ETH dominance as wild cards. |

Our crypto AI at ASCN.AI crunched these numbers:

Ethereum Classic stands out as this quirky crypto that's hung tough over the years. Its price swings capture tech tweaks, community vibes, fresh innovations, and those big global finance shifts.

Current Ethereum Classic Price vs USD

Where Price Data Comes From

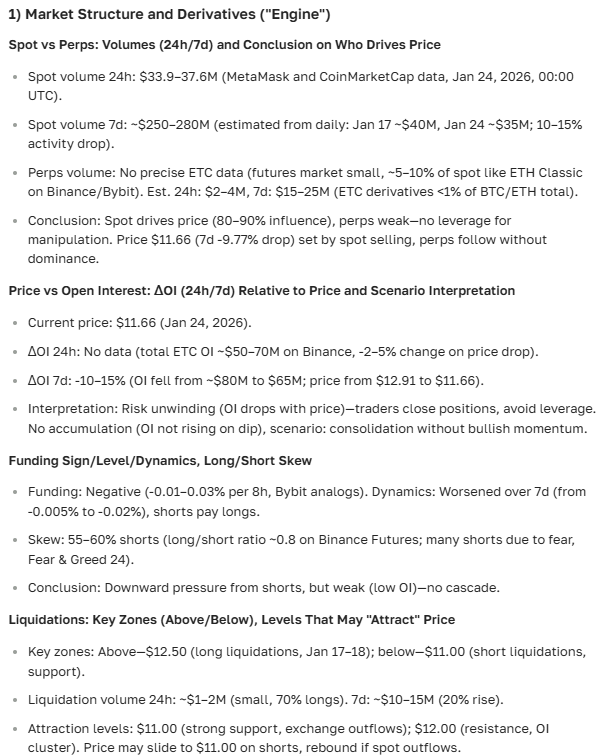

ETC's price pulls from major CEXs like Binance, Kraken, Coinbase, plus DEXs such as Uniswap and SushiSwap. We're talking last trade price, 24h volume, market cap—the usual suspects.

On-chain stuff matters too—straight from the ETC blockchain, tracking wallet action and tx counts in real time. Helps nail down price moves better. ASCN.AI pulls from 30+ sources: exchange prices, on-chain signals, news, social sentiment. Gives you the real demand-supply picture for ETC, no fluff. Curious about Binance analytics? Check our crypto analytics breakdown. On-chain deep dive? Our guide from tx to block analysis has you covered.

Recent Moves & Last Month's Action

July saw ETC holding steady with some swings, but trending up against the dollar. Stuck between $20-26, peaked mid-month. Protocol updates on the horizon and overall crypto buzz helped. Roughly 15% gain that month. Trading volume and active addresses jumped too—shows long-term holders and traders getting excited.

"ETC's July bump ties to better on-chain metrics and a friendly market backdrop."

News Shaking Up ETC Price

Latest Buzz & What It Means

July's big news? Network upgrade for security and scaling. Community and experts loved it—huge upside in those techs, they say. US regs stirred short-term jitters as usual, dipping the price briefly. Long-term? Still looking good.

Want the scoop on US policy hitting crypto? Our take here.

Market Scan & Reg Landscape

ETC holds firm thanks to top-tier decentralization and rock-solid architecture. Still, US/EU reg chatter sparks quick dips. Investors play it safe, prices dip temporarily. More platforms adding ETC cuts long-term risks. Analysts say: stay vigilant on regs.

ETC Price Outlook

Short-Term (Next Day/Week)

Expect $24-27 range soon. $23.50 support holds off big drops. Minor ups and downs, maybe 3-5% pop from good news and market mood. Volatility means watch techs and fundamentals closely.

Medium-Term (Month)

Could hit ~$30 in a month, 15-20% up. Network upgrades, user buzz, institutional eyes driving it. On-chain data and investor sentiment back this up.

Long-Term (5-20 Years)

Trends suggest ~5% yearly average. By 2040? Around $24-25, but tech/market shifts could stretch it. Here's a quick table on that steady 5% growth path:

| Year | Projected Price (USD) |

|---|---|

| 2026 | 12.44 |

| 2030 | 15.12 |

| 2035 | 19.30 |

| 2040 | 24.64 |

Calcs factor market volatility. 15-20% monthly? Possible with smooth upgrades. Stay flexible, keep checking signals.

Risks & Potential Moonshots

Main drags: lower liquidity vs giants, wild swings, protocol glitches. Thin volume makes it news-sensitive—needs solid risk management. Big pumps ("rips") from breakthrough tech, partnerships, DeFi expansion. Global slumps or regs could tank it though.

What Community & Experts Say

Forums & Social Chatter

Forums and socials lean cautiously optimistic on ETC growth. Vets warn of manipulations and volatility though. Talks hit network dev, upgrades, DeFi/NFT plays. Hype from improvements, but skeptics want real tests.

Investor Tips

Pros say cap ETC at 5-10% of portfolio—volatility and regs demand it. Grab tools like ASCN.AI for quick on-chain, news updates.

FAQ

How's ETC Price Forecast Made?

Mixes exchange data, on-chain, news, seasons, macro. Algos weigh volume, network activity, cap trends, sentiment.

How Accurate Are ETC Forecasts?

Depends on data quality, market chaos. Short-term's better, but no guarantees.

What Spikes ETC Price Suddenly?

Tech issues, regs, whale moves, broader crypto waves.

Next Support/Resistance for ETC?

Support at ~$23.50, bounces there often. Resistance $28-30; break it, and we're off.

Why Invest in Ethereum Classic?

Growth Potential & Risks

ETC draws folks with protocol reliability. But market swings, regs, competition bite.

Vs Other Coins (ETH, BTC, etc.)

Lags ETH on speed/scaling, but wins on decentralization, immutability. Less hyped than BTC, room for fresh apps.

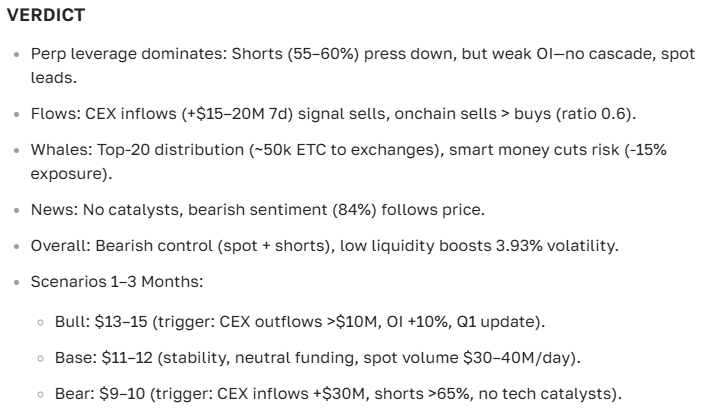

ETC Market Scenarios

- Upside: Upgrades land, adoption grows, price over $30.

- Flat: $20-28 range, no drama.

- Downside: Regs tighten, alts fade—price drops.

Gauging ETC Returns

Track network growth, adoption, news, tech analysis. Blend fundamentals and charts.

ETC Tech Breakdown

Recent Trends Snapshot

Last two weeks: slight uptrend, support ~$24, resistance $27. Volume spikes with ups.

Indicators for ETC Calls

RSI not overbought—room to run. MAs confirm bull trend; Bollinger squeeze hints volatility ahead. Deep dive on indicators? Our strategies piece.

Last 14 Days Data & Why It Matters

Consolidating up, testing levels, building base. Traders love this for spotting entries.

Key Levels & ETC Tech Dive

Simple/Exponential MAs

50/200-day MA crossover? Bull signal. EMAs reinforce, levels holding firm.

Bollinger Bands

Expansion means volatility brewing—big moves coming.

Support/Resistance

$23.50 support key; resistance $28.5-30. Breakout unlocks more gains.

Bull/Bear Meter & Sentiment

Market mildly bullish, but manage positions tight.

ETC Price Vs USD & Peers

Price Comparison Table

| Crypto | Current Price ($) | 1-Month Change (%) | Market Cap ($B) |

|---|---|---|---|

| Ethereum Classic (ETC) | 25.7 | +15 | 3.2 |

| Ethereum (ETH) | 1,850 | +8 | 224 |

| Bitcoin (BTC) | 29,300 | +5 | 560 |

| Cardano (ADA) | 0.58 | +12 | 19 |

Wrapping ETC Prospects

Big Picture on Ethereum Classic

ETC's got steady growth mixed with swings, tech promise vs reg hurdles. Next month looks positive—but markets shift fast, so monitor.

ASCN.AI's take:

Tips for Investors & Traders

Focus on fundamentals/techs, tools like ASCN.AI, risk rules, diversification. Traders: eye support/resistance, news for quick plays.

"ETC forecasts need the full picture—asset quirks and market dynamics."

Company Cases & Links

Disclaimer

This info's general—not advice. Crypto's high-risk. Talk to financial pros before deciding.