Siacoin (SC) price prediction for 2025-2035 — latest news and growth prospects

about cryptocurrencies.

Got a burning question about crypto? You can run any project through our AI assistant to get a breakdown. Start your analysis right here.

| Year | Conservative Scenario (Min–Max, USD) | Base Scenario (Average, USD) | Optimistic Scenario (Min–Max, USD) | Quick Take |

|---|---|---|---|---|

| 2026 | 0.0010 – 0.0028 | 0.0030 | 0.0618 – 0.1997 | Expect some cooling off after 2025. If the Sia network improves, we could see a 10–20% bump, though the "Fear & Greed" index suggests a bearish mood (~25). |

| 2027 | 0.0015 – 0.0035 | 0.0040 | 0.0483 – 0.1280 | Cloud storage partnerships are the big "if" here. The base case assumes it’ll mostly follow BTC’s lead. |

| 2028 | 0.0020 – 0.0045 | 0.0055 | 0.1000 – 0.2000 | A DeFi adoption surge might push prices up. On the flip side, competition from heavyweights like Filecoin could lead to stagnation. |

| 2029 | 0.0025 – 0.0055 | 0.0070 | 0.1500 – 0.2500 | Web3 storage could finally hit its stride. In a dream scenario—driven by a BTC halving cycle—we might see a 5x from today’s levels. |

| 2030 | 0.0030 – 0.0060 | 0.0080 | 0.2000 – 0.3770 | The make-or-break year. If global adoption hits, 200%+ growth is on the table. If not? DigitalCoinPrice puts it at a modest $0.0055. |

| 2031 | 0.0035 – 0.0070 | 0.0100 | 0.2200 – 0.4000 | Scalability gains should drive long-term value, though tightening regulations remain the elephant in the room. |

| 2032 | 0.0040 – 0.0080 | 0.0120 | 0.2400 – 0.4200 | Possible tailwinds from AI/blockchain integration. For now, expect a steady, moderate climb. |

| 2033 | 0.0045 – 0.0090 | 0.0140 | 0.2500 – 0.4400 | The market usually stabilizes by this point. Optimists are betting on Sia becoming a leader in decentralized storage. |

| 2034 | 0.0050 – 0.0100 | 0.0160 | 0.2600 – 0.4500 | It’ll likely come down to macroeconomics and how the world finally decides to regulate crypto. |

| 2035 | 0.0055 – 0.0110 | 0.0180 | 0.2496 – 0.4557 | Massive long-term upside potential—some models suggest up to 26,000% growth from 2026, provided the ecosystem actually delivers. |

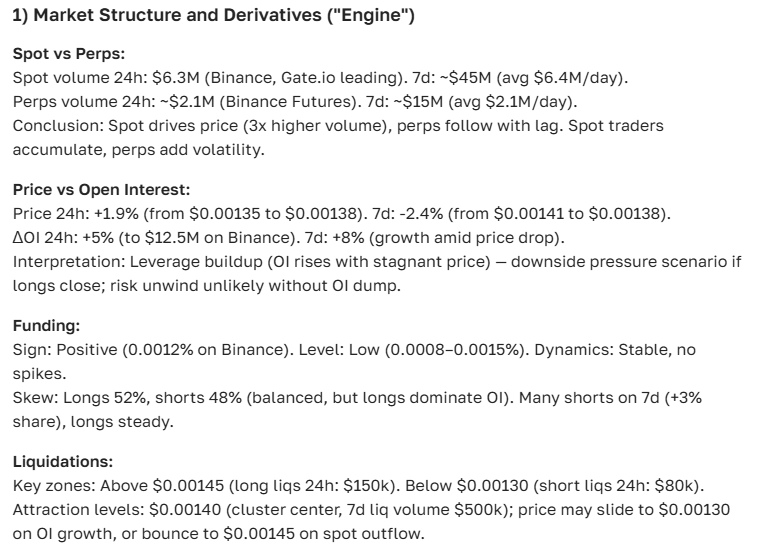

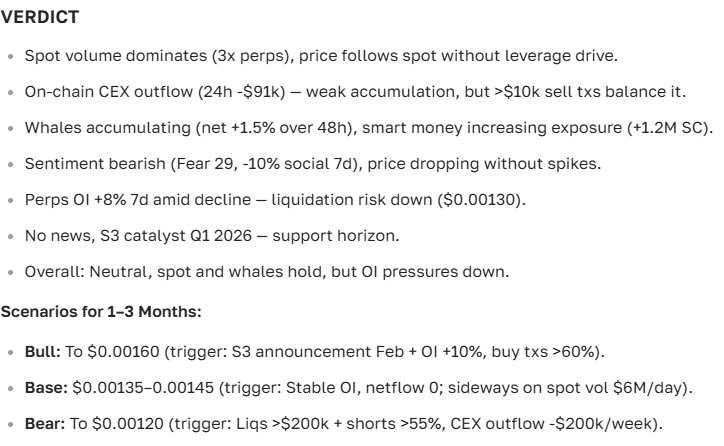

Here’s what our ASCN.AI assistant has to say about the Siacoin (SC) outlook:

"Siacoin is basically a crypto play on decentralized data storage. Looking at the SC charts, it’s clear the price action lives and dies by how the Sia ecosystem evolves and how the broader market is feeling on any given day."

Investors and traders are constantly trying to pin down where Siacoin is headed next—whether it's for tomorrow or the next month. To get a real sense of where SC is going, we have to look past the hype and check the news, the technical hurdles, and how it’s stacking up against the market leaders.

Where do we stand right now?

As of today, Siacoin is showing that typical crypto volatility we’ve all come to expect. The SC price is hovering around a key support level, which suggests things have calmed down a bit after the recent rollercoaster. Over the last month, there were a few distinct "up and down" moments that really tested investor nerves.

The Comparison: SC vs. The Big Guys

| Project | Monthly Growth | Current Price (USD) | Market Cap ($M) |

|---|---|---|---|

| Siacoin (SC) | +5.2% | 0.0053 | 250 |

| Bitcoin (BTC) | -1.3% | 30,500 | 575,000 |

| Ethereum (ETH) | -0.8% | 1,950 | 230,000 |

The numbers tell an interesting story: Siacoin actually managed to gain some ground while Bitcoin and Ethereum took a slight breather. It just goes to show that "smaller" altcoins like SC can often outrun the market when the timing is right. Still, keep in mind that with smaller caps comes bigger swings—don't let the green percentages fool you into ignoring the risk.

What’s the short-term forecast?

Today's SC price is caught between general market sentiment and the actual usage of the Sia network. While exchange liquidity is keeping the pressure on, many analysts think we could see a modest 2–3% bump, assuming no "black swan" events catch us off guard. It's a bit of a balancing act right now.

Looking at tomorrow

The news cycle seems pretty quiet for now, with no major shocks expected for the Siacoin project. If the market holds its ground, we might see another 3–4% push on decent volume.

The one-month outlook

Long-term, Siacoin's success depends on whether people actually want decentralized storage. Experts are eyeing the $0.007–$0.008 range over the next month, provided the ecosystem stays active. If we see a spike in on-chain transactions or a new partnership announcement, that target could move even higher.

Recent news and what's moving the needle

The Sia team recently rolled out some technical updates, and interestingly, the amount of data being stored on the network has ticked upward. That’s usually a good sign. Of course, SC doesn't live in a vacuum—whenever Bitcoin or Ethereum makes a sudden move, Siacoin usually feels the ripple effect. The core appeal remains its decentralized storage hook, which is still a major talking point for Web3 investors.

The Technical Breakdown

If we strip away the hype and look at the last 30 days of data, here’s what’s happening:

- The Safety Net: The 50-day moving average (SMA) is sitting at roughly $0.0051, acting as a decent floor for the price.

- RSI: The Relative Strength Index is hanging out in the neutral zone. Basically, neither the bulls nor the bears are in total control yet.

- Volume: Trading activity is up about 15% month-over-month. People are definitely paying attention again.

The Fundamentals

Why bother with SC? Well, there are a few things working in its favor:

- Encryption and data security on the Sia network are getting more robust.

- The user base and total data stored are slowly but surely growing.

- The niche for decentralized storage isn't as crowded as, say, Layer 1 blockchains.

New strategic moves in the Web3 space are helping Siacoin hold its ground against the competition.

What the community is saying

If you head over to the crypto forums or Twitter, the vibe is generally "cautiously optimistic." People love the tech and the potential, but they aren't shy about complaining about the volatility. The debate usually centers on whether Sia can outpace its rivals or if it'll just remain a niche tool for enthusiasts.

Is it a good investment?

From where we sit, Siacoin looks like a potential candidate for a medium-to-long-term bag. If you're worried about the day-to-day noise, a dollar-cost averaging (DCA) strategy might be the smartest way to play it.

The Catch: Risks to Watch Out For

- Global economic shifts can tank the whole market in hours.

- Competitors (like Filecoin) have bigger marketing budgets.

- Development delays can kill momentum fast.

That said, if you believe in the future of decentralized storage, Sia’s unique architecture is hard to ignore.

FAQ

What is Siacoin, exactly?

Think of it as the currency for the Sia storage platform. You use SC to pay for renting hard drive space from other people across the globe. It's a way to store files without relying on a single company like Amazon or Google.

What will SC be worth in a few years?

No one has a crystal ball, but many in the space think $0.01 to $0.015 is a realistic target over the next year if the platform keeps growing and the market doesn't crash.

How do I predict the price movement?

Keep it simple: watch the Moving Averages (SMA/EMA) for the trend, check the RSI to see if it’s "overbought," and always keep an eye on volume. If the price goes up but volume is low, be careful.

The Bottom Line

The outlook for Siacoin for the rest of the month suggests a slow, steady climb. For investors, the trick is to balance the technical charts with the actual project news. Don't go all-in based on a single green candle.

By the way, if you want a second opinion, here’s the final verdict from the ASCN.AI assistant:

Insights from the ASCN.AI Labs

In our experience at ASCN.AI, we’ve noticed that Siacoin tends to hold up surprisingly well during "flash crashes" compared to other altcoins. It seems to have a very loyal base. This has helped some of our users pivot their strategies quickly to minimize losses when the rest of the market is bleeding.

We’ve also seen real-time SC data reveal some pretty lucrative arbitrage opportunities between exchanges if you’re quick enough. If you’re not into manual digging, ASCN.AI can usually flag these gaps for you.

Case Study: ASCN.AI during the Falcon Finance drop

What happened on Oct 11? Profiting from a flash crash

Disclaimer

This isn't financial advice. Crypto is a wild ride and you can lose money just as fast as you make it. Always talk to a professional before putting your hard-earned cash into any digital asset.