Litecoin (LTC) price forecast for 2025-2035: analytics, trends, and prospects

about cryptocurrencies.

Any crypto question you have, you can throw at our crypto AI assistant — it will sort through the data much faster than a human analyst. Start digging into the numbers here.

| Year | Price range (USD) | Average price (USD) | Key drivers and risks |

|---|---|---|---|

| 2026 | $100 – $400 | ~$250 | Post‑2025 rally; MWEB adoption, payments up +30%. Risks: pullback after BTC peak, SEC pressure, thin TVL. |

| 2027 | $120 – $450 | ~$300 | Network upgrades (Lightning‑style); emerging markets, remittances. Risks: geopolitics, BCH competition. |

| 2028 | $150 – $500 | ~$350 | Synergy with BTC halving; global payments (BitPay and others). Risks: MiCA in the EU, PoW mining energy narrative. |

| 2029 | $180 – $600 | ~$400 | Cycle peak; TVL >$500M, MWEB privacy. Risks: “crypto winter”, dev interest fading. |

| 2030 | $200 – $700 | ~$450 | Matures as a payment‑first L1; AI integrations, cap >$10B. Risks: meme‑altcoins (DOGE, etc.), early quantum talk. |

| 2031 | $220 – $800 | ~$500 | Transition phase; fiat inflation, adoption in Africa/Asia. Risks: global crises, user migration to BTC L2. |

| 2032 | $250 – $900 | ~$550 | New halving cycle; global standards, PoW efficiency upgrades. Risks: mining energy costs, stricter audits. |

| 2033 | $280 – $1,000 | ~$600 | Bull‑cycle top; mass usage (15%+ of payments). Risks: protocol hacks, G20‑level regulation. |

| 2034 | $300 – $1,100 | ~$650 | Consolidation; throughput >500k TX/day, metaverse use cases. Risks: saturated market, CBDC competition. |

| 2035 | $350 – $1,200 | ~$700 | Institutional phase; strong position in P2P payments. Risks: tech disruption, BTC dominance narrative. |

This is the kind of Litecoin price path our crypto AI assistant at ASCN.AI tends to sketch out when you feed it enough assumptions and market data.

“Litecoin has carved out a peculiar niche: a mix of reliability and steady experimentation. Looking at current trends and how the network evolves, you can build a fairly realistic LTC price roadmap both for the near term and much further out.”

Getting to know Litecoin

So what is Litecoin, really?

Litecoin is a cryptocurrency launched back in 2011 as a Bitcoin fork, with one clear idea: make transfers faster and cheaper. LTC positions itself as a lighter alternative to BTC, with quicker confirmations and lower fees. Under the hood it uses the Scrypt algorithm for mining, which makes hardware requirements a bit more forgiving and, in theory, mining somewhat less centralized than on Bitcoin’s SHA‑256.

Here are a few things that define Litecoin:

- Block confirmation time is roughly 2.5 minutes, about four times faster than Bitcoin.

- Scrypt mining helps reduce concentration of hashrate in a handful of industrial pools.

- The maximum supply is capped at 84 million LTC, which is four times Bitcoin’s 21 million.

Over time this balance of speed, transaction cost and decent decentralization has helped LTC keep a stable spot among older large‑cap coins, even when newer narratives dominate the headlines.

How Litecoin evolved over time

The project was started by Charlie Lee, who framed LTC as “digital silver” to Bitcoin’s “digital gold”, and that metaphor still sticks in most discussions. Over the years the network has gone through several notable upgrades aimed at security, scaling and, more recently, privacy.

Key milestones for Litecoin include:

- 2011: project launch, keeping Bitcoin’s basic design but with faster block times.

- 2017: SegWit activation to shrink transaction size and boost throughput.

- 2017: early Lightning Network experiments for scaling everyday payments.

- 2023–2024: roll‑out of MimbleWimble Extension Blocks to add stronger privacy.

MimbleWimble, through extension blocks, gives users an option to move transactions into a more private zone, which matters for those who do not want their full on‑chain history exposed to everyone.

Thanks to this kind of steady, almost conservative development, LTC for the most part remains on investors’ radar as both a payment rail and a store‑of‑value style asset with a long track record.

Where Litecoin stands on the market now

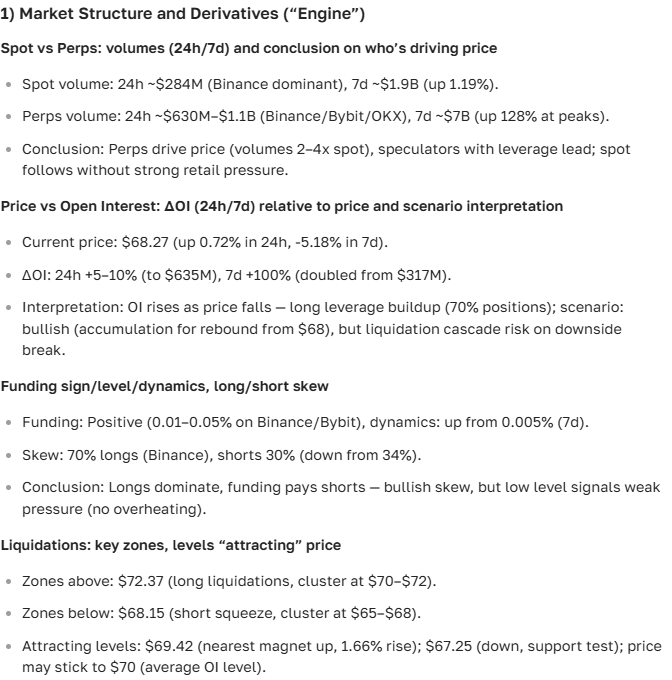

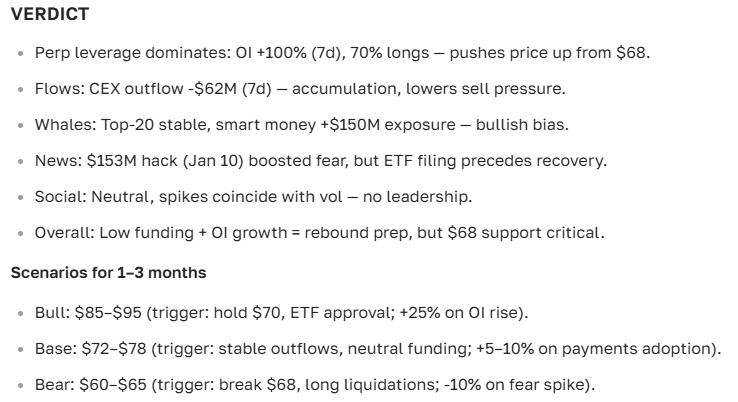

Spot price and recent moves

As of early July 2025, Litecoin trades roughly around the 90‑dollar area, depending on the day and venue. In the summer of 2025, LTC showed about a 12% upswing, moving in step with the broader risk‑on mood across the crypto market.

Day‑to‑day price action is heavily tied to demand, miner behavior and the overall macro narrative around cryptocurrencies. In July, the coin has been trying to hold above the 85‑dollar resistance zone, which many traders treat as a signal that buyers are still willing to defend their positions.

If you zoom in on the last month, the chart shows a cautious grind higher with several key technical levels reclaimed, hinting at a market that is stabilizing rather than capitulating.

What actually moves the LTC price

A few things tend to matter more than others:

- News and events: protocol upgrades, new integrations and listings can quickly revive interest.

- Market regime: when the whole crypto complex is in risk‑on mode, LTC usually benefits from rising liquidity and capital flows.

- Regulation: new rules, especially in the US and EU, often change how comfortable large players feel holding LTC.

- Macro backdrop: dollar strength, inflation and rates shape how attractive crypto looks versus bonds or equities.

Because these forces rarely move in sync, Litecoin’s price tends to react in bursts, which is exactly why investors try to combine on‑chain, macro and sentiment data instead of relying on a single indicator.

In other words, the drivers are messy and non‑linear, so anyone betting on LTC has to accept surprises as part of the game.

LTC price outlook

Near term: today and tomorrow

Right now Litecoin looks like it is in a classic accumulation phase after a sharp move up. That usually implies either a shallow correction or a sideways drift somewhere near the 90‑dollar mark, rather than a vertical breakout.

Most technical setups point to modest upside as long as liquidity stays healthy and sellers do not suddenly dominate the order books.

Moving averages together with RSI suggest that a broader uptrend is forming, with the 85‑dollar area acting as the first serious support level if the market wobbles.

Medium term: over the next month and year

Over a one‑month horizon, many traders see Litecoin oscillating in the 95–105 dollar band, with the round 100‑dollar mark acting as a psychological magnet. The outlook for July and the rest of the year looks cautiously optimistic, especially if scheduled upgrades roll out smoothly and fundamentals do not deteriorate.

Analysts who track LTC basics expect market cap to edge higher, provided there is no hard shift in regulation or a sudden liquidity crunch across majors.

Further out: 2030, 2040 and beyond

The long‑run story for Litecoin hinges on whether the network keeps shipping useful improvements, scales without breaking and stays relevant for real‑world payments. If that plays out, LTC can keep its “digital silver” role as a medium‑of‑exchange coin that also lives inside DeFi stacks and payment apps.

Under that scenario, projections for 2030 and later often talk about prices in the several‑hundred to low‑thousands per coin range, driven by a capped supply and a slow build‑up of institutional exposure.

LTC price table (2025–2050)

| Year | Minimum price (USD) | Average price (USD) | Maximum price (USD) | Potential ROI |

|---|---|---|---|---|

| 2025 | 150.64 | 156.23 | 183.42 | 3.3% |

| 2026 | 220.74 | 226.99 | 267.59 | 27.7% |

| 2027 | 311.26 | 320.34 | 381.84 | 168.5% |

| 2028 | 430.53 | 443.34 | 522.57 | 295.6% |

| 2029 | 597.48 | 619.65 | 739.68 | 490.6% |

| 2030 | 887.03 | 918.02 | 1,072.89 | 730.5% |

| 2031 | 1,275.87 | 1,320.87 | 1,525.85 | 1,060.5% |

| 2032 | 1,816.82 | 1,882.81 | 2,195.78 | 1,588.4% |

| 2033 | 2,721.73 | 2,816.72 | 3,250.67 | 2,317% |

| 2034 | 4,341.07 | 2,405.39 | 2,790.02 | 3,473.3% |

| 2040 | 44,355 | 46,881 | 52,077 | 66,597% |

| 2050 | 63,646 | 66,966 | 72,595 | 92,875.2% |

Projections that stretch out to 2040–2050 are, by nature, extremely fragile and should be treated more as scenario sketches than as targets. Anyone allocating capital to LTC on that basis needs to be comfortable with high volatility and the chance that the thesis simply does not play out.

Fundamentals and what could be next for Litecoin

Tech upgrades and network development

The standout upgrade in recent years has been MimbleWimble Extension Blocks, which add an optional privacy layer and make LTC more competitive as a fungible payment asset. For many users that extra privacy option is not a gimmick but a reason to choose Litecoin over more transparent chains.

Work on Lightning‑style scaling also continues, aiming to push cheap, instant payments without bloating the base chain. If those efforts deliver, Litecoin’s positioning in everyday commerce and merchant tools could quietly strengthen.

How LTC stacks up against other majors

| Metric | Litecoin (LTC) | Bitcoin (BTC) | Ethereum (ETH) | Ripple (XRP) |

|---|---|---|---|---|

| Block time | 2.5 min | 10 min | ~12 sec | ~4 sec |

| Average fee | <$0.05 | ~$1 | ~$0.20 | <$0.01 |

| Mining / consensus | Scrypt | SHA‑256 | Ethash | Consensus protocol |

| Privacy | With MimbleWimble | None | Optional tools | No |

| Market cap (July 2025) | $6B | $600B | $200B | $40B |

Litecoin’s mix of relatively fast blocks, modest fees and opt‑in privacy puts it in an interesting middle ground, especially for users who want something simpler than Ethereum but cheaper and quicker than Bitcoin.

Rules, regulators and what they mean for LTC

Whenever the regulatory conversation heats up, LTC tends to move alongside the rest of the large‑cap cohort, sometimes overreacting to headlines. At the same time, Litecoin has shown reasonably resilient behavior, helped by a long history, an active community and upgrades designed to keep it aligned with evolving standards rather than fighting them.

How Litecoin is used in the real world

In day‑to‑day terms, LTC is mostly used for fast online payments, cross‑border transfers and, in some cases, as collateral or a medium of exchange within DeFi platforms. Integration with payment gateways and micro‑payment services keeps organic demand ticking over even when speculative flows slow down.

Market news and ongoing analysis

Recent news that mattered for LTC

In July 2025, Litecoin drew extra attention around the MimbleWimble deployment and several exchange partnership announcements, and both themes helped support its short‑term price action.

How headlines and macro shocks hit the chart

Newsflow tends to drive short‑term spikes and dips in Litecoin: fresh tech releases, listings or tie‑ups usually act as upside catalysts, while regulatory ambiguity or enforcement talk can trigger quick corrections. If you do not feel like manually tracking every story, ASCN.AI can pull together the key events and show how each one moved the LTC chart in a couple of clicks.

There is also a detailed breakdown of how news can crush a token price in the ASCN.AI case study on the Falcon Finance (FF) sell‑off, which is a useful cautionary tale.

What the community is talking about

Topics dominating forums and comment sections

Community debates usually orbit around the same themes: whether LTC can keep up technologically, whether MimbleWimble gives it a durable edge and how attractive the risk–reward looks for long‑term holders. Investors also keep revisiting the “digital silver” label and whether it still makes sense in a market full of L2s and new L1s.

Slang, memes and how people talk about LTC

Among traders, Litecoin is still often nicknamed “digital silver”, especially in Bitcoin‑centric circles. Jargon like “to rip” (a violent move up or down) and “to hodl” (sit on a position for years, through all the noise) pops up constantly and gives a quick read on whether sentiment is greedy or fearful.

Investment angle

Is it a good time to buy Litecoin?

On paper, Litecoin currently looks attractive from both a fundamental and technical standpoint, particularly with privacy and scaling upgrades either live or in progress. The growth case does not look outrageous, but the usual crypto volatility remains a real and unavoidable risk factor.

Upside potential vs. real risks

Upside drivers:

- Consistent network development and a history of delivering upgrades.

- Solid liquidity and wide exchange coverage supporting large order execution.

- Low fees and quick settlement, which help for payments and high‑velocity use cases.

Main risks:

- Regulatory crackdowns in key jurisdictions that could hit liquidity and demand.

- Broad crypto‑market drawdowns that drag even strong names lower.

- Competition from newer, highly optimized chains and from BTC‑centric scaling solutions.

Our crypto AI assistant at ASCN.AI tends to summarize it this way: LTC still has room to run if the cycle stays friendly, but position sizing and risk management matter far more than any single price target.

Litecoin price forecast: quick Q&A

What’s the expected price of Litecoin in the near term?

In the coming months, most scenarios put LTC somewhere in the 90–105 dollar range, with a slight bullish tilt if broader market conditions cooperate.

What could cause a sharp move in LTC?

The biggest shock‑drivers tend to be major regulatory decisions, serious technical incidents or, on the upside, surprise announcements on integrations and protocol updates.

Is it reasonable to invest in Litecoin now?

It can make sense for long‑term investors who understand the risks and are willing to ride out deep drawdowns instead of reacting to every headline.

How do you avoid common mistakes when forecasting LTC?

The usual advice is to combine newsflow, technical signals and fundamental metrics, while keeping emotions in check and avoiding impulsive trades driven purely by fear or FOMO.

Disclaimer

Everything above is for general information only and should not be treated as investment advice. Crypto assets are highly risky and volatile, and you should talk to a qualified financial professional before making any decisions.