Quant cryptocurrency price forecast: analytics, news, and outlook

about cryptocurrencies.

Got a burning question about crypto? You can bounce ideas off our AI assistant over at ASCN.AI and start your analysis right now.

| Year | Min Price (USD) | Average Price (USD) | Max Price (USD) | The Main Drivers |

|---|---|---|---|---|

| 2026 | 71.91 | 115.00 | 181.26 | Interoperability adoption kicks in; post-halving bull cycle vibes. Watch for US/EU regulations—they might actually help. |

| 2027 | 90.00 | 140.00 | 220.00 | Heavy hitters (banks, CBDCs) move in. QNT usually tags along with ETH/BTC trends. |

| 2028 | 110.00 | 170.00 | 280.00 | Overledger scaling takes off. DeFi integrations look promising, though Polkadot and Cosmos are breathing down their necks. |

| 2029 | 130.00 | 200.00 | 350.00 | Long-term ecosystem maturity. We might even see a QNT ETF by then. Watch out for global recession risks, though. |

| 2030 | 35.00 (bear) / 463.60 (bull) | 300.00 | 568.18 | The "make or break" year. If blockchain standards go mass-market, $8000 is the moonshot dream, but $300 feels more realistic. |

| 2031 | 150.00 | 250.00 | 450.00 | Market stabilization. The focus shifts entirely to enterprise solutions and crypto-friendly geopolitics. |

| 2032 | 170.00 | 280.00 | 500.00 | Web3 integration goes full scale. Quant’s TVL grows, but keep an eye on new regulatory hurdles. |

| 2033 | 190.00 | 310.00 | 550.00 | The interoperability trend holds strong; massive correlation with the AI+blockchain narrative. |

| 2034 | 210.00 | 340.00 | 600.00 | Market maturity hits. CBDC projects are no longer "new." Macro factors will dictate the swings here. |

| 2035 | 33.00 (bear) / 463.00 (bull) | 350.00 | 620.00 | The final horizon. If Quant sets the global standard, it soars. If not? A conservative $100-$135 range is likely. |

Here’s how the Quant (QNT) landscape looks according to the ASCN.AI assistant:

"Predicting Quant isn't just about charts; it requires a deep dive into on-chain signals, market sentiment, and the latest headlines to get the full picture."

Where does Quant stand right now?

Quant’s price has been hovering in its usual range lately, showing the kind of moderate volatility we've come to expect from the broader market. Over the last 24 hours, QNT has been bouncing between $100 and $110. It seems investors are keeping a close watch. Right now, it's sitting near some pretty significant support levels, and with a market cap in the hundreds of millions, it feels relatively grounded compared to some of the flashier altcoins.

Day-to-day, the price is caught between technical patterns and whatever news is breaking. Usually, we see swings of 3% to 10%—nothing out of the ordinary for crypto, and Quant is no exception to the rule.

Interestingly, things are looking up slightly.

"In the last 24 hours, Quant has caught a bit of a tailwind, fueled by a generally positive market mood and some fresh industry chatter," notes an analyst at ASCN.AI.

The Dollar factor

Let’s not forget the USD. Since QNT, like most things, is mostly traded against the dollar, if the Greenback flexes its muscles, Quant usually feels the squeeze. On the flip side, when the dollar takes a breather, Quant tends to find some room to run.

As of July 2025, the dollar has been relatively calm, which gives Quant a nice, stable floor to move from without those gut-wrenching spikes. Analysts are keeping one eye on the DXY (Dollar Index) to see where the next move is coming from.

It’s a clear connection:

"When the dollar strengthens, digital assets usually take a hit—it’s just the nature of the beast right now."

Looking ahead: Tomorrow and the next 30 days

What’s the vibe for tomorrow? Most signs point to more of the same—steady stability with a chance of a small breakout if the news cycle stays friendly. A few things could push it higher:

- More people actually using the Quant ecosystem;

- Suddenly dropping a new partnership announcement;

- A renewed hype around fixing the "blockchain silos" (interoperability).

But here’s the catch. It could just as easily dip if:

- The stock market gets shaky;

- The dollar decides to rally;

- We hit the typical "cool-off" phase after a green day.

If you don’t want to dig through the raw data yourself, ASCN.AI’s engine—which blends on-chain stats with news feeds—is predicting a tight window of ±3–5% for the next 24 hours.

"Blending on-chain data with real-time news flows is really the only way to get short-term price calls right these days."

The mid-term view: What experts are saying

If we zoom out to the next month, the forecast depends on the bigger picture—macro trends and protocol updates. Many analysts are leaning toward a gradual climb, mostly because of a few key catalysts:

- Finance firms getting more comfortable with Quant's tech;

- Upcoming protocol tweaks and potential bridges to other big chains;

- Better liquidity as more traders jump in.

On paper, we could see QNT testing the $120–$130 range by the end of the month if it manages to punch through current resistance levels.

"The mid-term outlook is really a fundamental play. If the demand for Quant's utility stays strong, the price should follow," says an ASCN.AI specialist.

Why is Quant even worth watching?

So, what's actually driving the price? It usually boils down to four things:

- The Tech: Quant actually solves the scalability and "talk-to-each-other" problems that plague older chains.

- The Network: They aren't just playing in a sandbox; they’re actively talking to banks and Web3 heavyweights.

- The Ecosystem: As DeFi and NFTs grow, the need for a bridge (like Quant) grows with them.

- The Big Money: Institutional funds are finally starting to look past just Bitcoin and Ethereum.

"At the end of the day, interoperability and real partnerships are the two biggest growth engines in this space."

The "Bear Case": What could go wrong?

Let's be realistic—it's not all moonshots. Things could go sideways if:

- Regulators decide to get heavy-handed;

- The global economy takes a nosedive;

- The network hits a technical snag or a major update gets delayed;

- A competitor comes out with a better, cheaper mousetrap.

In these scenarios, a 10-20% correction is totally on the table before things find a new bottom.

"Regulatory pressure is the classic 'black swan' for crypto. It kills liquidity and scares off the retail crowd."

The latest buzz: News that matters

In July 2025, a few headlines have been doing the heavy lifting for Quant's price. Here’s what’s on the radar:

- Talk of a major partnership with a top-tier bank for payment integration;

- The rollout of a protocol update designed to make transactions even snappier;

- Community debates about how Quant fits into the next wave of NFT utility.

This kind of news creates a "feel-good" factor that usually translates into buy pressure.

"News moves the needle in the short term, period."

By the way, if you want to stay on top of these shifts without refreshing Twitter all day, the ASCN.AI blog handles the heavy lifting with real-time analytics.

What’s the word on the forums?

Generally, the "smart money" on crypto forums is staying optimistic. The community seems less focused on daily price action and more on the long-term tech roadmap.

"Market sentiment—the kind you find in deep-thread forum discussions—is often the first signal of a price swing."

The bottom line for investors

Is now a good time to buy? Given where the tech is headed, it looks like a solid play, but you have to be smart about it. We’d suggest using ASCN.AI to track the technicals, but always balance that against your own risk tolerance.

In practice, a "slow and steady" strategy usually beats trying to time the top.

Managing your risk (don't skip this)

If you're going to play the Quant game, follow the basics:

- Don't put all your eggs in one basket (diversify);

- Keep an eye on the news;

- Use stop-losses so a bad day doesn't ruin your month;

- Let the indicators guide you, not your "gut feeling."

"Smart diversification and basic technical analysis are the difference between a trader and a gambler."

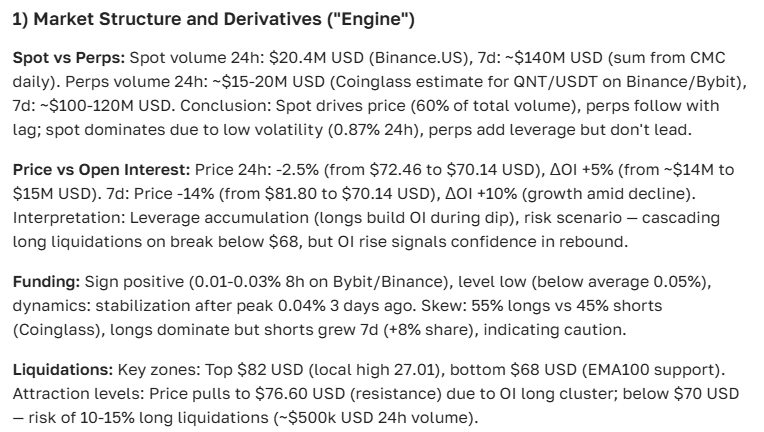

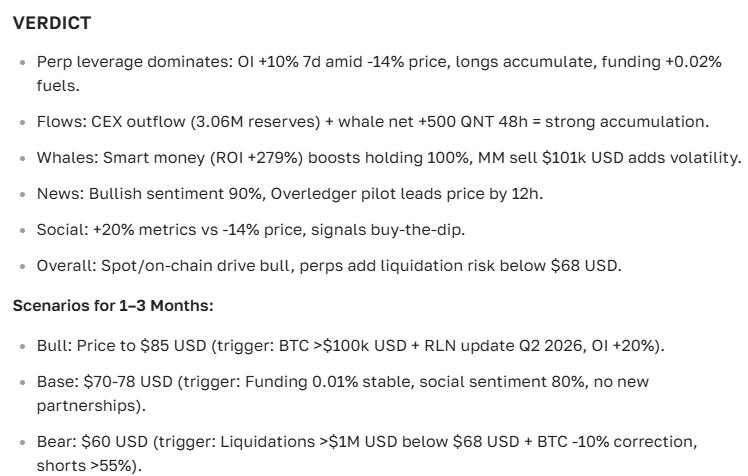

Speaking of data, here is the current verdict on Quant from our AI assistant:

FAQ — Quick Answers

What actually moves the price of Quant?

It’s a mix of the global economy, how the US dollar is doing, technical updates to the network, and plain old supply and demand.

Where is the price going soon?

The potential is there for a run toward $120–$130 in the mid-term, though expect some rocky patches along the way.

Where can I find more tips?

The usual spots: crypto Twitter (X), Telegram groups, and analytical hubs like ASCN.AI.

ASCN.AI Case Study

Real-world example: The ASCN.AI platform used its news-tracking algorithms to spot a shift in Quant’s sentiment before the market reacted, giving its users a head start on the trend.

Check out the ASCN.AI case study on Falcon Finance (FF) — see how two prompts turned into $1,000.

Disclaimer

This is for informational purposes only. Crypto is risky, and this isn't financial advice. Do your own research and talk to a pro before putting your money on the line.