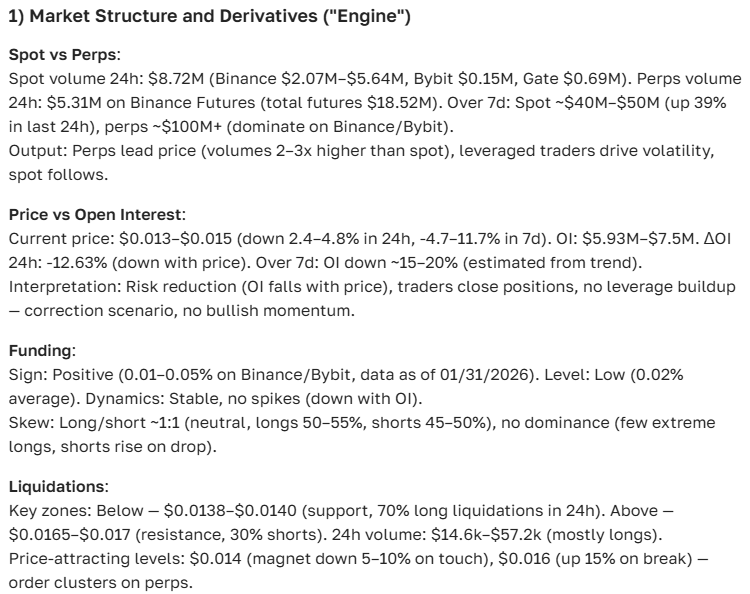

Xai exchange rate forecast: comprehensive analysis and investment prospects

about cryptocurrencies.

Curious about where a specific coin is headed? You can always bounce your questions off our crypto AI assistant. Start your analysis right here.

| Year | Floor Price (Bear Case) | Mid-Range (Neutral Case) | Peak Price (Bull Case) | What’s moving the needle? |

|---|---|---|---|---|

| 2026 | $0.0005 – $0.0028 (Market-wide slump) | $0.013 – $0.026 (Post-correction stability) | $1.4 – $3.9 (Gaming-driven explosion) | DeFi regulations, Arbitrum synergy, and the standard BTC cycle. |

| 2027 | $0.0010 – $0.0026 (Extended correction) | $0.030 – $0.040 (Slow recovery) | $2.0 – $5.0 (AI-gaming partnerships) | Xai ecosystem growth, the BTC halving hangover, and Metaverse adoption. |

| 2028 | $0.0010 – $0.0019 (Steady bottom) | $0.040 – $0.050 (Utility-driven lift) | $3.0 – $7.0 (Mainstream gaming usage) | Layer 3 upgrades and a global gaming market hitting ~$300B. |

| 2029 | $0.0008 – $0.0016 (Regulatory headwinds) | $0.060 – $0.085 (Supply/Demand balance) | $4.5 – $10.0 (Web3 AI integration) | The "Elon Musk xAI" narrative spillover and token unlock schedules. |

| 2030 | $0.0005 – $0.0012 (Long-term bear cycle) | $0.090 – $0.128 (Sustainable climb) | $6.0 – $15.0 (Dominating blockchain gaming) | Arbitrum scaling and global crypto adoption reaching ~10%. |

| 2031 | $0.0004 – $0.0010 (Macroeconomic risks) | $0.110 – $0.160 (Gradual expansion) | $8.0 – $20.0 (AI + Gaming synergy) | US/EU regulatory shifts and L2 competition. (Extrapolated data). |

| 2032 | $0.0004 – $0.0008 (Market stagnation) | $0.140 – $0.200 (Moderate growth) | $10.0 – $25.0 (Major bull run) | DeFi 2.0 evolution and the next NFT/Gaming boom. (Extrapolated data). |

| 2033 | $0.0003 – $0.0007 (High volatility) | $0.170 – $0.250 (Price stabilization) | $12.0 – $30.0 (Global partnerships) | Macro factors like inflation and rates. (Extrapolated data). |

| 2034 | $0.0003 – $0.0006 (Long-term risks) | $0.210 – $0.310 (Consistent demand) | $15.0 – $40.0 (Sector leadership) | The fusion of AI and blockchain tech. (Extrapolated data). |

| 2035 | $0.0002 – $0.0005 (Extreme bear case) | $0.260 – $0.390 (Optimistic average) | $18.0 – $50.0 (Hyper-growth) | Web3 gaming goes mainstream (~$500B market). Based on historical ETH-style cycles. |

Here is how the ASCN.AI assistant visualizes the Xai outlook:

“Tracking Xai’s price trajectory isn't just about numbers; it's a pulse check on the project's viability. Its movement reflects broader market health and gives investors a roadmap for decision-making.”

So, what’s the story with the Xai forecast?

Xai is a relatively new face in the crypto crowd, but it’s already turning heads. Why? Mostly because of its technical edge and surprisingly fast start. Everyone from day traders to long-term holders is trying to figure out where it lands next, especially since the coin’s price is so tightly linked to the general market mood. If you're looking to buy or sell, understanding the current Xai rate—and where it might be in six months—is the only way to stay ahead of the curve.

At the end of the day, Xai’s value is a tug-of-war between supply and demand, influenced by a cocktail of economic and technical shifts. Having a solid forecast handy doesn't just predict the future; it helps you cut through the emotional noise and find those elusive entry and exit points.

What actually moves the price?

It’s rarely just one thing. Several gears are turning at once here:

- The "Big Picture" Trends: Total market cap and the general volatility that defines the crypto world.

- The Community Factor: How active are the devs? Are the whales holding or dumping?

- Tech Milestones: New features or major ecosystem partnerships often act as a springboard for the price.

- Macro Shifts: Things like the USD strength and global economic stability—or lack thereof.

- The BTC/ETH Shadow: Like most alts, Xai often follows the lead of the market giants.

In practice, these factors collide to create the price swings we see. Keeping an eye on them is the foundation of any decent analysis.

The goal of these predictions

Whether we're looking at today or next month, the point is to spot the best windows for action. Should you buy the dip, or is it better to sit on your hands? We want to give you an analytical snapshot that reduces risk and makes sense of all those market metrics.

Checking the pulse: Xai’s current momentum

As of July 2025, Xai is sitting around $0.01506. It’s a fluid number, obviously, reacting to the latest news and general crypto sentiment.

"A rising market cap usually signals growing investor confidence, which in turn reinforces the token’s floor." — Binance Crypto Analysis, ASCN.AI, 2025

Recent headlines and their impact

Lately, Xai has been busy integrating into new DeFi protocols and fleshing out its ecosystem. Traders have noticed. While new partnerships usually drive demand up, any technical hiccup or delay can cause those quick "blink-and-you-miss-it" corrections. Keeping a tab on the news cycle is the best way to separate real potential from just another hype train.

Aptos Ecosystem: How partnerships move prices, ASCN.AI, 2025

Is there room for growth, or are we looking at a dip?

The path forward for Xai depends on a few fundamental pillars:

- Protocol updates and how innovative the dev team actually stays.

- Institutional interest—when the "big money" moves, the price follows.

- Global crypto health (the usual BTC and ETH dance).

- How well it integrates into the DeFi, NFT, and Web3 space.

- Regulatory shifts. Sometimes the law helps; sometimes it’s a hurdle.

Mastering Technical Indicators, ASCN.AI, 2025

The short-term outlook: Tomorrow and next month

If you don't want to dig through endless reports, ASCN.AI can spit out the numbers in a few clicks. Currently, our experts see a potential 5–12% upside over the next month, assuming the market stays favorable. But here's the catch: short-term volatility is a given. You have to watch the support and resistance levels. If it breaks through resistance, we might see a significant run.

Where is the market heading?

By 2025, the market has matured quite a bit, with institutional funds pouring in. Xai, given its tech stack, is positioned to compete with top-tier altcoins. It’s not just about surviving; it’s about whether it can carve out a permanent spot in the DeFi/Web3 landscape.

The big question: Is Xai a "Buy"?

On paper, Xai looks like a strong candidate for a balanced portfolio. Buying in the current range could offer decent returns in the coming months. But—and it’s a big "but"—don't ignore the risks. Volatility is part of the game. We always suggest diversifying; it’s the best way to protect yourself when the market decides to take a sudden turn.

Portfolio Optimization Strategies, ASCN.AI, 2025

“Keep the Xai forecast in focus. The goal is to act on data, not FOMO, to minimize your downside.”

Smart moves for crypto buyers

If you’re trading for quick gains, look for entries near support levels where indicators suggest a trend reversal. For the long-haulers? The best time to enter is usually during ecosystem growth phases or when market cap starts to climb steadily.

Keep these things on your radar:

- Trading volumes and key psychological price levels.

- The project roadmap—are they actually hitting their deadlines?

- Whale activity. Follow the money.

The Catch: Risks vs. Rewards

The reward is backed by solid tech and a growing community. The risk? Regulatory "surprises" and the inherent wildness of crypto prices. Using a Dollar-Cost Averaging (DCA) strategy is often the smartest move to smooth out those aggressive price swings.

Expert take and a quick CTA

Successful entries usually happen during short-term dips when others are panicking. If you want to stay informed without spending all day on Twitter (X), subscribing to ASCN.AI’s analytics will give you the edge you need to make rational calls.

“Investing in Xai requires a mix of patience and timing. Don't go in blind—use the right tools.”

Remember: All investment decisions carry risk. Always do your own research or talk to a pro.

The "Social" Factor: What the forums are saying

What happens on Reddit and Telegram doesn't stay there—it moves the price. A positive community vibe often acts as a leading indicator for a price pump. Experts emphasize that while "vibe" matters, you need to back it up with fundamental data to avoid getting caught in a bubble.

How hype translates to price

The market reacts to the news cycle fast. ASCN.AI actually pulls data from these social sources to refine its forecasts, giving you a clearer picture of market sentiment before it fully hits the charts.

FAQ — Your Xai questions answered

What’s the main driver for crypto prices?

It’s a mix of supply/demand, tech updates, regulatory news, and the general economic climate. Social sentiment is the wild card that often accelerates these moves.

Is now a good time to buy?

If you see an uptrend and solid support levels, it could be. But it really depends on your personal risk tolerance and how long you plan to hold.

What will the price be tomorrow?

Forecasts suggest potential growth, but corrections are always on the table. No one has a perfect crystal ball, so always leave room for uncertainty.

The Bottom Line

The Xai outlook is generally bullish, supported by strong tech and favorable market trends. It’s an asset that bridges the gap between innovation and market demand, making it one to watch for both traders and investors. Just remember: stay cautious, use the tools at your disposal, and don't bet more than you can afford to lose.

Key metrics to watch:

- Feature launches and dev progress.

- Macro crypto trends.

- What BTC and ETH are doing.

- Trading volume and institutional buy-ins.

By the way, here is the final verdict on Xai from our ASCN.AI assistant:

Real-world cases from the ASCN.AI archives

When Falcon Finance (FF) started to tank, our rapid monitoring helped users react instantly, significantly cutting down potential losses. It’s a prime example of why speed matters in this market.

Case Study: Protecting assets during the Falcon Finance drop

On the flip side, the October 11th flash crash was a goldmine for those who knew where to look. We identified arbitrage opportunities in real-time, turning a market disaster into a profit-making event.

Case Study: Profiting from the October 11 Flash Crash

Disclaimer

The information provided here is for educational purposes only and is not financial advice. Crypto investments are high-risk. Always consult with a professional financial advisor before making any investment decisions.