WOO Network Course Forecast: Full Overview and Analytics

about cryptocurrencies.

Got a burning question about crypto? Our AI assistant is ready to help. Start your analysis right now.

| Year | Floor Price (USD) | Ceiling Price (USD) | What’s driving this? |

|---|---|---|---|

| 2026 | 0.005 – 0.03 | 2.92 – 3.42 | DeFi activity picks up; potential post-halving BTC rally. |

| 2027 | 0.003 – 0.03 | 3.00 – 3.50 | Strategic partnerships (look at Cronos); tracking ETH 2.0 maturity. |

| 2028 | 0.002 – 0.04 | 3.50 – 4.50 | Going multi-chain (Solana, Base); NFT and gaming hype. |

| 2029 | 0.001 – 0.05 | 4.00 – 5.00 | Global adoption kicks in; likely major exchange listings. |

| 2030 | 0.001 – 0.08 | 5.00 – 5.19 | DeFi reaches maturity; full Web3 integration. |

| 2031 | 0.001 – 0.10 | 5.00 – 7.00 | Regulators finally get clear; another potential bull cycle. |

| 2032 | 0.001 – 0.12 | 6.00 – 8.00 | Mass adoption in Asia; protocol upgrades. |

| 2033 | 0.001 – 0.15 | 7.00 – 10.00 | AI meets blockchain. Global growth, though forks remain a risk. |

| 2034 | 0.001 – 0.20 | 8.00 – 12.00 | Long-term bull market; WOO becomes a perp-trading staple. |

| 2035 | 0.001 – 0.25 | 10.00 – 15.00+ | Full decentralization. If they capture 50% of the market, $15+ is on the table. |

Here’s how the ASCN.AI assistant breaks down the WOO forecast:

“Predicting where WOO goes next is a challenge, but a manageable one. We’re looking for an accurate, data-driven view based on fundamentals and market sentiment,” says the team at ASCN.AI.

So, what’s the deal with WOO Network?

In short, WOO Network is a liquidity ecosystem designed to bridge the gap between retail traders and the big institutional players. They do this via high-speed platforms and remarkably low fees. But why track the price so closely? Well, a solid WOO forecast isn't just about guessing numbers; it’s about managing your risk and deciding if today is a 'buy' day or if you're better off waiting until next month.

The project stays relevant because it's deeply woven into the DeFi fabric. As demand for liquidity shifts, so does the price. By watching these trends, investors can get a better sense of the coin’s "intrinsic value" and figure out the best time to jump in.

By the way, it’s worth noting that WOO has a bit of a cult following among pros and newbies alike—mostly because it keeps things simple in a complex market.

A look back: WOO's price history

WOO really caught its first big wave in early 2021. Back then, it was trading well under a dollar. But as DeFi took off and the total crypto market cap ballooned, WOO followed suit.

Things got a bit bumpy in 2022 and 2023. Like the rest of the market, it had to deal with bear cycles, regulatory noise, and internal protocol tweaks. Lately, though, it seems to be testing some key resistance levels. If it breaks through, we might be looking at the start of a whole new cycle.

“When you look at the historical data, it’s clear: WOO lives and breathes with the DeFi sector,” notes ASCN.AI for 2025.

What’s actually moving the needle?

Price doesn’t move in a vacuum. If you’re watching WOO, you’ve got to keep an eye on a few things:

- How many people are actually using the network and how much liquidity is there?

- New partnerships and major protocol upgrades.

- The general health of the crypto market (and what the US dollar is doing).

- Social media chatter—specifically Telegram and the usual crypto forums.

- Technical indicators that show who’s winning: the bulls or the bears.

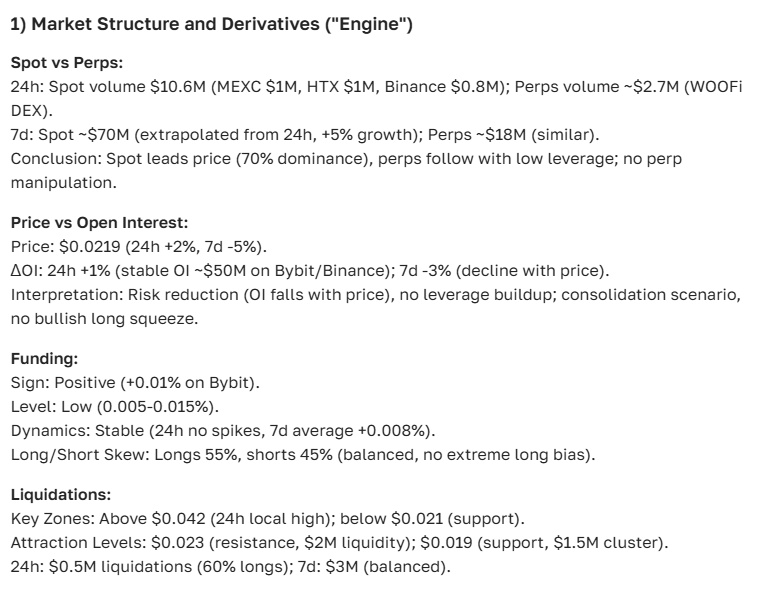

Where WOO stands today

As of April 2025, WOO is sitting around $0.0263. It’s dipped about 4.72% over the last month, which, in the world of crypto, is basically just a regular Tuesday. We’ve seen some choppy movement, mostly tied to new DeFi announcements and partnership news.

Numbers don't tell the whole story, but the current setup looks pretty interesting for those watching the charts.

The monthly view

The 30-day chart shows plenty of volatility. Right now, support seems to be holding firm around $0.0200, while $0.0300 is acting as a bit of a ceiling. Whenever we see a spike, it’s almost always trailing a piece of "big news" or a whale making a move.

WOO vs. The Big Guys

How does it stack up against BTC or ETH? Generally, WOO correlates pretty closely with the broader altcoin market. While a strong dollar can put some downward pressure on the price, the project’s fundamentals usually provide a decent safety net.

Future outlook: Is there room to grow?

Many analysts see WOO as one of those "slow burn" projects with significant upside in the coming months. The main arguments? Stable liquidity and a growing list of use cases. If the current investor sentiment holds, the coin could easily strengthen its market position.

The tug-of-war: Growth vs. Risks

On one hand, you have tech upgrades and new partners pushing the price up. On the other, you have macro shocks and technical glitches that can send things sideways. Short-term price swings are often driven by whatever is trending on crypto forums or Twitter (X).

“Data from the forums shows that traders still love WOO for its low-fee structure,” says the ASCN.AI 2025 report.

How the experts crunch the numbers

A good forecast isn't a crystal ball—it’s a mix of technical charting and fundamental research. We usually look at three scenarios: the "moon" shot (optimistic), the "steady as she goes" (neutral), and the "market crash" (pessimistic) outlook.

“To get the full picture, you have to balance trading volume with real-time sentiment,” adds ASCN.AI.

The toolkit: How we predict price

Moving Averages (SMA and EMA)

These help us cut through the noise. Currently, the 50-day SMA is hovering near $0.028, while the 200-day is further up at $0.057. This tells us the price is in a bit of a stabilization phase.

“When those moving average lines cross, that’s usually your signal that a new trend is starting,” according to this guide on technical indicators.

The RSI Factor

The Relative Strength Index for WOO is sitting at 49. In plain English? It’s not overbought, and it’s not oversold. It’s right in the middle, meaning supply and demand are basically duking it out for control.

Bollinger Bands and Candlesticks

Bollinger Bands help us spot when volatility is about to explode. Meanwhile, on the charts, we’re seeing "Hammer" and "Three White Soldiers" patterns—bullish signs that suggest the upward momentum might not be over just yet.

The global cash flow

Fundamental analysis isn't just about code; it's about the money. We look at how DeFi integrations and institutional investments are flowing into the ecosystem. If the big money starts moving into crypto, WOO is usually positioned to catch some of that spillover.

Volume speaks volumes

Price movement without volume is a trap. Luckily, WOO has seen a steady increase in trading activity lately. That usually means people are actually interested, rather than just bot activity.

Short-term price targets

Looking at the next few days, we’re cautiously optimistic. Expect WOO to trade between $0.0257 and $0.0275. Unless some major bad news drops, there’s a small window for growth here.

Walls and Floors

The $0.020 floor is solid. For the bulls to take over, they need to smash through the $0.030–$0.045 resistance zone. If that happens, the sky’s the limit (relatively speaking).

The reality check: Risks vs. Rewards

Let's be real: crypto is risky. You’ve got "whales" who can dump the market, regulatory changes that come out of nowhere, and the usual technical risks. The upside? If WOO continues to be adopted as a standard for trading, the current price might look like a bargain in a few years.

Always keep an eye on the news. If you want to see how fast things can change, check out this case study on the Falcon Finance (FF) crash.

The long game: WOO in 2030 and beyond

If you're a "HODLer," the long-term view is what matters. We’re expecting a slow climb with some potential fireworks by 2030 as the ecosystem matures.

| Year | Min (USD) | Avg (USD) | Max (USD) | The Trend |

|---|---|---|---|---|

| 2025 | 0.0244 | 0.0276 | 0.0309 | Stabilizing before the next leg up. |

| 2026 | 0.0101 | 0.0204 | 0.0308 | Heavy swings, but leaning bullish. |

| 2027 | 0.0097 | 0.0176 | 0.0255 | A bit of a cool-down/consolidation phase. |

| 2028 | 0.0175 | 0.0302 | 0.0429 | Growth starts to pick up speed. |

| 2029 | 0.0385 | 0.0825 | 0.1265 | Major upgrades could trigger a breakout. |

| 2030 | 0.0327 | 0.0636 | 0.0946 | Setting a new "normal" price floor. |

| 2031 | 0.0387 | 0.0625 | 0.0863 | The market finds its balance. |

| 2032 | 0.0590 | 0.1096 | 0.1601 | Big institutions start taking notice. |

| 2033 | 0.1372 | 0.2818 | 0.4265 | Aggressive expansion into new markets. |

| 2034 | 0.1103 | 0.1786 | 0.2470 | Volatility drops as the market matures. |

| 2035 | 0.1304 | 0.2107 | 0.2911 | Establishing its place in the Top 100 long-term. |

| 2036 | 0.2158 | 0.4090 | 0.6022 | Tech milestones could push it past $0.60. |

How high can it go?

If everything goes perfectly, we could see WOO top $0.60 by 2036. More conservative analysts are betting on the $0.20 to $0.40 range. It all comes down to how many people actually end up using the platform for their daily trades.

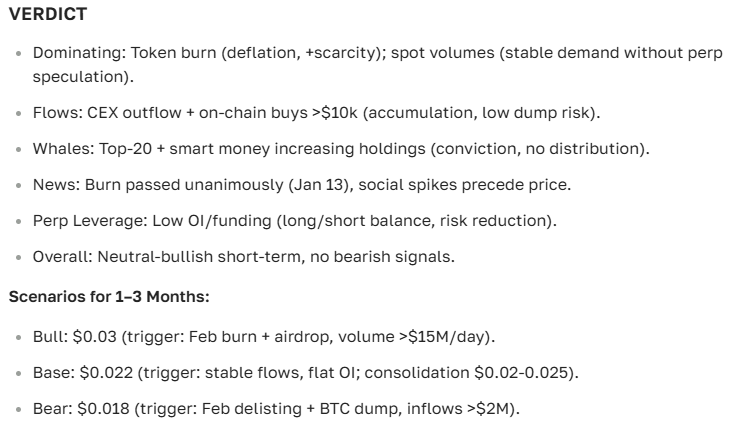

What are the possible scenarios?

- The Bull Case: Rapid protocol adoption and massive partnerships.

- The Neutral Case: Steady growth that tracks with the rest of the market.

- The Bear Case: Regulatory crackdowns or a general loss of interest in DeFi.

Common Questions

Is WOO a good investment?

On paper, it looks strong. The tech is there, and the liquidity is solid. But remember, this is crypto. High rewards always come with high volatility. Only invest what you’re okay with seeing move 20% in a day.

Can WOO actually "moon"?

It’s possible. If the ecosystem expands and the market conditions are right, there's definitely room for significant growth compared to where we are now.

What will WOO be worth in 10 years?

Long-term models suggest it could be worth significantly more, but you’ll need to check back often. A lot can happen in a decade—just look at where Bitcoin was ten years ago.

Latest News & Analysis

The recent buzz around DeFi updates has definitely helped WOO’s sentiment. With more big players using the platform, trust is growing, and demand is following.

What are people saying?

The consensus among experts is that WOO has "staying power." If you browse the forums, the most common praise is for the low fees and the reliability of the trading engine.

The Bottom Line

Predicting WOO isn't just about staring at charts; it's about watching the whole DeFi landscape. To stay ahead, you need a mix of real-time data and a solid understanding of the project's fundamentals.

Here’s the final word on WOO from ASCN.AI:

ASCN.AI Case Studies

- Falcon Finance (FF) Crash — How to spot risks before they wipe you out.

- Profiting from the Oct 11 Flash Crash — A lesson in using technical analysis when everyone else is panicking.

Disclaimer

Look, we’re analysts, not magicians. This info is for educational purposes and isn't financial advice. Crypto is a wild ride. Always talk to a pro before putting your money on the line.