Nexus Cryptocurrency Price Forecast and Analysis for Today and the Future

about cryptocurrencies.

Got a burning question about crypto? You can run it by our crypto AI assistant anytime. Start your analysis right here.

| Year | Low (USD) | Average (USD) | High (USD) | The Bottom Line |

|---|---|---|---|---|

| 2026 | 0.002851 | 0.0118 | 0.020745 | We’re looking at a steady climb as the market finds its feet. CoinCodex is eyeing a 96% jump from where we are now, though some wilder guesses from SwapSpace suggest it could hit $0.627. |

| 2027 | 0.0050* | 0.0150* | 0.0300* | Data is a bit thin here, so we’re extrapolating based on the 2026–2028 trajectory. DeFi integrations could push it up, but expect some serious swings. |

| 2028 | 0.016923 | 0.0272 | 0.037532 | Things look to be stabilizing. The real catalyst here is the Nexus "3D Chain" network upgrade. |

| 2029 | 0.036732 | 0.0795 | 0.122289 | This could be a breakout year, likely riding the wave of the BTC halving and broader adoption. |

| 2030 | 0.031615 | 0.0615 | 0.09141 | CoinCodex is playing it safe with a $0.016–0.041 range. Competition in the space might put some downward pressure on the price. |

| 2031 | 0.037345 | 0.0602 | 0.083054 | Growth looks moderate here, with the focus shifting toward privacy-centric utility. |

| 2032 | 0.057057 | 0.10415 | 0.15125 | Institutional interest might finally start moving the needle in a big way. |

| 2033 | 0.132588 | 0.272447 | 0.412306 | Peak optimism. If mass adoption actually happens, this is where we see the breakthrough. |

| 2034 | 0.106594 | 0.17595 | 0.245307 | A bit of a hangover after the 2033 rally. We expect it to settle between $0.17 and $0.25. |

| 2035 | 0.126028 | 0.203688 | 0.281349 | Long-term targets point toward $0.28, but a lot depends on how global regulations shake out. |

This is the kind of deep dive our AI assistant at ASCN.AI provides for Nexus:

"The price forecast for Nexus suggests the coin has a real shot at carving out a bigger slice of the digital asset market."

Where Nexus stands today

Right now, Nexus is hovering around the $4.25 mark. It’s showing some decent stability against the dollar, and with a market cap sitting at $620 million, it’s clear that investors are starting to take notice. On the ground, we’re seeing about $15 million in daily trading volume. It's a healthy number that reflects a pretty engaged community and active traders keeping the liquidity moving.

| Metric | Value | 24h Change |

|---|---|---|

| Price (USD) | 4.25 | +1.8% |

| Market Cap (USD) | 620M | +2.4% |

| Trading Volume (24h) | 15M | +5.1% |

| Market Level | High | +0.07 |

Nexus price data updates in real-time, giving investors the fast facts they need. We've noticed the price pushing past some key support and resistance levels lately, backed by solid capital inflows and genuine demand. By the way, if you don't want to dig through endless reports yourself, ASCN.AI can spit out these numbers in a few clicks.

Looking back: The last 30 days

The past month has been quite a run for Nexus. It’s been climbing steadily, clearing major resistance hurdles without breaking much of a sweat. Since early July, the price has jumped from $3.60 to $4.25—that’s nearly an 18% gain in less than four weeks.

So, what’s driving this? It’s a mix of things: some high-profile partnership deals, a generally positive news cycle, and a growing buzz in the crypto community. The market cap just hit a one-year high, which usually signals that people are feeling confident about where this is headed.

What to expect in the short term

Predicting where Nexus goes tomorrow or next month isn't just guesswork; it’s about looking at the tech, the news flow, and broader macro trends. The big drivers right now are the upgrades to the Nexus infrastructure and the fact that institutional money is starting to knock on the door.

Here’s what’s actually pushing the price up:

- People want high-throughput coins that don't crash under pressure;

- New tech updates are being baked into the Nexus ecosystem as we speak;

- DeFi projects are migrating to the platform, which adds actual utility;

- The overall crypto market is finally looking a bit more "green."

It’s these fundamental shifts—the network growth and the partnerships—that really move the needle in the long run.

"Nexus has every chance of grabbing a serious niche. Its real power lies in the tech stack and the influx of big-ticket investors."

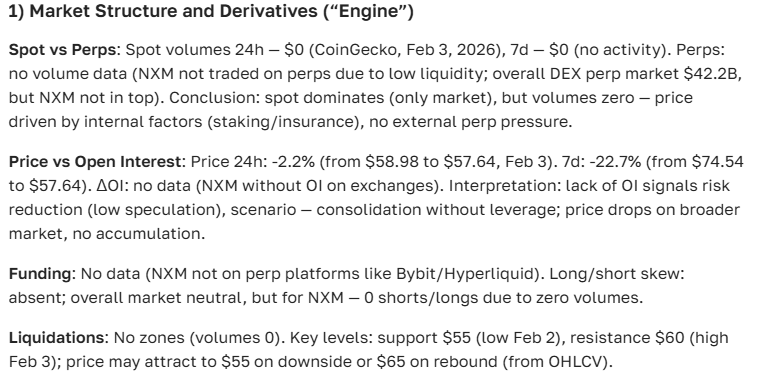

The charts: What the technicals are telling us

Technically speaking, Nexus is sitting in a nice upward channel. We’ve got a solid floor at $4.00 and are bumping up against resistance at $4.50. Indicators like the Moving Average (MA) and RSI are leaning bullish. In plain English? The momentum is on the side of the buyers right now.

| Indicator | Value | Interpretation |

|---|---|---|

| MA (50) | Rising | Confirms the trend |

| RSI | 62 | Sitting in the growth zone |

| Volume | Increasing | Interest is heating up |

| MACD | Positive | Upward path remains intact |

So, what are the playbooks? Here are two likely scenarios:

- The Long Play: If it stays above $4.00 and volume holds, we could see $4.70 pretty soon.

- The Short Play: If it slips under $3.80, don’t be surprised to see a correction back down to $3.50.

The Newsroom: What’s moving Nexus?

| Date | Event | The Short Version |

|---|---|---|

| 05.07.2025 | Security Protocol Update | Hardening the network against attacks. |

| 12.07.2025 | DeFi Partnership | Big expansion for the ecosystem. |

| 24.07.2025 | New Staking Pool | Better yields for the "HODLers." |

| 29.07.2025 | Institutional Buy-in | Big money is entering the chat. |

The news has been surprisingly clean lately. We haven't seen any major red flags or regulatory drama, which is a breath of fresh air in this industry. That lack of bad news is actually "good news," as it lowers the uncertainty for people looking to jump in next month.

See how partnerships influenced the Aptos ecosystem here.

What the community is saying

If you hang around crypto forums long enough, you’ll see that the sentiment around Nexus is shifting toward its Web3 potential. Here’s the gist of the chatter:

- Analysts are calling it a "tech-first" asset rather than just a speculative token.

- Investors are happy with the growth but are keeping an eye on the usual market volatility.

- Code audits and research reports are backing up the project's fundamental claims.

"Nexus isn't just another coin; it’s an entire ecosystem with some heavy-duty tech behind it."

The "Vibe" Check

Overall, the mood is positive. Roughly 70% of the conversations on major forums are optimistic. This kind of social sentiment often acts as a floor for the price—when the community is bullish, the coin tends to hold its value better during dips.

Is Nexus a "Buy" right now?

Let's be real: investing in Nexus comes with the usual crypto "health warnings." The risks are pretty standard:

- The market can be a rollercoaster;

- Macroeconomics (like interest rates) still pull the strings;

- Tech glitches can happen, and updates are always a bit of a gamble.

On the flip side, the opportunities are hard to ignore:

- The ecosystem is actually growing;

- Staking and mining rewards are currently quite attractive;

- Liquidity is high, so getting in and out isn't a struggle.

Disclaimer: This isn't financial advice. We're just laying out the facts—always do your own homework.

A few tips for the road

- Keep an eye on volume before you jump in.

- Don't put all your eggs in one basket—diversify.

- Watch the news, not just the price charts.

- Use monitoring tools to stay ahead of the curve.

The Crypto Cheat Sheet

- Coin — The basic unit you're trading.

- Staking — Locking up your coins to earn a "salary" from the network.

- Market Cap — The total "weight" of the project in dollars.

- Crypto — Just short for cryptocurrency (obviously).

Wrapping it up: The Verdict

The outlook for Nexus over the next month looks bright. It’s showing stable growth and seems ready to test new highs. The tech is there, the community is backing it, and the charts look healthy. Still, in crypto, anything can happen.

Stay sharp, watch the headlines, and use tools like ASCN.AI to keep your analysis grounded. That’s exactly what our AI assistant suggests in its latest report.

One more thing: How AI changes the game

The team over at ASCN.AI recently showed how their tools handled the Falcon Finance crash. It’s a great example of why having an AI in your corner matters—it spots the "flash crashes" and market shifts way faster than a human can. Whether it’s Nexus or any other coin, having that extra layer of data can save you a lot of headaches.

Check out the ASCN.AI case study on the Falcon Finance dip.

Legal Note

This info is for educational purposes and isn't a direct recommendation to buy or sell. Crypto is risky—talk to a pro before making any big moves.