Stacks cryptocurrency forecast for 2025-2035: price, prospects, and news today

about cryptocurrencies.

Got a crypto question? Fire it off to our crypto AI assistant. Jump in and start analyzing right now.

| Year | Price Range (USD) | Avg Price (USD) | Key Drivers & Risks |

|---|---|---|---|

| 2026 | $0.17 – $4.58 | ~$2.40 | Post-2025 rally kicks off; sBTC rollout, BTC DeFi TVL jumps 50%. But heads up—BTC peak corrections, SEC regs, and TVL still under $500M could drag it down. |

| 2027 | $0.65 – $5.00 | ~$2.80 | Clarity expands; BTC-NFTs and remittances pick up steam. Risks? Geopolitics, RSK competition, Nakamoto delays throwing wrenches. |

| 2028 | $0.29 – $6.00 | ~$3.10 | BTC halving synergy; global dApps on STX explode. Watch for EU MiCA rules and staker centralization creeping in. |

| 2029 | $0.64 – $7.00 | ~$3.80 | Cycle peak hits; TVL tops $1B, SIP upgrades roll out. Downside: crypto winter or devs losing interest. |

| 2030 | $0.55 – $8.91 | ~$4.70 | Ecosystem matures; AI/BTC mashups, cap over $5B. Altcoin rivals like RSK and quantum threats loom. |

| 2031 | $0.65 – $9.00 | ~$4.80 | Shifts ahead; fiat inflation, emerging markets boom. Global crises or BTC L3 migrations could hurt. |

| 2032 | $0.99 – $10.00 | ~$5.50 | New halving cycle; global PoX standards solidify. Energy debates on PoW side and audits are the catches. |

| 2033 | $2.29 – $11.00 | ~$6.60 | Bull peak; mass adoption (15%+ BTC DeFi). Ecosystem hacks and G20 regs? Big worries. |

| 2034 | $1.67 – $12.00 | ~$6.80 | Consolidation phase; scalability over 10k TPS, metaverses thrive. Market saturation and BTC dependency bite back. |

| 2035 | $1.71 – $13.00 | ~$7.40 | Institutional takeover; dominates BTC L2. New L2 rivals and tech shifts could shake things up. |

Our crypto AI at ASCN.AI crunched this Stacks outlook for you.

"Over five years watching crypto markets, one thing's clear: solid forecasts for Stacks or any token come from deep data dives. Right here—fresh updates and real insights."

Stacks Quick Take

What's Stacks All About?

Stacks bolts smart contracts and dApps onto Bitcoin without messing with BTC's core. The killer feature? Proof of Transfer (PoX), tying STX mining straight to Bitcoin's. It amps up security and pulls more folks into the BTC ecosystem. In practice, that means safer plays for devs building on top.

STX powers DeFi, NFTs, and Web3 stuff, all glued tight to Bitcoin. That's what sets it apart—strong setup for the long haul, if Bitcoin keeps climbing.

PoX links STX mining to BTC, boosting network security and action.

Price History at a Glance

Stacks rides the crypto waves—peaks during bull runs, dips with corrections. Big movers: 2021 mainnet launch, protocol upgrades, Bitcoin swings. NFT hype on Stacks? Price popped. Market crashes? It tanked too.

Surprisingly, those NFT surges and updates often line up with quick gains. But here's the thing—it's all tied to broader market vibes.

NFT buzz and upgrades? That's when Stacks price heats up.

Stacks Price Right Now

Today's Price (Latest Data)

Last check, STX hovers around $0.7. Past 24 hours? Mild swings, nothing wild—matches the crypto market's chill mood. Holds steady against recent months' average cap, keeping traders hooked.

Price Chart Breakdown

Chart screams bull: busted $1 resistance multiple times. $0.5 support held during pullbacks. July spiked with user growth and cap bump—classic momentum play.

Stacks Price Outlook

Next Few Days?

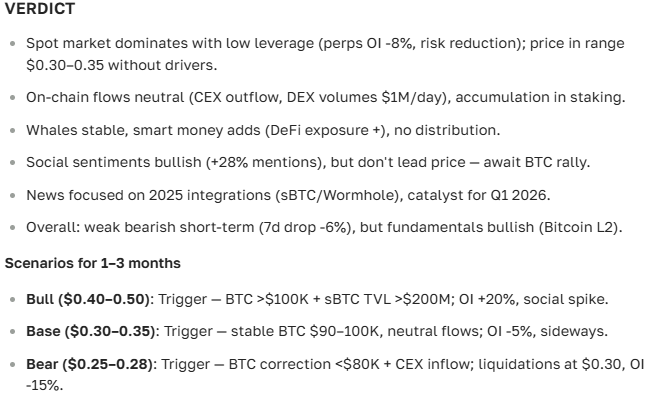

Expect $0.65-$0.75 range short-term, maybe quick pops. News or ecosystem wins could spark bigger moves; bad vibes mean dips. History says volatility's the name of the game.

Stacks moves with news and market mood. — Crypto Market Deep Dive, 2025. More here

Quick Tech Read

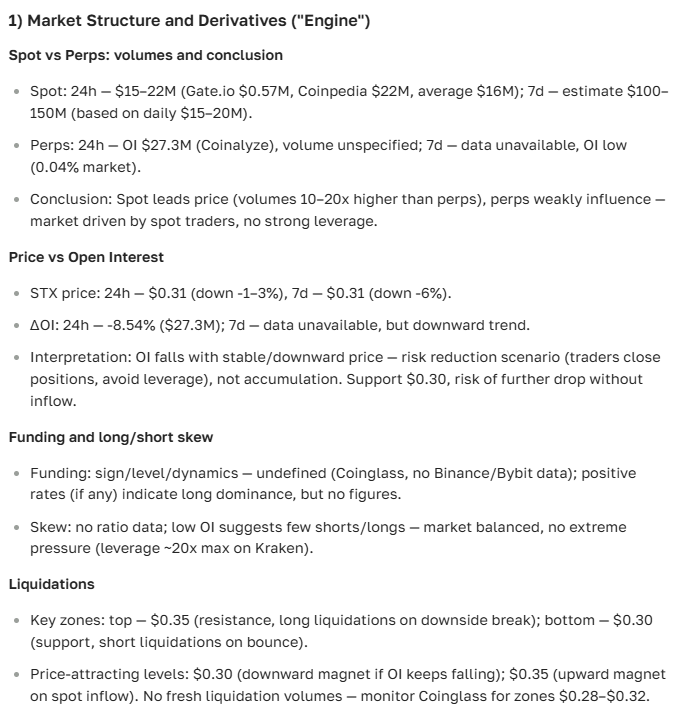

RSI (14) at 16.9 screams oversold—rebound incoming? EMAs (20/50/100/200) all above price: bearish signal. But that RSI? Often flips the script.

| Indicator | Value | Takeaway |

|---|---|---|

| RSI (14) | 16.92 | Oversold—growth potential |

| EMA 20 | 0.2711 | Price below = bearish |

| EMA 50 | 0.3229 | Price below = bearish |

| EMA 100 | 0.4067 | Price below = bearish |

| EMA 200 | 0.5512 | Price below = bearish |

| Bollinger Bands | Upper 0.3263, Lower 0.2224 | Price under SMA 0.2744 |

Next Month & Growth Vibes

Could hit $0.85 if good news drops—new contracts, user surge, market cheer. On the flip side, macro shakes or volatility might push it lower. Community buzz often tips the scale.

Long Haul (2025-2040)

| Year | High ($) | Low ($) |

|---|---|---|

| 2025 | 10.03 | 6.87 |

| 2026 | 8.77 | 2.39 |

| 2030 | 17.08 | 1.40 |

| 2035 | 20.77 | 2.04 |

| 2040 | 47.96 | 4.40 |

These pull from history and project momentum. Tech wins, ecosystem growth, market maturity? They'll make or break it. Fun fact: many analysts peg BTC ties as the real driver.

What Drives Stacks?

Price swings on a mix: crypto sentiment, tech updates/BTC links, news/partnerships, macro stuff like USD moves and regs, whale action and liquidity. On paper strong, but regs can flip it fast.

Tech tweaks and macro factors hit hard.

Buy or Nah?

Time to Grab STX?

For long-term holders eyeing BTC expansion, yeah—current price feels like a decent entry. Balance risk with that upside. Track news, TA, manage positions smart.

Upside vs. Pitfalls

Growth from platform builds; risks from volatility, tech glitches, regs. Still, community debates if the BTC hook outweighs it all.

Risks there, but growth potential balances it. — Crypto Portfolio Strategies, 2024. Details

Heads Up: This is for info only—not pro advice.

Community Buzz

Hot Forum Takes

Stacks crowd's cautiously upbeat. DeFi and BTC pairing draw eyes. Hard forks, upgrades spark debates on future price.

Expert & User Tips

Pros say watch dev closely, hedge risks. Vets mix HODL with short trades, glued to news feeds. Surprisingly effective combo.

FAQ

What’s "Rip" Mean?

"Rip" is slang for a sharp, quick price surge—news or hype-driven.

Rip: fast pump on news/demand. — Crypto Guide 2025. More

How’s STX vs. USD?

Tied to crypto market and USD strength. Strong dollar? STX dips in USD terms, even if crypto's pumping. Reverse holds too.

News That Moves Price?

- Protocol updates, new features;

- Partnerships, big projects;

- BTC/crypto market health;

- Reg changes, laws.

Smart Price Forecasting?

Layer it: history, TA, news, on-chain, sentiment. AI tools like ASCN.AI sharpen it, cut biases. Can't beat comprehensive.

Forecasts blend data, indicators, sentiment, news. — Top TA Methods 2025. Details

Wrapping Up

Final Calls on Stacks

Short-term: moderate gains with swings from tech updates and market mood. Long play? Solid BTC-tied asset.

Key watches:

- Ecosystem/dev updates;

- BTC trends;

- News/macros.

AI tightens forecasts, fewer mistakes.

Pro tools and trend tracking nail Stacks potential—smart decisions follow. If digging reports bores you, ASCN.AI delivers in clicks.

ASCN.AI's take on Stacks:

Disclaimer

This is general info, not financial advice. Crypto investments carry high risks. Always consult qualified pros before deciding.