Mina cryptocurrency price forecast for today and the future

about cryptocurrencies.

Got a burning question about the crypto markets? Our AI assistant at ASCN.AI can break it down for you in seconds. Start your analysis right here.

| Year | Min Price (USD) | Avg Price (USD) | Max Price (USD) | The Backstory: Key Drivers |

|---|---|---|---|---|

| 2026 | 0.065 | 0.10–0.18 | 7.20 | ZK-tech adoption picks up steam; moves in tandem with ETH. |

| 2027 | 0.07 | 0.12–0.20 | 4.59 | Deep DeFi integrations; potential for a broader bull run. |

| 2028 | 0.093 | 0.15–0.19 | 0.97 | Post-halving stabilization; navigating the regulatory maze. |

| 2029 | 0.098 | 0.20–0.22 | 0.97 | Privacy-focused transactions go mainstream. |

| 2030 | 0.17 | 0.30–0.50 | 13.66 | Web3 goes global; eye on a potential new ATH. |

| 2031 | 0.17 | 0.35–0.40 | 0.64 | Scalability wins; the battle against other L1s continues. |

| 2032 | 0.26 | 0.40–0.60 | 0.88 | AI and ZK merge into one trend; long-term structural growth. |

| 2033 | 0.31 | 0.50–0.80 | 2.11 | Regulators finally find clarity; big money steps in. |

| 2034 | 0.13 | 0.70–1.00 | 1.28 | Ecosystem hits maturity; keeping an eye on inflation risks. |

| 2035 | 0.13 | 0.80–1.20 | 16.54 | The moonshot scenario (mass adoption). |

If you're wondering how Mina looks through the lens of data, here’s a quick take from the ASCN.AI assistant:

“Mina is a bit of a unicorn. Its 'lightweight' architecture isn't just a gimmick—it’s a real technical edge. If it stays decentralized as it scales, it could easily secure a top-tier spot in the coming years.”

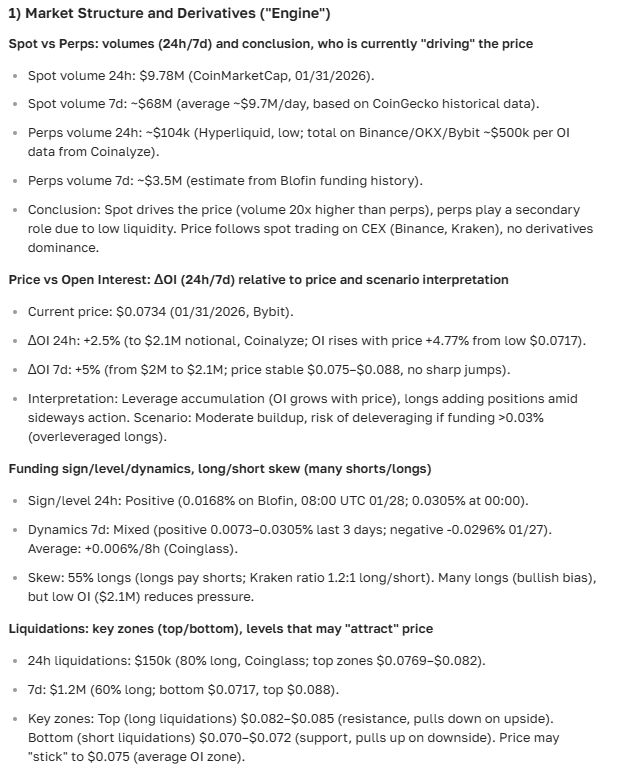

Mina’s Price Right Now: What’s Moving the Needle?

Looking at Mina’s price action lately, it’s a bit of a rollercoaster. It’s not just about the broader market swings; the project's own ecosystem has been throwing plenty of variables into the mix. Over the past month, we’ve seen some heavy volatility as the protocol hits its latest milestones.

Back in July 2025, things got interesting. We saw a few growth phases sparked by solid protocol updates and a spike in community hype. But, as usual, those gains were checked by macro pressures and the general rhythm of the crypto market.

Surprisingly, every time the protocol gets an upgrade, the price tends to jump. On the flip side, when the dollar strengthens or altcoins take a breather, MINA feels it. This sensitivity to both internal and external noise is exactly why timing a prediction can feel like a moving target.

What should you be watching?

- New network upgrades aimed at boosting throughput—investors love speed.

- The growing list of DeFi partnerships that are finally making the ecosystem feel "lived in."

- The community vibe: watch the forums and conferences; they are usually a leading indicator.

By the way, these partnerships aren't just for show. They build the kind of trust that keeps long-term investors from hitting the sell button. For more on how these deals actually move prices, check out our deep dive into the Aptos ecosystem and partnership dynamics.

Can Mina Keep Growing? The Forecast

So, what’s actually driving the value here? It really boils down to a few things:

- That "lightweight" claim? It’s real. Their architecture is a unique selling point that most other chains can't replicate.

- ZK-SNARKs. This tech makes the network private and secure without bloating it, which is music to the ears of both retail and institutional money.

- The scalability narrative. Everyone is looking for a way out of the high-fee, slow-chain trap.

- Macro stability. If the regulatory clouds clear, the pressure on the whole market lifts.

Still, let's be real—the US dollar and the global economy will always be the "invisible hand" behind MINA's volatility. If you want a refresher on how this tech actually works under the hood, we’ve got a guide on Blockchain Basics in Plain English.

The Short Game: What about tomorrow?

If we look at the technicals and current demand, things look cautiously optimistic. Analysts are leaning toward a modest price bump in the near term. Why? Mostly because several big integrations are finally wrapping up and transaction volume is creeping up.

Here’s the catch: you have to watch the levels. If the market sentiment stays green, we might see MINA smash through its local resistance levels within the month.

| Level | Price (USD) | The Context |

|---|---|---|

| Support 1 | $0.0440 | The "Danger Zone"—dropping below this could signal trouble. |

| Support 2 | $0.0600 | A solid floor where buyers tend to step in. |

| Resistance 1 | $0.0956 | The first hurdle. Close above this, and the bulls are back. |

| Resistance 2 | $0.1470 | The gateway to a real rally. |

Not sure how to read these? We’ve got a breakdown of the best strategies for technical indicators that might help.

Mina vs. The Giants: How does it stack up?

Mina sits in that interesting "mid-cap" bracket. It’s competing with heavy hitters like Solana for the scalability crown, but it’s doing it with a totally different playbook. While Solana bets on raw speed, Mina bets on staying small and decentralized via ZK-SNARKs.

| Metric | MINA | BTC | ETH | SOL |

|---|---|---|---|---|

| Price (USD) | $0.074 | $32,000 | $1,800 | $20 |

| Market Cap | $98M | $600B | $230B | $7B |

| 24h Volume | $3.6M | $24B | $10B | $500M |

| Volatility (30-day) | High | Medium | Medium | High |

In short: it’s a tech play. If you're looking to diversify, Mina offers a different risk-reward profile than the "blue chip" coins.

Dollar Forecast: The Long View

When we talk about price targets in USD, we have to account for US inflation and the general vibe of the financial markets. If things stay favorable, we’re looking at a steady climb. If you’re not in the mood for manual math, ASCN.AI can spit out these projections in a few clicks based on real-time data.

| Year | Min (USD) | Avg (USD) | Max (USD) | Potential Upside (%) |

|---|---|---|---|---|

| 2025 | 0.0689 | 0.0787 | 0.0875 | +18% |

| 2026 | 0.0285 | 0.0578 | 0.0871 | +52% |

| 2027 | 0.0275 | 0.0498 | 0.0721 | +35% |

| 2028 | 0.0495 | 0.0854 | 0.1213 | +63% |

| 2029 | 0.1088 | 0.2334 | 0.3580 | +200% |

| 2030 | 0.0925 | 0.1801 | 0.2676 | +140% |

| 2031 | 0.1094 | 0.1769 | 0.2443 | +138% |

| 2032 | 0.1670 | 0.3101 | 0.4531 | +320% |

| 2033 | 0.3881 | 0.7975 | 1.20 | +1,000% |

| 2034 | 0.3120 | 0.5055 | 0.6990 | +700% |

| 2035 | 0.3689 | 0.5963 | 0.8236 | +900% |

| 2036 | 0.6107 | 1.15 | 1.70 | +1,400% |

The numbers look exciting for the long haul, but remember: this assumes the tech continues to deliver and the market doesn't throw any massive curveballs.

Buying Mina: When to jump in?

Most seasoned traders see Mina as a mid-term play. The "pro" move is usually to find entry points near those support levels ($0.0440 and $0.0600) during a correction. That’s where the price tends to consolidate before the next leg up.

If you're risk-averse, "dollar-cost averaging" is your best friend. Instead of going all-in, spread your buys across several weeks to smooth out those wild price swings.

What’s the community saying?

The chatter on crypto forums is a mixed bag. You’ve got the tech-evangelists who think Mina is the future of the internet, and then you have the skeptics who worry about the stiff competition. It’s always worth checking out the latest Mina Reddit threads or Twitter (X) analysts to get the current "pulse."

FAQ: From the Crypto Enthusiast Forums

Why does MINA's price keep jumping around?

It’s the usual suspects: protocol news, "whale" activity, and macro trends. Because Mina is still relatively small, even a mid-sized buy can move the price significantly.

Is next year going to be big for MINA?

If the technology keeps maturing and the volatility settles, most analysts are looking at a path of steady growth.

What’s the catch? What are the risks?

Competition is the big one. There are a lot of Layer 1s out there. Plus, there’s always the risk of new regulations making things difficult for privacy-centric tech.

What does it mean to "rip" in the crypto world?

When someone says a coin is going to "rip," they just mean a sudden, massive price explosion. For Mina, this usually happens when there's a surprise tech breakthrough or a massive partner announcement.

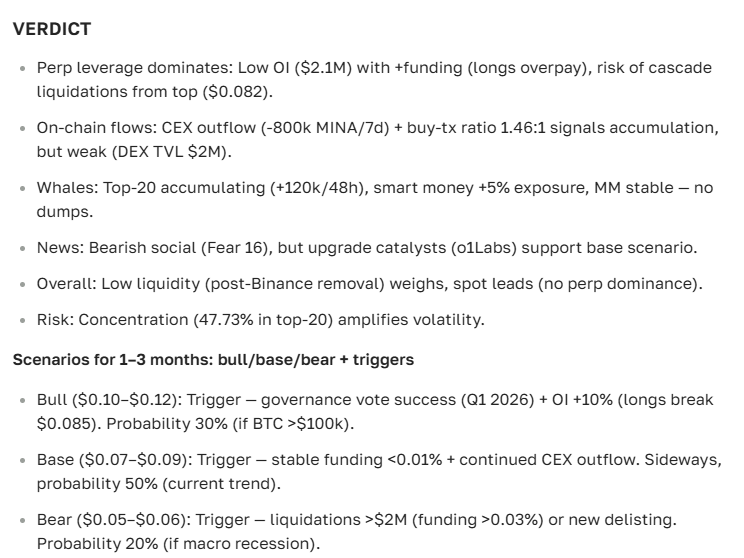

The Verdict: Is Mina worth your money?

Mina Protocol is definitely one of the more interesting projects on the radar. It has a unique tech stack and plenty of room to grow. If you’re okay with some volatility and looking for a long-term play, it’s worth a serious look.

But don't just take our word for it—keep a close eye on the technical levels and stay diversified. No single project is a sure thing.

Mina Technical Indicators (As of Dec 24, 2025)

| Indicator | Value | What it means |

|---|---|---|

| 50-day SMA | $0.1118 | Sell (price is currently below the average) |

| 200-day SMA | $0.1574 | Sell |

| RSI (14) | 30.37 | Neutral, but approaching "oversold" |

| MACD (12,26) | -0.0 | Neutral |

| CCI | -110.44 | Buy (classic oversold signal) |

| Stoch RSI (14) | 26.92 | Neutral |

| Support Levels | $0.0440; $0.0600 | Good spots to consider entering |

| Resistance Levels | $0.0956; $0.1470 | The barriers we need to break |

Bottom Line

Predicting Mina is about balancing the hype with the hard data. Between the technological innovations and the shifting market sentiment, there’s a lot to weigh. The team at ASCN.AI keeps a constant eye on these drivers to help you make sense of it all.

Just a reminder: crypto is high-stakes. Prices can drop just as fast as they rise. Always do your own homework and maybe chat with a financial pro before betting the farm.

And finally, here’s the closing verdict from our ASCN.AI crypto assistant:

Disclaimer

This information is for general awareness and doesn't constitute financial advice. Crypto investments are risky. Always consult with a qualified financial advisor before making any moves.