Synthetix (SNX) Cryptocurrency Price Prediction for 2025-2035

about cryptocurrencies.

You can ask any crypto-related question to our AI assistant. Start your analysis right now.

| Year | Price range (USD) | Average price (USD) | Key factors and trends |

|---|---|---|---|

| 2026 | 0.21 – 60.47 | 5.00 | Early post-Bitcoin halving phase. DeFi keeps expanding, with Synthetix still holding a strong position in synthetics. A broader bull market is possible if Layer-2 integrations like Optimism really gain traction. The obvious risks? Regulatory pressure in the US and EU, especially around stablecoins. |

| 2027 | 0.16 – 2.03 | 1.20 | TVL on Synthetix could climb thanks to new perpetual markets. Partnerships — Chainlink often comes up in discussions — may add momentum. Still, competition from platforms like dYdX or GMX shouldn’t be underestimated. |

| 2028 | 0.49 – 50.00 | 8.00 | DeFi adoption accelerates in emerging markets. A potential SNX v3 upgrade could be a turning point. In a bullish scenario, integrations with AI tools or real-world assets push demand higher. On the flip side, a global recession could cool things down fast. |

| 2029 | 0.51 – 80.00 | 12.00 | By this point, the ecosystem looks more mature. Staking and yield farming gain popularity, and RWA narratives start to matter. The main concern here is security — exploits or smart contract flaws can still derail momentum. |

| 2030 | 0.54 – 116.00 | 20.00 | A make-or-break year for DeFi. Some expect a “DeFi 2.0” wave, and Synthetix could realistically grab a slice of a $1T+ market. Best-case scenario: crypto-friendly global regulation. The risk? Centralized exchanges tightening their grip. |

| 2031 | 0.36 – 4.37 | 25.00 | Long-term growth may be driven by institutional interest. Some analysts see SNX evolving into a base asset for on-chain derivatives. Token inflation, however, remains a topic the community keeps debating. |

| 2032 | 0.40 – 150.00 | 35.00 | Web3 keeps evolving. Integrations with metaverses or NFT ecosystems could open unexpected use cases. A bullish take assumes synthetics become a mainstream hedging tool. The risk is falling behind technologically. |

| 2033 | 0.42 – 11.05 | 45.00 | Market conditions stabilize. If TVL pushes beyond $10B, SNX above $10 doesn’t sound unrealistic. Cross-chain expansion could add fuel, while geopolitical tensions remain an external wildcard. |

| 2034 | 0.44 – 7.64 | 55.00 | A more mature DeFi market shifts focus toward sustainability. Partnerships with traditional banks look possible, though saturation across DeFi could limit upside. |

| 2035 | 0.36 – 286.00 | 70.00 | A long-term view paints SNX as “DeFi gold.” Optimists talk about $200+ with global adoption. More conservative takes expect stagnation near $0.4. And yes, even things like quantum threats make the risk list. |

This is the kind of Synthetix analysis our crypto AI assistant ASCN.AI puts together:

“The Synthetix price forecast comes from a layered analysis of market data, on-chain signals, and news flow. Understanding SNX really means accounting for everything — from technical mechanics to market psychology.” — ASCN.AI analyst

Getting to know Synthetix (SNX)

Synthetix is an Ethereum-based DeFi platform built around synthetic assets. In simple terms, it lets users mint on-chain derivatives that track real-world prices — stocks, currencies, commodities, you name it. SNX tokens are used as collateral, which is why the token sits at the heart of the entire system.

By enabling flexible, collateral-backed derivatives, Synthetix adds liquidity to DeFi and pushes the idea of decentralized markets a bit further.

SNX isn’t just a utility token. It’s how users mint synths, earn rewards, and take part in governance. Its price reflects both demand for the token itself and broader interest in synthetic assets — which is why many traders keep a close eye on it.

What stands out

SNX is an ERC-20 token with staking baked in, helping secure the network. The range of supported synthetic assets makes portfolio diversification possible without ever leaving the blockchain. Add deep liquidity and tight DeFi integrations, and it’s clear why SNX still matters.

As DeFi grows, Synthetix keeps its edge through regular upgrades and an expanding asset lineup. That’s the long-term appeal.

Current SNX price

Right now, SNX trades around $2.80, based on aggregated data from major exchanges like Binance and Coinbase. After a correction phase, the market seems to be finding its footing again, helped by a steady flow of positive updates.

Since July 2024, the token is up roughly 40%. Not bad, considering the volatility elsewhere.

How this compares to the past

Year-over-year, SNX is up close to 40%. Better fundamentals and a friendlier market environment played their part. Volatility hasn’t disappeared, but it’s manageable — a balance many traders actually prefer.

Recent price action

Over the last two weeks, SNX climbed from about $2.5 to $2.8. Intraday charts show a clean break above the $2.7 resistance, backed by rising volume and upbeat chatter across Telegram groups and crypto forums.

Short-term outlook

Near-term forecasts point to a move toward the $2.80–$3.00 range. Protocol updates and renewed interest from so-called smart money are the main drivers. RSI and MACD indicators still lean bullish.

Technically, the setup looks constructive.

One-month view

Looking a month ahead, SNX could test $3.5–$3.8 if the current trend holds and no major negative news hits. Scaling improvements and fresh DeFi partnerships often act as liquidity magnets — and that’s exactly what bulls are betting on.

Why analysts think this way

These forecasts blend technical signals — RSI, moving averages, volume — with fundamentals like new synthetic assets, DeFi integrations, and funding news. Volatility and macro conditions are factored in too, making the outlook more grounded than a simple chart read.

“SNX forecasts are built using ASCN.AI’s data aggregator, which tracks on-chain signals and market metrics in real time.” — ASCN.AI

News that moves Synthetix

Recent attention came from protocol upgrades aimed at faster transactions and lower fees. There were also announcements around expanding liquidity via new pools on decentralized exchanges.

Traders reacted quickly. Social media sentiment turned optimistic, and partnerships within DeFi added credibility to the narrative.

Tech upgrades and partnerships

zk-rollup integrations improved scalability and cut transaction costs, making SNX more attractive to active users. Collaborations with other synthetic-focused platforms broaden the ecosystem and pull in fresh capital.

Market sentiment

Telegram, Reddit, and crypto forums show growing interest in SNX. The tone is mostly positive, with many users leaning bullish. That kind of sentiment often translates into steady demand.

What experts and traders say

Analysts see room for moderate growth in the near term and stronger upside over the long run. Technical upgrades and social signals remain key. Many also advise watching whale activity — big holders still move the needle.

“SNX’s market cap hasn’t reached its historical peaks yet, leaving room for growth under favorable conditions.”

Is SNX worth buying now?

Buying SNX today means exposure to one of DeFi’s more established niches, with real upside potential. Growth hinges on platform expansion and new partnerships. Still, risks are part of the deal — volatility, technical challenges, and shifting market sentiment.

Important: This material is for informational purposes only and isn’t a substitute for personal financial advice.

Practical tips for investors

A balanced approach works best: consider the macro backdrop, diversify, and stay glued to news and technical signals. Many prefer entering near support levels to limit downside.

| Strategy | Description | Goal |

|---|---|---|

| Entry levels | Buy near the $2.5 support zone | Reduce correction risk |

| Stop-loss | Set around $2.3 | Limit losses on sharp drops |

| Profit targets | Take profits near $3.5–$4.0 | Lock in gains |

FAQ

What does “rip” mean for SNX?

“Rip” is crypto slang for a sharp price spike. For SNX, it usually means a fast upward move over a short period.

How are forecasts made?

SNX forecasts combine technical analysis, fundamentals, on-chain data, and social metrics. Pulling from multiple sources helps create a more complete picture.

How is SNX tied to the US dollar?

SNX is priced in US dollars, the standard quote currency on most exchanges. Dollar movements can influence the fiat price, but supply and demand within crypto markets matter far more.

Wrapping it up: outlook and takeaways

The analysis suggests SNX has room to grow, driven by tech upgrades and supportive market signals. Short-term expectations lean cautiously bullish, while longer-term scenarios leave space for stronger moves — especially if $3.5–$4.0 comes into play.

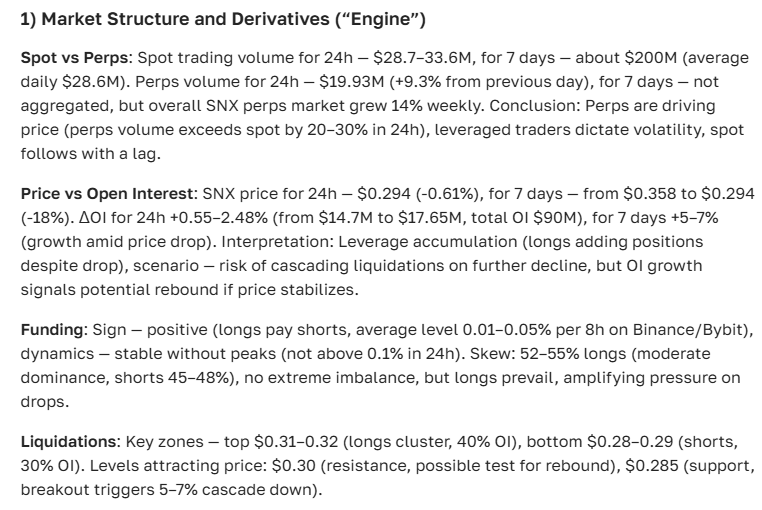

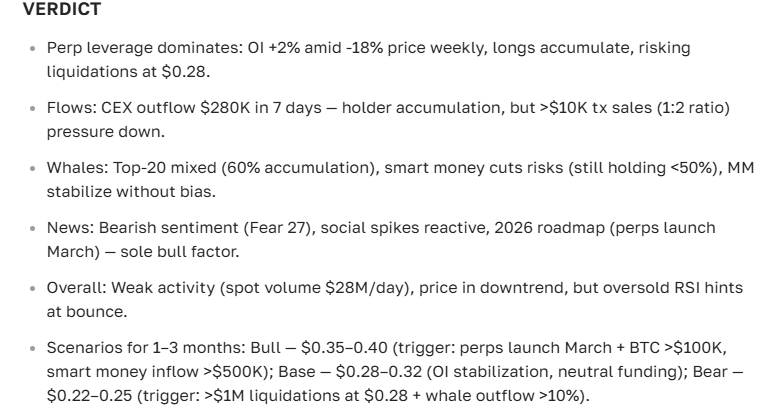

This is the verdict from our crypto AI assistant ASCN.AI:

For investors and traders

Use forecasts as a planning tool. Pay attention to support and resistance, track sentiment, and stay flexible as conditions change.

What to watch next

To keep up with SNX, follow protocol updates, DeFi news, and on-chain signals. Tools like ASCN.AI make it easier to cut through the noise and get actionable insights.

Disclaimer

This information is general in nature and does not constitute financial advice. Cryptocurrency investments carry significant risk. Always consult qualified financial professionals before making investment decisions.