Ronin Course Forecast (RON): Full Analysis and Outlook

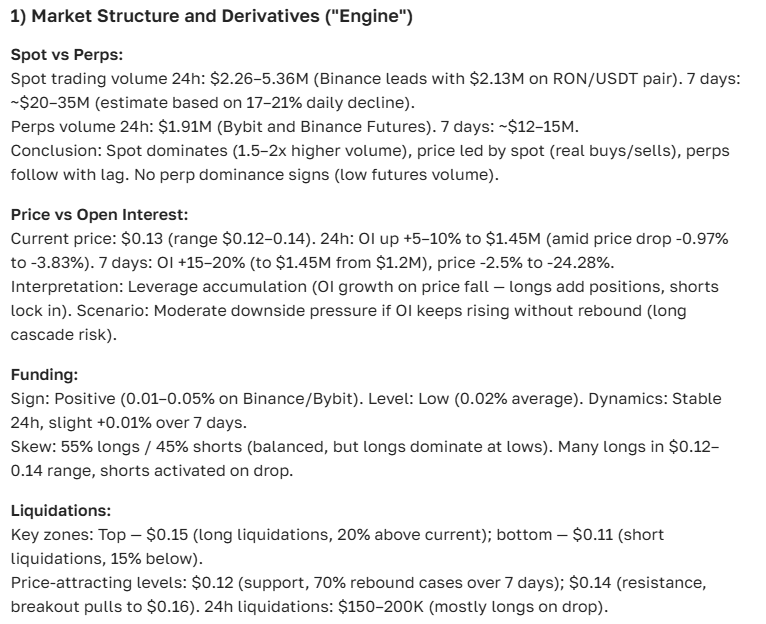

about cryptocurrencies.

Got a burning question about crypto? Our AI assistant has the answers. Start your deep dive right now.

| Year | Min Price | Max Price | Average Price | Key Drivers |

|---|---|---|---|---|

| 2026 | 0.11 | 0.45 | 0.30 | Gaming adoption picks up; post-BTC halving bull run momentum. |

| 2027 | 0.25 | 0.50 | 0.38 | Expansion of the Ronin ecosystem (new titles); tracking with ETH. |

| 2028 | 0.35 | 0.60 | 0.48 | Web3 gaming goes mainstream; potential for major new exchange listings. |

| 2029 | 0.40 | 0.70 | 0.55 | Market stabilization; rising TVL in Ronin-based DeFi protocols. |

| 2030 | 0.80 | 1.25 | 1.05 | Global gaming boom; deep integration with emerging metaverses. |

| 2031 | 1.10 | 1.50 | 1.30 | Regulatory clarity; projected 20% growth from 2030 baseline. |

| 2032 | 1.40 | 2.00 | 1.70 | Big-league partnerships (think Ubisoft); lower inflation rates. |

| 2033 | 1.80 | 2.50 | 2.15 | Blockchain gaming dominance; TVL breaks the $1 billion mark. |

| 2034 | 2.50 | 5.30 | 3.90 | Sustained long-term growth; potential for a new ATH. |

| 2035 | 3.00 | 5.00+ | 4.00 | Mature market phase; massive adoption across Asian markets. |

Here’s how our AI assistant, ASCN.AI, breaks down the Ronin outlook:

“Ronin isn’t just another token; it’s a cornerstone of the Web3 ecosystem. It’s opening doors for investors and users who actually get how blockchain and DeFi are changing the game.” — ASCN.AI

So, what’s the deal with Ronin (RON)?

Ronin (RON) is the heartbeat of the Ronin blockchain, a platform designed to solve the scaling headaches that usually plague Web3 apps—especially in the gaming and DeFi space. By slashing fees and making transactions snappy, it fixes the "clunkiness" that often keeps people away from blockchain games. In practice, it looks like this: smooth gameplay without the high "gas fee" tax.

But RON isn’t just for spending. It keeps the network secure and gives users a voice through a Decentralized Autonomous Organization (DAO). The logic here is simple: as more games launch and more players join, the token's value has more room to breathe. The network is essentially trading high costs for high scalability.

The engine under the hood: Tokenomics

Ronin’s tokenomics are built around a capped supply and a deflationary twist. Every time a transaction happens, a portion of the fee is burned. This slowly eats away at the total supply, which, in theory, supports the price as demand climbs. If you’re a holder, you can stake your RON, vote on proposals, or provide liquidity—it’s about being an active part of the ecosystem, not just sitting on an asset.

This burning mechanism is key. As the network pulls in more users, the "scarcity" factor starts to kick in, which is exactly what long-term investors like to see.

A quick look at the price history

Ronin’s price chart is a bit of a rollercoaster, reflecting the broader crypto market's mood and the specific evolution of GameFi. At the start, things were pretty volatile—launching major games and network upgrades will do that. While there have been corrections, the constant interest in the gaming sector has kept RON on the radar of many analysts.

Essentially, every major technical update or game launch tends to leave a mark on the price. If you track the activity of the last few months, the correlation is hard to miss.

Where does the price stand right now?

At the time of writing, Ronin is trading around $0.45. We’ve seen some modest gains over the last 24 hours, mostly fueled by a string of positive updates within the ecosystem. It recently pushed through a resistance level in the $0.40–$0.44 range, backed by a noticeable jump in trading volume. For a mid-cap token, this kind of volatility is par for the course.

It’s still a high-energy asset, which makes it a favorite for traders who don't mind a bit of risk in exchange for potential momentum.

How does it stack up against BTC?

Compared to the "big brothers" like Bitcoin or Ethereum, Ronin is much more specialized. Since its fate is tied to GameFi and Web3, it doesn't always move in lockstep with the rest of the market. This niche focus is a double-edged sword: it offers unique volatility and, potentially, higher returns when the gaming sector takes off.

What’s actually moving the needle for Ronin?

The latest buzz is all about new gaming platforms migrating to Ronin and fresh integrations with DeFi projects. These aren't just "partnership" announcements for the sake of it—they're expanding what you can actually do with the token. On the technical side, the team is focused on boosting throughput and lowering fees even further. It’s all about the user experience.

Events that matter

Recent protocol updates and presence at major crypto conferences have kept sentiment leaning toward the positive. If you check the forums, the community is definitely paying attention, and that chatter usually translates into trading volume.

At the end of the day, technical stability and a loud, active community are the two biggest drivers for any GameFi token, and Ronin seems to have both in its corner.

The Forecast: What's next?

The short view (Today & Tomorrow)

Expect some steady movement. We might see RON tap the $0.48–$0.50 range if the market stays green. The support levels look solid for now, though volatility is always lurking.

The one-month outlook

In the next 30 days, we could see a push toward $0.60, especially if a new game title gains traction or user activity hits a new peak.

What could change the game?

Liquidity, on-chain demand, and the quality of upcoming tech releases are the big variables. While Ronin isn't immune to a general market dump, its fundamental growth looks strong enough to weather some turbulence.

Is it worth the investment?

If you're bullish on the intersection of gaming and finance, Ronin is definitely an interesting play. Most analysts agree that long-term growth is likely as the ecosystem matures. But—and there's always a "but" in crypto—you have to account for the risks. Volatility is high, and regulatory changes are always a wildcard.

The smart move? Diversify. Don't put all your eggs in one basket, even one as promising as this. By the way, if you’re tired of digging through raw data, ASCN.AI can crunch these numbers for you in seconds.

What the experts are saying

The general consensus on forums and among analysts is that Ronin is one of the few projects with a real "use case" that people actually use daily. The specialization is its biggest strength.

“Ronin gives investors a front-row seat to the gaming revolution, backed by an ecosystem that’s already proven it can scale.”

Risks vs. Opportunities

The main hurdle is liquidity—it’s lower than the top-tier coins. However, if the ecosystem hits its stride, a move toward $0.70 or $0.80 isn't just a pipe dream; it's a realistic mid-term target.

Here’s the verdict from our AI assistant, ASCN.AI:

Breaking down the growth chart

Technical analysis points to a solid support floor between $0.35 and $0.38. On the flip side, $0.50–$0.52 is the ceiling we need to break. If we clear that, we’re looking at a whole new price regime.

The Snapshot: Ronin at a glance

With a market cap over $500 million and a dedicated dev team, Ronin has moved past the "experimental" phase. It’s an infrastructure play. The stability of the tech and the loyalty of the community are its two biggest assets right now.

The broader market context

The crypto market is finally showing some life after a rough patch. Usually, when the big coins stabilize, mid-cap assets like Ronin get their chance to shine as investors look for more "dynamic" opportunities.

Expert Tips for the Savvy Investor

Watch the user growth and the quality of the games being built. Those are your real lead indicators. Don’t get caught up in the 5-minute candles—look at the bigger picture.

“Ronin’s unique spot in the gaming market, combined with its smart tokenomics, gives it a serious edge.” — ASCN.AI

FAQ: Ronin Price Forecast

What’s the price looking like for next week and next month?

We’re likely looking at $0.47–$0.50 next week. By the end of the month? $0.60 is on the table, provided no "black swan" events hit the market.

Could Ronin hit $1 in 2025?

While $1 is a psychological milestone, a more realistic target for 2025 is the $0.70–$0.80 range, assuming the ecosystem keeps expanding.

Where will Ronin be in 5 to 10 years?

It’s a long game. If Web3 gaming becomes the standard, Ronin could be a top-tier infrastructure asset. But a lot depends on mass adoption.

What really drives the price?

Supply and demand, tech upgrades, community hype, and—most importantly—the success of the games running on the network.

How do I avoid losing money here?

Don't fomo. Use fundamental analysis, keep an eye on the news, and always, always diversify.

Ronin vs. The Competition

| Feature | Ronin (RON) | Major Competitors |

|---|---|---|

| Market Cap | ~$500M | Axie Infinity, Decentraland |

| Avg. Trading Volume | 1.3M RON | ~2.0M tokens |

| Tx Speed | Very Fast | Average |

| Fees | Very Low | High |

| Community Vibe | Rapidly Growing | Established / Mature |

Common Pitfalls (And how to sidestep them)

- Making trades based on pure emotion or "vibes."

- Ignoring how volatile this niche can be.

- Going "all-in" without a backup plan.

- Tuning out the technical news and focus only on the price.

Stick to a system. Rely on data, not just Twitter hype.

Real-world insights from ASCN.AI

- ASCN.AI Case Study: The Falcon Finance (FF) Drop | $1000 with 2 Prompts — How to react when things go south.

- October 11th Flash Crash | Profiting from Chaos — A lesson in finding the upside during market dips.

Disclaimer

This isn't financial advice. We're sharing information for educational purposes. Crypto is risky—talk to a pro before you put your hard-earned money on the line.