OKB cryptocurrency forecast for 2025-2035 — latest news and analysis

about cryptocurrencies.

For any crypto-related question, you can ping our crypto AI assistant and get a ready-made breakdown instead of digging through charts yourself. Start the analysis here.

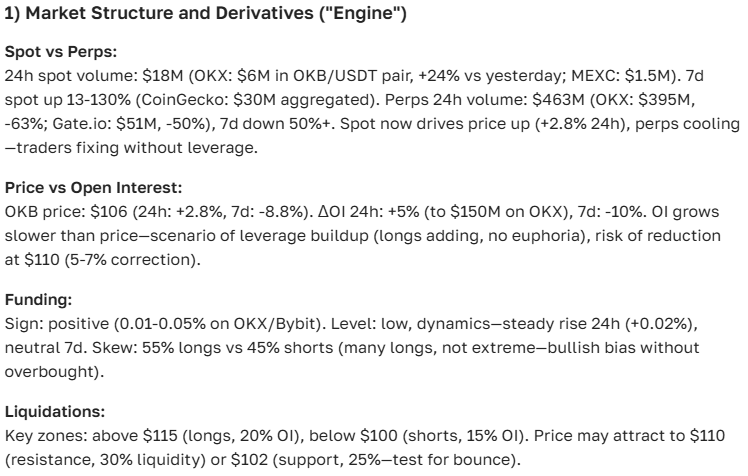

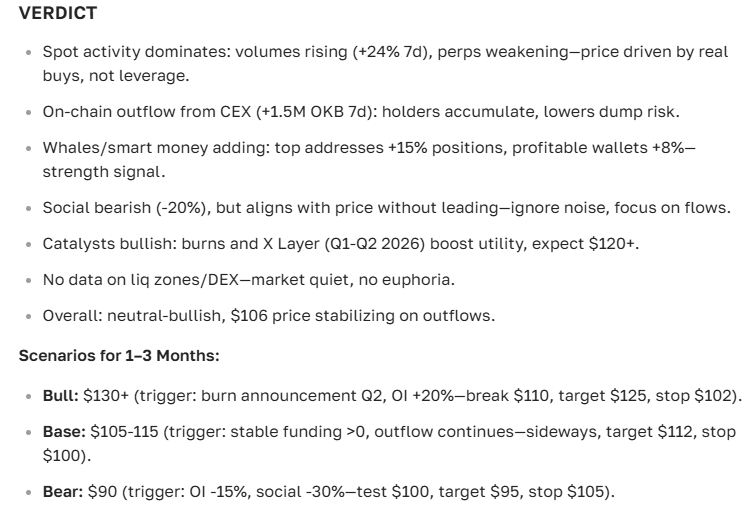

| Year | Price range (USD) | Average price (USD) | Key drivers and risks |

|---|---|---|---|

| 2026 | $50 – $150 | ~$100 | Post-2025 rally; burns up by ~20%, OKX TVL +40%. Risks: pullback after a BTC peak, SEC pressure, Binance and other CEX competition. |

| 2027 | $60 – $180 | ~$120 | OKX DeFi build-out; stronger Asian adoption, NFT activity. Risks: geopolitics (e.g., China crackdowns), exchange hacks. |

| 2028 | $70 – $200 | ~$140 | Synergy with the BTC halving cycle, broader global listings. Risks: MiCA enforcement in the EU, perceived over-centralization around OKX. |

| 2029 | $80 – $250 | ~$160 | Cycle peak; TVL above $5B, new Jumpstart campaigns. Risks: a new “crypto winter”, user outflows. |

| 2030 | $90 – $300 | ~$180 | Maturing ecosystem; AI/OKX integrations, market cap above $10B. Risks: pressure from major alts like BNB, early-stage quantum threats. |

| 2031 | $100 – $350 | ~$200 | Transition phase; fiat inflation, growth in emerging markets. Risks: global crises, liquidity shifting to DEXs. |

| 2032 | $110 – $400 | ~$220 | Next halving-driven cycle; more global standards. Risks: energy policies (even if OKB’s footprint is relatively low), OKX audit issues. |

| 2033 | $120 – $450 | ~$250 | Strong bull top; broader adoption (15%+ of the CEX market). Risks: hacks, tighter G20 regulations. |

| 2034 | $130 – $500 | ~$270 | Consolidation; OKX scaling, metaverse use cases. Risks: market saturation, overdependence on OKX. |

| 2035 | $150 – $600 | ~$300 | Further institutionalization; dominance across Asian markets. Risks: tech disruption, pressure from new centralized exchanges. |

This is the kind of long-horizon breakdown our ASCN.AI crypto assistant tends to produce when you feed it OKB fundamentals and CEX market cycles.

The OKB price outlook is one of those topics that keeps coming up among active traders and longer-term holders. Understanding where OKB might be headed helps to make more grounded buy and sell decisions, especially in a market where daily swings can be brutal.

OKB in a nutshell: what you are actually buying

Definition and purpose of OKB

OKB is the native token of the OKX ecosystem, one of the larger centralized exchanges on the market. It is used to pay trading fees, join new token launches via OKX Jumpstart, and take part in governance-style votes that shape how the platform evolves. Because it is wired into multiple OKX services and products, OKB tends to keep steady demand and a fairly resilient market cap over time.

In practice, it works like an internal “currency within a currency” for the OKX ecosystem, making it easier to reward activity, cut fees, and bootstrap new products.

Source: Аналитический обзор криптовалют на платформе Binance

How OKB evolved over time

Launched back in 2018, OKB has gone through several iterations, from basic utility token to a core element in OKX’s broader strategy. Over the years it has become the backbone for a growing list of partnerships and now sits in the top 30 coins by market capitalization on most major trackers. Each new feature on OKX tends to add another small use case, which, in turn, supports long-term demand for the token.

The market cap growth and expansion of its partner network show that OKB is positioning itself less as a standalone coin and more as a key building block in a larger exchange-centered crypto stack.

Where OKB stands on today’s market

Right now OKB effectively works as a primary incentive and settlement token for OKX users. It trades with solid liquidity and a meaningful market cap, which mainly reflects the exchange’s scale and the stickiness of its user base. By mixing some benefits typical for DeFi tokens with the infrastructure of a centralized exchange, OKB stays relevant for both active traders and more patient investors.

This combination of liquidity, brand backing and ongoing usage keeps OKB on the radar of funds and retail traders who focus on exchange tokens as a separate niche.

Source: Комплексный анализ крипторынка, 2025

Current OKB price and how it has been moving

OKB price today (in USD)

At the start of July 2025, OKB was trading around $42.80 per token. This level mirrors the current balance between spot demand, derivatives activity and the broader risk-on or risk-off attitude across the crypto space.

One-month price action: what changed

From June to early July 2025, OKB climbed from about $35 to $42.80. The move came with rising trading volumes and growth in total market capitalization, which usually signals that investors are not just speculating, but also adding exposure with a medium-term view.

OKB price forecast: near term vs the big picture

Short-term view (today and tomorrow)

In the very short run, the baseline scenario points to a moderate move in the 1–3% range. Steady volumes, a stream of positive tech updates from OKX and a reasonably constructive market mood all support the idea that the price will hover close to current levels, with a slight upward bias.

Many analysts see a 1–3% uptick over the next day or two as realistic, assuming no sudden shock on the wider market.

Medium-term outlook (one month)

For July 2025, the working range for OKB sits roughly between $43 and $48, with occasional spikes toward $50 during stronger risk-on phases. The main drivers here are higher user activity on OKX, fresh product launches and news flow that keeps demand from cooling off. Still, corrections are very much on the table if the broader crypto market wobbles or macro sentiment turns.

If OKX continues to bring in new users and ship features, pushing toward the $50 area during the month does not look far-fetched.

Longer view (one year)

Rolling forward into the yearly horizon, the rough projections look like this for 2025, 2026, 2027 and beyond:

- 2025: price could reach the $55–$60 band on the back of ecosystem growth and stronger demand.

- 2026: a move into the $65–$75 range would be tied to deeper DeFi integration and higher trading volumes.

- 2027 and later: pushes above $80 become more likely if OKX broadens its reach, rolls out new products and keeps strengthening the overall ecosystem.

Under a constructive market scenario, it would not be surprising to see OKB trading above $75 by 2027, mainly thanks to its expanding DeFi role and the cumulative impact of ecosystem growth.

Extended OKB forecast through 2036

When you stretch the horizon all the way to 2036, the models start to project much more aggressive paths. Some long-term scenarios put OKB in the low hundreds of dollars already by the late 2020s, and in the 2033–2036 window individual forecasts even show potential spikes above $1,000. These numbers are essentially extrapolations of today’s adoption curves, growth of the broader crypto market and OKX becoming more intertwined with global finance.

| Year | Min. price ($) | Average price ($) | Max. price ($) |

|---|---|---|---|

| 2028 | 71.22 | 122.83 | 174.44 |

| 2029 | 156.45 | 335.55 | 514.65 |

| 2030 | 133.05 | 258.87 | 384.70 |

| 2033 | 558.00 | 1 146.59 | 1 735.19 |

| 2036 | 877.96 | 1 663.87 | 2 449.79 |

On paper, the curve looks impressive, but when you go that far out the error margin becomes huge, so any such forecast should be treated more as a scenario map than a ready-made plan for allocating capital.

What actually moves OKB: main drivers

Internal triggers: tech, listings, headlines

The market tends to react quickly to new OKX features, fresh integrations with promising chains and infrastructure upgrades that improve speed, security or UX. Each positive update nudges confidence a bit higher, pulls in more activity and often supports OKB’s price, at least in the short term.

As a rule of thumb, meaningful tech upgrades and strong partnerships make the token more appealing, while stalled development or lack of news usually does the opposite.

Source: Экосистема Aptos: как партнерства влияют на цену, 2024

External forces: crypto cycles and macro backdrop

OKB doesn’t trade in a vacuum, so broad crypto cycles, macro trends and politics all feed into its chart. When Bitcoin and Ethereum grind higher, most altcoins, including OKB, usually catch a tailwind; when BTC dumps, OKB rarely escapes the drawdown. On the flip side, regulatory noise, monetary policy shifts or geopolitical tensions can quickly inject extra volatility and uncertainty.

In practice, BTC and ETH remain the main barometers for overall sentiment, and OKB’s moves often echo their direction, just with its own exchange-token twist.

Source: Анализ позитивных и негативных факторов по BTC, 2024

Fresh news around OKB: what people are watching

Recent headlines to keep in mind

July 2025 brought a batch of updates: OKX rolled out a new NFT platform, stepped up DeFi integrations and pushed a security upgrade across its systems. All of this supports demand for OKB, since more use cases and better perceived safety usually pull in extra users and trading activity.

Themes that dominated the last month

- Launch of an NFT marketplace on OKX.

- Announcements of strategic partnerships with other crypto projects.

- Reports pointing to steady growth in the OKX user base.

- Analyst pieces on how macro headlines spill over into crypto pricing.

What the community is saying

On forums and in social feeds, OKB is regularly discussed in the context of its upside versus risk profile and how it stacks up against other exchange tokens. A lot of users highlight its relative stability and the pace of OKX’s tech rollouts as the main reasons they keep it in their portfolios.

What analysts and traders are arguing about

Quotes and expert takes

“OKB still has substantial upside as long as OKX keeps scaling and users stay loyal. In a reasonably calm market the token has a fair shot at breaking above $50 by the end of 2025.”

“Aggressive deployment in NFT and DeFi keeps adding utility, which in turn makes OKB more interesting for both active traders and longer-term investors.”

Should you buy OKB now? A look at the risk–reward

How attractive OKB looks as an investment

So far OKB has shown a fairly steady trend, supported by the growing toolkit and network effects of the OKX platform. New products and technical upgrades tend to bring in fresh capital, and if that continues, a medium-term gain in the ballpark of 10–25% does not look unrealistic under normal market conditions.

Practical pointers for investors

- Consider OKB as part of a diversified crypto basket, not as a single bet.

- Track OKX-related updates, listings and ecosystem news on a regular basis.

- Account for volatility and macro risk when sizing positions and setting timeframes.

- Avoid excessive leverage, so that inevitable drawdowns do not wipe out the position.

Upside potential vs key risks

The upside scenario is driven by product innovation, growth in the active user base and a friendly market environment for altcoins in general. The risk side includes sharp price swings, sudden regulatory moves and global economic stress, all of which can hit liquidity and sentiment faster than most people expect.

Regulation and market-wide volatility remain the two main wildcards that can quickly change the picture for OKB, both for better and for worse.

Source: Всё об арбитраже криптовалют: Как заработать на разнице в ценах, 2024

“From a long-term angle, OKB still looks interesting as long as OKX keeps delivering and the broader ecosystem stays healthy. The platform effect is what underpins its investment case.”

FAQ: common questions about OKB

What could OKB trade at next week and next month?

In the near term, models point to a small pullback first, followed by a move toward the $43–$45 zone. Through July, a push into the $48–$50 range looks achievable if there are no major negative surprises on the macro or crypto side.

How high could OKB go in 2025?

If current trends hold and OKX executes on its roadmap, many scenarios place OKB somewhere around $55–$60 by the end of 2025, especially in a supportive market cycle.

What could completely change these forecasts?

Game-changers include heavy-handed regulation, violent swings in the overall crypto market, serious technical issues on key infrastructure, or broader economic shocks that force investors to de-risk across the board.

Extra data and materials

Key OKB technical indicators at a glance

| Indicator | Value (July 2025) | Comment |

|---|---|---|

| RSI (14 days) | 58 | Moderate upward momentum, no clear overbought signal yet |

| MACD | Positive | Suggests potential continuation of the current uptrend |

| Trading volume | $350M | Healthy liquidity for both spot and derivatives markets |

| Market cap | $3.2B | Comfortable position within the top-30 crypto assets |

How similar tokens are priced and projected

| Cryptocurrency | Current price | 2025 forecast | Relevance for OKB |

|---|---|---|---|

| Binance Coin | $350 | $400 | Direct competitor among exchange tokens |

| FTX Token | $19 | $24 | Illustrates how exchange tokens can share similar narrative arcs |

| KuCoin Token | $12 | $15 | Shows a parallel exchange-driven development path |

Wrapping it up without overpromising

What the current OKB outlook boils down to

Right now OKB benefits from expanding utility and consistent backing from the OKX ecosystem, which together support a constructive price trend. For investors, it looks like a reasonably promising token, as long as its growth story is weighed against the usual crypto risks rather than ignored.

What to watch going forward

Going ahead, the key variables will be how quickly OKX evolves, whether users stick around, and what kind of market environment crypto has to operate in. Keeping an eye on both internal metrics and external shocks will help adjust expectations in time instead of reacting after the move has already happened.

“Having a deep Web3 data stack and hands-on experience with exchange tokens makes it easier to build price models and scenario trees for assets like OKB. Tools such as ASCN.AI can crunch those inputs for you and turn them into practical signals instead of just raw numbers.”

And this is exactly the sort of verdict on OKB you can pull from our ASCN.AI crypto assistant if you do not feel like parsing dozens of reports and charts by hand.

Disclaimer

All of the above is general market commentary, not personalized financial advice. Crypto assets are high-risk instruments, and before making any investment decision you should talk to a qualified financial professional and assess your own risk tolerance.