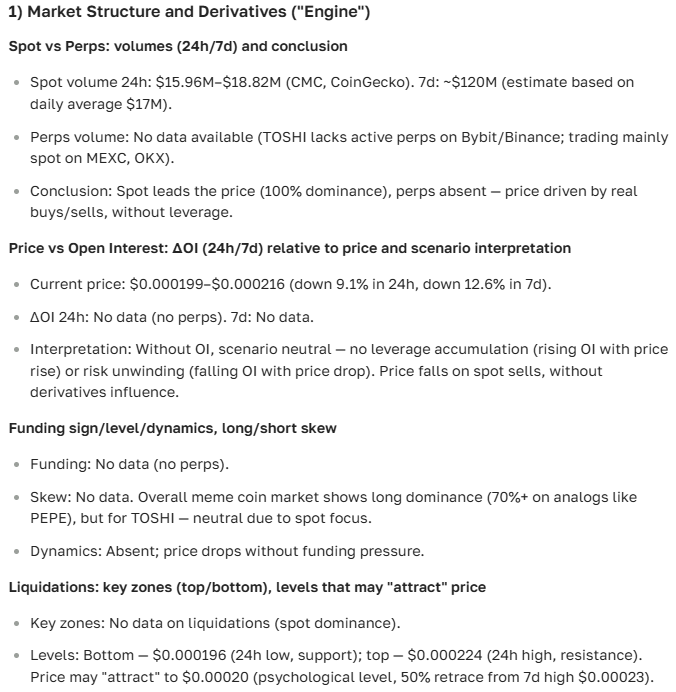

Toshi price prediction: a complete overview and analysis

about cryptocurrencies.

Got a burning question about crypto? Our AI assistant is ready to help. Start your analysis right here.

| Year | The Lows (USD) | Average Price (USD) | The Highs (USD) | What’s driving it? |

|---|---|---|---|---|

| 2026 | 0.000226 | 0.00284 | 0.00443 | Post-halving bull run; the Base ecosystem boom; typical meme-coin hype cycles. |

| 2027 | 0.00035 | 0.00350 | 0.00500 | Stabilization phase; potential meme-coin ETFs; SEC regulatory noise. (Kraken-based interpolation). |

| 2028 | 0.00050 | 0.00400 | 0.00600 | Next cycle shift; DeFi deeper integration on Base; following ETH’s lead (eyeing $10k). |

| 2029 | 0.00070 | 0.00500 | 0.00750 | 2028 halving ripple effects; a potential meme-coin "renaissance"; pressure from new competitors. |

| 2030 | 0.000592 | 0.00600 | 0.00826 | Market maturity kicks in; L2 adoption goes mainstream; potential Tier-1 CEX listings. |

| 2031 | 0.001301 | 0.00289 | 0.00401 | Typical post-bull correction; shifting focus to actual utility; global regulatory clarity. |

| 2032 | 0.00514 | 0.00540 | 0.00547 | Recovery mode; growth driven by AI/blockchain fusion; new-age meme trends. |

| 2033 | 0.004619 | 0.009492 | 0.014364 | New major bull cycle; potential new ATHs; macro influence (inflation, rates). |

| 2034 | 0.003713 | 0.00538 | 0.008546 | Post-2033 cooldown; sustainability focus; emerging tech threats (like quantum concerns). |

| 2035 | 0.00439 | 0.008535 | 0.00980 | Long-term survival; Toshi’s evolution into a utility token; total crypto market >$10T. |

Here’s the breakdown for Toshi as calculated by the ASCN.AI crypto assistant:

So, what’s the deal with Toshi?

Predicting Toshi’s price today—and where it’s headed tomorrow—has become a favorite pastime for traders on the Base network. It’s a fast-moving asset in an even faster market. Crypto doesn't exist in a vacuum; it reacts to everything from global political shifts to the latest Fed interest rate decision. If you're looking to understand Toshi's trajectory over the coming months or years, you need to look past the surface-level hype.

Volatility is the name of the game here. Toshi isn’t just riding the general market wave; its price is tethered to internal project milestones, community sentiment, and the overall "vibe" on social media. For anyone trying to manage risk, having a solid price forecast isn’t just helpful—it’s essential for making informed moves rather than just gambling on a green candle.

"Forecasting crypto isn’t about guessing; it’s about digging into Web3 data. On-chain signals and real-time news give you an edge that simple charts just can't match."

We base these outlooks on a mix of blockchain events and current market sentiment. While this provides a clearer picture, remember: this is an analysis, not a crystal ball. Always chat with a professional financial advisor before putting your capital on the line.

Checking the pulse: Current Toshi stats

| Date | Price (USD) | 24h Change (%) | Market Cap (USD) | 24h Volume (USD) |

|---|---|---|---|---|

| 2025-06-01 | 0.0458 | +3.2 | 112,000,000 | 7,500,000 |

| 2025-05-31 | 0.0443 | -1.5 | 109,000,000 | 6,800,000 |

| 2025-05-30 | 0.0450 | +0.1 | 110,500,000 | 7,000,000 |

Right now, Toshi is showing some decent resilience. After a quick dip, we’re seeing a modest recovery. It seems the price is being tugged between internal technical progress and the broader market mood. A few things are really moving the needle lately:

- Technical protocol upgrades aimed at making the network faster and more secure.

- The general 2025 "altcoin fever" that has investors hunting for the next big thing.

- The usual suspects: USD fluctuations and the constant drumbeat of SEC regulation news.

"High DEX activity and a very vocal Telegram community are keeping the demand pressure high for now."

The latest buzz and its impact

The past month has been busy for the project. If you haven't been following closely, here’s what happened:

- A new partnership with a major DeFi platform dropped, which immediately put eyes on the token.

- Integration with fresh infrastructure services has made it easier for developers to build around the ecosystem.

- Recent whale reports suggest that institutional players might be quietly building their positions.

All of this builds a pretty strong foundation for growth. But here’s the thing: in crypto, the floor can drop if the broader market catches a cold. Still, these partnerships aren't just for show—they add real functionality.

"DeFi partnerships are the lifeblood of utility; they give the token a reason to exist beyond just speculation." — ASCN.AI

Looking at the numbers: A reality check

If we look at the short-term technicals, the signals are interesting:

- Tomorrow? We're looking at roughly 0.046 USD, likely oscillating by 2–3%.

- Over the next week, a push toward 0.05 USD is on the table, assuming the community stays hyped and no "black swan" news hits.

- The monthly outlook sits around 0.055 USD, provided the new partnerships actually start showing results.

Naturally, if regulators start getting aggressive or the market loses its appetite for risk, we could see a correction back to previous support levels.

"Merging technical charts with real-time market metrics usually gives the most accurate short-term picture."

Where will Toshi be in 2030?

Long-term bets on Toshi depend entirely on how well it adapts. If you don't want to dig through endless reports yourself, ASCN.AI will spit out these projections in a few clicks. Here's how the horizon looks:

- 2025: We expect things to settle in around $0.06–$0.07 with a market cap nearing the $300M mark.

- 2030: If the team delivers on decentralized solutions, we could see $0.15 to $0.20. It sounds ambitious, but in a mature market, it’s feasible.

- 2040: This is the "moon" scenario. If Web3 becomes the global standard, hitting $1.00 isn't out of the question, though it's a long road ahead.

The real drivers? Innovation and the legal landscape. Everything else is just noise.

"Tech progress and the regulatory climate are the two pillars that will either build or break long-term crypto value."

The investor's playbook

Is it time to buy? Many analysts believe you should look for a few specific "green lights" before jumping in:

- A clean break above the 0.047 USD resistance on high trading volume.

- On-chain data showing a spike in active wallets and transaction counts.

- Real-world updates that actually expand what the token can do.

At the end of the day, diversification is your best friend. Don't go all-in on one asset, especially one as volatile as this.

Risk control isn't optional—it's the only way to survive in this market.

Spotting the signals

How do you tell if it's a pump or a dump? It’s a mix of science and gut feeling:

- Watch those support and resistance levels like a hawk.

- Check the volume: if the price goes up but volume is flat, be careful.

- Read the room: community sentiment often leads price action.

- Dive into on-chain metrics: are the whales holding or selling?

- Keep a news tab open at all times.

This systematic approach doesn't eliminate risk, but it definitely makes it more manageable.

"When trading volume and positive vibes align, the price usually follows." — ASCN.AI

Expert takes and forum chatter

If you hang out on the right forums, the conversation around Toshi usually boils down to four main points:

- How well the DeFi integrations are actually performing.

- Whether the "big money" (institutions) is sticking around for the long haul.

- The looming threat of competition from newer, shinier tokens.

- The evolution of its smart contracts and true decentralization.

These debates give us a much more grounded view of the project than any marketing brochure ever could.

"The smartest discussions right now aren't about price—they're about institutional interest and tech milestones." — ASCN.AI

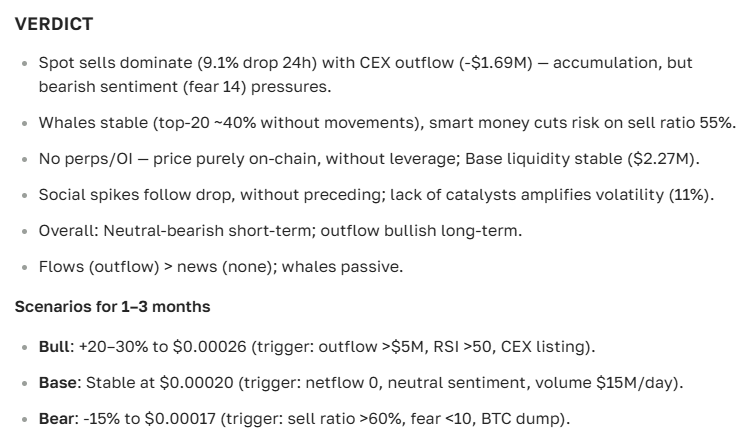

The Final Verdict

Toshi still has plenty of gas in the tank. With a solid technical core and a growing list of partners, the medium-to-long-term outlook leans bullish—assuming the macro environment plays nice.

For those looking to get serious, don't just follow the crowd. Use tools that aggregate Web3 data. ASCN.AI, for instance, pulls together on-chain metrics and news so you aren't just guessing in the dark.

"ASCN.AI is a reliable shortcut for traders who want deep Web3 analytics without the headache of manual data mining." — The ASCN.AI Team

By the way, here’s the final AI-driven verdict for Toshi:

Frequently Asked Questions

What actually moves the Toshi price?

It’s a mix of tech updates, broader market trends, news cycles, and how much "buy-in" there is from the community.

How can I tell when a rally is starting?

Look for the "triple threat": positive on-chain signals, a surge in trading volume, and a fresh partnership announcement.

What should I watch out for before investing?

Keep an eye on key price levels, whale movements, and whether the project is actually hitting its roadmap targets.

How do I keep from losing my shirt?

Simple: diversify your portfolio, never invest more than you can lose, and stay updated on the news.

Can I automate my price tracking?

Absolutely. Tools like ASCN.AI can handle the monitoring for you and send alerts when something important happens.

What are the critical price levels to watch?

Right now, the community is watching support at 0.0270 USD and resistance at 0.0373 USD.

Disclaimer

This is all just information, not financial advice. Crypto is a wild ride and involves significant risk. Talk to a professional before making any big financial moves.