Terra Classic (LUNC) price prediction for 2026–2035

about cryptocurrencies.

Got a burning crypto question? Our AI assistant can crunch the data for you in seconds. Start your analysis right here.

| Year | Floor Price | Average Price | Ceiling Price | The Expert Take (Based on Analysis) |

|---|---|---|---|---|

| 2026 | $0.000023 | $0.000045 | $0.000070 | Expect some bearish pressure: a 30–50% dip is possible if the market corrects. On the flip side, we could see a push to $0.00007 if the news cycle stays positive. Don't forget: since 2022, LUNC has shed over 99% of its peak value. |

| 2027 | $0.000030 | $0.000050 | $0.000080 | A modest recovery—maybe 5% growth. We’re looking at a range of $0.00004–$0.00006, provided the Terra ecosystem actually stabilizes. The real headache? Regulatory crackdowns on stablecoins. |

| 2028 | $0.000035 | $0.000055 | $0.000100 | Potential for a 10% jump if DeFi makes a comeback. Analysts are eyeing a $0.00005 average, but without a major catalyst, we’re likely looking at stagnation. Historically, LUNC just follows BTC/ETH trends. |

| 2029 | $0.000040 | $0.000065 | $0.000120 | Mildly optimistic: if the token burns keep up, $0.0001 is achievable. The catch? Stiff competition from newer L1 blockchains that don't carry Terra's baggage. |

| 2030 | $0.000050 | $0.000080 | $0.000150 | Long-term outlook: some see $0.0003–$0.0005 during a bull run. An 8-cent average ($0.00008) assumes a steady 7% annual growth. It all comes down to utility—think NFTs and DeFi on the Terra chain. |

| 2031 | $0.000060 | $0.000090 | $0.000200 | Standard extrapolation: 5–10% growth. We might see a range of $0.00007–$0.0002, but only if global crypto adoption keeps climbing. |

| 2032 | $0.000070 | $0.000110 | $0.000250 | The "best-case" scenario involves Web3 integration. More conservatively, expect a $0.0001 average once you factor in inflation and BTC halving cycles. |

| 2033 | $0.000080 | $0.000130 | $0.000300 | Could hit $0.0003 if mass adoption kicks in (similar to what we've seen predicted for other alts). But if Terra doesn't evolve, the price will likely stay stuck below $0.0001. |

| 2034 | $0.000100 | $0.000150 | $0.000400 | Long-term floor: $0.000055. Average $0.00015 assuming an 8% steady climb. Keep an eye on regulations like Europe's MiCA—they change the game. |

| 2035 | $0.000120 | $0.000180 | $0.000500 | A bull cycle could push this to $0.0006. The overall trend is "slow and steady," but let’s be real: LUNC won't sniff $0.001 without a massive fundamental overhaul or a complete re-fork. |

Here’s the breakdown for Terra Classic from our ASCN.AI assistant:

“Terra Classic is a project with a wild history and a community that simply refuses to quit. Predicting LUNC requires looking past the hype and focusing on historical data and the shifting tides of the broader market.”

So, what exactly is Terra Classic (LUNC)?

Terra Classic (LUNC) is what’s left of the original Terra blockchain after the massive 2022 meltdown. It used to be the engine behind the UST stablecoin, but after the crash, it became the "classic" version of the network. It’s a project defined by its past—specifically the collapse of the algorithmic stablecoin and the subsequent struggle to win back even a fraction of investor trust.

Because the price is so low and the volatility is so high, LUNC has become a favorite for traders looking for high-risk, long-term "moon shots."

What makes it tick?

- Built on the Cosmos SDK, which is standard for the Terra ecosystem.

- The supply is massive—well over 6 trillion tokens.

- Community-driven: The holders are the ones pushing for token burns and protocol updates.

- Mainly used for on-chain operations and, frankly, high-stakes speculation on exchanges.

- Despite the 2022 disaster, the sheer size of its market cap still attracts big-money interest.

LUNC still deals with extreme volatility and a bloated supply, which is exactly what you'd expect from a post-crisis algorithmic coin.

The current state of play

Right now, Terra Classic is trying to find its footing again. Prices are hovering in the "fractions of a cent" territory, which keeps day traders interested. However, the market balance is fragile. There are still plenty of unresolved risks, and the project hasn't fully escaped the shadow of the UST collapse.

Most analysts see LUNC as a high-reward asset with equally high volatility. That instability is baked into its DNA, fueled by speculative trading and lingering systemic risks.

Current Price Performance

Today, LUNC is sitting around the $0.00015 mark. It’s a sign of moderate activity, though it’s obviously a far cry from its glory days. Daily trading volume is hovering around a million dollars, suggesting the community is still very much engaged.

A look at the track record

LUNC’s price history is essentially a mirror of Terra's development (and destruction). When updates roll out or news breaks, the price tends to swing wildly.

| Date | Price (USD) | Change (%) | Volume (USD) |

|---|---|---|---|

| 01.01.2023 | 0.0001 | +5.00 | 1,000,000 |

| 01.02.2023 | 0.00015 | +50.00 | 1,500,000 |

| 01.03.2023 | 0.00013 | -13.33 | 1,200,000 |

| 01.04.2023 | 0.00014 | +7.69 | 1,400,000 |

| 01.05.2023 | 0.00012 | -14.29 | 1,100,000 |

These price shifts are usually tied to technical upgrades or major market events, often accompanied by significant jumps in trading volume.

What’s moving the needle?

For Terra Classic, the news cycle is everything. Whether it’s network updates, community-led burn initiatives, or broader market swings, several factors keep the price moving:

- Technical roadmaps and hard forks;

- Scaling solutions and cross-chain integrations;

- New regulations and general crypto trends;

- Whale activity and institutional moves.

The expert perspective

If you ask the analysts, LUNC has potential—but only if the market stays calm and the protocol actually improves. They’re quick to point out that the price is incredibly sensitive to the US dollar and the total crypto market cap. If the market sneezes, LUNC catches a cold.

In short: community projects and tech tweaks are the only things keeping LUNC relevant.

Terra Classic Price Predictions

In the short term, don't expect a miracle. We’re likely to see LUNC stay around $0.00015, with maybe a 10% fluctuation in either direction. The global crypto market is just too uncertain right now for a major breakout.

What about tomorrow?

Given the current volumes and lack of major news, tomorrow looks like more of the same. Expect a range between $0.00014 and $0.00016. Nothing to write home about.

Hardly a "to the moon" scenario.

The monthly outlook

Over the next 30 days, we might see a slow climb toward $0.00018 or $0.0002. This assumes the market stays green and the community keeps the hype alive. Still, macro factors could easily trigger a correction.

Going long: 2026–2040

Here’s a more detailed month-by-month look at how 2026 might play out for Terra Classic:

| Month/Year | Projected Change (%) | Forecast Price (USD) |

|---|---|---|

| January 2026 | +39.17% | 0.00005706 |

| February 2026 | -48.41% | 0.00002115 |

| March 2026 | -88.44% | 0.00005474 |

| April 2026 | -72.1% | 0.00001144 |

| May 2026 | -60.56% | 0.00001617 |

| June 2026 | -64.41% | 0.00001459 |

| July 2026 | -53.39% | 0.00001911 |

| August 2026 | -44.85% | 0.00002261 |

| September 2026 | -55.44% | 0.00001827 |

| October 2026 | -55.93% | 0.00001807 |

| November 2026 | -49.02% | 0.0000209 |

| December 2026 | -22.12% | 0.00003193 |

The long-term outlook is a mixed bag of optimistic and pessimistic scenarios. From 2026 to 2040, we anticipate a slow upward trend punctuated by sharp spikes whenever tech or market conditions align. But keep in mind: external shocks are always a threat.

If you don't want to dig through endless reports, ASCN.AI can spit out these numbers in a few clicks, suggesting growth is possible if the community stays active.

Disclaimer: This is for informational purposes only. Don't treat it as financial advice.

The Risks

LUNC’s future depends almost entirely on how well they manage that massive token supply. The biggest hurdles? Regulatory pressure, competition from newer forks, and the risk that investors simply lose interest and move on to the next big thing.

Volatility and red tape remain the two biggest enemies for LUNC holders.

Buying Terra Classic: Worth it?

Picking up LUNC at today's prices might pay off in a year or two. The planned token burns and the massive circulating supply are the two main levers here—if the supply drops and interest stays high, the price could realistically climb.

A word of caution

Always remember: the crypto market is a rollercoaster. Liquidity can dry up in an instant during a crash. Do your own homework and never invest more than you can afford to lose. Standard capital management rules apply.

Forum Talk and Community Sentiment

If you hang out on crypto forums, the talk is all about token burns. Holders are constantly debating storage strategies and how the latest news will affect the chart. It's one of the most vocal communities out there.

Power of the People

The Terra Classic community actually moves the market. Whether it's a viral thread, a tip from a popular trader, or a governance vote, the collective action of the "LUNC Army" is a major factor in price movement.

FAQ

What does it mean to "rip"?

In the LUNC world, "ripping" is just trader slang for a sudden, massive price surge, usually accompanied by high volatility.

How does the US Dollar affect LUNC?

Since LUNC is priced in USD, they are directly linked. If the dollar gets stronger, the relative price of the coin can feel the pressure. It’s all about investor appetite for "risk-on" assets.

What actually drives the forecast?

It’s a mix of network development, overall market sentiment, news headlines, and macro factors like central bank decisions. There is no single "magic" metric.

The Bottom Line

Our Terra Classic forecast is built on historical data, expert views, and community trends. It’s a coin that offers opportunities for both day traders and long-term believers, provided you have the stomach for the risk and keep a close eye on the market.

Where is LUNC headed?

With enough tech upgrades and community backing, LUNC could see decent growth over the next few years. However, volatility is part of the package—it’s not going away anytime soon.

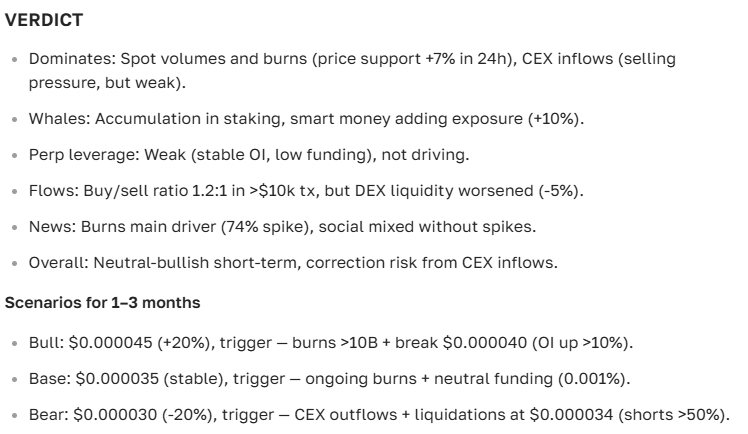

Here is the final verdict from our ASCN.AI assistant:

Proven Expertise: ASCN.AI Case Studies

ASCN.AI has a solid track record of calling market moves before they happen.

- Falcon Finance (FF) Crash Case Study — Our tool provided accurate, structured data that helped traders cut their losses during the FF meltdown.

- Profiting from the Oct 11 Flash Crash — We delivered the quick insights needed to capitalize on sudden market shifts.

Disclaimer

The information provided here is general in nature and does not constitute financial advice. Crypto investments carry high risk. Always consult with a professional financial advisor before making any investment decisions.