NEAR Protocol cryptocurrency price forecast for today and the future

about cryptocurrencies.

Got a question about crypto? Fire it off to our crypto AI assistant. Dive into the analysis right now.

| Year | Price Range (USD) | Avg Price (USD) | Key Drivers & Risks |

|---|---|---|---|

| 2026 | $5 – $25 | ~$15 | Post-2025 rally; Nightshade v2, DeFi TVL up 50%. Risks: BTC peak pullback, SEC regs, Sui competition. |

| 2027 | $7 – $30 | ~$18 | Sharding expansion; AI-dApps, NFT adoption. Risks: geopolitics, network outages (like 2022). |

| 2028 | $10 – $40 | ~$25 | BTC halving synergy; BOS ecosystem, global partnerships. Risks: EU MiCA, validator centralization. |

| 2029 | $12 – $50 | ~$30 | Cycle peak; TVL >$5B, NEAR AI integrations. Risks: "crypto winter," L1 fragmentation. |

| 2030 | $15 – $60 | ~$35 | Ecosystem maturity; Web3/AI dominance, cap >$10B. Risks: altcoins (Aptos), quantum threats. |

| 2031 | $18 – $70 | ~$40 | Transition phase; fiat inflation, emerging markets. Risks: global crises, migration to faster L1s. |

| 2032 | $20 – $80 | ~$45 | New halving cycle; global standards, PoS upgrades. Risks: energy concerns (low though), network audits. |

| 2033 | $25 – $90 | ~$50 | Bull peak; mass adoption (30%+ AI-dApps on NEAR). Risks: ecosystem hacks, G20 regs. |

| 2034 | $30 – $100 | ~$55 | Consolidation; scalability >100k TPS, metaverses. Risks: market saturation, dev interest fade. |

| 2035 | $35 – $120 | ~$60 | Institutionalization; AI/Web3 dominance. Risks: tech shifts, new protocol competition. |

Our crypto AI assistant at ASCN.AI crunched this NEAR Protocol forecast for you.

"Forecasting NEAR's price today and long-term means digging into market vibes, tech upgrades, and fresh news. ASCN.AI pulls Web3 data together to give you the straightest, most up-to-date take on its ups and downs." — ASCN.AI

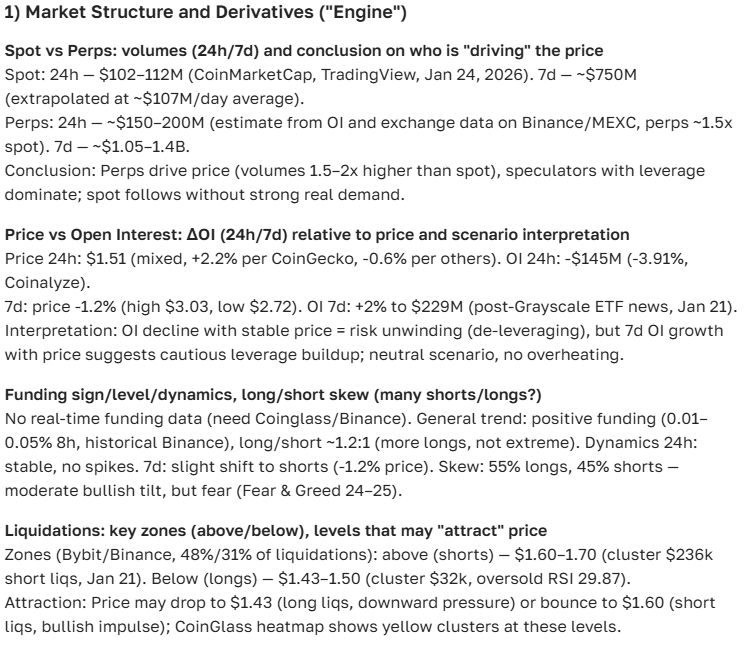

NEAR's Current Price and Market Snapshot

NEAR Protocol's price is bouncing around mildly right now, mirroring the broader crypto mood. Its volatility lines up with other big coins—nothing shocking for a project this size. Prices get shaped by all sorts of stuff, from on-chain stats to the latest headlines.

Over the past month, it's hovered between $1.00 and $1.40. ASCN.AI's breakdown shows this matches typical crypto swings, with market cap climbing steadily—sign of a solid project drawing more eyes from investors.

Developer buzz, economic news, and the big financial picture drive NEAR's price. Keeping tabs on the news blog helps you stay ahead of shifts and react fast.

"NEAR's volatility tracks other crypto assets, with steady cap growth." — ASCN.AI, Full Crypto Market Breakdown, 2025.

Recent News Shaking Up the Price

Lately, big protocol upgrades, fresh dApps launching, and new partnerships with heavy hitters have been pushing NEAR's price. These tech leaps and alliances keep things growing steady.

Geopolitics and regs throw curveballs too, messing with liquidity and sentiment. Good news and deals usually lift prices; uncertainty sparks quick dips. But here's the thing—ASCN.AI's take is blending on-chain metrics with news sentiment nails predictions and spots trends early.

Last Month's Price Swings

The past 30 days brought some real ups and downs for NEAR—hype around releases mixed with market-wide wobbles. Daily range sits at $1.44–$1.49; weekly's $1.40–$1.60.

With cap growing 3–5% monthly, it stands out among Layer-1s. Traders and investors can't look away.

NEAR's Road Ahead and Growth Outlook

What Experts Are Saying

Outlets like CoinGecko highlight NEAR's strong tech foundation and mid-term upside. Next six months? It could smash resistance and hold higher ground, if markets play nice.

Real talk: $2–$3 in 6–12 months feels doable under good conditions.

"NEAR's growth ties to dev activity and cutting-edge features making the ecosystem magnetic."

Tech upgrades, scalable fixes, smarter contracts, and DeFi boom all fuel token demand. New ties with top blockchain players build trust, liquidity, and hype. Global econ and regs play in too—gotta watch 'em close. ASCN.AI backs this with on-chain plus news data for sharper calls.

What's Driving Growth (and Price)

- Tech base upgrades and protocol tweaks.

- Scalability plus DeFi/NFT integrations.

- Market trends and investor mood.

- News buzz, analysis, public chatter.

- Community energy and key partnerships.

Long-Term View: 2026–2040

| Month/Year | Expected Price (USD) | Change (%) |

|---|---|---|

| Jan 2026 | 1.28 | -11.56 |

| Apr 2026 | 2.39 | +64.95 |

| Aug 2026 | 3.62 | +150.15 |

| Dec 2026 | 3.48 | +140.89 |

This forecast pulls from tech indicators like MAs, RSI, MACD, Ichimoku—weekly charts.

In a mild scenario, NEAR hits $4–$5 in 1–2 years on tech strength and ecosystem growth. But crypto's wild—corrections happen.

What’s Next for NEAR's Price Tomorrow and Soon

Short-Term Calls and Tips

Expect modest upside over weeks, with quick pullbacks. Key levels for traders:

- Support: ~1.10 USD

- Resistance: ~1.55 USD

Mix news, social vibes, and tech signals for smart moves. Trading support/resistance picks best entries/exits, cuts risk.

"Trading NEAR with tech indicators and ASCN.AI data boosts returns, dials down emotions." — ASCN.AI Analytics, 2025.

Investor and Trader Intel

Buy/Sell Tips for NEAR

Buy on dips to support levels—lowers risk, sets up gains. Sell at profit targets or reversal signs.

Hold mid-term, track news and charts. In one ASCN.AI case during Falcon Finance's drop, mixing on-chain and sentiment data juiced NEAR trades.

More on the ASCN.AI Falcon Finance case

Forum and Social Buzz

NEAR's short-term swings often stem from Reddit, Telegram, Twitter chatter. Hot discussions spark pumps; bad vibes dumps.

Community drives those quick moves.

"Crypto community talks routinely spike NEAR's price." — ASCN.AI, Crypto Sentiment Analysis, 2025.

FAQ: NEAR Price and Forecasts

How Do News Hit NEAR's Price?

News packs a punch—partnerships, upgrades, regs swing sentiment and price fast.

Best Time to Jump In?

After a solid dip to support, backed by tech signals. Lowers risk, eyes growth.

"Prime entry: corrections to support with confirming signals." — ASCN.AI, Crypto Trading Guide, 2025.

What’s "Rip" Mean for NEAR?

"Rip" is that explosive price surge to new highs—draws traders like moths to flame.

Extra Resources and Tools

NEAR Prices: Now and History

| Date | NEAR Price (USD) | Volume (M USD) | Market Cap (B USD) |

|---|---|---|---|

| 2025-06-01 | 1.25 | 150 | 2.5 |

| 2025-05-25 | 1.20 | 140 | 2.4 |

| 2025-05-15 | 1.10 | 160 | 2.2 |

| 2025-05-01 | 1.00 | 170 | 2.0 |

Wrapping Up

NEAR's price forecast draws from tech updates, partnerships, trends, and news flow. It holds growth potential today, backed by fundamentals and charts. Tools like ASCN.AI help traders make sharper calls.

"On-chain data plus news sentiment sharpens NEAR forecasts big time."

Here's ASCN.AI's crypto AI assistant verdict:

Case Study Links:

Disclaimer

This article's info is general — not investment advice. Crypto trading risks total capital loss. Consult pros and dig deep before deciding.