WBTC Cryptocurrency Price Forecast for Today and the Future – Analysis and Latest News

about cryptocurrencies.

Got a burning question about crypto? Our AI assistant has the answers. Start your analysis right here.

| Year | Low (USD) | Average (USD) | High (USD) | Context and Sources |

|---|---|---|---|---|

| 2025 | 50,942 | 101,612 | 154,791 | BTC Peg; AMBCrypto/CoinCodex; ETF-driven volatility. |

| 2026 | 69,901 | 115,314 | 193,993 | Growing DeFi adoption; CoinLore/Binance; lows expected during corrections. |

| 2027 | 93,240 | 124,000 | 200,000 | 5% annual growth; Kraken/Margex; highs hit during bull runs. |

| 2028 | 110,000 | 137,000 | 250,000 | Tokenization hype; AMBCrypto; lows tied to regulatory shifts. |

| 2029 | 130,000 | 165,000 | 300,000 | BTC halving impact; CoinCodex; historical cycle averages. |

| 2030 | 150,000 | 200,000 | 350,000 | Mass adoption; Margex; highs from global integration. |

| 2031 | 180,000 | 220,000 | 400,000 | DeFi maturity; Binance; competition-driven floors. |

| 2032 | 200,000 | 250,000 | 450,000 | Institutional inflows; CoinLore; 5-10% CAGR average. |

| 2033 | 220,000 | 280,000 | 500,000 | Regulatory clarity; AMBCrypto; max levels during ETF expansion. |

| 2034 | 250,000 | 320,000 | 550,000 | Blockchain scaling; Kraken; macro risks impacting the low end. |

| 2035 | 314,805 | 393,506 | 472,208 | Long-term peg stability; AMBCrypto; highly speculative, DYOR. |

“Wrapped Bitcoin (WBTC) is a heavyweight in the crypto space, essentially bridging Bitcoin's massive liquidity with the sheer utility of Ethereum.”

Where is WBTC headed today and in the long run? It's a question on the mind of almost every investor keeping tabs on the market. WBTC has carved out a massive niche for itself in the DeFi ecosystem by backing every token with BTC and setting it loose on the Ethereum network. To get a clear picture of its potential, we’re digging into the price action, technical setups, and the general market mood.

By the way, if you want a deeper look, here is what our ASCN.AI assistant has to say about the trend:

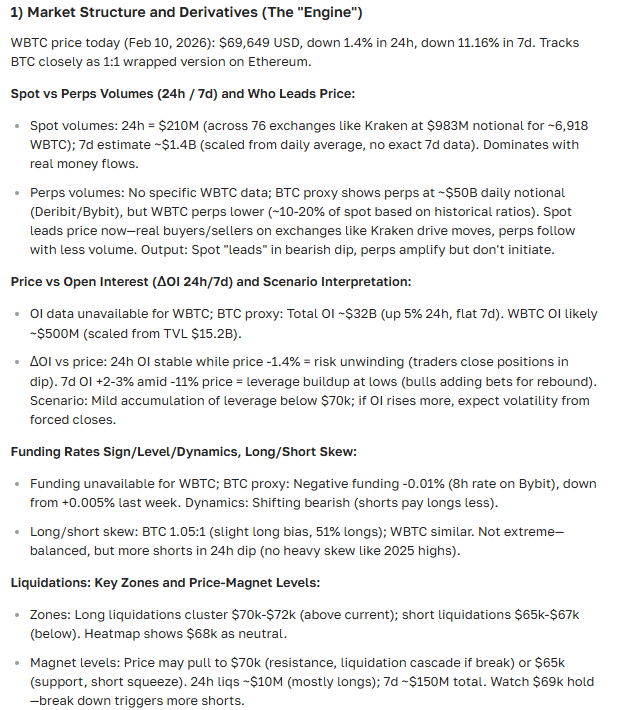

Where does WBTC stand right now?

As of today, WBTC is trading almost neck-and-neck with Bitcoin—which makes sense, given the 1:1 backing. But don’t let that fool you into thinking it's only about BTC. On-chain activity on Ethereum and the overall health of DeFi protocols also play a role in how the market values this token.

The correlation with BTC is tight—over 0.99—but small discrepancies sometimes pop up. These are usually tied to demand for DeFi products or liquidity shifts within Ethereum. Throughout July 2025, WBTC has been bobbing up and down, largely mirroring the broader market's indecisiveness.

The short-term outlook: Today, tomorrow, and the month ahead

Looking at the next 24 hours, the price seems to be leaning on Bitcoin’s current stability. Trading volume is moderate, and the RSI is hanging out around the 50 mark. This basically tells us the market is in equilibrium, with volatility likely staying within a 1% range unless something unexpected happens.

Short-term charts confirm we’re in a consolidation phase. There aren’t many strong impulses right now, so don't expect any "to the moon" moves overnight. Still, in crypto, a single news headline can change that in seconds.

The mid-term view (one month)

As we move through July 2025, there’s a sense that WBTC might start to firm up. This is often a seasonal thing—quarterly reports and new DeFi launches tend to bring investors back to the table. Historically, the summer period sees a bump in activity that helps push demand for wrapped assets.

There’s a good chance we’ll see it test some key resistance levels soon. Even if we see a 3–5% pullback due to thin liquidity here and there, the general trend looks healthy, backed by a constant need for WBTC in the DeFi world.

Looking way ahead: The long-term game

What about 2025–2036? We’re talking about a decade where blockchain might actually go mainstream. As institutional interest ramps up, WBTC stays relevant by keeping its tether to Bitcoin while benefiting from whatever upgrades Ethereum rolls out next.

On a macro scale, the $20,000 and $40,000 zones remain the historical anchors. If the total crypto market cap continues its climb, these levels will be far in the rearview mirror. The real fuel for growth, though, is how deeply WBTC gets woven into sophisticated financial tools.

| Year | Min Price, $ | Avg Price, $ | Max Price, $ |

|---|---|---|---|

| 2025 | 86,331.64 | 91,185.42 | 96,039.19 |

| 2026 | 31,303.43 | 63,435.97 | 95,568.51 |

| 2027 | 30,135.03 | 54,649.97 | 79,164.92 |

| 2028 | 54,384.88 | 93,795.23 | 133,205.57 |

| 2029 | 119,467.93 | 256,231.66 | 392,995.39 |

| 2030 | 101,602.36 | 197,682.34 | 293,762.32 |

| 2031 | 120,125.47 | 194,148.56 | 268,171.65 |

| 2032 | 183,362.43 | 340,403.53 | 497,444.62 |

| 2033 | 426,094.38 | 875,552.89 | 1,330,000.00 |

| 2034 | 342,559.47 | 554,967.49 | 767,375.52 |

| 2035 | 405,011.41 | 654,585.43 | 904,159.45 |

| 2036 | 670,421.08 | 1,270,000.00 | 1,870,000.00 |

What’s actually driving the price?

News moves the needle. Whether it’s an Ethereum network upgrade, a major whale move, or a new DeFi protocol going live, WBTC demand reacts almost instantly. For example, back in July 2025, updates regarding Ethereum's scaling and the expansion of the DeFi sector gave the token a noticeable boost.

If you want to stay on top of these events as they happen, check out our News Blog.

The charts don't lie—or do they?

Technically speaking, we're in a bit of a "wait and see" mode. The RSI is neutral, suggesting that neither buyers nor sellers have the upper hand. Interestingly, the 50-day moving average (MA) recently crossed above the 200-day MA, and the price is currently sitting above both. In many books, that’s a bullish sign.

However, the MACD shows a side-to-side grind. It’s a classic stalemate. If you’re curious about how to read these signals yourself, we’ve got a guide on the best RSI and MACD strategies for this kind of market.

Whales and "ripping" the market

Lately, we’ve seen some local price spikes followed by quick corrections—classic "whale" behavior. In the community, you’ll often hear people talk about the price "ripping." Usually, this describes those sudden, aggressive jumps triggered by a massive order or a technical breakout.

While these moves can be jarring, the long-term chart for WBTC still shows a gradual, upward climb. It’s the standard "two steps forward, one step back" pattern we see with major assets.

Is WBTC a good buy right now?

There’s no such thing as a risk-free investment. Buying WBTC means you're exposed to Bitcoin’s legendary volatility and any potential issues with the Ethereum network. On the flip side, the growing institutional appetite and the token's deep liquidity make it hard to ignore.

Since it's a staple in DeFi and a common tool for hedging, the utility alone gives it a level of "stickiness" that many other tokens lack.

What the community is saying

If you browse the major forums, the consensus is usually centered on reliability. People trust WBTC because it’s backed by the "real thing." Analysts often point out that the current price reflects a very balanced demand for Bitcoin-level security within an Ethereum-style playground.

The pros will tell you: watch the news, but don't ignore the indicators. That's usually where the best entry points are hidden.

FAQ

What is WBTC, exactly?

It’s an ERC-20 token pegged 1:1 to Bitcoin. Think of it as a way to use your Bitcoin on the Ethereum network without actually selling it.

Why should I watch the WBTC price?

Because it tracks BTC but reacts to DeFi demand. If you're trading on DEXs or using lending protocols, the WBTC price is your primary benchmark.

How is the price determined?

It’s mostly dictated by Bitcoin’s market price, but local demand for liquidity in the DeFi space can create small, tradable gaps.

Pro Tips for Your Strategy

- Monitor BTC and ETH trends simultaneously; they both matter here.

- Don't just look at the price—look at RSI and candlestick patterns.

- Keep an eye on DeFi news; it’s the primary driver for WBTC utility.

- Always model a "worst-case" scenario before you jump in.

Common pitfalls to avoid

- Chasing short-term hype while ignoring the long-term trend.

- Forgetting about support and resistance levels.

- Ignoring how macroeconomics (like interest rates) affects Bitcoin.

- Sticking to one strategy when the market clearly changes its mind.

A balanced, diversified approach usually wins the day in the long run.

Comparing the heavyweights

| Feature | WBTC | BTC | ETH | USDT |

|---|---|---|---|---|

| Token Type | ERC-20 (Backed) | Native Coin | Native Coin | Stablecoin |

| Backing | 1:1 BTC | Self-custodied | None | 1 USD |

| Market Cap | Tracks BTC | #1 Crypto | #2 Crypto | Top Stablecoin |

| Primary Use | DeFi, DEXs | Store of Value | DApps, DeFi | Liquidity |

| Volatility | Same as BTC | High | High | Virtually Zero |

To wrap it up

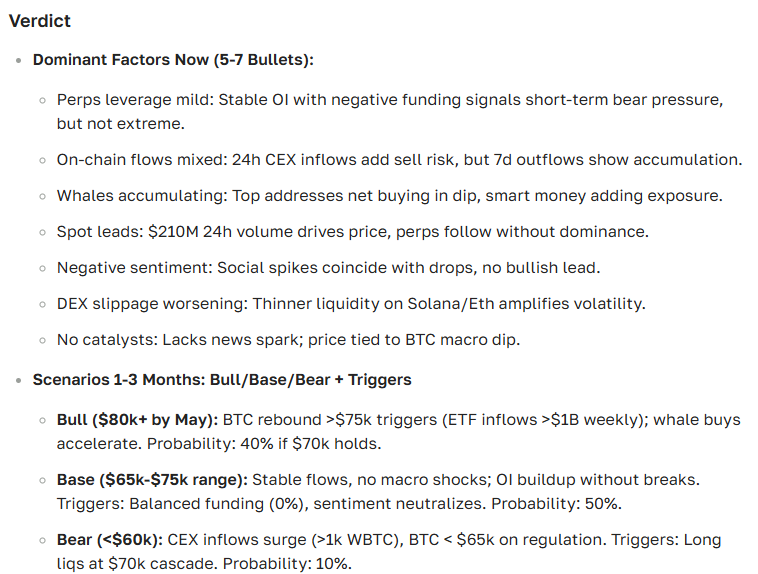

The WBTC forecast is, for the most part, a Bitcoin forecast with a DeFi twist. We’re expecting a period of stability followed by a slow grind upward. In the long term, as the walls between blockchains continue to come down, WBTC is positioned to be a major bridge for institutional capital.

Here is the final verdict from ASCN.AI:

A quick reality check

Don't forget that crypto is risky. Volatility and technical shifts are part of the game. Doing your own homework is the only way to stay ahead of the curve.

“The most successful investors aren't the ones with the best luck; they're the ones who do their own digging and stick to the data.”

Real-world insights from the field

Interestingly, ASCN.AI data showed that during recent flash crashes, WBTC held its liquidity better than many other altcoins. This allowed savvy traders to pivot quickly and protect their capital. You can read more about that in our Flash Crash Case Study.

Also, when Falcon Finance saw a sharp dip, our tools identified the risks early, helping users diversify into WBTC to stabilize their portfolios. Catch the full story in the Falcon Finance Case Study.

Note: This content is for informational purposes only. The crypto market is high-risk, so always be cautious with your capital.

Disclaimer

This information is general in nature and does not constitute financial advice. Investing in cryptocurrencies involves significant risk. Always consult with a qualified financial professional before making any investment decisions.