Whitebird: a legal Belarusian cryptocurrency exchange — ASCN

about cryptocurrencies.

In this deep-dive, we’ll take a close look at Whitebird — the official Belarusian cryptocurrency exchanger. We’ll go through its pros and cons, how withdrawals actually work, and what makes it stand out in 2025.

Before you trust any platform with your funds — Whitebird included — take one minute to check its reputation with ASCN.ai. Seriously, it takes less than sixty seconds and can save you both nerves and money.

Just type a quick request like: “Check Whitebird exchanger — registration, reviews, and legal status.”

The AI agent will instantly pull verified data — legal background, registration records, real user feedback. It’s not just about automating searches; ASCN often spots red flags that a human might miss. Try it today so you don’t regret it tomorrow.

What Exactly Is Whitebird — and Why People Trust It

Not every exchanger plays by the rules. That’s precisely where Whitebird draws the line. It’s not some random crypto swap service operating in the shadows, but a licensed participant in the Belarusian digital asset market — with clear rules, transparent structure, and official recognition.

This isn’t a gray-area project or a Telegram bot with a fancy name. Whitebird works inside the legal system, giving it a level of legitimacy few regional exchangers can match.

History and Mission

The original idea was to build a crypto service that actually works across the CIS countries — simple, convenient, and professional. The team behind Whitebird comes from both trading and legal backgrounds, so they know how to balance compliance with usability.

From day one, the company built its work on three main principles:

• Legality of operations

• Ease of use

• Speed of transactions

These aren’t marketing slogans — they define how the exchanger functions day-to-day.

Legal Registration and Status in Belarus

Whitebird isn’t a “garage project” like many of its peers. It’s a fully registered company, officially listed as CJSC White Bird, incorporated in the Republic of Belarus.

That status means the service:

• operates under national financial and tax laws;

• complies with anti–money laundering (AML) and know-your-customer (KYC) requirements;

• bears legal responsibility before state regulators.

In practice, this sets Whitebird apart from the majority of exchangers that still operate semi-anonymously or offshore.

Licenses and Regulation

Belarus has taken an unusually progressive stance toward blockchain. Instead of banning it, the country decided to regulate it — and that’s exactly what gives Whitebird its edge.

Whitebird operates under the legal framework of the High-Tech Park (HTP), which issues licenses for crypto companies. This license allows the company to legally perform:

• crypto-to-fiat and fiat-to-crypto exchanges;

• storage and accounting of digital assets;

• transaction support under official financial oversight.

If you visit whitebird.io, you’ll find full legal disclosures — contact information, address, internal policies, even privacy and AML documentation. That level of transparency is a rarity in the CIS crypto space.

Ratings and User Feedback

Jump over to sites like BestChange or Trustpilot, and you’ll see a clear pattern — Whitebird ranks high in almost every key metric.

• Speed of transactions: usually 5 to 20 minutes.

• Customer support: polite, fast, and available in Russian and Belarusian.

• Transparent fees: no hidden extras; everything is spelled out before you start.

One point users constantly highlight — Whitebird is among the very few services that can convert USDT to BYN directly to a card, smoothly and legally.

Supported Cryptocurrencies

When picking an exchanger, supported assets often decide everything. If your token isn’t listed, nothing else matters. Fortunately, Whitebird supports both major coins and several altcoins that other Belarusian platforms don’t bother with. And all of it works through a clean, no-nonsense interface — literally a couple of clicks.

USDT (Tether): TRC20, ERC20, BEP20

The undisputed champion of stablecoins in 2025 is still USDT. Whitebird handles all main networks:

• TRC20 (Tron) — fast and low-cost.

• ERC20 (Ethereum) — more universal but with higher gas fees.

• BEP20 (Binance Smart Chain) — the middle ground between speed and price.

You pick the network that fits your needs — transaction size, fees, or blockchain load. Simple.

Bitcoin (BTC)

Whitebird allows easy swaps between bitcoin and fiat currencies. The rates are fair, especially for larger transactions, and confirmations take roughly 10–60 minutes, depending on network traffic.

Ethereum (ETH)

Ethereum remains just as relevant in 2025 — both as an investment and as the backbone of DeFi and NFT ecosystems. Whitebird supports ETH with withdrawal options to BYN, RUB, USD, and EUR or straight to a personal wallet.

Litecoin, XRP, and Other Assets

Beyond the heavyweights, the platform supports:

• Litecoin (LTC) — fast and lightweight;

• Ripple (XRP) — ideal for cross-border transfers;

• TON, TRX, and other popular tokens.

Sure, the list isn’t huge, but every coin is vetted and stable. Whitebird also adds new assets regularly based on real user demand — not hype.

Exchange Directions on Whitebird

No matter where you live, being able to convert crypto into local currency easily is key. And this is where Whitebird really proves itself. The platform covers a wide range of directions — from CIS to EU currencies — with quick and transparent processing.

In short: it’s one of the few exchangers where you can receive BYN legally and fast.

Crypto → Belarusian Rubles (BYN)

This is Whitebird’s bread and butter. You can exchange USDT, BTC, ETH, and other assets into BYN and receive funds directly on a Belarusian bank card.

The rate is fixed at the moment you create the deal, and the commission is visible upfront — no “surprises” at checkout. On average, transfers take 5 to 20 minutes.

Crypto → Russian Rubles (RUB)

For users in Russia, conversion to RUB is smooth. You can send crypto and receive rubles to Visa/Mastercard (RF-issued) or to YooMoney and similar wallets.

Freelancers, traders, and investors often use this option to cash out quickly without worrying about blocked accounts or bureaucracy.

Crypto → U.S. Dollars (USD)

Whitebird also supports payouts in USD, useful for businesses, international transfers, or anyone preferring a stable fiat currency. Transfers can go to multi-currency cards or via SWIFT for international wires.

Crypto → Euros (EUR)

The same goes for EUR, with SEPA transfers available. It’s convenient for users living in the EU, working with European platforms, or just preferring euro-based accounts. Exchange rates are competitive, and confirmations happen quickly.

Reverse Exchange: Fiat → Crypto

Yes, you can go both ways. In 2025, buying crypto with fiat is more relevant than ever. You can send BYN, RUB, USD, or EUR and get:

• USDT (TRC20, ERC20, BEP20)

• BTC

• ETH

• or other supported assets.

That makes Whitebird a universal two-way platform — cash in or out from the same place.

How the Exchange Works: Step-by-Step

People often ask: is it complicated? Not really. The process on whitebird.io is straightforward enough for total beginners. No confusing dashboards — just the essentials.

Choose your direction and currency.

For example: USDT (TRC20) → BYN (Belarusbank card) or RUB (Visa) → BTC (TRC20).

Enter details and amount.

You specify either the amount you’re sending or what you want to receive, your card or wallet number, and an email (plus name if required for AML/KYC).

Confirm the rate and pay.

The system instantly calculates the final sum and lets you lock in the rate. Better to send funds immediately — the rate doesn’t stay fixed for long.

Receive your funds.

Once the transaction is confirmed, Whitebird automatically sends the payout. Typically 5–15 minutes, maybe longer if the blockchain or payment system is busy.

That’s all there is to it.

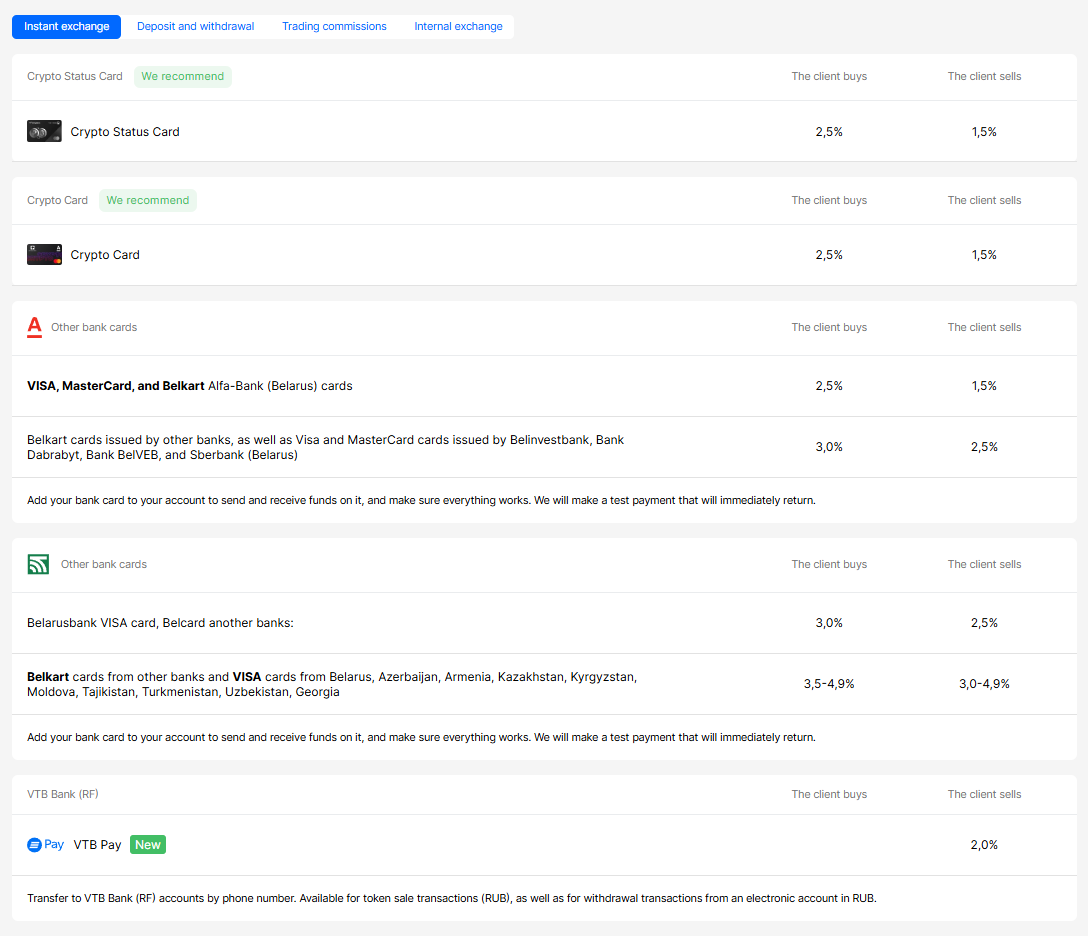

Payment and Withdrawal Methods

This is one of the strongest sides of Whitebird. Compared to competitors, it offers one of the broadest selections of payment options in the CIS.

The best part? Most operations don’t require full verification unless you exceed certain limits.

Bank Cards (Visa/Mastercard — Russia, Belarus, CIS)

Supported cards include:

• Russia: Sberbank, Tinkoff, VTB, and others;

• Belarus: MTBank, Belarusbank, Belagroprombank, etc.;

• CIS countries: Kazakhstan, Armenia, Uzbekistan, Kyrgyzstan, and more.

Pro tip: stick to banks Whitebird already lists as active partners — it’ll be faster.

Belarusian Banks

For Belarusian residents, direct transfers are available to accounts in:

• Alfa-Bank

• Belgazprombank

• MTBank

• Technobank

• Belarusbank, and others.

You just enter your card number and name — perfect for freelancers and IT workers who get paid in USDT.

QIWI, YooMoney, and Others

Whitebird supports popular e-wallets, especially in Russia:

• QIWI — fast, minimal fees.

• YooMoney — great for smaller transactions.

• Payeer, Advcash, PerfectMoney — available upon request.

Handy for users who don’t use traditional banking.

SEPA and SWIFT Transfers

For international clients, Whitebird handles SEPA and SWIFT transfers — a rare option among regional exchangers. Perfect for:

• freelancers working with foreign clients;

• businesses paying for services in crypto;

• investors withdrawing to stable fiat currencies.

Transfers usually take 1–3 banking days — not instant, but reliable.

Why Whitebird Stands Out

With dozens of exchangers out there, why do users keep choosing this one? It comes down to a mix of legality, usability, and reliability.

Operating in the Legal Field

The number-one reason: Whitebird is official.

It’s not a Telegram chat or offshore domain — it’s a licensed, registered company (CJSC White Bird), compliant with Belarusian law and the HTP framework.

That means:

• your transaction happens within legal boundaries;

• your funds aren’t at risk of random account freezes;

• you can prove the origin of funds if needed.

For investors and businesses, that’s a major plus.

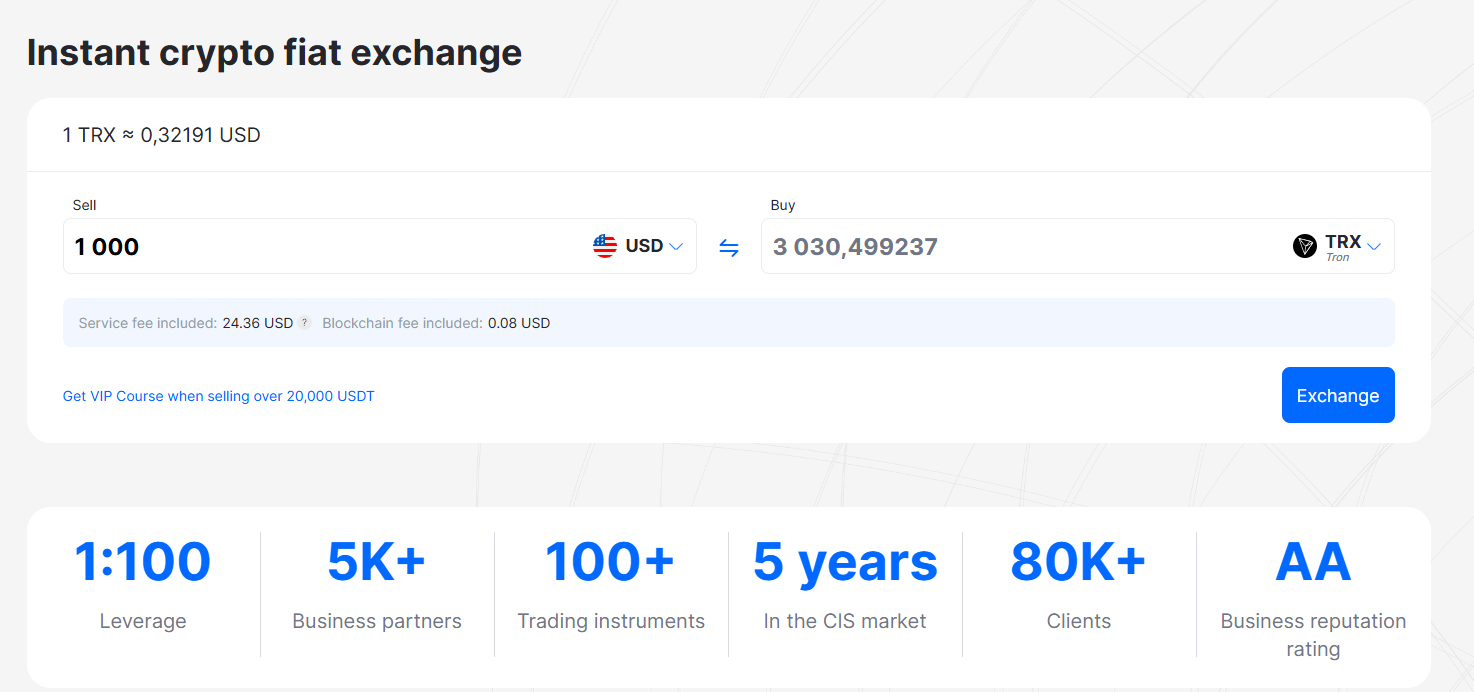

Transparent Fees and Fixed Rates

One of the most frequent compliments on whitebird.io: “Finally, an exchanger where the rate doesn’t jump mid-transaction.”

Here’s why:

• rates are fixed when you submit the request;

• commissions are displayed upfront;

• no hidden markups during processing.

There’s even a live calculator to estimate payouts in real time.

Fast Processing

Nobody wants to wait all day for a payout. Whitebird completes:

• most deals within 5–15 minutes;

• large ones within an hour (manual verification);

• all with live status tracking.

Pretty solid compared to industry averages.

Support in Multiple Languages

Customer service is often the weak point of exchangers — but not here.

Whitebird offers help in Russian, Belarusian, and English, via email, Telegram, or live chat. Response times are usually under ten minutes, even in the evening.

That alone saves a lot of headaches when something doesn’t go as planned.

No Hidden Fees

No “extra 3%” on withdrawal, no paid subscriptions, no forced registration. You can complete a swap as a guest — clean and simple.

Security and User Protection

Working with crypto is always a matter of trust, especially when personal or banking data is involved. In 2025, with phishing and data leaks everywhere, strong security isn’t optional.

Whitebird’s setup meets international standards, both technically and legally.

SSL Encryption and Data Protection

The site uses 256-bit SSL encryption, ensuring a secure connection between your browser and their server.

• Your payment info and wallet data aren’t stored in plain text.

• Even if intercepted, the data is encrypted.

• Internal services (backend, database, admin panels) are isolated and protected with 2FA.

Anti-Phishing Measures

Crypto phishing is rampant, so Whitebird takes it seriously:

• official links are only published via verified channels (site, Trustpilot, BestChange);

• the site uses a unique visual marker — a small “bird” icon next to the address and a green SSL zone;

• no “Log in” buttons in emails — only text notifications.

The team also regularly posts warnings about scam copies on their social channels.

Personal Data and Compliance

CJSC White Bird processes user data under Belarus’ Law on Personal Data Protection and the EU’s GDPR.

This includes:

• a detailed privacy policy;

• the right to delete your data on request;

• limited access storage on secure servers;

• logging and suspicious activity monitoring.

KYC and AML

While small swaps can be done anonymously, larger ones trigger verification.

The KYC process involves:

• ID or passport upload;

• selfie with document;

• (optionally) proof of address.

All documents are handled manually and disclosed only upon official legal request.

What Users Actually Say

When it comes to money — especially crypto — no amount of advertising beats real feedback. Whitebird has been around since the early 2020s and has earned a solid reputation among thousands of users.

Real Exchange Stories

Artem:

“Whitebird seems to work legally, and you can actually find license info on their site — rare for exchangers. I tried it myself; USDT to Visa went through without any issues.”

Evelina Gregory:

“This exchanger is a lifesaver! I live in the UK but send money to my Belarusian card regularly. Used to do it via Paysend until that stopped working — Whitebird filled the gap.”

Volodyal:

“Used it several times. Fast and fair commissions. I’m not a fan of KYC, but their rates are better than other legal exchangers, so I stick with them.”

BestChange and Trustpilot Ratings

On BestChange, Whitebird consistently ranks near the top:

• over 1,000 positive reviews;

• average rating — 4.9 out of 5;

• users praise speed, honesty, and customer support.

On Trustpilot, as of 2025, the score stays around 4.7–4.9 — similar story: reliability, no hidden fees, helpful staff.

Reputation in the Crypto Community

Across Telegram groups, Reddit threads, and crypto forums like CryptoTalk and Profinvestment, Whitebird’s team is active and responsive. They don’t ghost criticism — they fix issues fast. That openness builds genuine community trust.

FAQ

What are the exchange limits?

Minimum limits:

• BTC, ETH (ERC-20): from $50

• USDT (ERC-20): from $100

(minimums may vary by payment direction)

Maximums:

• up to ≈ $8,000 / 32,000 BYN — no extra docs;

• above ≈ 32,000 BYN (~$8 000) — ID and card/account verification required;

• over ≈ 64,000 BYN (~$19 000) monthly — proof of source of funds may be requested.

Is verification required?

Basic ID (passport + selfie) is only needed for larger or regulated transactions.

Small exchanges stay under the threshold — no ID required.

For VIP clients (larger amounts), additional documents like address proof may be requested.

How long does it take?

24/7 automated processing. Most transfers take 5–20 minutes; manual checks — up to an hour.

SEPA/SWIFT — 1–3 banking days.

What are the fees?

• Selling crypto: around 1.5%

• Buying crypto: about 2.5% (Crypto/Belkart cards: 3%)

• Larger deals get lower rates. All fees are shown upfront and fixed when you submit the order.

Final Verdict: Is Whitebird Worth Using in 2025?

Whitebird has earned its place among the most trusted exchangers in the region. It’s legal, fast, transparent, and secure — a rare combination these days.

By 2025, the service:

• operates officially under Belarusian law as an HTP resident;

• offers exchanges across BYN, RUB, USD, EUR, supporting cards, wallets, and bank transfers;

• processes requests in 5–20 minutes on average;

• maintains fixed rates and transparent fees;

• follows KYC/AML standards and uses SSL-level encryption for safety.

Ultimately, whether to use it is up to you — but as far as regional exchangers go, Whitebird is one of the safest bets out there.

And if you’re still not sure, don’t guess — check with ASCN.ai. The platform will dig up verified info, market sentiment, and background data on any crypto company you’re curious about. It’s like having a crypto compliance analyst right in your browser — quick, thorough, and always awake.

Because in crypto, trust is everything — but it helps to double-check.