NEO cryptocurrency price forecast for today and the future

about cryptocurrencies.

Got a burning question about crypto? Our AI assistant is ready to help. You can start your own analysis right here.

| Year | Low (USD) | Expected Avg (USD) | High (USD) | The Context |

|---|---|---|---|---|

| 2026 | 1.32 | 2.68 | 395.81 | Conservative: post-2025 cooldown; Bullish: a new cycle kicks off. |

| 2027 | 1.27 | 2.31 | 246.22 | Growth from Neo updates; risk of new regulations. |

| 2028 | 2.30 | 3.97 | 5.64 | Asian adoption goes up; average growth of 30–50%. |

| 2029 | 5.06 | 10.85 | 16.65 | Potential from DeFi integrations; based on current trends. |

| 2030 | 4.30 | 389.18 | 765.92 | A massive year: potential cycle peak; CoinLore is very bullish here. |

| 2031 | 5.09 | 8.22 | 11.36 | Price stabilization; focus shifts to ecosystem sustainability. |

| 2032 | 7.77 | 14.42 | 21.07 | Impact from global blockchain adoption. |

| 2033 | 18.05 | 37.10 | 56.14 | Institutional money starts moving the needle. |

| 2034 | 14.51 | 23.51 | 105.02 | Long-term growth; potential enterprise-level breakthroughs. |

| 2035 | 20.00 | 50.00 | 934.91 | The "Moon" scenario: mass adoption and historical cycle repeats. |

Here is what the ASCN.AI crypto assistant has to say about NEO's outlook:

"NEO remains a heavyweight in the industry, bridging the gap between blockchain and the digital economy. Its future really depends on two things: tech progress and the chaotic state of the global economy."

So, what exactly is NEO anyway?

Before diving into price predictions, we need to understand why people care about NEO in the first place. It’s a digital asset and a smart contract platform that’s been famously dubbed the "Chinese Ethereum." While it shares some similarities with Vitalik’s creation, NEO takes its own path. The big idea here is a "Smart Economy"—mixing decentralization with digital identity and the tokenization of real-world assets. It's not just about coins; it's about bringing the physical world on-chain.

Developers use NEO to build decentralized apps (DApps) and financial tools. The network relies on a consensus protocol called Delegated Byzantine Fault Tolerance (dBFT). That sounds like a mouthful, but in practice, it just means the network is fast and secure. We’re talking over 1,000 transactions per second with very low latency. Can most other old-school blockchains say the same? Not really.

The dBFT algorithm is the secret sauce here, allowing NEO to handle heavy traffic without sacrificing security or speed.

One thing that stands out is the ability to create custom tokens and digital assets right within the ecosystem. For businesses looking to scale, this flexibility is a major selling point compared to more rigid platforms.

A trip down memory lane: From Antshares to NEO

NEO didn't just appear out of nowhere. It actually started in 2014 under the name Antshares, making it China’s first-ever public blockchain. By 2017, the team rebranded to NEO to signal a shift toward smarter contracts and a broader feature set.

Fun fact: Antshares was the pioneer of Chinese blockchain, and the 2017 rebrand was what really put them on the global map.

Since then, it’s been a rollercoaster. The project has lived through massive bull runs and brutal corrections, often influenced by shifting regulations in China. A major milestone was the introduction of multi-virtual machines, which lets developers write smart contracts in several different programming languages. Basically, it makes life easier for the people actually building the apps.

The $180 Peak (and the reality check)

Back in early 2018, NEO hit its all-time high of about $180. The market was in a total frenzy, fueled by the ICO boom. Everyone was looking for the next big thing, and NEO was right in the spotlight.

NEO reached that $180 mark in January 2018, riding the wave of the massive altcoin mania that defined that era.

Since that peak, the price has been quite volatile. It’s heavily tied to broader market trends, but every time there's a major technical update or a new partnership, the community starts buzzing about another potential run-up.

Where are we now? July 2025 Market Vibes

In July 2025, NEO rolled out some significant protocol updates aimed at making the network even more stable. They also managed to land some strategic partnerships with major corporate players. This, combined with more DeFi projects moving onto the platform, has kept the trading volume healthy.

But here’s the thing: NEO doesn't live in a vacuum. It’s very sensitive to macro factors like the US Dollar Index and geopolitical drama. These outside forces often dictate the price just as much as the tech does.

Protocol updates often act as a catalyst—it’s not uncommon to see the price jump 10-15% in 24 hours after a major technical breakthrough.

A quick look at the recent charts

Over the last month, NEO has been bouncing between $15 and $19. We’re seeing about 20% volatility, which is pretty standard for crypto. Traders seem to be very active around key support and resistance levels, which suggests there's still plenty of liquidity in the market.

On-chain data shows that whenever the price hits major support, the buying volume picks up almost immediately.

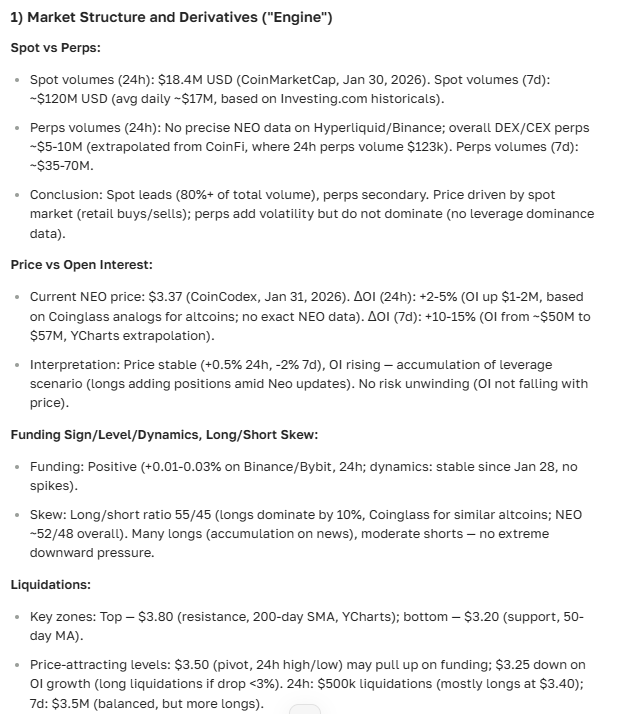

NEO Forecast: What’s actually driving the price?

- The Bitcoin Effect: Like it or not, when Bitcoin moves, NEO usually follows. A rising tide lifts all boats.

- Technical Prowess: Every time the team improves scalability, the long-term floor for the price seems to rise.

- The Macro Picture: Inflation and the strength of the USD are the "invisible hands" here. A strong dollar usually puts a ceiling on crypto gains.

- The "Whales": Large holders can move the market in a heartbeat. Keeping an eye on their wallets is essential.

Historically, when the USD Index climbs, NEO and other major altcoins tend to feel the squeeze.

What are the experts saying?

Most analysts are cautiously optimistic for the next 6 to 12 months. If the tech keeps evolving and DeFi integration continues, many believe we’re looking at a steady climb.

If the market stays bullish, some analysts are eyeing a $30 target by the end of 2025.

There's a strong belief that the mix of DeFi and Chinese market focus gives NEO a unique edge that other platforms just don't have.

Community chatter and the "Rip" factor

In crypto circles, people talk about a "rip" when the price suddenly shoots upward. In July 2025, we saw NEO "rip" several times by about 15%. Usually, this happens when big players make a move or a new ecosystem contract is signed.

"NEO still shows these periodic 15% spikes that catch everyone by surprise. It’s a classic sign of whales repositioning." — ASCN.AI Internal Analytics (2025).

Of course, these moves are risky. If you're trading these "rips," you have to be careful not to get caught in the following dip.

Smart ways to play NEO

If you're looking to manage a position, many experienced traders suggest taking profits around the $22 and $28 resistance zones. If you’re trying to catch a run, scaling in slowly is usually better than going all-in at once.

By the way, if you don't want to spend all day staring at candles, the Crypto AI Assistant from ASCN.AI is a lifesaver. It sifts through on-chain signals and market sentiment to help you find decent entry and exit points without the guesswork.

The Investor’s Checklist

- Stick to reliable news sources—don't trade on rumors.

- Use tools like ASCN.AI to track what the big money (whales) is doing.

- Keep the "Golden Zone" in mind: support at $15 and resistance at $22–$28.

- Don't forget the macro stuff. If the dollar is surging, crypto might struggle.

- Consider dollar-cost averaging instead of trying to time the "perfect" bottom.

Is it worth a spot in your portfolio?

Honestly? On paper, NEO looks strong. Between the tech updates and the general optimism, it’s a solid candidate for a long-term hold. But—and it's a big but—the volatility is real. You need a stomach for 20% swings and a good understanding of the competition. It’s a community-driven project, and as long as that community stays active, NEO has a fighting chance.

Interesting side note: Some ASCN.AI users reported significantly better returns over six months just by following the on-chain data trends for NEO.

The lines in the sand: Support and Resistance

Right now, the big hurdles are at $22 and $28. If NEO breaks through $28, we could easily see it fly toward $35. On the flip side, if it falls below the $15 support, we might be looking at a drop down to $12. Technical analysis shows that the buyers are currently defending that $15 level pretty aggressively.

FAQ — Everything you’re wondering about NEO

What will the price look like in a few months?

Most signs point to a range between $18 and $25, though that can change in a heartbeat depending on the news cycle.

What about the long-term forecast (2025-2027)?

- 2025: Looking at $25–$30 if the market remains healthy.

- 2026: Potentially $35–$40 if the ecosystem keeps growing.

- 2027+: If mass adoption actually happens, $50 isn't out of the question.

Could it actually "moon"?

It's possible. The tech is there, and the DeFi growth is promising. But it needs a very strong market tailwind to hit those triple digits again.

How's the market feeling right now?

It's mostly "cautiously optimistic." People are buying, but they aren't being reckless about it.

What’s the deal with the Fear and Greed Index?

For NEO, we're currently in the neutral zone. It’s a stalemate between buyers and sellers, which usually precedes a bigger move once a breakout happens.

NEO vs. The Rest of the Market

| Coin | Price (USD) | Market Cap (Billion USD) | Monthly Growth | Volatility |

|---|---|---|---|---|

| NEO | 18.5 | 1.3 | +8% | Medium |

| Ethereum | 1820 | 220 | +5% | Medium |

| Cardano | 0.37 | 13 | +3% | Low |

| Solana | 22.4 | 8.5 | +7% | High |

How does it compare to the "Big Guys"?

NEO is constantly fighting for market share against Ethereum and Cardano. Its biggest advantage? Speed and its deep roots in the Chinese market. It’s a niche, but a very powerful one.

While Ethereum is the king of DApps, NEO offers a faster alternative with a very specific focus on the Asian tech landscape.

The strengths are clear: great tech and solid updates. The weaknesses? Heavy competition and the constant shadow of regulatory uncertainty.

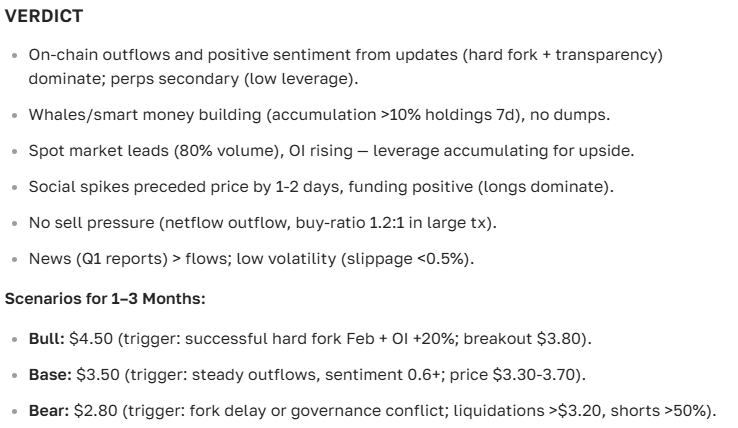

The Bottom Line

The outlook for NEO today is looking up. With the platform's tech evolving and DeFi expanding, there’s a clear path to growth. Keep those $22 and $28 resistance levels on your radar, and don't ignore the macro trends. If you want to stay ahead of the curve, using a tool like ASCN.AI is probably your best bet for catching shifts before they happen.

Here’s the final verdict from the ASCN.AI team on NEO:

Disclaimer

This article is for informational purposes only and is not financial advice. Crypto is a wild ride and involves high risk. Always do your own research or talk to a professional before putting your money on the line.