Sei cryptocurrency forecast: current price and outlook for today and tomorrow

about cryptocurrencies.

Have a burning question about crypto? Our AI assistant at ASCN.AI is ready to help you crunch the numbers in real-time.

| Year | Min Price | Avg Price | Max Price | Key Drivers |

|---|---|---|---|---|

| 2026 | 0.10 | 0.20 | 0.50 | Possible bearish blip early on; recovery driven by network upgrades and DeFi integrations. CoinCodex notes a wide range, but we’ve adjusted for volatility. |

| 2027 | 0.15 | 0.29 | 0.70 | TVL growth within Sei; potential post-BTC halving bull run. AMBCrypto targets an average of $0.29. |

| 2028 | 0.20 | 0.40 | 1.00 | Ecosystem expansion (NFTs/DeFi); impact of global regulatory shifts. Extrapolated from Changelly data. |

| 2029 | 0.25 | 0.55 | 1.50 | Adoption surge in Asia; strong correlation with ETH/SOL moves. Cross-chain bridge potential. |

| 2030 | 0.30 | 0.80 | 2.00 | Full-scale network maturity; possible bull market peak. Changelly sees an average of ~$0.81 by year-end. |

| 2031 | 0.40 | 1.00 | 3.00 | Web3 integration; growing institutional interest. Kraken analysts suggest long-term upside above $0.21. |

| 2032 | 0.50 | 1.30 | 4.00 | Market stabilization; Sei positioning itself as a DeFi trading leader. |

| 2033 | 0.60 | 1.60 | 5.00 | Global adoption kicks in; AI/DeFi synergy. DigitalCoinPrice projects $1.54+ by 2034. |

| 2034 | 0.70 | 2.00 | 6.50 | Potential bearish correction; focus shifts to long-term sustainability. |

| 2035 | 0.80 | 2.50 | 8.00 | Long-term optimism: Sei enters Top-20 by market cap. BitScreener sees $4.87, while AMBCrypto’s ultra-bull case hits $16+. |

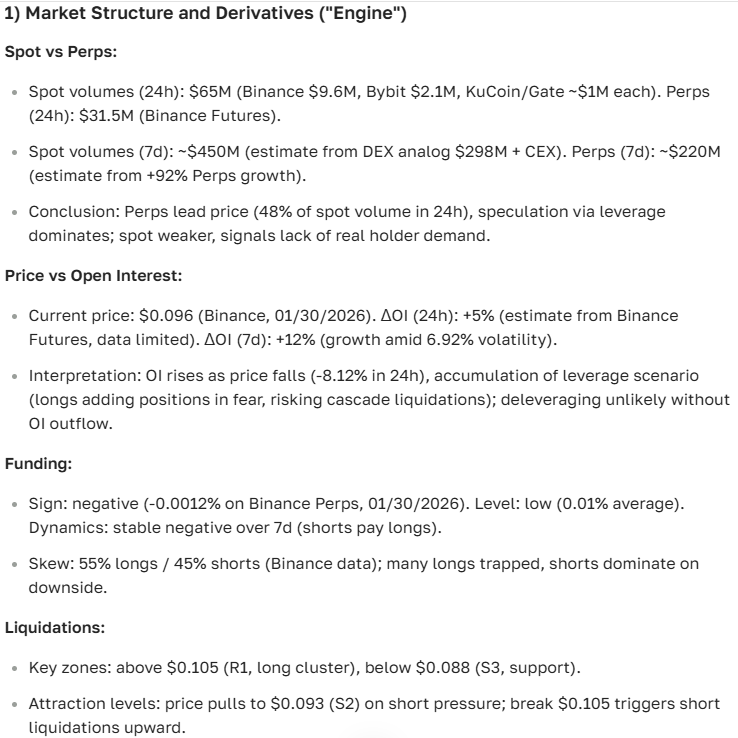

Here is the breakdown for Sei provided by our AI analyst at ASCN.AI:

“Predicting Sei's trajectory isn't just about looking at a graph; it's about navigating market shifts to make informed calls. Given its unique tech stack, we have to look at everything from capital flows to technical updates to see the full picture.”

What is Sei and where does it fit in the market?

Sei is essentially a third-generation blockchain designed from the ground up to solve the scalability headaches that slow down most decentralized platforms. It’s built for speed, specifically targeting smart contract processing and the DeFi sector. While many projects claim to be "Ethereum killers," Sei focuses on being a high-performance hub for Web3. Its market cap is on a steady climb, and the community activity suggests it’s carving out a real niche among its peers.

Because the crypto market is famously volatile, having a solid forecast for Sei is more than just a convenience—it’s a necessary tool for anyone trying to gauge risk and price dynamics.

Why bother with price forecasts?

For both green investors and seasoned whales, a price prediction serves as a roadmap. It helps you manage a portfolio more effectively, spotting potential exits and entries before the market moves against you. In a space where emotions often drive the bus, a data-backed forecast helps you keep a cool head, highlighting key support and resistance levels so you don't make panic-driven decisions.

Ultimately, understanding where the price might go helps minimize losses. If you know the major pivot points, you can manage your assets with a lot more confidence.

Learn more about portfolio management and risk mitigation.

So, what’s the current state of Sei?

At the moment, Sei is trading at $0.1082. It’s showing a fair bit of resilience despite the general pressure the market has been under lately. The price action right now is a tug-of-war between global macro trends, the moves of "smart money" holders, and the technical milestones of the blockchain itself.

“Sei's current price is the primary barometer for market demand and investor interest.”

The news that actually matters

Recent headlines have been mostly positive: protocol updates, new dApps launching on the network, and strategic partnerships that are boosting its visibility. This usually builds a bullish sentiment. However, keep an eye on broader market corrections—if Bitcoin catches a cold, Sei often sneezes, regardless of how good the local news is.

Community buzz and forum sentiment

If you hang out on crypto forums or Discord, you’ll notice a lot of talk about "rips"—those sudden, sharp price jumps. Community activity often front-runs these moves, making social sentiment a surprisingly useful indicator for traders looking to catch a breakout.

What does the immediate future look like?

For the coming weeks, the outlook is cautiously optimistic. We’re seeing signs of moderate growth backed by capital flowing into the network. There's a decent chance the price could push toward $0.125 within the next seven days, though a minor correction wouldn't be surprising.

What could push it up (or pull it down)?

- The Upside: Strong validator activity, higher trading volumes, more DeFi integrations, and "smart money" accumulation.

- The Downside: Regulatory crackdowns, broader market sell-offs, or unexpected technical glitches in the network.

It’s a balancing act. If you want to dive deeper into the data, check out our guide on on-chain metrics and market analysis.

Expert scenarios to watch

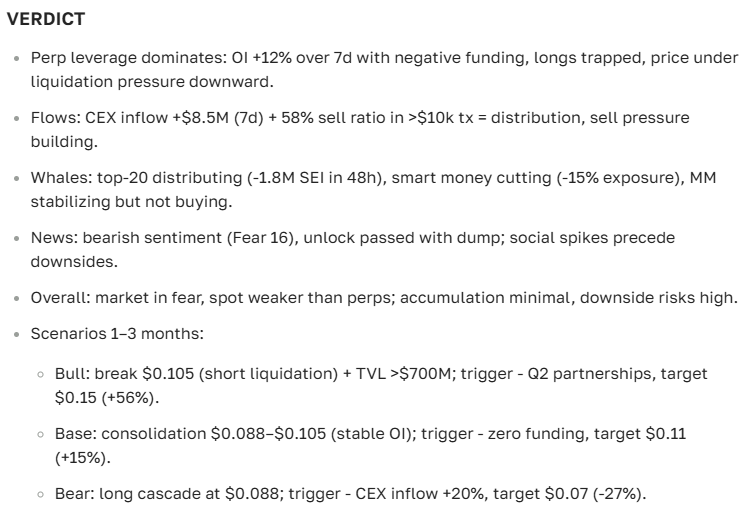

Analysts generally see three paths for Sei right now:

- Bull Case: A steady climb to $0.14 over the next month.

- Neutral Case: Moving sideways with minor fluctuations.

- Bear Case: A market-wide dip dragging Sei down toward $0.09.

“Sei's long-term potential remains massive, even if the short-term chart looks a bit choppy.”

Analyzing the trends

Over the past year, Sei has moved from $0.05 to over $0.11. That’s a solid performance, though it hasn’t been a straight line up. Like any high-beta asset, it’s prone to sharp corrections following big runs.

The BTC/ETH connection

Surprisingly or not, Sei often moves in lockstep with the big players like Bitcoin and Ethereum. If the "kings" of crypto are trending up, Sei usually follows with even more volatility. The US Dollar index (DXY) also plays a role—a stronger dollar usually puts weight on crypto prices across the board.

Is a "rip" coming?

Sudden jumps—rips—usually happen around major protocol upgrades or big partnership announcements. If you see a spike in volume without a clear reason, it might be the start of a trend. If you don't want to monitor this manually, using a tool like ASCN.AI can help you filter the noise and focus on the data that matters.

The Technical Breakdown

| Indicator | Current Value | Interpretation |

|---|---|---|

| 50-day SMA | $0.140523 | SELL Signal (Price is below average) |

| 200-day SMA | $0.241662 | SELL Signal (Long-term downtrend) |

| RSI (14) | 34.12 | NEUTRAL (Oversold territory is close) |

| MACD (12,26) | -0 | NEUTRAL |

| Momentum (10) | -0.02 | Weak bearish momentum |

| Hull Moving Average (9) | 0.110066 | BUY Signal |

On the daily, the moving averages suggest some weakness since the price is currently sitting below the 50 and 200-day averages. However, the RSI is dipping toward 34, which often signals that the selling is exhausted and a bounce might be around the corner.

What the candles are telling us

Traders are keeping a close eye on a few specific patterns for Sei:

- Bullish signs: Hammers, Bullish Engulfing, and Morning Stars suggest a reversal to the upside.

- Bearish signs: Shooting Stars and Hanging Man patterns usually warn of a potential drop.

FAQ

What actually drives the price of Sei?

It's a mix of news, how active the network's validators are, trading volume, and how the overall market (especially BTC) is feeling.

Where will Sei be in a month?

Forecasts suggest it could gain about 10–15%, potentially hitting $0.125 if the market stays stable.

Which news should I follow?

Focus on protocol upgrades and new DeFi partnerships. For instance, when Sei launched its new DeFi products recently, we saw a noticeable spike in interest.

The Bottom Line

Predicting where Sei goes from here requires a blend of technical charts and fundamental news. While the project has huge upside potential, it’s not immune to market swings. Successful investing here means keeping one eye on the charts and the other on the ecosystem's growth.

Our AI at ASCN.AI summarizes it like this:

Deep Dive Data

Performance over time

| Period | Starting Price | Ending Price | Change (%) |

|---|---|---|---|

| Past Week | $0.105 | $0.108 | +2.86% |

| Past Month | $0.100 | $0.108 | +8.00% |

| Past Year | $0.050 | $0.108 | +116.00% |

How Sei stacks up against the market

| Asset | Price (USD) | Monthly Trend (%) |

|---|---|---|

| Sei | $0.1082 | +8.0% |

| Bitcoin (BTC) | $45,000 | -1.5% |

| Ethereum (ETH) | $3,200 | +3.2% |

| USD Coin (USDC) | $1.00 | ±0% |

Recent Milestones

- A major smart contract upgrade boosted transaction speeds while cutting fees.

- A new partnership with a top-tier DeFi project has sparked fresh community interest.

- User activity has climbed by 15% in just the last 30 days.

Disclaimer

This is for informational purposes only and isn't financial advice. Crypto is volatile—like, really volatile. Talk to a professional before you put your money on the line.