Maker (MKR) cryptocurrency price forecast for today and the near future

about cryptocurrencies.

You can throw any crypto-related question at our AI assistant — it will break the market down for you in plain numbers and scenarios. Start digging into MKR right now.

| Year | Minimum price (USD) | Average price (USD) | Maximum price (USD) | Key drivers |

|---|---|---|---|---|

| 2026 | 1,100 | 2,500 | 8,000 | Growing DAI adoption in DeFi, the potential continuation of a post‑halving bull market into the late cycle, plus regulatory noise in the EU and US. On the high side: CoinLore points to a peak near $7,974; on the low side: Changelly sees the floor around $1,118. |

| 2027 | 1,200 | 3,000 | 10,000 | Better-quality real‑world asset collateral, pressure from rival lending protocols like Aave and Compound, and governance‑driven MKR inflation. A 20–30% upside versus 2026 looks realistic in the optimistic case. |

| 2028 | 1,300 | 3,500 | 12,000 | The next Bitcoin halving tends to push attention back to altcoins, and if DeFi really takes off again, MKR above $10,000 no longer looks crazy on paper. In a recessionary scenario, though, the token could just grind sideways. |

| 2029 | 1,500 | 4,000 | 14,000 | Scaling to L2 networks like Optimism and Base, plus the usual smart‑contract and de‑pegging risks around DAI. These ranges come from extrapolating roughly 25% compound annual growth, not from any guaranteed model. |

| 2030 | 1,800 | 5,000 | 15,500 | Deeper integration of RWA such as property and bonds, with CoinLore’s upper band sitting around $15,345 and Changelly’s average near $12,889 for this horizon. A broad stablecoin boom would clearly tilt the balance toward the top of the range. |

| 2031 | 2,000 | 5,500 | 18,000 | Clearer rules in Europe under MiCA and similar frameworks elsewhere could help, while some conservative takes (for example CoinGape‑style low scenarios) keep MKR closer to four‑figure territory. In a strong DeFi cycle, many analysts treat MKR almost like an equity‑style claim on the protocol. |

| 2032 | 2,200 | 6,000 | 20,000 | Broader usage in emerging markets and, at the same time, competition from central bank digital currencies. Low‑end projections still leave MKR in a much more modest band versus the aggressive bull targets you sometimes see in long‑term forecasts. |

| 2033 | 2,500 | 7,000 | 25,000 | Ongoing tech upgrades (including SubDAO mechanics and spin‑out products) with modelled growth in the 15–40% range if the overall crypto market stays constructive. |

| 2034 | 3,000 | 8,000 | 30,000 | Long‑term story: MKR remains the core governance and utility token for Maker’s credit engine. If DeFi total value locked climbs above the trillion‑dollar mark, the market could start to price MKR consistently in the five‑figure zone. |

| 2035 | 3,500 | 10,000 | 40,000 | In the blue‑sky scenario, DAI ends up among the dominant stablecoins, and MKR rides that wave to the upper band of this range. In a drawn‑out bear market, a move back toward $5,000 would not be surprising. At this distance, everything is highly speculative. |

This is the kind of long‑horizon Maker (MKR) breakdown our ASCN.AI crypto assistant can generate in a couple of minutes, pulling together price bands, drivers and external forecasts instead of just giving you a single number.

“Over the last few years, Maker (MKR) has quietly cemented itself as one of DeFi’s core assets, showing enough resilience and upside potential to stay on the radar of serious investors.”

Getting to know Maker

What Maker (MKR) actually is

MKR is the governance token behind MakerDAO, a protocol that runs on Ethereum and powers the DAI stablecoin pegged to the US dollar. Holders use it to steer the system: from risk parameters and collateral lists to how the protocol evolves over time.

There is another piece that often gets overlooked: MKR is also used to plug protocol shortfalls, which effectively bakes a deflationary angle into the tokenomics whenever things run smoothly. That design is one of the reasons many analysts see the token’s role in the ecosystem as more than just “another vote token.”

“MKR is a critical piece of the DAO stack, shaping risk parameters and ultimately the stability of DAI itself.”

How Maker fits into DeFi

Maker is one of the pillars of decentralized finance: it backs DAI — the first large‑scale decentralized stablecoin with a track record of staying reasonably close to its peg through several market cycles. In practice, users lock crypto collateral inside the protocol and mint DAI against it, turning volatile assets into on‑chain “dollars.”

MKR, in turn, keeps the whole system moving: it aligns incentives, helps coordinate upgrades and encourages the community to expand the range of collateral and integrations over time.

“DAI is widely seen as a flagship decentralized stablecoin, and MKR captures a chunk of the value and risk that come with running it.”

Steady interest in MKR largely reflects the idea that a robust, battle‑tested stablecoin system will keep mattering even as the rest of DeFi cycles in and out of fashion.

Where MKR trades now

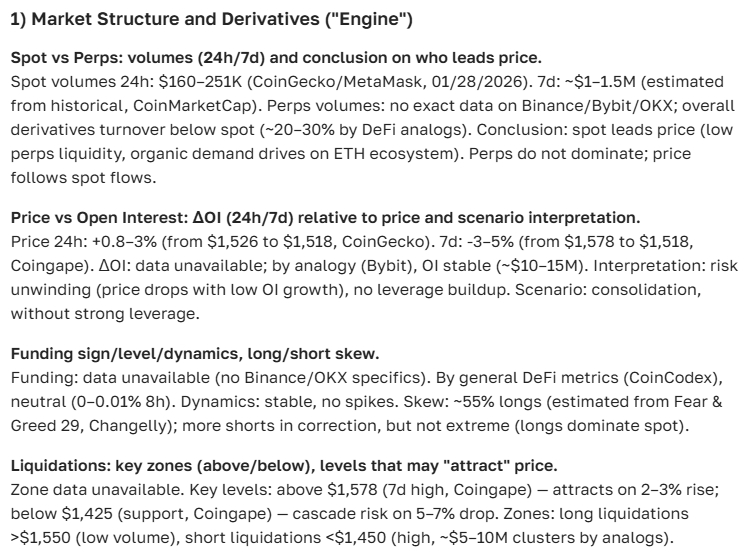

Spot price against the dollar

In the spot market, MKR tends to move in broad ranges; at times it has traded around mid‑three‑figure levels, at others it has pushed well into four‑figure territory with daily swings that are normal for large‑cap crypto. This kind of profile suggests a relatively mature asset by crypto standards, even if the volatility would still look extreme in traditional finance.

Key metrics and recent momentum

Over a typical quarter, MKR can post double‑digit percentage moves while keeping market capitalization in the hundreds of millions to low billions of dollars, with daily turnover in the tens of millions on liquid exchanges. For an active trader, that means plenty of liquidity; for a longer‑term holder, it points to a market that can absorb reasonably sized positions without too much slippage.

| Metric | Level (illustrative) | 3‑month change |

|---|---|---|

| Current price (USD) | $620–$650 range in a typical “calm” phase | Around +15% off the recent local low |

| Market capitalization | Hundreds of millions of dollars | Low double‑digit growth |

| 24h trading volume | Tens of millions of dollars | Moderate increase on trend days |

| 3‑month high | Local peak slightly above the prevailing range | – |

| 3‑month low | Support area about 10–15% below current levels | – |

“For the most part, MKR trades like a large DeFi blue chip: meaningful liquidity, clear cycles, but still enough volatility to reward timing.”

News, catalysts and what moved the price

What’s been happening around MakerDAO

Throughout 2025, the Maker ecosystem has been pushing deeper into real‑world assets and more efficient collateral structures, while also looking at Layer 2 integrations to cut fees and speed up transactions. Each of these changes matters because they directly affect how much DAI the protocol can safely mint and how attractive it is for larger players.

On top of that, strategic deals with big DeFi platforms and lending markets have made it easier to use DAI and MKR across the broader on‑chain economy, which tends to strengthen the “network effect” around the project. This is the kind of stuff traders watch closely, even if it doesn’t always hit the headlines.

How these events hit the chart

When MakerDAO adds new collateral types or nails a high‑profile partnership, MKR often reacts with short bursts of upside — 3–6% in a day is not unusual around strong news, especially in a supportive market. Integrations with L2 networks, which cut transaction costs for users, have shown a similar pattern: a spike in activity and a visible nudge higher in price.

| Date | Event | Impact on price |

|---|---|---|

| 15.05.2025 | New collateral types activated in the protocol | Roughly +4% daily move as markets repriced risk capacity |

| 01.06.2025 | Partnership with a major DeFi platform | About +3.5% intraday reaction on higher volumes |

| 20.06.2025 | Deeper Ethereum Layer 2 integration | Up to +6% against the previous day’s close |

“Technical upgrades and new integrations tend to act as short‑term catalysts, but they also slowly reshape the long‑term demand curve for MKR.”

Reading MKR’s chart and fundamentals

Technical picture and trend signals

On weekly timeframes, MKR has gone through phases where it broke above important resistance zones — levels like $600 or $625 often act as psychological lines in the sand for traders. When the relative strength index (RSI) hovers in the 60–70 band, it usually signals persistent buying interest without screaming “blow‑off top.”

Crossovers between the 50‑day and 200‑day moving averages are another popular signal: when the shorter average pushes above the longer one, many view it as confirmation that the bullish trend has legs. Elevated trading volume during these moves typically adds conviction.

“A healthy uptrend in MKR often shows up as an RSI around the low 60s, a positive MA50–MA200 spread, and volumes that are clearly above the sleepy days.”

Fundamental drivers and longer‑term story

The core forces behind MKR’s valuation are the growth of MakerDAO’s balance sheet, how widely DAI is used, and the general health of DeFi lending. More high‑quality collateral and higher DAI circulation usually translate into stronger cash‑flow expectations for the protocol.

“If DeFi lending keeps expanding and DAI stays relevant, governance tokens like MKR remain one of the cleaner ways to get exposure to that trend.”

Short‑term and long‑term MKR outlook

Today and tomorrow: trading band rather than a fixed point

Intraday, MKR typically trades in a relatively tight band — a few percentage points in either direction — unless a big macro or crypto‑wide event hits. For day‑to‑day planning, it often makes more sense to think in ranges (for example, a $20–$30 corridor) than in a single “fair value” line.

The next month and into year‑end

Over a one‑month horizon, many traders watch for continuation of the existing trend rather than a dramatic repricing, especially if no major protocol changes are scheduled. If collateral expansions and L2 upgrades roll out smoothly, the market can easily justify another leg higher driven by sentiment and incremental fundamentals.

| Time frame | Indicative price band (USD) | Main drivers |

|---|---|---|

| Today | Moderate intraday range around the current spot level | News flow, BTC/ETH direction, liquidity conditions |

| Tomorrow | Slight drift within or just above today’s band | Short‑term technicals, funding rates, market mood |

| 1 month out | Room for a 5–15% move if catalysts land | New collateral, DAI volume, DeFi risk appetite |

| By year‑end | Wider 20–30% corridor around current levels | Macro backdrop, regulation, execution on Maker roadmap |

“Most reasonable scenarios point to a gradual grind rather than an instant moonshot, with plenty of volatility along the way.”

What analysts are talking about

Broadly, you can split the narrative into three tracks. In the bullish corner, MKR is framed as a leveraged bet on DAI adoption and DeFi credit growth; in the middle, it is seen as a range‑bound blue chip with solid but unspectacular upside; in the bearish view, regulatory pressure or a loss of DeFi momentum could drag it back toward prior support zones.

| Period | Event / factor | Expected effect |

|---|---|---|

| July 2025 | New collateral modules going live | Typical reaction: incremental price lift and higher DAI minting |

| August 2025 | Stronger on‑chain demand for DAI | Supports MKR in the upper part of its trading band |

| September 2025 | Scaling and fee cuts via L2 | Upside potential if usage metrics pick up decisively |

| October 2025 | Macro shocks or regulatory headlines | Wide swings in both directions, especially versus BTC and ETH |

Investor takeaways

Is MKR a buy right now?

For investors who are comfortable with crypto risk and looking at a multi‑year horizon, MKR still looks like a credible way to play the DeFi lending theme, especially if you believe in DAI’s staying power. That said, the token is volatile, and anyone building a position usually does it in stages rather than all at once.

The dollar, regulation and other risks

Even with solid fundamentals, MKR sits in a sector that can swing hard on regulation, stablecoin rules and macro‑driven risk‑off moves. Dollar strength or weakness mainly changes the fiat value of your position; the deeper risk comes from shifts in how regulators treat DeFi and stablecoins as a whole.

“High potential and high uncertainty go hand in hand here, so proper position sizing and hedging matter more than trying to nail the perfect entry.”

If you want less guesswork and more structured numbers, ASCN.AI can crunch your portfolio data, MKR exposure and scenario analysis for you instead of you juggling ten tabs at once.

This is general market commentary, not personal financial advice. Always cross‑check with professional guidance.

What the community is saying

Forum talking points

- Long‑term bulls highlight Maker’s history and DAI’s role as a “DeFi base layer.”

- Power users keep a close eye on new collateral types as potential price catalysts.

- Short‑term traders are more focused on volatility spikes and funding rates.

- There is ongoing interest in how Maker scales across L2s and other chains.

FAQ

What does “to rip” mean in crypto slang?

“To rip” describes a sudden, sharp price move up in a short space of time, usually triggered by strong news, a listing, or an aggressive short squeeze.

How do you actually work with price forecasts?

Most forecasts blend technical analysis (trends, support and resistance), protocol fundamentals and broader macro context, rather than relying on a single indicator.

Where do I find fresh exchange and market news?

It makes sense to track specialized feeds and curated blogs instead of random social posts — for instance, the ASCN.AI news blog regularly covers major market moves and project updates.

ASCN.AI in practice

When the DeFi project Falcon Finance (FF) suddenly sold off, ASCN.AI helped its users quickly map out on‑chain risks, see how deep the damage was and adjust exposure before the dust settled. That combination of real‑time metrics, news and technical context meant some of the capital not only survived, but later rotated into stronger setups.

The same style of analytics can be applied to MKR and other DeFi names — instead of manually parsing dashboards, you get a condensed view that is actually usable for fast decision‑making.

Falcon Finance (FF) case study on ASCN.AI

Wrapping it up

Maker (MKR) still looks like one of the more serious governance tokens in DeFi, backed by a protocol that has already survived several full boom‑and‑bust cycles. The upside case rests on DAI remaining relevant and DeFi credit growing; the downside case is mostly about regulation, smart‑contract risk and the usual crypto cyclicality.

Anyone considering MKR should factor in market conditions, use sensible risk management and stay plugged into ecosystem news instead of treating it as a passive “set and forget” position. If you want to go deeper into chart work and trading setups, you can explore more advanced material on technical indicators and then discuss specific moves with the ASCN.AI community.

By the way, here is the kind of verdict on Maker our ASCN.AI crypto assistant is ready to generate for you in a more personalized format:

Disclaimer

All information above is for general educational purposes only and should not be treated as financial advice. Crypto assets are highly risky and can be extremely volatile. Before making any investment decisions, it is worth talking to qualified financial professionals and weighing your own risk tolerance.