WAX Cryptocurrency Price Forecast: Outlook and Latest News

about cryptocurrencies.

Got a burning question about crypto? You can always ask our AI assistant for a quick deep dive. Start your analysis right here.

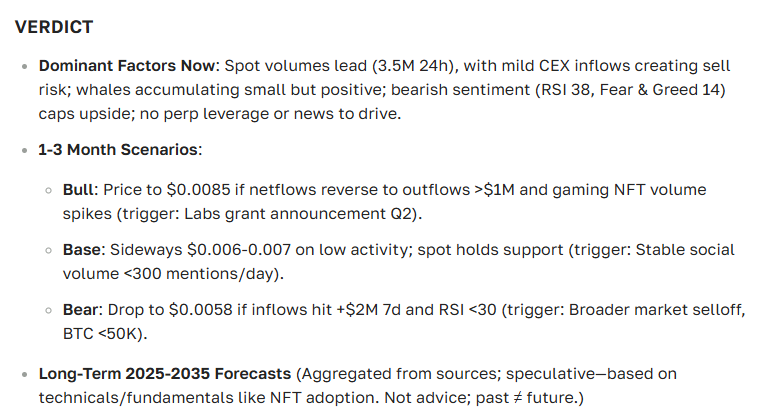

| Year | Min Target (USD) | Average Target (USD) | Max Target (USD) | Notes & Sources |

|---|---|---|---|---|

| 2025 | 0.0081 | 0.0088 | 0.0091 | Conservative TA; Changelly. Alt: max 0.152 with network growth. |

| 2026 | 0.0085 | 0.0090 | 0.0163 | Neutral channel; CoinCodex, PricePredictions max. |

| 2027 | 0.0100 | 0.0120 | 0.0200 | NFT growth extrapolation; Mudrex/Gate. |

| 2028 | 0.0150 | 0.0200 | 0.0300 | Average growth of 20%/year; DigitalCoinPrice. |

| 2029 | 0.0200 | 0.0250 | 0.0455 | Changelly max assuming key partnerships. |

| 2030 | 0.0556 | 0.0571 | 0.0659 | Baseline; Changelly. Alt: max 16.68. |

| 2031 | 0.0600 | 0.0700 | 0.0800 | Extrapolation; Coinbase ~0.014 CAD. |

| 2032 | 0.0650 | 0.0750 | 0.0900 | Steady ecosystem expansion. |

| 2033 | 0.0700 | 0.0800 | 0.1000 | No major catalysts factored in. |

| 2034 | 0.0750 | 0.0850 | 0.1100 | DigitalCoinPrice min 0.10. |

| 2035 | 0.0800 | 0.0900 | 0.1200 | Conservative; +10%/year trend from 2030 (extrapolation). |

Here is how our AI assistant breaks down the WAX outlook:

"Predicting where WAX goes next isn't just about reading a chart—it’s about looking at technical fundamentals and the pulse of the broader market. You need the full picture to see if the potential matches the hype."

What exactly is WAX?

WAX was built with a clear purpose: making virtual commerce and gaming actually work for the average user. Think of it as the plumbing for the NFT world and digital collectibles. While other blockchains struggle with congestion, this network focuses on speed and keeping fees low enough that you don't even notice them. It’s the go-to for Web3 projects where users need to trade items instantly without a massive "gas" headache.

The main audience here is gamers, collectors, and developers. They use WAX to swap virtual goods in real-time on decentralized platforms. At the end of the day, its job is to keep the gears of the ecosystem turning, ensuring that every transaction is confirmed almost as soon as you click the button.

Under the hood: Technicals and features

The network runs on a Delegated Proof of Stake (DPoS) protocol. In plain English? It’s designed to handle a ton of traffic without burning through massive amounts of electricity. This sets it apart from more traditional "heavyweight" blockchains and makes it practical for mass adoption.

Here’s the catch: with block times around 0.5 seconds, it’s lightning-fast. It fully supports smart contracts, integrates natively with NFTs, and hosts a variety of dApps. By using DPoS, the network dodges the usual pitfalls of high fees and lag that often plague other chains when things get busy.

Source: All About Ethereum: An Analytical Review, 2025

A bit of history: How WAX got here

The project hit the scene back in 2017. Back then, the goal was simple: create a platform that could handle digital assets better than anyone else. Since those early days, it has grown into a versatile ecosystem, constantly layering on security updates and scaling solutions.

What really moved the needle were the big-name partnerships with gaming giants and major marketplaces. It’s been impressive to watch how quickly the project pivots to stay relevant in the ever-shifting world of NFTs and virtual goods. If you don’t want to dig through every single historical update, ASCN.AI can give you the highlights in a few seconds.

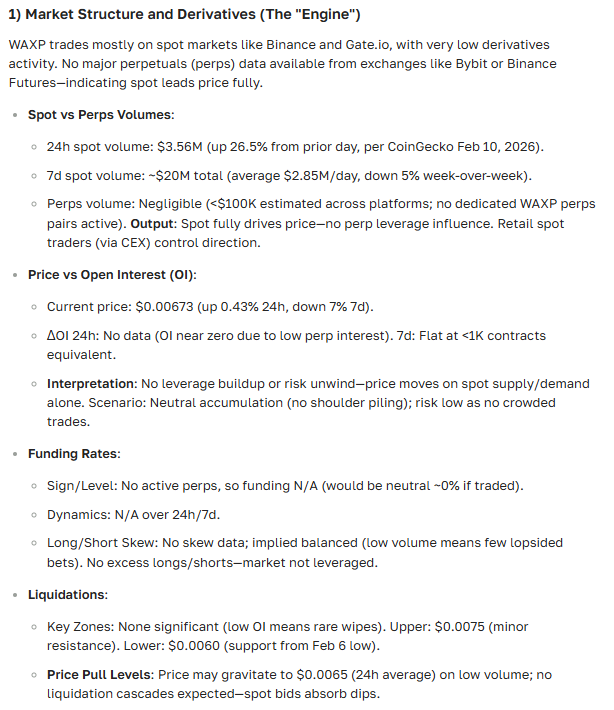

Where does the price stand today?

Over the last month, WAX has been on a bit of a rollercoaster. We saw a dip early in July, but by mid-month, things started to level out. It’s a classic tug-of-war between the demand for NFT projects and the general mood of the crypto market.

Does the US Dollar still call the shots?

Since WAX is mostly traded against the USD on major exchanges, the strength of the dollar matters—a lot. Usually, when the dollar takes a breather, investors start looking at alternatives like crypto, which can push the price up. Conversely, a "strong" dollar often keeps the price of assets like WAX in check.

There is also the "gamer factor." Since WAX is tied so closely to virtual goods, the actual spending power of its users (which is affected by the dollar's value) plays a subtle but real role in the token's daily price action.

Volume and Market Presence

Trading volume usually peaks when there’s a new NFT drop or a big game update. On paper, its market cap is strong enough to keep it relevant in the digital assets niche, showing that there is still plenty of institutional and retail trust in the coin.

| Metric | Current Value |

|---|---|

| Current Price (USD) | $0.15 |

| 24h Trading Volume | $25M |

| Market Capitalization | $450M |

| Monthly High | $0.18 |

| Monthly Low | $0.12 |

Source: Comprehensive Crypto Market Analysis, 2025

Analysis: What’s the forecast?

Right now, WAX is showing some modest strength, hovering above a key support level at $0.14. If it manages to hold this line, we might see it test the $0.16–$0.17 range soon, provided the news cycle stays relatively quiet.

Looking at the next few days, the trend seems cautiously optimistic. However, in crypto, everything can change in an hour based on a single NFT headline or a sudden shift in market volatility. By the way, if you need a real-time update on these levels, ASCN.AI is great for pulling current sentiment.

Source: Best Crypto Trading Strategies for 2025

The monthly outlook: What to expect?

If we look a month ahead, the price depends on a few "ifs." If NFT interest picks up and the global economy doesn't throw a curveball, we could see WAX hitting $0.20 or even $0.22. On the flip side, we can’t ignore the potential for short-term corrections—the market is nothing if not volatile, and big players can still swing the price.

What’s pushing the price (and what’s holding it back)?

Here’s why the price might climb:

- Increased NFT volume and more content on WAX-backed platforms.

- New partnerships or tech upgrades that actually make a difference.

- A general "rising tide" in the crypto market.

And here’s why it might stall:

- People losing interest in gaming tokens or NFTs.

- Regulators deciding to get tougher on digital assets.

- A sudden spike in the dollar making investors play it safe.

Source: Bear vs. Bull Markets in Crypto, 2025

Reading the charts: Technical Analysis

The $0.14 mark is the line in the sand right now. If it breaks, expect some choppiness. Resistance is sitting up between $0.18 and $0.19. Interestingly, indicators like the RSI and MACD are hinting at a slow, steady climb—not quite a "moon mission," but a sign that the bulls are starting to wake up.

We’ve also seen some "Hammer" and "Engulfing" patterns on the daily candles. In the world of technical analysis, these are often the first signs that a reversal is on the cards.

Recent news and the "Word on the Street"

WAX recently teased a new integration with a major gaming platform. This is the kind of news that gets investors excited because it actually expands the user base. Couple that with recent protocol updates that cut fees even further, and you have a solid foundation for growth.

If you check Telegram or the usual forums, the vibe is mostly positive. Investors seem to appreciate that the team is actually shipping updates rather than just talking about them.

"The chatter on Telegram and various forums highlights how much the community still values WAX's role in the NFT sector."

Is WAX a "Buy" right now?

Buying WAX today could be a solid move for a medium-term play, but only if you’re comfortable with the risks. The main "catch" is that WAX lives and dies by the NFT market. If that sector goes cold, the token will likely follow suit.

Still, at current prices, it’s an accessible asset. Under the right conditions, a push toward $0.20 or higher isn't out of the question.

A strategy for the cautious investor

Many experienced traders use a "dollar-cost averaging" approach—buying in small chunks to smooth out the price swings. It’s also worth keeping a close eye on the ecosystem updates. Here’s a quick checklist:

- Watch the price in real-time on major exchanges.

- Use tools like ASCN.AI to filter out the noise and get real data.

- Know your support and resistance levels.

- Don't invest more than you can afford to lose.

- Stay flexible—if the news turns sour, be ready to adjust.

Burning Questions (FAQ)

What actually makes the price move?

It’s a mix of NFT demand, the general crypto climate, project updates, and the strength of the US dollar.

Where is the best place to track WAX?

Major exchanges give you the raw numbers, while Telegram and specialized crypto forums are where you’ll find the real community sentiment.

What’s the long-term play?

The long-term value is tied to how much people actually use virtual commerce and whether WAX stays the top choice for Web3 gaming.

The Verdict

WAX still has plenty of gas in the tank. Its technical foundation is solid, and its niche in the NFT world is well-established. While the market is always a bit of a gamble, the outlook leans toward a recovery and growth in the medium term.

Think of it as a diversification tool. It’s not your average "blue chip" crypto, but it has a specific job to do, and it does it well. Just remember to keep an eye on the news—in this market, being informed is your best defense.

Here’s the final take from our AI assistant:

Disclaimer

This information is for educational purposes and should not be taken as financial advice. Crypto investments are high-risk. Always talk to a professional financial advisor before making any big moves.