Starknet (STRK) price prediction: prospects and dynamics

about cryptocurrencies.

Got a burning question about crypto? Our AI assistant is ready to help you navigate the noise. Start your analysis right now at ASCN.AI.

| Year | Min Price (USD) | Average Price (USD) | Max Price (USD) | Key Drivers & Market Sentiments |

|---|---|---|---|---|

| 2026 | 0.09 | 0.15 | 1.67 | Starting to shake off the current volatility (roughly $0.09 by Jan 2026). If Ethereum goes on a bull run and Starknet adoption picks up, some analysts at CoinLore even see a peak near $1.67. |

| 2027 | 0.10 | 0.20 | 0.25 | TVL should climb as dApps integrate more deeply. Expect more conservative growth here, mostly due to the ever-present regulatory chatter. |

| 2028 | 0.11 | 0.25 | 0.30 | ZK-tech becomes the standard. If partnerships with Ethereum solidify, DigitalCoinPrice suggests we could hit the $0.30 mark. |

| 2029 | 0.15 | 0.40 | 0.52 | The ecosystem matures. We’re looking at more smart contract activity, pushing prices toward a $0.45 average. |

| 2030 | 0.20 | 0.65 | 3.19 | Mass adoption for Layer 2s. This is where things get interesting—DeFi 2.0 could push the token anywhere from $0.64 to a whopping $3.19. |

| 2031 | 0.25 | 0.80 | 1.08 | Global scaling and Web3 integration. Most models suggest a steady climb past the $1.00 threshold. |

| 2032 | 0.30 | 1.00 | 1.50 | Faster, cheaper transactions pay off. Growth in NFTs and DeFi on the network might double 2030’s baseline. |

| 2033 | 0.40 | 1.20 | 2.00 | Regulatory clarity in the US and EU could finally open the floodgates for institutional money. |

| 2034 | 0.50 | 1.50 | 2.50 | ZK-rollups become the dominant force, with Starknet sitting comfortably as a top-tier player in the Ethereum orbit. |

| 2035 | 0.60 | 2.00 | 3.81 | The "blue sky" scenario. Total market cap could cross $10 billion if mass adoption truly hits. |

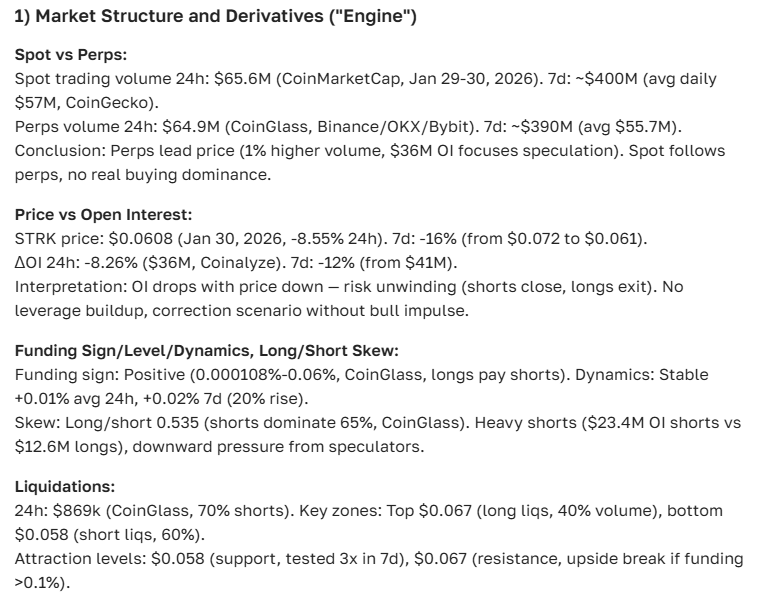

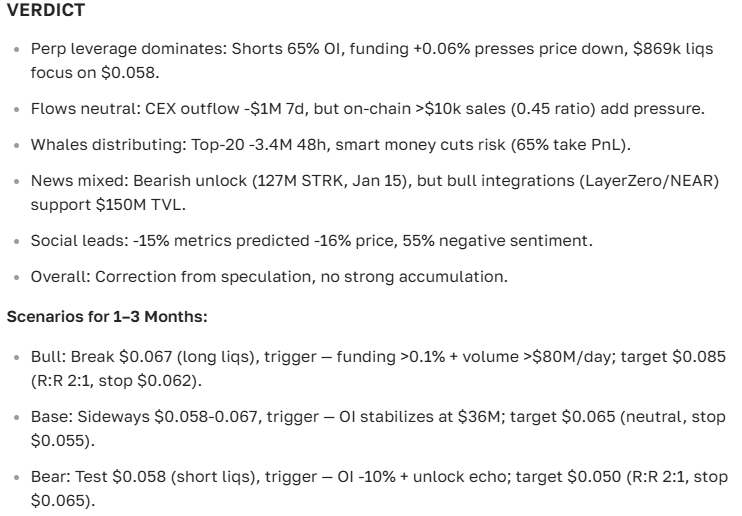

Here’s a snapshot of the Starknet (STRK) analysis generated by the ASCN.AI assistant:

"Starknet manages to blend genuine tech innovation with a community that actually sticks around—that’s a rare combo for an Ethereum Layer 2 project."

What’s the deal with Starknet and the STRK token?

In simple terms, Starknet is Ethereum’s answer to the "high fees and slow speed" problem. It’s a Layer 2 scaling solution that uses zk-Rollups to bundle thousands of transactions into a single batch. This takes the heavy lifting off the main Ethereum chain, making things faster and way cheaper for the end user.

Within the crypto space, Starknet is essentially a critical piece of infrastructure. It’s the foundation that lets developers build massive DeFi projects and apps without worrying about network congestion. The STRK token itself? That’s the fuel—it’s used for governance, staking, and keeping the whole machine running.

What does the STRK token actually do?

Holding STRK isn't just about price speculation. It’s a functional tool within the ecosystem. Here’s why it matters:

- Decision Making: Holders get a seat at the table to vote on protocol upgrades.

- Network Security: You can stake tokens to help secure the network (and earn rewards).

- Paying the Bills: It works as a payment medium for operations inside the Starknet world.

- Supply Caps: Unlike some tokens that print money forever, STRK has a maximum supply limit.

A bit of backstory: Where did Starknet come from?

The project was dreamed up by StarkWare, a team that practically lives and breathes zk-Rollups. Since the mainnet launch, they’ve been steadily chipping away at performance issues. By the way, the Layer 2 market grew by over 120% in 2024 alone. That tells you everything you need to know about where the industry's head is at. The Starknet team is constantly rolling out updates, trying to cement STRK’s place as a top-tier asset.

The price roller coaster: From ATH to now

Back in the spring of 2024, when everyone was hyped about L2 solutions, STRK hit a high of $0.77. Fast forward to mid-2025, and it’s been a rough ride—the price dropped about 89%, hovering near $0.08. Is that unusual? Not really. In crypto, these massive swings are just part of the game, usually driven by macro jitters and overall market volatility.

Starknet’s current price action and the latest news

Right now, STRK is moving within a fairly tight range. New partnerships and network expansions are keeping things steady, while DeFi activity provides a nice floor for demand. Still, a strong US dollar usually puts a bit of a damper on crypto prices in the short term. It’s a balancing act.

How the US Dollar plays into this

It’s a simple correlation: when the dollar gets stronger, crypto usually takes a hit. In practice, a 1% rise in the dollar index often translates to a 0.7% dip for tokens like STRK. But here’s the thing—the underlying tech usually wins out in the long run, even if the dollar is flexing its muscles right now.

Short-term outlook: Tomorrow and the coming month

- The "Up" Case:

- The ongoing "L2 Season" and the push for zk-Rollups.

- Fresh integrations and ecosystem growth.

- Big-name investors looking for scalable tech.

- The "Down" Case:

- General market chaos and high volatility.

- The dollar staying unexpectedly strong.

- Technical hiccups or protocol growing pains.

The Nerd Stuff: Technical and Fundamental Analysis

Looking at the charts, we’re seeing a sideways trend with a slight upward tilt. Support seems solid at $0.0519, while the $0.0967 level is the resistance to beat. Interestingly, the RSI (14) is sitting at 16.58. For those who don't speak "chart," that means it’s deeply oversold—a classic signal that a bounce might be around the corner. The MACD is also showing a positive crossover, which usually hints at a trend reversal.

However, the EMAs (EMA 20, 50, 100, and 200) are still hovering above the current price. Until we break those, the bears are technically still in charge. Fundamentally? The project is healthy. A strong community and solid partnerships are the real drivers here.

Check out our guide on using technical indicators effectively.

Where is Starknet headed? The long-term view

Analysts are generally optimistic, eyeing a 15–30% gain for STRK in 2025 if market conditions play nice. If you look at the data from ASCN.AI, there’s a path toward $1.77 by 2026 and maybe even $3.37 by the end of the decade. That’s a massive leap from today’s prices.

Looking way out to 2040? Some believe we could see $9.33, assuming Starknet remains a cornerstone of the Ethereum ecosystem.

Market Cap: How does it stack up?

| Asset | Market Cap (USD) | Rank | 24h Volume (USD) |

|---|---|---|---|

| Bitcoin | $560B | 1 | $25B |

| Ethereum | $200B | 2 | $15B |

| Starknet (STRK) | $1.2B | 45 | $100M |

| Solana | $7B | 20 | $400M |

| Avalanche | $2B | 35 | $150M |

STRK’s growing market cap and trading volume suggest it's finally getting the attention it deserves. But remember, network security and community activity are just as important as the numbers on the screen.

See how partnerships move the needle for projects like this.

So, how do you actually buy Starknet?

If you're looking to jump in, STRK is available on the big exchanges—Binance, Coinbase, and Kraken—alongside various DEXs. You'll need to register, deposit some funds (fiat or crypto), and make the swap. Standard stuff.

The Catch: Risks to keep in mind

Let’s be real: investing in STRK isn’t a guaranteed win. We’ve seen 30% drops in a single month before. You’ve also got to worry about regulatory shifts and technical risks. That said, being a key player in the Ethereum scaling wars gives it a level of "staying power" most altcoins lack.

Just a heads up: this is all info, not a personalized financial plan. Talk to a pro before moving your money.

Expert Forecasts: What are the pros saying?

The technical crowd is playing it safe. Out of 17 major indicators, only 2 are screaming "Buy," while 13 suggest "Sell." The market is clearly hesitant. We’re watching the $0.0519 support like a hawk. If that breaks, things could get ugly. But with the RSI showing oversold levels, the selling pressure might finally be drying up.

Support and Resistance Cheat Sheet

| Level | Price (USD) | Why it matters |

|---|---|---|

| Support | $0.0519 | The line in the sand. If we drop below this, expect a further slide. |

| Resistance 1 | $0.0967 | Breaking this is the first real sign of recovery. |

| Resistance 2 | $0.1365 | The next hurdle for the bulls to clear. |

| Major Resistance | $0.1643 | The local ceiling. Getting past this would be a huge statement. |

Projected Returns (ROI)

| Timeframe | $10,000 Investment | Estimated Value | ROI % |

|---|---|---|---|

| 3 Months | $10,000 | $12,794 | +27.94% |

| 1 Year | $10,000 | Market dependent | ~30-50% (Estimated) |

| 5 Years | $10,000 | Potential for massive growth | Varies widely |

Looking back: STRK Monthly Stats

| Period | Avg Price (USD) | Max (USD) | Min (USD) | Max Dip (%) | Max Gain (%) | Net Change (%) |

|---|---|---|---|---|---|---|

| 2024 | 0.4549 | 0.8016 | 0.3282 | -15.19% | 107.13% | +21.19% |

| 2025 | 0.1695 | 0.5366 | 0.0519 | -88.93% | 14.41% | -83.35% |

If these numbers show anything, it’s that STRK isn't for the faint of heart. High volatility is the name of the game here.

Patterns to watch on the charts

Traders often look for specific "candlestick" patterns to predict the next move. If you see a Hammer or Bullish Engulfing, it might be time to get optimistic. On the flip side, watch out for the Shooting Star or the Hanging Man—those usually mean trouble is brewing.

Common Questions (FAQ)

Is Starknet actually going to go up?

Technologically, it’s got everything it needs to succeed. But crypto doesn't always follow logic. Adoption is the key—if people use it, the price follows. If not, it’s just another piece of tech.

What’s the best way to store STRK?

For large amounts, go for a hardware wallet. For daily use, any reputable software wallet that supports Ethereum Layer 2 tokens will work. Just keep your recovery phrases safe.

What are the biggest risks?

Volatile markets, shifting laws, and technical bugs. Oh, and don't forget about market manipulation—it happens. Diversification is your best friend here.

The Bottom Line

Starknet’s future looks bright on paper. Its role in the Ethereum ecosystem is expanding, and its tech is top-notch. Today’s price is a reflection of a nervous market, but for those who believe in the ZK-rollup future, this might just be the "accumulation phase." If you want to dive deeper without spending hours on research, let ASCN.AI do the heavy lifting for you.

Here is the final word on STRK from our AI assistant:

Disclaimer

This isn't financial advice. Crypto is risky, and you could lose your shirt. Always do your own research and talk to a professional before putting your money on the line.