Pyth Network (PYTH) Price Forecast: Full Analysis and Outlook

about cryptocurrencies.

Got a burning question about crypto? You can bounce ideas off our AI assistant over at ASCN.AI—it's a solid place to start your analysis right now.

| Year | Potential Low (USD) | Average Target (USD) | Potential High (USD) | Context & Key Drivers |

|---|---|---|---|---|

| 2025 | 0.01–0.10 | 0.03–0.12 | 0.45–1.40 | Conservative: DeFi slumps; Bullish: Institutional inflow. |

| 2026 | 0.04–0.13 | 0.05–0.30 | 0.60–0.80 | Governance-driven growth vs. standard volatility risks. |

| 2028 | 0.13–0.19 | 0.19 | 0.23–0.45 | Market stabilization, though growth may feel sluggish. |

| 2029 | 0.19–0.26 | 0.27 | 0.33 | Wider adoption kicks in. |

| 2030 | 0.23–0.40 | 0.33–0.41 | 0.45 | Long-term DeFi boom scenario. |

| 2031 | 0.24–0.60 | 0.30–0.61 | 0.69–0.87 | Major institutional partnerships. |

| 2032 | 0.31–0.87 | 0.40 | 1.00+ | Oracle scaling milestones. |

| 2035 | 0.50–1.00 | 0.80–1.50 | 2.00+ | Tapping into a $50B global data market. |

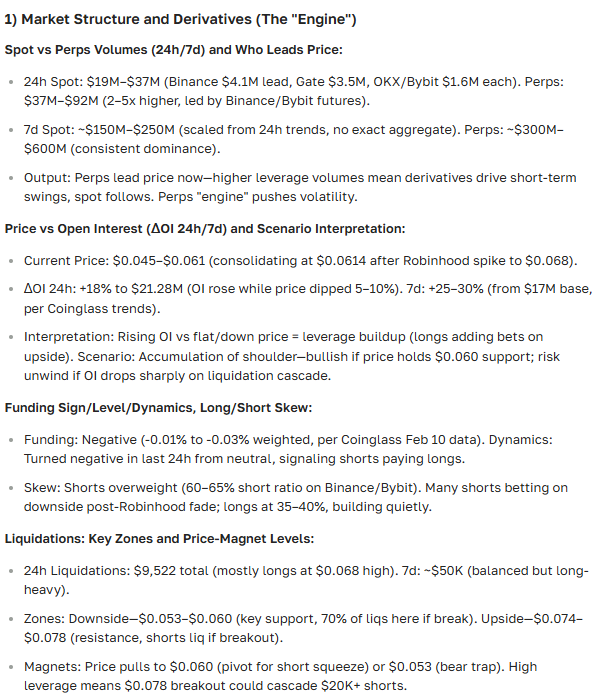

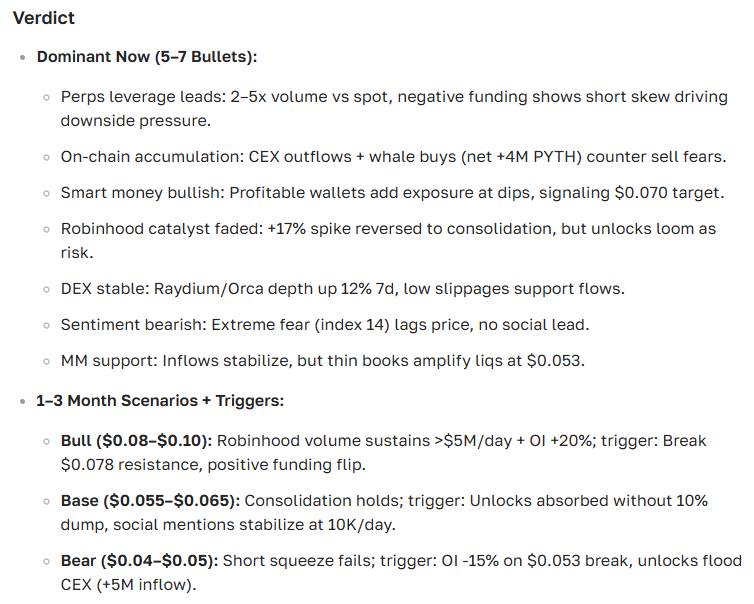

Here’s a quick look at the PYTH analysis generated by the ASCN.AI assistant:

So, what exactly is Pyth Network?

In simple terms, Pyth Network is a decentralized oracle. Its job is to provide accurate, real-time market data to various crypto projects that can't "see" outside their own blockchain. The PYTH token is the lifeblood of this ecosystem—it’s used to pay for services and gives holders a seat at the table for governance decisions.

What makes PYTH stand out? It’s its ability to pull data directly from the heavy hitters: exchanges, on-chain sources, and institutional trading desks. Because it’s built on Solana, it offers the kind of speed and precision that DeFi platforms and high-frequency traders actually need. It's less about "eventually" getting data and more about getting it now.

A few things that give it an edge:

- Impressive throughput with almost zero lag.

- Deep ties with major DeFi protocols and centralized exchanges.

- A working model for staking and network consensus.

- The inherent transparency and security that comes with the Solana backbone.

The price of PYTH in USD is constantly shifting, reacting to the usual push and pull of supply and demand, plus whatever news is breaking in the industry. It’s a dynamic environment where multiple data streams ensure the market price stays honest.

“Pyth Network is one of those rare examples of an oracle built specifically for high-speed chains. That’s why it’s become such a cornerstone of the Web3 world.”

When you're dealing with high-frequency trading, that lack of latency isn't just a feature—it's the whole point.

Where is the price heading?

Right now, PYTH is caught between general market sentiment and specific project updates. We’ve seen volatility pick up lately as trading volumes climb and the network rolls out fresh changes.

A few things are driving the current price action:

- DeFi projects are hungry for reliable oracles, and Pyth is filling that gap.

- The broader "crypto vs. dollar" dance that dictates overall market appetite.

- Ongoing chatter within the community regarding security and new features.

For the moment, the price seems to be finding a floor between $0.058 and $0.061. These support levels were recently tested and held (as of late December 2025). Can it go higher? It’s possible, but news-driven spikes of 5–10% are pretty common here, so expect some choppy water.

The outlook for tomorrow

Expect a bit of cautious optimism tomorrow. We might see some localized activity spikes. What should you watch? Keep an eye on protocol update rumors or new integration announcements. Technically, we're looking at established support/resistance levels within the current channel. If the news is good, a push toward $0.063 isn't out of the question.

The beauty of Pyth is that its own data feeds often give us a more granular look at these market conditions than standard trackers.

Looking a month ahead

When we zoom out to the monthly view, it’s all about the fundamentals. We’re looking for scheduled network upgrades, big-name DeFi partnerships, and the general health of the crypto market cap.

If the current foundation stays solid, a 15–30% climb over the month is a realistic target. But let’s be real—this is crypto. Short-term corrections are part of the deal. If it manages to break past resistance at $0.062 and $0.081, we could see some serious institutional interest wake up.

Understanding these levels is key. If you want to dive deeper into how to play these trends, check out our guide on the best technical indicator strategies.

“The next few weeks for PYTH won't just be about charts. It’s about whether the team can keep the momentum going through actual utility and new partnerships.”

What’s actually moving the needle?

The factors moving PYTH usually fall into two buckets:

- The Internal: Think protocol updates, team activity, and how vocal the community is feeling.

- The External: Macroeconomics, the strength of the USD, and how the stock market is behaving.

- The "Rip" Factor: Sudden, sharp moves often triggered by unexpected news or large-scale liquidations.

Volatility is just part of the furniture here. It creates risk, sure, but it's also where the opportunities hide. Watching key price levels is the best way to spot a trend before it fully reverses.

By the way, the folks over at Falcon Finance found that mixing news sentiment with technical data is usually the best way to call short-term moves. You can see how that played out in the ASCN.AI case study on Falcon Finance.

The latest buzz and updates

Lately, Pyth has been busy. They’ve been aggressively expanding their footprint through new exchange listings and integrations. More listings usually mean better liquidity, which is almost always a win for the token's price stability.

They've also been doubling down on security audits. In a post-exploit world, keeping investor trust is just as important as the tech itself.

Does news actually change the price?

In short: yes. A major announcement can easily swing the price by 5–10% in just a few hours. That’s why many traders are moving toward a structured approach—using on-chain data and Telegram signals to filter the signal from the noise.

“Using AI assistants to aggregate on-chain signals helps investors jump on opportunities before the rest of the market catches on.”

You can find more deep dives and real-time analysis in the ASCN.AI news blog.

What are people saying?

If you hang around the forums, the consensus from seasoned investors is to treat PYTH as a long-term play but keep the leash short. The common advice? Buy at support levels and always use a stop-loss. In a market this volatile, a "set it and forget it" strategy can be dangerous.

“Being strategic with stop-losses is how you survive a volatile market long enough to actually see the gains.”

Growth prospects

Most analysts seem to agree that Pyth has the "bones" to grow. Because it’s a core piece of infrastructure for DeFi and Web3, its success is tied to the growth of those sectors. Some are even whispering about a "rip" effect—a massive price surge—if a major institutional player adopts the protocol in the coming months.

FAQ — Your PYTH questions answered

Is PYTH a good investment?

It’s a solid pick if you believe in the future of Web3 infrastructure. But let's be clear: no investment is a "sure thing." You need to weigh the tech against the market risks.

Can Pyth Network actually scale?

The potential is definitely there, especially with their current roadmap. However, a lot depends on how well they handle network congestion and whether the broader market remains friendly.

What will PYTH be worth in a few years?

Predicting crypto is notoriously difficult, but here’s what the current models suggest:

- 2025: $0.058 – $0.065

- 2026: $0.021 – $0.065 (expect a wider range here)

- 2028: $0.037 – $0.090

- 2030: $0.069 – $0.199

- 2036: Potentially up to $1.27 if everything goes perfectly.

Which price levels actually matter?

Keep your eyes on $0.053 for support. If we break below that, things could get ugly. On the flip side, $0.081 and $0.129 are the big resistance hurdles to clear.

What mistakes do people usually make with PYTH?

Usually, it’s one of three things: ignoring on-chain data, forgetting about support levels, or making panic-buys based on a single tweet. A professional approach always blends technicals with fundamentals.

The Expert Take

Analysts generally see Pyth keeping its spot at the top of the oracle food chain. Its tech is unique enough and its partnerships are deep enough to weather most storms. Still, it’s not immune to the volatility that defines this space.

When you're looking at forecasts, don't just trust one source. Compare them, look at the underlying data, and see how it stacks up against the day's news. If you’re looking for an edge, tools like ASCN.AI can help automate the boring part—tracking those on-chain signals—so you can focus on the big picture.

“In a market like this, the winner is usually whoever has the fastest access to the best data.”

The bottom line

Pyth Network has the technical chops and the market position to stay relevant. While the price will definitely hit some bumps along the way, the long-term potential is hard to ignore. Watch the integrations, watch the support levels, and stay informed.

Here’s the final verdict from the ASCN.AI assistant:

Disclaimer

This content is for informational purposes only and is not financial advice. Crypto markets are risky. Always do your own research and talk to a professional before putting your money on the line.