Unveiling the Power of AI in Crypto Research Tools

about cryptocurrencies.

Crypto research tools collect and interpret data from blockchains, exchanges, and social platforms to inform trading decisions. Traders rely on them to track token prices, analyze market trends, and assess project viability. In 2025, these tools process vast datasets from Ethereum, Solana, and other networks, revealing patterns in transaction volumes and holder behaviors. Without such tools, investors face incomplete views of market dynamics, leading to delayed reactions in volatile conditions.

Tools that work well integrate multiple data sources. For instance, they pull on-chain metrics like wallet balances and transfer histories alongside off-chain signals from news feeds. This combination helps users spot opportunities, such as undervalued tokens with rising adoption. Platforms vary in focus: some emphasize real-time alerts, others deep historical analysis. Selecting the right set accelerates research from hours to minutes, enabling precise strategies.

How AI is Transforming Crypto Research

AI enhances crypto research by automating pattern recognition in complex datasets, outperforming manual methods. Machine learning models scan on-chain data to predict token movements based on historical correlations. For example, AI identifies whale accumulations by analyzing large transfers, signaling potential price shifts. This reduces human error in interpreting signals like gas fee spikes during network congestion.

In token research, AI summarizes whitepapers, evaluates team credentials, and flags risks like unlocked vesting schedules. Natural language processing parses social sentiment from Twitter and Telegram, quantifying hype versus substance. Results show AI-driven tools boost accuracy: a 2024 study from Chainalysis reported 35% faster anomaly detection in fraud cases. Traders gain edges through predictive analytics, such as forecasting DeFi yields from liquidity pool trends.

AI makes research accessible to more people. Beginners query simple prompts for tokenomics breakdowns, while experts build custom models for arbitrage scans. Integration with APIs allows seamless data flow into trading bots, executing trades on detected signals. Overall, AI shifts research from reactive to proactive, equipping users to navigate 2025's maturing markets.

Top 10 AI-Enhanced Crypto Research Tools

Tool 1: ASCN.AI - Overview and Features

ASCN.AI delivers instant crypto insights through an AI assistant trained exclusively on Web3 data. It aggregates on-chain metrics, sentiment analysis, and exchange prices in under 10 seconds. Features include real-time node queries for Ethereum and Solana, plus summaries of Telegram alpha and whale activity.

Users input prompts like "Analyze SOL tokenomics and risks" to receive structured reports with holder stats and unlock schedules.

This tool excels in on-chain data analytics, providing verifiable signals without multiple subscriptions.

Tool 2: Nansen - Overview and Features

Nansen uses AI to label wallet addresses and track fund flows across blockchains. It visualizes smart money movements, such as venture capital inflows into new tokens. Features cover token research with dashboards for exchange inflows and NFT floor prices. AI algorithms detect unusual patterns, like coordinated dumps, alerting users to risks. Integration with Dune supports custom queries for deeper analytics.

Tool 3: Glassnode - Overview and Features

Glassnode applies AI to on-chain metrics, generating insights on Bitcoin and altcoin networks. It forecasts market cycles through indicators like MVRV ratios and exchange reserves. For token research, AI processes transaction graphs to assess adoption rates. Users access automated reports on staking yields and miner revenues, with API hooks for trading platforms.

Tool 4: Dune Analytics - Overview and Features

Dune Analytics empowers AI-driven SQL queries on blockchain data. Community dashboards use machine learning to highlight DeFi trends, such as protocol TVL changes. Token research benefits from AI visualizations of liquidity events and governance votes. Free tier allows basic exploration, while pro versions enable predictive modeling.

Tool 5: Santiment - Overview and Features

Santiment combines AI sentiment analysis with on-chain data for comprehensive token profiles. It scores social volume against price action to predict pumps. Features include AI-generated narratives on project developments, drawing from news and forums. Researchers use it to benchmark tokens against peers in market cap and developer activity.

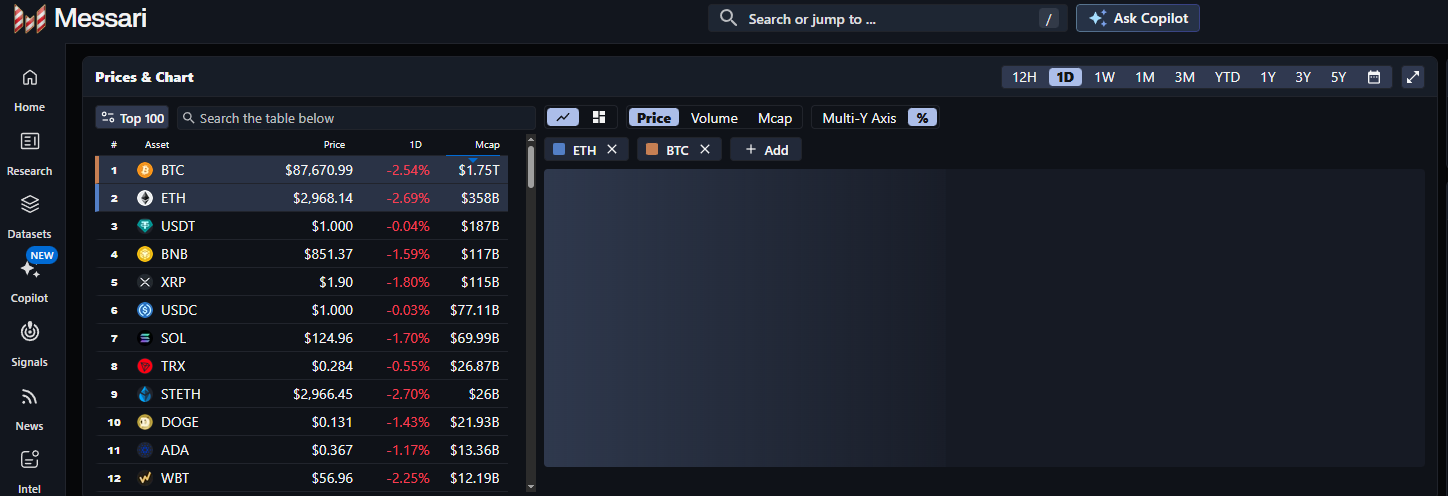

Tool 6: Messari - Overview and Features

Messari leverages AI for curated research reports on over 2,000 tokens. It automates screener tools to filter by fundamentals like revenue models. On-chain analytics cover exchange listings and partnership impacts. AI summarizes quarterly earnings for protocols, aiding long-term investment decisions.

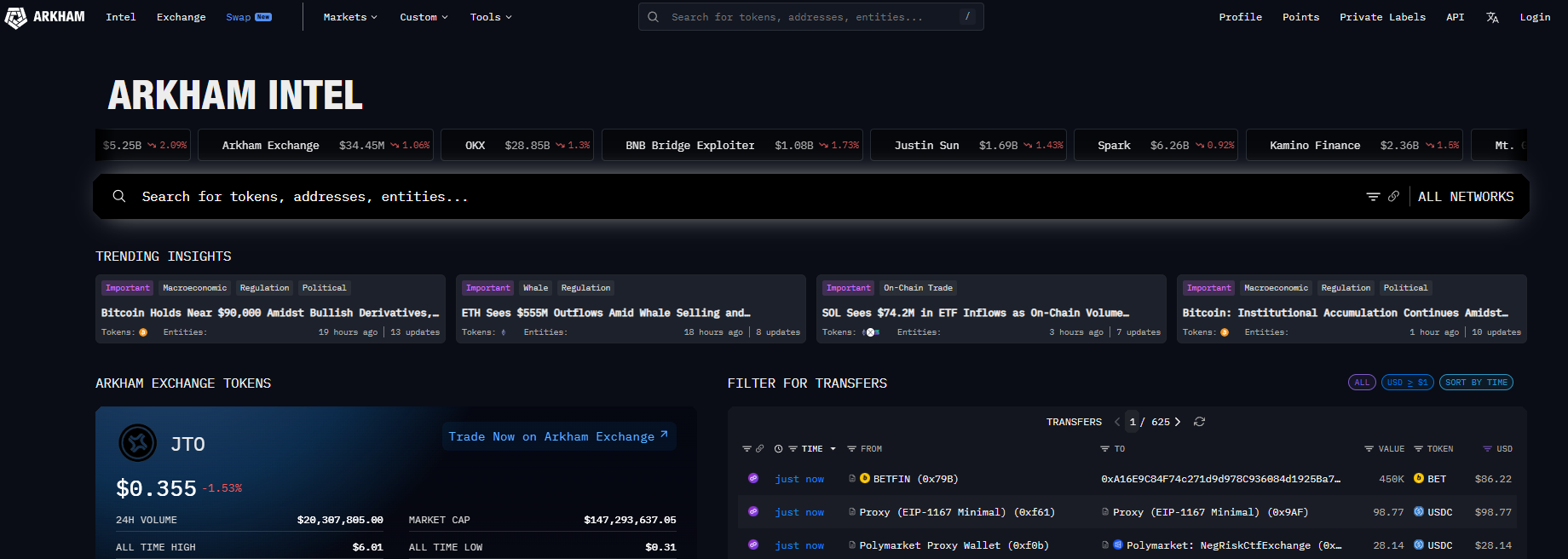

Tool 7: Arkham Intelligence - Overview and Features

Arkham Intelligence employs AI to deanonymize blockchain entities, mapping wallets to real-world actors. It tracks token flows for research into insider trading risks. Features include entity alerts and visual entity graphs, enhanced by machine learning for pattern matching in cross-chain transfers.

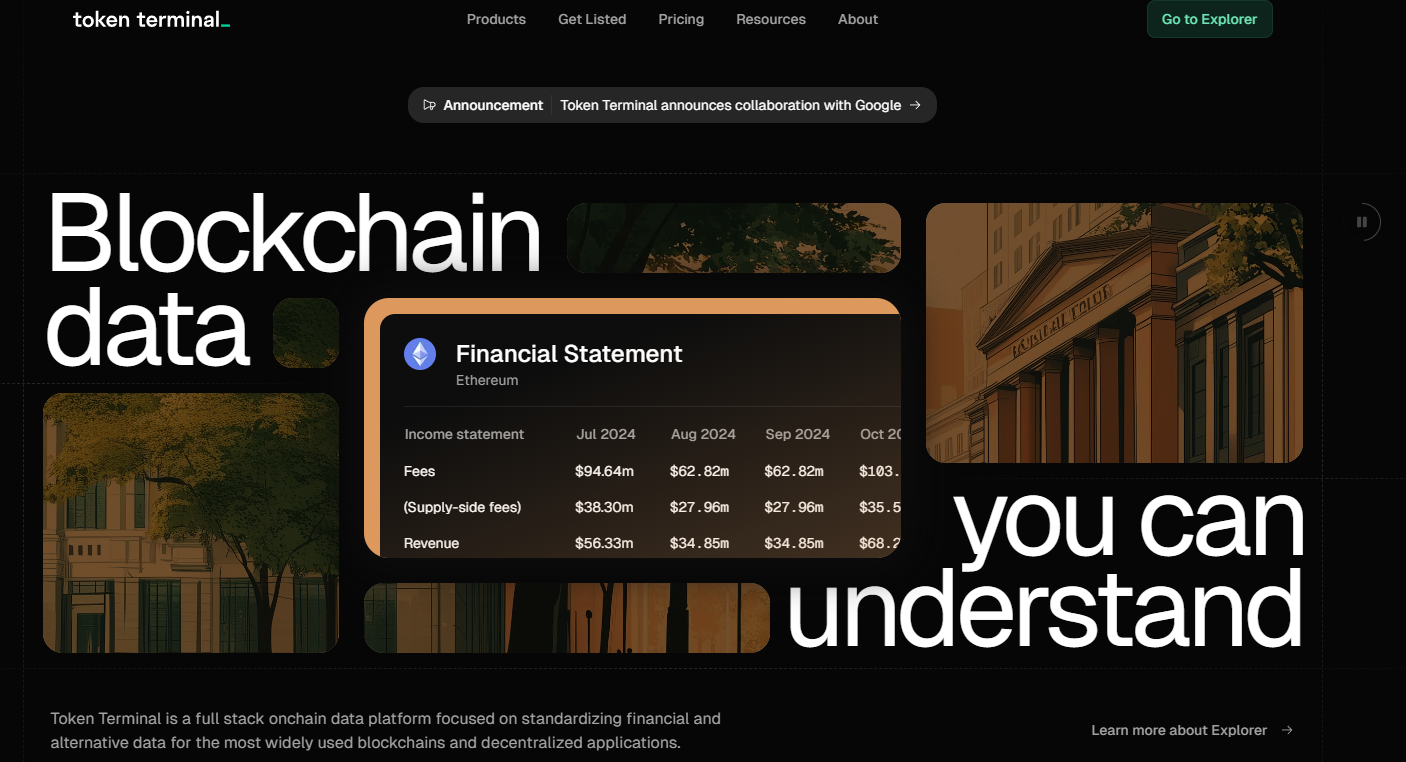

Tool 8: Token Terminal - Overview and Features

Token Terminal uses AI to standardize financial metrics for crypto projects, like P/E ratios adapted for blockchains. It analyzes on-chain revenue and user growth for token valuation. Researchers query AI for comparative tables, revealing undervalued assets based on profitability trends.

Tool 9: Chainalysis - Overview and Features

Chainalysis applies AI forensics to detect illicit on-chain activity, supporting compliant token research. It clusters addresses for risk scoring and traces fund origins. Features extend to market intelligence reports, using predictive models for regulatory shifts affecting tokens.

Tool 10: IntoTheBlock - Overview and Features

IntoTheBlock integrates AI signals with on-chain data for trading indicators. It predicts price directions via holder concentration metrics. Token research includes AI breakdowns of supply dynamics and sentiment correlations, with mobile alerts for real-time updates.

On-chain Data Analytics Explained

On-chain data analytics examines transactions recorded on blockchains to uncover network health and user behaviors. It tracks metrics like active addresses, transaction volumes, and smart contract interactions. This approach reveals truths hidden from price charts, such as token concentration in few wallets signaling manipulation risks.

In 2025 markets, on-chain analytics identifies trends like rising DeFi participation through TVL growth. AI improves it by processing petabytes of data to spot anomalies, like sudden outflows from exchanges indicating sell-offs. Tools query nodes directly for fresh data, avoiding delays in aggregated feeds.

It allows early detection of catalysts: a spike in developer commits correlates with token appreciation. Investors use it to validate hype—high social buzz without on-chain volume often flags scams. Combined with off-chain data, it creates strong strategies, reducing exposure to volatility.

To get started, begin with basic queries: filter transfers above $1 million to monitor whales. Advanced users build dashboards for correlations, like gas fees versus network upgrades. Reliability stems from immutable ledgers, ensuring tamper-proof insights.

Integrating ASCN.AI in Your Crypto Research

Features of ASCN.AI

ASCN.AI runs proprietary Ethereum and Solana nodes for direct on-chain access, delivering metrics like holder distributions and DEX volumes. It performs sentiment analysis on Telegram channels and news aggregators, scoring project narratives. Users query for token reports covering tokenomics, risks, and 6-month outlooks. Integration with exchanges provides funding rates and arbitrage gaps, all in structured formats.

Anonymous handling ensures privacy, with responses in 10 seconds via web or Telegram. The system aggregates from dozens of sources, including CEX/DEX data and VC funding trackers.

Prompts yield outputs like "Top smart money buys on ETH," complete with sentiment summaries and trading scenarios.

How ASCN.AI Stands Apart

ASCN.AI accesses exclusive Web3 datasets unavailable to broad models, ensuring crypto-specific accuracy. It avoids web-search limitations by indexing blockchains directly, providing real-time signals such as whale alerts or unlock events. Cost efficiency replaces multiple $100+ subscriptions with a $29/month plan, consolidating analytics into one interface.

It specializes in DeFi insights: calculating yields from liquidity pools and flagging rug pull indicators like team wallet drains. Users report 80% time savings on research, turning hours of manual checks into instant reports. Verification modules rank data trustworthiness, noting uncertainties in volatile narratives.

Real-life Applications of ASCN.AI

Traders use ASCN.AI for scalping: prompt "Review ETHUSDT on 1H chart with MA, RSI, entry/stop/target for LONG/SHORT" yields technical breakdowns with two scenarios.

An example response: "ETH shows bullish structure above $3,200 support; RSI at 45 indicates entry. LONG: Enter $3,250, stop $3,180, target $3,400 (4.6% gain). Volume supports upside."

Investors query "Undervalued altcoins based on on-chain and news," receiving lists with rationales: "Token X undervalued at 15x revenue multiple; on-chain active users up 40% post-partnership."

This guides portfolio adjustments, highlighting opportunities like a16z-backed projects.

Beginners start with "Explain SOL staking step-by-step," getting safe instructions: "Connect wallet to Phantom, select stake pool via Solflare, deposit amount—earn 6-8% APY."

Users avoid scams by prompting "Check [project] for rug pull signs," which scans contracts and team legitimacy, preventing losses from unverified ventures.

For arbitrage, "Compare SOL prices on Binance vs. KuCoin" outputs gaps: "2.1% differential; execute spot buy on lower, sell higher for $210 profit on $10k."

These applications demonstrate practical advantages, from risk mitigation to profit capture.

AI makes crypto research tools indispensable in 2025, streamlining on-chain analytics and token evaluations. From Nansen's wallet tracking to ASCN.AI's integrated insights, these platforms help make informed decisions amid market complexities. Adopting them shifts users from guesswork to data-driven strategies, enhancing outcomes in trading and investing.

Start with ASCN.AI today for specialized crypto research. Try prompts like "List top on-chain signals for BTC today" or "Provide a VC-style report on [token]" to get immediate insights. Subscriptions begin at $29/month—access exclusive Web3 intelligence and transform your workflow.