Pendle cryptocurrency rate forecast: Price today, outlook and news

about cryptocurrencies.

Got a burning question about crypto? You can bounce it off our AI assistant over at ASCN.AI and get a deep-dive analysis rolling immediately.

| Year | Floor Price (USD) | Average Price (USD) | Ceiling Price (USD) | The Catalysts |

|---|---|---|---|---|

| 2026 | 1.53 | 3.12 | 4.70 | Post-halving DeFi surge; new Pendle yield trading products; likely bull market tempered by US/EU regulatory friction. |

| 2027 | 1.47 | 2.67 | 3.88 | Cooling off after 2026; tighter L2 integrations (Arbitrum/Optimism); inflation and competition risks. |

| 2028 | 1.62 | 2.92 | 3.49 | RWA (real-world assets) adoption picks up; potential AI+DeFi synergy; bear case involves a broader recession. |

| 2029 | 5.78 | 12.52 | 19.26 | Protocol scaling hits its stride; TVL north of $10B; riding the wave of a global crypto boom. |

| 2030 | 8.00 | 15.00 | 25.00 | Yield farming goes mainstream; regulatory clarity improves; simple growth extrapolation. |

| 2031 | 9.48 | 11.00 | 12.52 | Market consolidation; a shift toward sustainability and stablecoin dominance. |

| 2032 | 12.00 | 18.00 | 24.00 | Growth fueled by Metaverse/DeFi 2.0; potential "quantum threat" jitters in the tech space. |

| 2033 | 14.00 | 22.00 | 30.00 | Global adoption across Asia/Africa; serious banking partnerships. |

| 2034 | 16.79 | 27.71 | 38.64 | Cycle peak; TVL crosses $50B; the Web3 economy becomes the "real" economy. |

| 2035 | 19.85 | 32.08 | 44.32 | Long-term moonshot (up to 1300% from today); focus on sustainable yield; bear case drops to $5–$10 if things stagnate. |

Here is how the long-term outlook for Pendle stacks up according to our AI assistant at ASCN.AI:

"Pendle is a bit of a rare breed in the crypto world, blending fresh DeFi mechanics with some actually thoughtful tokenomics. Keeping an eye on its news and price action is basically a masterclass in seeing what forces are driving the market right now."

What’s the deal with Pendle?

In the crowded DeFi space, Pendle stands out by doing something a little different: it specializes in yield tokenization. Essentially, the project lets you split an asset from its future yield, which opens up some pretty sophisticated ways to manage risk. It’s not just another "me-too" token; it actually addresses the time value of money on the blockchain.

By letting users "slice and dice" their principal and interest, the protocol introduces a level of flexibility that's usually reserved for traditional bond markets. For anyone deep in the crypto weeds, it’s a powerful tool for building capital management strategies that can actually survive a volatile market.

"The way Pendle handles yield helps investors spread their risk without having to dump their core positions." — ASCN.AI Market Expert

Market standing and cap

While it hasn't cracked the top 10 list of mega-caps just yet, Pendle is moving fast. Its market cap fluctuates with the price and circulating supply, but the momentum is clearly catching the eye of professional analysts.

Liquidity isn't much of an issue here, as it's traded heavily on major decentralized exchanges (DEXs). As more people look for advanced yield tools, Pendle’s slice of the market pie seems poised to grow.

Pendle price today

Right now, Pendle is hovering around the $0.55 mark. It’s staying relatively steady, though like everything else in crypto, it’s tethered to the broader market sentiment. Whether you're pricing it in USD or looking at Euro pairs, the activity levels suggest a solid base of interest.

The USD pairs remain the main benchmark, but the USDT and ETH pairs are where most of the action happens, giving traders plenty of room for hedging.

A look back: 2023 Price Action

| Date | Price (USD) | Change (%) |

|---|---|---|

| Jan 01, 2023 | 0.50 | - |

| Feb 01, 2023 | 0.60 | +20% |

| Mar 01, 2023 | 0.58 | -3.3% |

| Apr 01, 2023 | 0.62 | +6.9% |

| May 01, 2023 | 0.55 | -11.3% |

| Jun 01, 2023 | 0.57 | +3.6% |

| Jul 01, 2023 | 0.54 | -5.3% |

The data shows some moderate swings—nothing too crazy for a mid-cap project. It’s a typical pattern for a protocol that is steadily building its foundation rather than relying on pure hype.

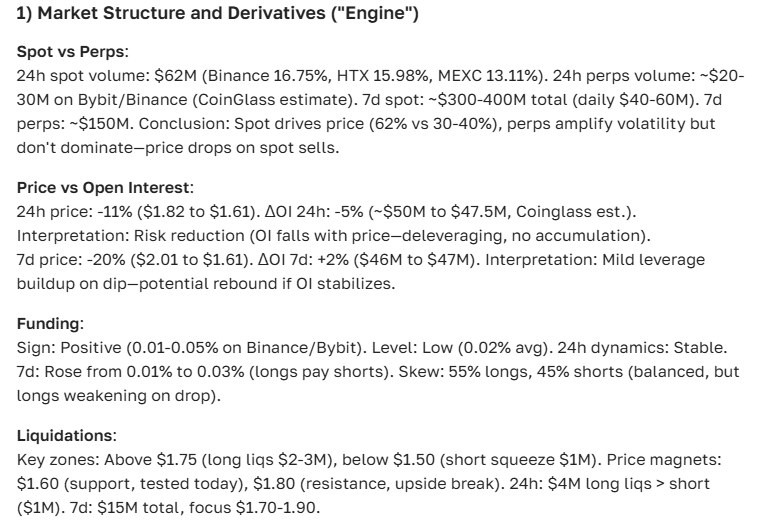

Short-term forecast: Where are we headed?

If we dive into the technicals, Pendle is currently bouncing between some very specific support and resistance levels. Indicators like the Moving Average (MA) and the Relative Strength Index (RSI) suggest we’re in a bit of a range-bound phase, but there’s a hint of upside potential.

- The MA50 is sitting just above the current price. If we can break that, we might see a decent medium-term rally.

- The 14-day RSI is down at 16.73. In plain English? It’s oversold, which usually signals a bounce is overdue.

- The EMAs tell a bit of a "bearish" story for now—with the EMA20 at $2.03 and the EMA200 way up at $3.42—but that low RSI suggests the sellers might be exhausted.

- Bollinger Bands are stretched between $1.52 and $2.66. We’re currently trading below the mid-line, but a bit of good news could easily push us toward that upper band.

So, what's the verdict? The charts suggest a modest climb in the coming days, with the potential for a more significant breakout over the next month if the fundamental backdrop stays clean.

Our guide on technical indicators breaks down exactly how to play these MA and RSI signals if you want to get deeper into the strategy.

What’s actually driving the price?

Charts only tell half the story. The real moves usually come from:

- Protocol upgrades and new technical features.

- Major partnerships within the DeFi ecosystem.

- The sheer number of people actually using the platform.

- The ever-changing regulatory landscape.

- The "Bitcoin factor"—if BTC sneezes, everyone else catches a cold.

We’ve seen that smart contract improvements and new collaborations often lead to a price pump. ASCN.AI actually tracks these on-chain moves alongside the news to give a clearer picture of what’s coming.

Check out our breakdown of how partnerships impact price for more context.

What the experts are saying

Most analysts seem cautiously optimistic. The consensus is that Pendle has plenty of room to grow because it offers a real service that people need. But let’s be real: the market is a rollercoaster. For every "moon" prediction, there’s a risk of a sharp correction.

"The roadmap is everything. If Pendle hits their milestones, the growth will follow."

The latest Pendle buzz

Over the last month, the team has been busy. They’ve rolled out new yield trading features and tightened ties with some of the biggest names in DeFi. This kind of "building in public" has kept investor confidence high.

The chatter on Telegram and various crypto forums is generally positive, which helps create a nice support level for the price.

Sentiment Check

News acts like a fuel. Positive updates usually trigger buying pressure, while any delay in the roadmap tends to lead to a quick sell-off. Right now, the sentiment is leaning toward "buy and hold."

What the community thinks

If you head over to Reddit or specialized DeFi forums, the debate around Pendle is pretty lively. People are digging into the security audits and the long-term viability of the yield-splitting model.

The general vibe

It’s mostly optimistic. Users love the innovation, but they aren't blind to the risks. Most participants are taking a rational, calculated approach rather than just "aping in."

Investment Takeaways

Pendle looks like a solid choice for someone with a medium-term horizon who isn't afraid of a little risk. It’s a great way to diversify a portfolio, especially if you’re already heavy on standard DeFi assets and want to try something more sophisticated.

Upside vs. Downside

- Growth is backed by real tech and an expanding community.

- Risks include market volatility, potential smart contract bugs, and regulatory shifts.

- Using tools like ASCN.AI can help strip away the noise and let you build a strategy based on data, not just "vibes."

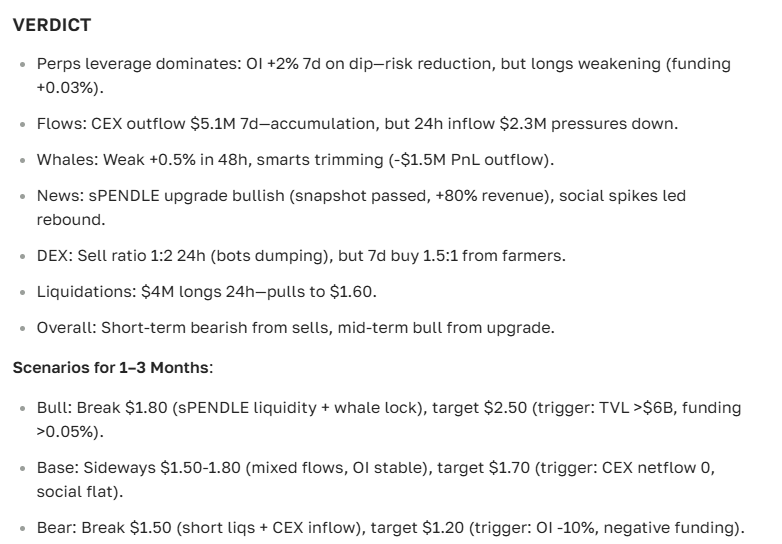

By the way, here is the final verdict from our AI assistant on this one:

Keeping it real: The risks

Don't jump in without looking at the fine print. You need to consider:

- The classic crypto volatility that can wipe out gains in hours.

- Technical risks—even the best smart contracts can have vulnerabilities.

- Liquidity issues if the market goes quiet.

- Regulators deciding they don't like how yield is being "tokenized."

Basically, don't put in more than you can afford to lose and keep your tools sharp.

FAQ: Your questions answered

What’s the price target for the next few months?

We’re likely looking at a 5–10% move in the short term. If the market stays bullish, $0.60–$0.65 is a realistic target for the month. Just watch out for a broader market pullback.

Is Pendle a good long-term hold?

Many believe it could cross the $1 mark in the next year or two, provided the team keeps delivering on their promises and the DeFi sector remains healthy.

Could Pendle ever hit $1,000?

Let's stay grounded—hitting $1,000 would require a massive, fundamental shift in the entire global economy and crypto market cap. It’s highly unlikely in any foreseeable future.

A quick case study from the ASCN.AI team

While monitoring arbitrage opportunities, our team noticed that by combining Pendle's demand data with technical indicators, we could spot an entry point that most people missed. It’s a classic example of how having the right data at the right time pays off.

Check out our Falcon Finance case study to see how we turned two AI prompts into a $1,000 win during a market dip.

Disclaimer

Look, we’re analysts, not magicians. This info is for educational purposes and isn't financial advice. Crypto is a wild ride. Always talk to a pro before putting your money on the line.