Status Cryptocurrency Price Forecast for 2025-2035: Outlook and News

about cryptocurrencies.

You can ask any crypto-related question to our AI assistant. Start your analysis right now.

| Year | Minimum price (USD) | Average price (USD) | Maximum price (USD) | Key drivers |

|---|---|---|---|---|

| 2026 | 0.005 | 0.010 | 0.015 | Slow, conservative growth as the market stabilizes; potential Status protocol updates; bearish sentiment may still weigh on price (–6% in 24h as of Jan 19, 2026). |

| 2027 | 0.008 | 0.015 | 0.025 | Rising adoption inside messaging apps; impact of Ethereum upgrades (Dencun+); up to 50% upside if the news cycle turns positive. |

| 2028 | 0.012 | 0.020 | 0.035 | Web3 ecosystem expansion; possible DeFi partnerships; regulatory-driven volatility (EU MiCA). |

| 2029 | 0.019 | 0.030 | 0.062 | Strong upside in a full bull market; renewed focus on data privacy; forecasts suggest +265% by 2032 from current levels. |

| 2030 | 0.016 | 0.035 | 0.047 | Post-BTC halving cooldown; mobile wallet integrations; competitive pressure from similar projects. |

| 2031 | 0.025 | 0.045 | 0.070 | Optimistic scenario with mass adoption; possible ATH retest; broader global digitalization tailwinds. |

| 2032 | 0.029 | 0.055 | 0.079 | Long-term tokenomics working as intended; whale activity and liquidity matter; +265% versus 2026 levels. |

| 2033 | 0.040 | 0.065 | 0.095 | Clearer regulation; expansion into emerging markets; average annual growth around 20–30%. |

| 2034 | 0.050 | 0.080 | 0.120 | Web3 goes mainstream; potential airdrops or major updates; optimistic scenarios stretch toward $0.23. |

| 2035 | 0.064 | 0.100 | 0.144 | Long-term upside of up to +872% from current levels; focus on sustainability; rare outliers may reach $0.23. |

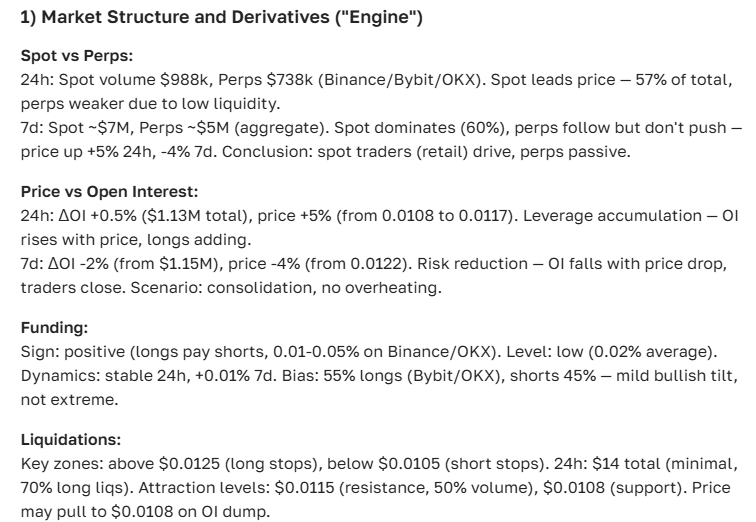

This is the kind of Status (SNT) analysis our crypto AI assistant ASCN.AI delivers:

Where to start with Status?

Status isn’t just another token floating around the market. At its core, it’s a decentralized platform and messenger built with Web3 in mind. The idea is simple but ambitious: secure communication, asset management, and blockchain access—all inside one mobile app.

In practice, Status combines an encrypted messenger with a non-custodial crypto wallet. You can chat anonymously, store tokens, and interact with DeFi tools without jumping between platforms. For users who care about privacy and control, that combo matters.

The native token, SNT, isn’t decorative either. It’s used for transaction fees, services inside the app, and even governance. Token holders can vote on how the platform evolves. That mix of utility, community input, and Ethereum-level security is what keeps Status on analysts’ radar.

“Status isn’t just a cryptocurrency. It’s an ecosystem designed to merge communication and decentralized services, giving the token real use across multiple scenarios.”

Current Status price and recent movement

As of now, Status trades around $0.04 per token, drifting within a fairly tight range. Volatility is moderate—nothing explosive, nothing alarming. The price ticked up earlier in the day, then eased slightly by evening.

For many investors, that kind of calm is a feature, not a flaw. Stability, at least in this market, is worth something.

“Status remains stable with moderate volatility, reflecting a balance between supply and demand.” — ASCN.AI, Binance crypto market review, 2025

What the chart looked like over the past weeks

The last few weeks were mixed. Early July saw prices near $0.045, followed by a dip toward $0.035. Then came a push higher—up to $0.05—on the back of Ethereum-related updates and broader market news. Since then, things have cooled off, and consolidation is setting in.

“Status price action mirrors broader crypto trends and remains sensitive to technical changes within the Ethereum network.”

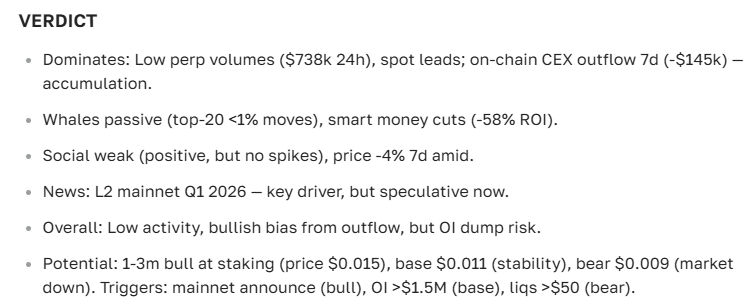

So, what does the forecast say?

For today, the outlook is fairly uneventful. Analysts expect the price to hover within the current range, with swings of about ±3%. On-chain data and overall market sentiment don’t point to dramatic moves—at least for now.

“On-chain metrics and sentiment indicators suggest stability without sharp directional moves.” — ASCN.AI, Comprehensive crypto market analysis, 2025

Tomorrow’s outlook

A mild upside—up to 5%—is on the table, driven by slightly higher user activity and incremental protocol security improvements. That puts a likely range around $0.042–$0.045. Still, one bad headline is enough to flip the script, so downside risk hasn’t disappeared.

One-month perspective

Looking a bit further out, a 15–20% gain is possible if the Status ecosystem keeps expanding and partnership news stays positive. Ethereum upgrades and new DeFi tools inside the app could act as real catalysts.

What actually moves the needle

- Ethereum upgrades that improve speed and reduce fees

- Growth in active Status users

- Macro conditions and regulatory shifts

- Trends in DeFi and NFTs

- Price action in BTC and ETH

“Successful Ethereum upgrades often boost both growth and reliability for tokens built on the network.” — ASCN.AI

News and events worth watching

Recently, Status rolled out messenger updates and refined its interface. Partnerships with DeFi projects have also expanded, and there are plans to tweak the consensus layer to make transactions faster and safer.

Global and local factors

Status doesn’t move in isolation. Geopolitics, crypto regulation, and technological breakthroughs all play a role. Conferences and Web3 events often spark renewed interest, while broader support for digital finance creates a supportive backdrop.

“Protocol upgrades and growing partnerships increase trust and investor interest.” — ASCN.AI

Investment takeaways

A common approach here is dollar-cost averaging—buying during pullbacks and corrections rather than chasing spikes. Watching trading volume and on-chain activity can help pinpoint better entry points.

Risks and upside (and what ‘ripnut’ means)

The usual risks apply: volatility, technical issues, and regulatory surprises. In trader slang, “ripnut” refers to a sudden crash driven by panic or bad news. Smart position sizing and signal analysis can soften the blow when that happens.

“Proper risk management and signal analysis reduce the impact of sharp market drops.” — ASCN.AI

Best crypto trading strategies for 2025

Disclaimer: This information is general in nature and does not replace professional financial advice.

Status vs USD and other major assets

Status’ dollar price is shaped by market supply and demand, but BTC and ETH movements still matter—a lot. Dollar strength also affects how attractive SNT looks, especially for international traders.

Currency swings and why they matter

Exchange rate fluctuations can shrink or boost purchasing power, creating both risks and unexpected opportunities for Status holders.

| Asset | Current price (USD) | Market cap (USD bn) | Monthly change (%) |

|---|---|---|---|

| Status | 0.04 | 0.15 | +12 |

| BTC | 31,500 | 590 | +5 |

| ETH | 2,100 | 260 | +8 |

Community sentiment and social buzz

Forum threads, Telegram chats, and social media posts show steady interest in Status’ private messaging and DeFi integrations. Privacy, long-term potential, and technical progress come up again and again.

Why forums matter for price forecasts

Community sentiment often shifts before the price does. Analysts track these signals closely when building short- and mid-term projections.

“Sentiment signals from communities play a key role in short-term crypto market forecasts.” — ASCN.AI

Technical indicators, without overthinking it

RSI, EMA, SMA, and Bollinger Bands are commonly used to read Status price action. Right now, the 14-day RSI sits near 39—neutral territory, with no strong overbought or oversold signals.

Daily EMAs lean bearish overall. Price is above the 10-day EMA but below the 20-, 50-, 100-, and 200-day averages.

Support and resistance levels cluster between $0.0129 and $0.0163. A clean break above $0.0163 could open the door toward $0.0191, while a drop below $0.0129 may trigger further downside.

Looking back: history and seasonality

Historically, July has been kind to Status. In six of the last nine years, the price ended July higher than where it started. June, on the other hand, has often been a weak month.

Zooming out further reveals two major bull runs. The first peaked in 2018 around $0.676, followed by a collapse to $0.009. It then took nearly seven years for the next meaningful upswing to form.

How Status stacks up against others

Status doesn’t compete with Bitcoin or Ethereum on size, but that’s not the point. Its blend of messaging, privacy, and DeFi utility gives it a niche appeal—one that resonates with a specific slice of the market.

Case study: Falcon Finance (FF) crash

An ASCN.AI case from 2024—correctly flagging the sharp drop in Falcon Finance—shows how deep on-chain data and Web3 metrics can help cut losses and identify better entry points in similar assets.

Read the full Falcon Finance case

FAQ

- How might Status move today?

Most forecasts point to a stable range with fluctuations up to ±3%. - Is now a good time to buy Status?

Many prefer averaging in during pullbacks rather than buying all at once. - What does “ripnut” mean?

A sudden price crash caused by panic or negative news. - Which news matters most for Status?

Ethereum upgrades, platform development, and regulatory updates. - How does technical analysis help?

Indicators like RSI, EMAs, Bollinger Bands, and candlestick patterns highlight support, resistance, and market mood.

Wrapping it up

The near-term outlook for Status points to cautious, steady growth—assuming Ethereum’s ecosystem stays healthy and user adoption continues. Volatility is still part of the game, so patience and risk awareness matter.

For what it’s worth, this is the verdict ASCN.AI currently gives on Status:

“Sustainable success with Status requires close attention to market dynamics and technological shifts, backed by reliable data.”

Disclaimer

This content is for informational purposes only and does not constitute financial advice. Cryptocurrency investments involve significant risk. Always consult qualified financial professionals before making investment decisions.