ORDI price forecast: comprehensive analysis and outlook

about cryptocurrencies.

Got a burning question about crypto? You can bounce ideas off our crypto AI assistant anytime. Start your analysis right here.

| Year | Floor Price | Average Target | Bull Case | What’s driving the price? |

|---|---|---|---|---|

| 2026 | $1.65 | $8.50 | $17.16 | Riding the post-2024 BTC halving wave and Ordinals ecosystem growth. Conservative estimates sit around $3–$5, but some analysts (like AMB Crypto) see a moonshot to $17. Watch out for ETF-driven volatility. |

| 2027 | $2.50 | $12.00 | $25.00 | Growing TVL in BRC-20 tokens and a potential BTC bull cycle. We’re looking at roughly 40% growth from 2026. The main hurdle? Looming regulations in the US and EU. |

| 2028 | $3.50 | $18.00 | $35.00 | Mass adoption of NFTs and Runes on Bitcoin. If BTC clears the $100K mark, ORDI will likely follow. Some aggressive models from CoinLore suggest even higher peaks. |

| 2029 | $5.00 | $25.00 | $50.00 | Bitcoin DeFi goes global. If Layer-2 solutions take off, a 30–40% annual climb is a very realistic baseline. |

| 2030 | $7.00 | $35.00 | $70.00 | Long-term bullishness settles in. ORDI becomes the "Bitcoin meme-asset" staple. $35 is the consensus, but $70 is on the table if BTC hits $200K. |

| 2031 | $10.00 | $45.00 | $90.00 | Market stabilization and serious institutional money flowing into Ordinals. The real test will be competition from heavyweights like ETH and SOL. |

| 2032 | $12.00 | $55.00 | $110.00 | The 2028 BTC halving momentum finally matures here, fueling a steady 20–30% annual gain. |

| 2033 | $15.00 | $70.00 | $140.00 | Full Web3 integration. If Ordinals become a global standard, triple digits aren't just a dream anymore. |

| 2034 | $20.00 | $90.00 | $180.00 | Sustained ecosystem growth. Extrapolating from current trends, we're looking at a massive scale-up towards $180. |

| 2035 | $25.00 | $110.00 | $250.00 | The wide range reflects the risk: $35 is the safety net, but the bull case sees $400+ if BTC dominates everything. Potential ROI? Anywhere from 20x to 50x. |

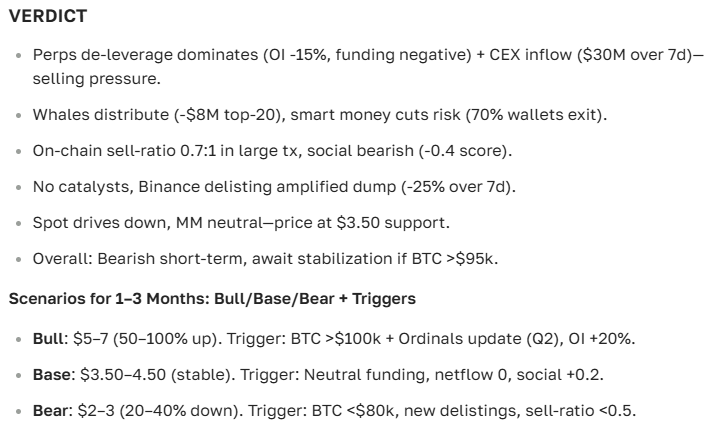

Here’s the breakdown for ORDI as calculated by the ASCN.AI assistant:

“We’ve spent the last few years dissecting market shifts and assets like ORDI. The verdict? Predicting its path isn't just about looking at a chart—it’s a mix of technical grit, sentiment, and how the 'big money' is moving.”

So, what exactly is ORDI?

ORDI essentially lives on the back of Bitcoin Ordinals technology. In plain English, it lets people write data and tokens directly onto the Bitcoin blockchain. It’s a clever workaround that allows for NFTs and digital assets using Bitcoin’s ironclad security. But here’s the catch: while it’s incredibly secure and decentralized, you’re still playing by Bitcoin’s rules, which means dealing with slower speeds and sometimes hefty transaction fees.

By putting NFTs straight onto the chain, Ordinals makes digital assets much harder to mess with.

Chainlink: Bridging blockhains and the real world, 2024

Investors jumped on ORDI pretty quickly, seeing it as a high-upside play. That hype pushed its market cap up fast. To figure out where the price is going next, you have to keep one eye on the tech and the other on the broader NFT market. When NFTs are "in," ORDI flies. When the hype dies down, it tends to get quiet.

It’s no secret that NFT sentiment drives volatility. If everyone is talking about digital art, expect wild price swings.

Binance Crypto Review, 2025

Interestingly, the NFT sector often sets the pace for coins like ORDI. It’s rarely just doing its own thing.

A quick look back

The coin hit the scene in 2023, right when the Ordinals craze started boiling over. At first, it was just a playground for digital collectors and artists. Since then, it’s been a rollercoaster of "moon" moments and sharp corrections—standard stuff for a high-volatility asset in this space.

The all-time highs

ORDI hit its peak back in November 2023, touching around $5.25. Since then, we’ve seen the usual corrections. These historical peaks are helpful because they show us the "ceiling" the market is willing to tolerate during a frenzy.

Binance Platform Review, 2025

Where do we stand right now?

Over the last two weeks, ORDI has been bouncing between $2.10 and $2.85. It’s showing some life, with trading volumes creeping up—a sign that traders are starting to pay attention again.

| Date | Price (USD) | Change (%) | Volume (USD) |

|---|---|---|---|

| July 1, 2025 | 2.10 | -1.2 | 1.2M |

| July 5, 2025 | 2.50 | +9.5 | 1.8M |

| July 10, 2025 | 2.85 | +14.0 | 2.5M |

| July 14, 2025 | 2.70 | -5.3 | 2.1M |

It looks like ORDI is trying to punch through some key resistance levels. Usually, that’s a signal that the bulls are feeling confident.

The monthly numbers

In June 2025, the average price hovered around $2.35. It wasn't exactly a breakout month, but it held steady. Looking back at 2024, the coin grew about 40%, which actually outpaced many other NFT-related tokens. This gives us a reason to be cautiously optimistic about the rest of the summer.

The lines in the sand: Support and Resistance

Right now, $2.00 and $1.70 are the safety nets. If the price drops, buyers usually step in there. On the flip side, there’s a ceiling between $2.85 and $3.00.

Best Crypto Strategies for 2025

If ORDI manages to clear $3.00 and stay there? Then we’re likely heading toward new highs.

Checking the "Vital Signs" (Technical Analysis)

To get a clear picture, we look at the usual suspects: SMA, EMA, RSI, and Bollinger Bands.

Trading Guide 2025

Simple Moving Averages (SMA)

The 50-day SMA is pointing up. As long as the price stays above this line, the trend is our friend.

Exponential Moving Averages (EMA)

The 20-day EMA is acting like a floor. Every time the price dips and touches it, buyers seem to jump back in.

Bollinger Bands

These are stretching out, which means things are getting volatile. We’re hugging the upper band, so it might be slightly "overbought" in the short term.

Relative Strength Index (RSI)

The RSI is sitting at 60. It’s strong but not "dangerously hot" yet. There’s still room for the price to climb before the market gets exhausted.

Bull/Bear Gauge

The sentiment is leaning Bullish. Most traders seem to be betting on the upside for the coming weeks.

What the candles are saying

- The Bullish Engulfing: We’ve seen this pop up on the daily charts recently—usually a good sign that the selling is over.

- The Hammer: These keep appearing near support levels, showing that the price is bouncing back quickly.

- The Evening Star: Watch out for this one; it’s a warning that a correction might be around the corner.

The Forecast: Where is ORDI heading?

For tomorrow: Expect a range between $2.75 and $2.90. It might take a breather, but the momentum is there.

For the week: We could see $3.10 if the news cycle stays quiet. No news is usually good news for a steady climb.

Mid-term (July 2025): If the NFT market catches a second wind, $3.50 is a very possible target.

End of 2025: We’re looking at $5.00 to $6.00 if the community stays active and Bitcoin stays strong.

The Long Game (2026–2041)

Looking way ahead—say, 2026 to 2031—it all comes down to how Bitcoin Ordinals evolve. If the tech scales, $10 or $15 is well within reach. By 2041? It’s hard to be precise, but if ORDI becomes a core part of the digital economy, we could be looking at $50+.

Factors to watch

Since ORDI is the "little brother" to Bitcoin’s ecosystem, they move in tandem. If BTC hits $100K, ORDI is going to get a massive boost.

Bitcoin Price Forecast 2025-2035

What moves the needle?

- Upgrades to the protocol and better infrastructure.

- Community hype and developer activity.

- New listings on major exchanges and NFT marketplaces.

- Global trends, the strength of the Dollar, and SEC/EU regulations.

By the way, keep an eye on July’s conference schedule. Major updates usually lead to price spikes.

“News moves the market. When a new product drops or a big partnership is announced, the chart usually reacts before the ink is dry.”

Is ORDI a good investment?

ORDI is exciting because it’s a pioneer. It’s the "first" for Bitcoin NFTs. But let’s be real: it’s volatile. If you can handle the swings, the potential for 100–200% gains is there, but you have to be smart about your entry points.

ORDI vs The Competition

While ORDI leads the Bitcoin pack, Ethereum-based rivals like BORING and RARE are also fighting for market share.

| Metric | ORDI | BORING | RARE |

|---|---|---|---|

| Market Cap | $150M | $90M | $75M |

| Current Price | $2.70 | $1.90 | $1.50 |

| Annual Growth | 40% | 25% | 30% |

| Blockchain | Bitcoin | Ethereum | Ethereum |

| Volatility | Medium | Medium | High |

FAQ

What will ORDI be worth in 5 years?

Most models point to the $10–$15 range, assuming the NFT market doesn't disappear.

When was the worst time to hold ORDI?

March 2024 was rough. The price tanked to $1.10 during a broader market slump. It’s a good reminder that what goes up can come down fast.

The Bottom Line

ORDI has a solid road ahead, both short and long-term. It’s a tech play on the world’s most secure blockchain. If you're looking for an alternative to digging through complex reports yourself, ASCN.AI can crunch these numbers for you in seconds. Here is the final verdict from the AI:

Disclaimer

This is for informational purposes only. Crypto is risky, and the market can be a beast. Always talk to a financial pro before putting your hard-earned money into any asset.