TRON cryptocurrency forecast for 2025-2035 — latest news and prospects

about cryptocurrencies.

Got a crypto question? Hit up our crypto AI assistant anytime. Jump into the analysis now.

| Year | Price Range (USD) | Avg Price (USD) | Key Drivers & Risks |

|---|---|---|---|

| 2026 | $0.28 – $0.45 | ~$0.35 | Post-2025 rally kicks in; USDT booms on TRON, DeFi TVL jumps 40%. But watch out—SEC regs (those Sun lawsuits), BTC peak pullback. |

| 2027 | $0.37 – $0.55 | ~$0.45 | Network upgrades (TRON 3.0); Asia adoption, NFTs/content surge. Risks: geopolitics (China ban vibes), Solana crowding in. |

| 2028 | $0.40 – $0.70 | ~$0.55 | Synergy with BTC halving; global payments via BitTorrent. Downsides: that 27 super reps centralization talk, EU MiCA rules. |

| 2029 | $0.50 – $0.90 | ~$0.70 | Cycle peak; TVL tops $10B, stablecoin dominance. Risks: crypto winter hits, Sun's legal headaches linger. |

| 2030 | $0.61 – $1.05 | ~$0.80 | Ecosystem matures; AI/Web3 mashups, cap over $20B. Watch alts like TON, quantum threats lurking. |

| 2031 | $0.36 – $1.20 | ~$0.90 | Transition phase; fiat inflation, emerging markets boom. Global crises, shift to decentralized L1s could hurt. |

| 2032 | $0.40 – $1.40 | ~$1.00 | New halving cycle; global standards, DPoS tweaks. Energy's low but audits needed. |

| 2033 | $0.50 – $1.60 | ~$1.10 | Bull peak; mass adoption (40%+ stables on TRON). Ecosystem hacks, G20 regs loom. |

| 2034 | $0.60 – $1.80 | ~$1.20 | Consolidation; scalability over 5k TPS, metaverses. Market saturation, Sun trust issues. |

| 2035 | $0.62 – $2.01 | ~$1.30 | Institutional push; Asia/payments king. Tech shifts, CBDC rivals. |

Our crypto AI at ASCN.AI crunched this TRON outlook. In practice, it pulls from on-chain vibes and market swings.

"On-chain digs and market metrics show TRON holding steady amid the chaos. Web3 data hints at growth potential, but external shocks keep correction risks alive."

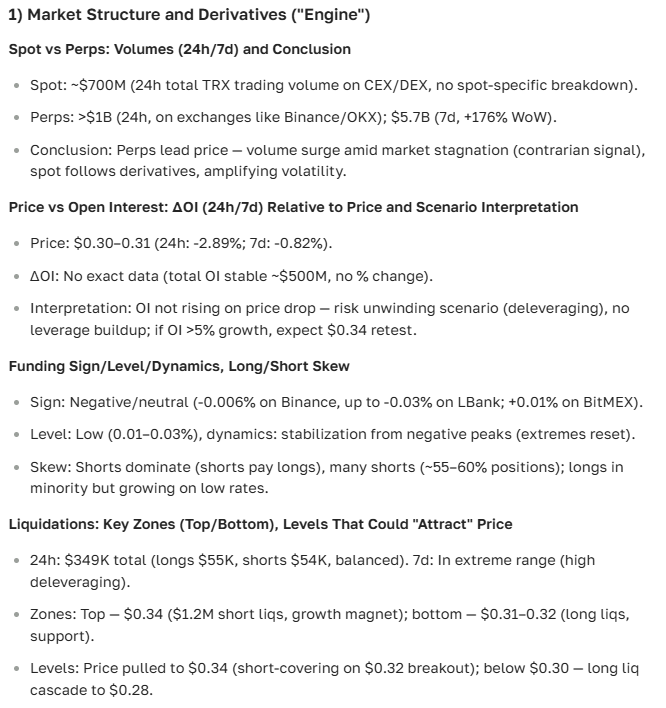

TRON's Price Today – What's Moving It?

TRX in USD and RUB

TRON (TRX) sits around $0.30 USD right now—mild swings, nothing wild. That's roughly 28 RUB per coin, tracking the dollar rate. Traders get real-time bids on exchanges and aggregators, keeping everyone in the loop.

| Date | TRX (USD) | TRX (RUB) | Change (%) |

|---|---|---|---|

| July 16 | 0.069 | 4.6 | -1.2 |

| July 17 | 0.070 | 4.7 | +1.4 |

| July 18 | 0.071 | 4.75 | +1.7 |

| July 19 | 0.068 | 4.55 | -4.2 |

| July 20 | 0.070 | 4.7 | +2.9 |

| July 21 | 0.072 | 4.8 | +2.8 |

| July 22 | 0.073 | 4.85 | +1.3 |

What's Behind the Swings?

TRX price jumps around for a few reasons. Overall crypto volatility hits supply-demand first. On-chain buzz—like more txns or holder interest—pumps appeal. Ecosystem news, partnerships, upgrades? Investors pile in. Macro stuff (dollar wobbles, regs, economy) drags the whole market. New rivals shake perceptions. Whales buying or dumping? That amplifies moves, up or down.

By the way, user activity and metrics show real demand. But news and big players often spark the real fireworks.

"TRON rides a growing on-chain scene, fresh integrations, solid community. Still, sentiment shifts and shocks can whip the price around fast."

TRON Outlook: Tomorrow to Next Month

Short-Term (Tomorrow)

Tomorrow looks mildly bullish for TRX. Hold that $0.30 support, and it could nudge to $0.31–0.32 if no bad headlines drop. On-chain signals mix with Telegram chatter for these tweaks—though volatility means pullbacks stay possible.

One-Month View

Next month hinges on market flow and TRON news. Good dApp launches or on-chain spikes? Could hit $0.32–0.34. Flip side: pressure from economy, regs, rivals drops it to $0.28–0.29. Community debates this nonstop—on paper strong, but reality bites.

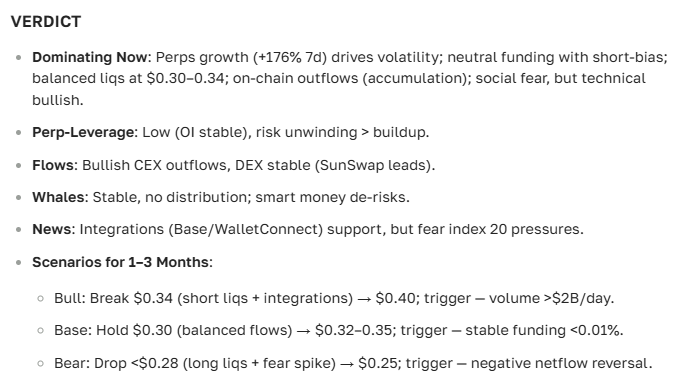

Scenarios & Pitfalls

Three paths for the month ahead. Bull: News hype and community push past $0.34, volatile ride. Base: Stays $0.30–0.33, balanced. Bear (or "rip"): Dumps to $0.27–0.28 on regs or whale sells—"rip" means that gut-punch crash.

Market's wild; news triggers panic sells. Stay nimble.

"TRON scenarios factor in crypto's nasty volatility. Prep for drops or moons—investors, buckle up."

Fresh TRON News Shaking Things Up

Market Buzz

- TRON-DeFi/NFT integrations announced lately.

- Protocol tweaks for better throughput.

- Institutional eyes on TRX tokens growing.

- Global regs and events rippling through.

How It Hits Price

Good news and tech wins draw cash, lifting TRX and outlook. But geopolitics or tighter rules sour mood, spark corrections. Mixing news with on-chain? Sharper calls, say ASCN.AI folks.

"Blending news feeds and on-chain metrics nails timely TRON forecasts," ASCN.AI analysts note.

Community Chatter on TRON

Expert & User Takes

Experts and forum folks agree: TRON's tech and community give it legs. Some call it undervalued for the long haul. Others flag volatility, rivals. Views split—do your homework.

- Price seems cheap vs future upside.

- Risks from swings and competition real.

"TRON's got legs from innovations and backers."

Buy Tips from the Crowd

- Buy at confirmed support with entry signals.

- Skip leverage—losses sting.

- Go long-term on ecosystem growth.

Buy TRON Now? Investor Angle

Upsides vs Downsides

Why buy? Ecosystem's buzzing with new tricks. Super liquid on big exchanges. Cheap entry for most.

The catches: Crypto swings hard. Regs could crimp. Rivals everywhere.

Risk Busters

- Diversify—don't bet the farm on one coin.

- Track on-chain and trends via pro tools like ASCN.AI.

- No leverage in volatile plays.

- News alerts, quick pivots.

Remember Falcon Finance's 2024 crash? ASCN.AI analytics helped folks dodge bullets by tweaking positions fast.

More on ASCN.AI's Falcon Finance save

Quick FAQ

What’s "Rip" Mean?

"Rip" is that brutal, sudden price plunge—shocks or bad news trigger it quick on crypto.

How Do Forecasts Work?

They blend on-chain data, trends, news, tech signals, expert gut.

TRON Price Drivers?

Demand, tx volume, protocol news, community heat, regs, global econ shakes it.

Live Price Checks?

CoinMarketCap, CoinGecko, or ASCN.AI's Web3 feed for fresh data.

Wrapping Up

TRON's today/tomorrow/month outlook draws from price action, drivers, news, crowd views. Growth potential's there, but risks demand caution in buys or trades.

Here's ASCN.AI's crypto AI take:

Disclaimer: Not investment advice. Crypto's high-risk—assess yourself, talk pros.