Lido DAO (LDO) cryptocurrency price forecast and outlook for today, tomorrow, and the month

about cryptocurrencies.

Got a burning question about crypto? Our AI assistant is ready to help. Start your analysis right now.

| Year | Bear Case (USD) | Bull Case (USD) | Average Target (USD) | The Big Picture |

|---|---|---|---|---|

| 2026 | 0.34 | 5.95 | 1.50 | Post-upgrade ETH staking growth; potential bull run tempered by regulatory noise. |

| 2027 | 0.16 | 3.69 | 1.20 | Lido TVL could cross $30B, but watch out for those vesting unlocks—inflation might bite. |

| 2028 | 0.13 | 1.68 | 0.90 | Heavier DeFi competition; potential upside from ETH ETFs and big-money adoption. |

| 2029 | 0.12 | 2.50 | 1.00 | Market stabilization; L2 solutions like Optimism and Arbitrum could provide a nice tailwind. |

| 2030 | 0.10 | 11.24 | 2.00 | Massive staking adoption (>50% of ETH); global rules might cap the ceiling, though. |

| 2031 | 0.08 | 12.00 | 2.50 | Lido maintains PoS dominance; the main "if" here is the threat of quantum computing. |

| 2032 | 0.07 | 13.50 | 3.00 | DeFi TVL eyes the $1 trillion mark; price stays glued to BTC/ETH movements. |

| 2033 | 0.06 | 15.00 | 3.50 | Deep Web3 integration; macro headwinds are the biggest wildcard here. |

| 2034 | 0.05 | 18.00 | 4.50 | Best case: Lido becomes the "gold standard" for staking. Worst case: pure stagnation. |

| 2035 | 0.04 | 20.00 | 5.50 | Long-term growth via adoption; roughly a 20% CAGR if things go according to plan. |

The numbers above reflect the current outlook for Lido DAO, as crunched by the ASCN.AI crypto assistant:

“Lido DAO isn't just another DeFi protocol—it's a cornerstone of the staking ecosystem. If you’re trying to predict LDO’s path, you have to look at real-time market data, not just surface-level hype.”

So, what exactly is Lido DAO?

Lido DAO is a decentralized powerhouse that runs the Lido protocol—the undisputed heavyweight champion of Ethereum staking. But the LDO token isn't just a digital coin you hold for fun. It’s the engine of the DAO, giving holders a seat at the table to vote on major decisions while aligning everyone's economic interests.

At its core, Lido makes staking simple. Instead of the headache of running your own node or locking up funds, you just delegate. You get liquid tokens back, which you can use across the DeFi world or trade whenever you want. For LDO holders, that liquidity is the real "killer feature."

- LDO holders call the shots on protocol governance;

- It’s not just for Ethereum—Solana and others are (or were) in the mix;

- Tight integration with top DeFi platforms ensures your assets stay liquid.

This is why Lido DAO keeps drawing in investors who want more than just passive yield—they want a stake in the infrastructure of the DeFi future.

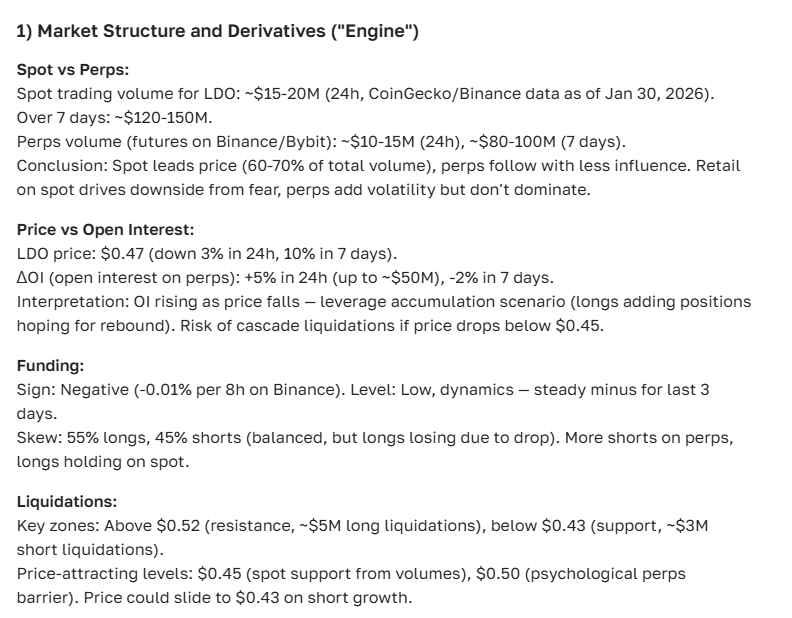

LDO’s price action right now

LDO is notoriously volatile, which is par for the course for anything tied to the hip with Ethereum. Recently, the price has been hovering between $1.40 and $1.55. It’s seen a bit of a bounce lately, mostly thanks to a broader recovery in the DeFi sector after a few rough patches.

Over the last week, LDO climbed more than 8%. This reflects a renewed interest in Ethereum staking and some positive sentiment around Lido's recent protocol tweaks.

One thing to keep in mind: LDO almost acts like a shadow of Ethereum. When ETH sneezes, LDO usually catches a cold. If you’re forecasting LDO, you’re essentially forecasting ETH’s momentum as well.

“LDO price action is a mirror of Ethereum’s health, fluctuating with staking activity and general market vibes.” — ASCN.AI Report (2025).

The news driving the narrative

What’s actually moving the needle for Lido DAO? It usually boils down to a few key things:

- New updates that broaden blockchain support;

- The ever-looming threat of tighter DeFi regulations;

- Strategic partnerships with major funds and platforms;

- How Ethereum itself is performing day-to-day.

Lately, the buzz has been around a proposed change to Lido’s fee structure. If it goes through, it could boost rewards for LDO holders, which is a classic catalyst for a price spike.

On the flip side, whenever a major staking protocol has a glitch or Ethereum takes a dive, LDO tends to overcorrect. It’s hard to escape that gravity.

“Protocol upgrades and regulatory hurdles remain the two biggest swing factors for Lido DAO’s valuation.” — ASCN.AI Report (2025).

Where is the price headed?

The short-term view (Today & Tomorrow)

In the immediate future, we’re likely looking at some modest growth, with LDO probably settling into the $1.45–$1.60 range. The demand for staking services isn't going anywhere, especially as Ethereum 2.0 matures.

If a fresh partnership announcement drops or a protocol improvement goes live, don't be surprised to see a quick jump. But remember, in this market, "stability" is a relative term.

The monthly outlook

Looking a month out, the picture seems a bit more optimistic. If the broader market stays steady and Lido successfully rolls out its latest updates, we could see the price push past the $1.70–$1.80 resistance level.

- It all depends on Ethereum's fundamental strength;

- Success of new Lido protocol features;

- The general "risk-on" or "risk-off" mood of the DeFi community.

Technically speaking, LDO looks like it’s building a solid base at its current support levels, potentially prepping for a leg up.

What could send it soaring—or crashing?

The Bull Case:

- Proof-of-Stake (PoS) networks become the global standard;

- More DeFi integrations make liquid staking tokens indispensable;

- Lido grabs an even bigger slice of the total staking market.

The Bear Case:

- Classic crypto volatility scares off the "paper hands";

- Regulators decide to get aggressive with DeFi protocols;

- A technical vulnerability or bug is discovered in the code.

“The appetite for PoS and the utility of liquid tokens are the primary engines behind LDO’s growth.” — ASCN.AI DeFi Review (2025).

Crunching the technicals

Support for LDO is sitting around $1.35 and $1.28. If things get rocky, those are the floors to watch. On the way up, resistance is waiting at $1.60 and $1.75.

If you look at the MACD and RSI, there’s a distinct bullish lean. It suggests that once this consolidation phase ends, the upward trend is ready to resume.

“Indicators like MACD and RSI suggest strong upside potential, with solid support at $1.35.” — ASCN.AI, 2025.

By the way, if you want to get nerdy with technical indicators, check out our guide on the best technical analysis strategies.

What the community is saying

If you hang out on crypto forums, the mood is a mixed bag, though mostly leaning towards "cautiously bullish":

- People are excited about Lido’s lead in liquid staking;

- Everyone is comparing current yields and trying to find the best edge;

- Regulatory risks are the main thing keeping people up at night.

Could LDO "RIP"?

In crypto slang, to "RIP" usually means a total price collapse. While anything is possible during a black swan event or a massive security breach, LDO’s high liquidity and multi-chain approach make a total "RIP" scenario much less likely than your average altcoin.

“Understanding the risk of a sharp drop helps you stay grounded when investing in something like Lido DAO.” — ASCN.AI Analytics, 2025.

The million-dollar question: Should you buy LDO?

LDO is definitely an interesting play if you believe in the future of DeFi and staking. But before you hit the "buy" button, keep these things in mind:

- ETH's price is your primary indicator;

- Decide if you’re trading the swings or holding for years;

- Keep a close eye on protocol news—it changes everything.

Smart ways to play it:

- Consider dollar-cost averaging (DCA) for a long-term position;

- Use analytical tools to cut through the noise;

- Leverage AI assistants to get data before the crowd reacts.

“Investors using AI tools tend to make more confident, data-driven moves.” — See the Falcon Finance Case Study by ASCN.AI.

FAQ: Lido DAO at a glance

What is LDO’s price right now?

It’s sitting around $1.50, showing some upward momentum.

Is a massive rally coming?

It’s possible, especially if Ethereum 2.0 continues to thrive and Lido stays the dominant staking choice.

Can I lose money?

Of course. Volatility and technical risks are always part of the deal in crypto.

Is it a good long-term hold?

If you’re bullish on the crypto market as a whole and can handle the swings, yes.

Where do I buy it?

Most big exchanges—both the centralized ones (CEX) and decentralized ones (DEX)—carry LDO.

How LDO stacks up against the competition

| Asset | Price (USD) | Monthly Change | Market Cap ($B) |

|---|---|---|---|

| Lido DAO (LDO) | 1.50 | +12% | 1.2 |

| Ethereum (ETH) | 1860 | +15% | 230 |

| Solana (SOL) | 22 | +5% | 8.5 |

| Avalanche (AVAX) | 16 | +8% | 4.7 |

Rookie mistakes to avoid

- Forgetting that LDO and ETH are practically joined at the hip;

- Ignoring the news about security or new regulations;

- Putting all your eggs in one basket (diversify!);

- Buying when the hype is at its peak without checking the charts.

Lido vs. The Others

| Metric | Lido DAO (LDO) | Rocket Pool (RPL) | Ankr (ANKR) |

|---|---|---|---|

| Market Cap ($B) | 1.2 | 0.4 | 0.5 |

| Blockchains | ETH, SOL | ETH | ETH, Polygon |

| Annual Yield | ~5–7% | ~4–6% | ~6–8% |

| Staking Type | Liquid | Delegated | Delegated |

| DAO Control | Full | Partial | Partial |

The Bottom Line

The outlook for Lido DAO looks fairly bright for now. As PoS networks grow and the protocol adds more bells and whistles, LDO’s value proposition only gets stronger.

Sure, there’s the usual volatility and some regulatory shadows, but the growth potential is hard to ignore. Just stay sharp, watch the technical levels, and don't be afraid to use modern tools to help you decide.

“Lido DAO is effectively the key to liquid staking and the evolution of DeFi.”

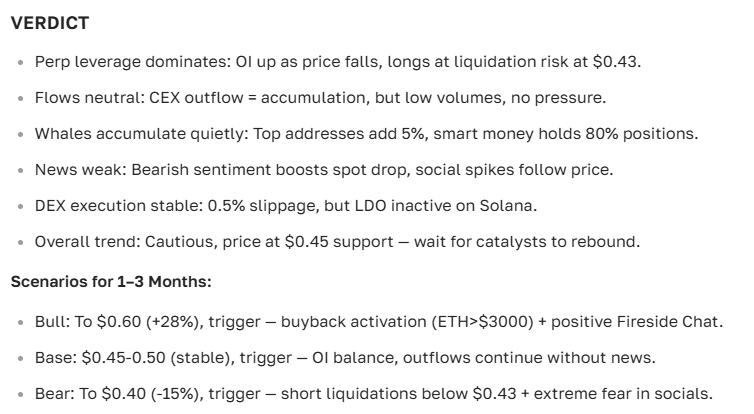

Here is the final verdict from our ASCN.AI assistant regarding LDO:

Disclaimer

This info is for educational purposes and isn't financial advice. Crypto is a high-risk game. Always talk to a professional before making big moves with your money.