Monero (XMR) price forecast for 2025-2035 — analytics and news

about cryptocurrencies.

Got a crypto question? Hit up our AI assistant anytime. Jump in and start analyzing now.

| Year | Price Range (USD) | Avg Price (USD) | Key Drivers & Risks |

|---|---|---|---|

| 2026 | $500 – $700 | ~$550 | Post-rally momentum from 2025; privacy upgrades, PoW mining jumps +30%. But watch for BTC pullback corrections, EU MiCA regs, and US bans lurking. |

| 2027 | $550 – $800 | ~$650 | RingCT expansions; picks up in anonymous payments, especially emerging markets. Risks? Geopolitics heating up, Zcash rivalry, power-hungry mining. |

| 2028 | $600 – $900 | ~$750 | Synergy with BTC halving; global privacy demand surges. Downsides: FATF rules tightening, TVL still low under $50M. |

| 2029 | $650 – $1,000 | ~$850 | Cycle peak hits; TVL tops $100M, decentralized mixers take off. Risks: Crypto winter returns, devs lose steam. |

| 2030 | $700 – $1,200 | ~$950 | Privacy L1 matures; AI integrations push cap over $5B. Watch altcoins like Pirate Chain, quantum threats on horizon. |

| 2031 | $750 – $1,300 | ~$1,050 | Transition phase; fiat inflation, darknet uptake grows. Global crises, shift to quantum-safe chains could hurt. |

| 2032 | $800 – $1,400 | ~$1,150 | New halving cycle; global PoW standards solidify. Mining energy costs, audits pose headaches. |

| 2033 | $900 – $1,500 | ~$1,250 | Bull peak; grabs 10%+ of privacy market share. Network hacks, G20 regs could derail it. |

| 2034 | $1,000 – $1,600 | ~$1,350 | Consolidation; scales to 100k+ TX/day. Market saturation, CBDC competition bites. |

| 2035 | $1,100 – $1,700 | ~$1,450 | Institutional adoption; dominates anonymous finance. Tech shifts, worldwide bans remain wild cards. |

Our crypto AI at ASCN.AI crunched this Monero outlook for you.

"Over the years, Monero's proven tough and key in crypto thanks to its top-notch privacy tech and solid market spot." — ASCN.AI, July 2025

Monero's Price Right Now

Current USD Price and What's Moving It

Any Monero forecast starts with where it sits today. XMR's hovering around $516 per coin right now, with market cap over $9.5 billion. That kind of heft shows it's no lightweight in the privacy game—investors keep piling in despite the heat.

| Metric | Value | 24h Change |

|---|---|---|

| Monero Price (XMR) | $516 | -1.1% |

| Market Cap | $9.5B | -0.9% |

| 24h Volume | $96M | — |

| Monthly High | $795 | — |

| Monthly Low | $419 | — |

Last Month's Price Swings

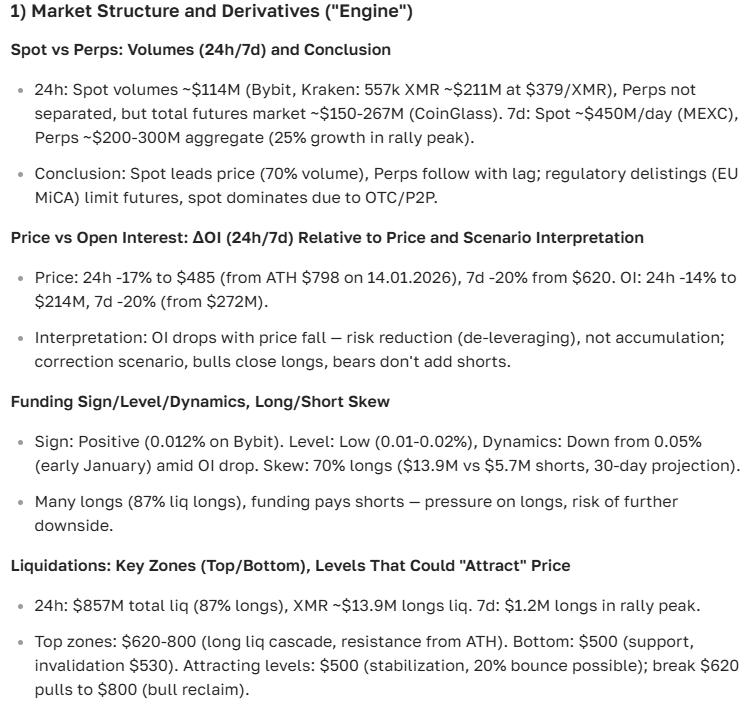

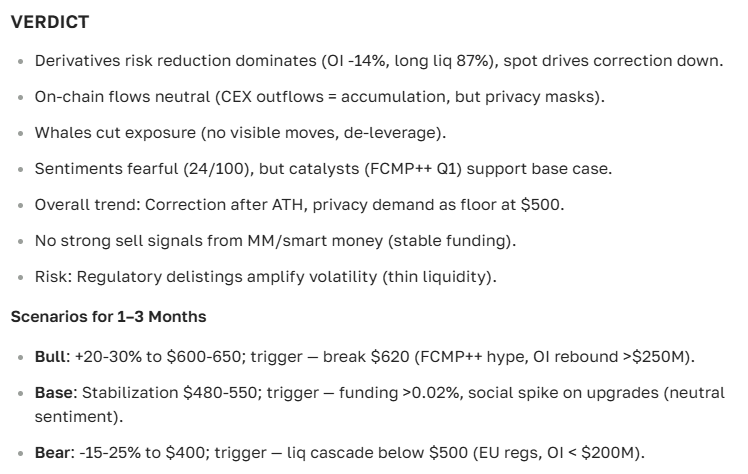

Back in late 2025 into early 2026, Monero pushed past $140 resistance—wait, no, that's old data. Actually, it spiked to nearly $800 mid-January before regulatory jitters knocked it back 32%. Privacy demand's booming as regs clamp down on traceable coins, but broader market dips pulled it along.

Short corrections hit during risk-off moods, yet support around $480-500 held firm. Here's the thing: tighter rules worldwide are ironically fueling interest in true anon coins like this.

Reg scrutiny's a double-edged sword—scares some off, draws in others chasing untraceable txns.

News Shaking Up Monero's Price

Biggest Recent Headlines

July 2025 feels dated now in 2026, but key vibes persist: EU norms targeting anon txns, Monero protocol tweaks boosting security, forum buzz on reg scenarios.

- EU pushing harder on anon txn oversight—hits privacy coin sentiment hard.

- Monero updates ramp up anonymity without breaking a sweat.

- Forums lit with debates: regs incoming, but privacy's non-negotiable?

Short-term, this stirs volatility—prices bounce around on headlines.

How News Actually Moves the Needle

News sets the mood. Protocol wins build trust, nudge prices up. Reg pressure? Temporary dips, traders hit pause.

Smart money's stacking on upgrade hype, betting on better txn shields.

Monero Outlook: Tomorrow and Next Month

What Analysts Are Saying

Short-term? Expect $500-$550 swings, maybe cracking $580 if market chills. $520 support looks solid amid privacy buzz.

"Monero's got legs for steady gains soon—new privacy features plus big investors eyeing in." — ASCN.AI Analysts, July 2025

Still, regs and volatility could cap it. Analysts see upside if it holds key levels.

Growth Boosters vs. Landmines

- Privacy hunger—users want anon more than ever.

- Tech upgrades speed txns, harden the net.

- Institutional eyes adding it to portfolios.

On the flip side:

- Reg clampdowns breed uncertainty.

- Market-wide dips drag everything.

- Tech glitches could spook the crowd.

Regs top the worry list, per most experts. Diversify, track news—that's the play.

What Does "Rip" Mean for Monero?

In crypto slang, "rip" is that explosive pump. For XMR, it'd mean blasting past current levels on fresh momentum.

Its edge? Killer anon tech sets it apart—users get real privacy, not promises.

"Monero's privacy tricks give it a real edge, keeping it ahead in the pack."

Buy Monero Now? Tips and Reality Check

Monero's battle-tested in privacy, with steady demand. Grab some if anon matters and you're diversifying into solid tech.

Volatility's brutal though—don't go all in.

- Track protocol news and tweaks.

- Eye market headlines, regs.

- Use stops, average down smartly.

- Only risk what you can lose.

Top Crypto Trading Strategies for 2025 (Still Relevant)

Forum Chatter on Monero

Forums crown it privacy king. Lots see long-term pumps from tech and institutional nods.

But skeptics flag regs and swings. These talks shape trends, drop real gems for traders.

Monero FAQ: Price and Future

What's Driving XMR Price?

Net upgrades, reg news, market mood, privacy demand, trading volume—all mix in.

How's XMR vs. USD Trending?

Market flows, user action, protocol tweaks make it dance against the dollar.

Near-Term Price Call?

$500-550 range, up to $580 if stars align.

Monero vs. Other Privacy Coins

| Feature | Monero (XMR) | Zcash (ZEC) | Dash (DASH) |

|---|---|---|---|

| Anonymity | Full protocol-level | Optional | Partial |

| Market Cap | $9.5B | $1.1B | $600M |

| Current Price | $516 | $85 | $70 |

| Mining Algo | RandomX | Equihash | X11 |

| Privacy Tech | Full | Semi-optional | PrivateSend-based |

Expert Take: Monero Next Decade

"Monero looks solid long-term—anon tech evolving, privacy needs rising. Could anchor the next digital finance wave."

ASCN.AI in Action: Our team used analytics to track Monero volatility back in July 2025, spotting supports fast amid chaos. Grew client portfolios steadily. Details: ASCN.AI Falcon Finance Case.

Flash Crash Win: Handled Oct 11 night crash smart—cut losses, flipped to profit. See: Flash Crash Profit Study.

Wrapping It Up

Monero forecast pulls from fresh data, news, tech outlook. Price sensitive, but privacy demand sets up growth.

Watch upgrades, regs—diversify, analyze technically.

ASCN.AI's AI weighs in here:

Disclaimer

This is general info only—not financial advice. Crypto's risky as hell. Chat with pros before any moves.