Komodo (KMD) Price Forecast 2025-2036: Full Analysis and Outlook

about cryptocurrencies.

Got a burning question about crypto? Our AI assistant has the answers. Start your analysis right here.

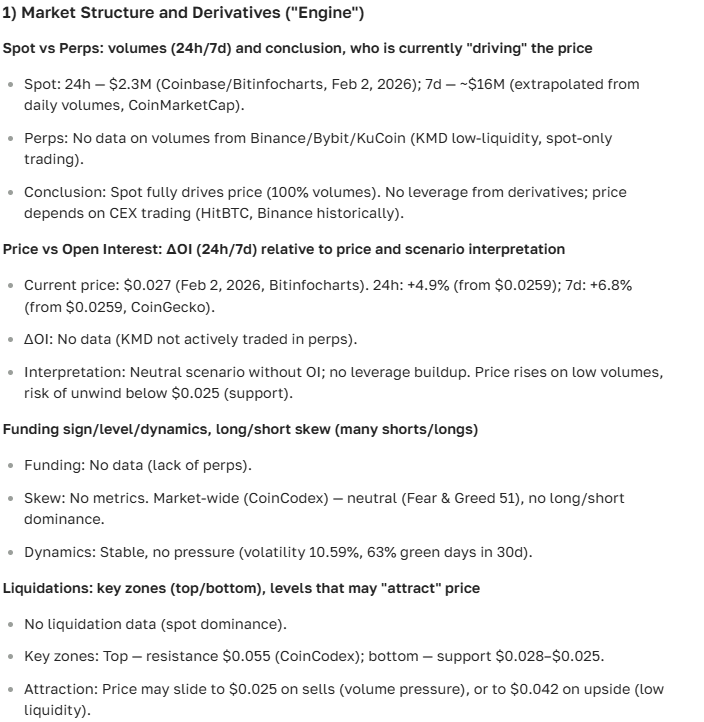

| Year | Min Price (USD) | Max Price (USD) | Average Price (USD) | What’s driving the price? |

|---|---|---|---|---|

| 2026 | 0.0107 | 0.37 | 0.05 | Growing appetite for privacy-centric assets; potential DeFi protocol tie-ups; the usual BTC correlation. Risks: Regulators in the EU/US tightening the screws on privacy coins. Historically, KMD swings around 200% a year. |

| 2027 | 0.019 | 0.13 | 0.07 | SuperNET ecosystem upgrades; Web3 integration; post-BTC halving ripples. Optimists see a 150% jump if adoption sticks. Realists worry about Monero and Zcash eating their lunch. |

| 2028 | 0.025 | 0.20 | 0.09 | Global shift toward private transactions; protocol refreshes. Main risk: a broader bear market triggered by inflation. Expect a steady 30% YoY growth based on past cycles. |

| 2029 | 0.030 | 0.35 | 0.12 | Cross-chain expansion; AI hitting the crypto mainstream. In a bull run scenario, we could see $0.35. Watch for institutional money moving into niche tokens. |

| 2030 | 0.070 | 0.50 | 0.18 | Long-term dPoW adoption; potential new exchange listings. Market maturity could drive 50–100% gains. The wild card: potential quantum threats to privacy tech. |

| 2031 | 0.044 | 0.25 | 0.14 | Market stabilization; a pivot toward sustainability. Moderate growth is the likely path as digital finance goes global. If CBDCs integrate, things get interesting. |

| 2032 | 0.10 | 1.54 | 0.40 | Innovation breakthroughs like refined atomic swaps; some analysts eye a $1.51 peak if mass adoption hits. The catch? New privacy protocols emerging from left field. |

| 2033 | 0.095 | 1.13 | 0.45 | Regulatory clarity (think post-MiCA in the EU); 20–50% YoY growth. Institutional interest in specialized assets will be the main engine here. |

| 2034 | 0.12 | 1.50 | 0.55 | A mature privacy market; steady 25% climbs on positive news cycles. Global recessions remain the primary "black swan" risk. |

| 2035 | 0.13 | 1.80 | 0.65 | The "Blue Sky" scenario: KMD becomes a standard for private chains, potentially up 288% from today. Still, volatility isn't going anywhere; $0.13 is the floor if things stall. |

Here’s how the ASCN.AI crypto assistant breaks down the Komodo outlook:

“Komodo is one of those projects with a unique architecture. Its massive ecosystem provides a really solid foundation for whatever the crypto market throws at it in the coming years.”

What’s the deal with Komodo (KMD)?

Komodo (KMD) isn't just another coin; it’s a blockchain platform built with a focus on security, privacy, and making dApps actually scale. The big idea? A flexible network of independent blockchains living under one roof, protected from 51% attacks and capable of talking to each other through cross-chain tech.

In practice, Komodo focuses on moving data and tokens securely, often using high-speed confidential transactions. It’s a direct response to the growing demand for privacy that doesn't sacrifice user experience.

A bit of history and the tech that matters

Launched back in 2016, Komodo grabbed attention early on with its focus on decentralization. At its core is the Komodo Smart Chain, which handles "Atomic Swaps"—basically, trading assets directly without needing a middleman or a centralized exchange.

- The Security Angle: Their delayed Proof-of-Work (dPoW) tech is clever. It essentially "recycles" Bitcoin's mining power to protect its own network, making it incredibly hard to hack.

- Scaling up: By running multiple independent chains in parallel, the main network doesn't get clogged up.

- Privacy: They use zk-SNARKs protocols to keep transaction details under wraps when needed.

- Versatility: It supports DeFi and NFTs, which keeps it relevant in the modern crypto landscape.

Think of dPoW as a safety net that hashes Komodo’s data onto the Bitcoin blockchain, giving it top-tier security.

By using zk-SNARKs, Komodo manages to offer high-level anonymity without breaking the system.

KMD's current pulse: Price and dynamics

As of June 2024, Komodo is sitting somewhere between $0.50 and $0.60. It’s showing average volatility, moving mostly in sync with the broader market and internal ecosystem updates. It’s the usual mix of macro trends and project-specific milestones driving the price.

The Forecast: Where is KMD headed?

Recent snapshots put Komodo around $0.56, up about 5% over the last week. This little rally seems tied to fresh network updates and a general "feel-good" vibe in the DeFi sector lately.

Over the past month, we saw KMD hit highs of $0.65 before cooling off to current levels. These swings are a classic sign of trader activity and shifting community interest.

Keep in mind that tech news almost always dictates short-term price action. — Market Review: Binance Insights

The "Why": Factors moving the needle

The market is usually sensitive to a few key things:

- Tech Upgrades — Better security and faster optimization usually lead to a price bump.

- Partnerships — Every time they integrate with a big DeFi or NFT platform, the market notices.

- Regulation — Changes in major markets (US/EU) can add risk or provide a green light.

- Social Sentiment — Sometimes a simple spike in Twitter chatter or a meme can cause a temporary price surge.

Strategic tie-ups in the DeFi and NFT space are huge for long-term demand. — Case Study: How partnerships drive price

Short-term outlook: Today, Tomorrow, and Next Month

- Today: Holding steady around $0.56.

- Tomorrow: If the mood stays positive, we could see a push toward $0.58–$0.60.

- Monthly view: Barring any bad news, the target range looks like $0.70–$0.75.

Growth vs. Risk: The Reality Check

- Constant platform evolution;

- A growing list of partners;

- A generally expanding crypto market.

But watch out for:

- Standard crypto market volatility;

- New regulatory hurdles;

- Heavy competition from newer blockchain projects.

Regulatory shifts remain the biggest "if" for assets like Komodo. — Bitcoin Factor Analysis

What the community is saying

The general consensus? Komodo has great tech but sometimes struggles with liquidity. Most discussions revolve around whether the next big feature will finally trigger a major breakout.

Investing in KMD: Some thoughts

KMD looks like a candidate for long-term holding or portfolio diversification. But you’ve got to stay on top of the news—this isn't a "set it and forget it" asset if you want to maximize gains.

Deep Dive: What actually drives Komodo's price?

Technical Evolution

- Better transaction speeds and tighter security create a bullish narrative.

- New features keep investors interested and the platform useful.

Partnerships

- Collaborations with DeFi platforms directly boost KMD token demand.

- Every new cross-chain integration makes the ecosystem stickier.

The Macro Picture

- Global finance, inflation, and currency shifts always bleed into crypto.

- Investor appetite for risk is the tide that lifts (or sinks) all boats.

The Technicals

A quick look at the indicators most analysts are watching:

Relative Strength Index (RSI): Currently around 55, suggesting the market is balanced—neither overbought nor oversold, with room to move up.

MACD: We're seeing a bullish crossover, which often points to a continuing upward trend.

Moving Averages: Short-term averages (7, 14, 50-day) are sitting above the 200-day line. That’s a classic bullish signal.

Candlestick Patterns: We’ve spotted "Hammers" and "Bullish Engulfing" patterns lately, reinforcing the idea that buyers are stepping in.

Volume: Higher trading volume is backing up the price increases, which shows there's actual weight behind the move.

Indicators like RSI and MACD are your best bet for spotting trend reversals before they happen. — Mastering Indicators in 2025

External Influences

- Government regulations in key regions.

- "Whale" activity—large moves by big holders.

- New innovations from competitors in the privacy space.

Reading the KMD Charts

The Indicators: RSI in the 50-60 range shows a market that's leaning bullish but isn't overheated yet. Moving averages across different timeframes confirm this upward bias.

Projecting Moves: Analysts are watching for breaks above key resistance levels. If volume supports a breakout, the trend is likely to hold.

Fundamental Analysis: The core of Komodo

The team is made up of seasoned blockchain engineers, and the project is open-source. Frequent GitHub updates are a great sign—it means the project is alive and kicking.

Transparency and regular code commits are usually the hallmark of a mature project. — Blockchain 101 Guide

The Roadmap

They’ve got new DeFi products and better NFT support on the horizon. This steady stream of development helps keep the project relevant while others fade away.

Komodo Price Prediction by Year

| Year | Min Price (USD) | Average Price (USD) | Max Price (USD) |

|---|---|---|---|

| 2025 | 0.036 | 0.040 | 0.07 |

| 2026 | 0.013 | 0.026 | 0.045 |

| 2027 | 0.012 | 0.023 | 0.033 |

| 2028 | 0.023 | 0.040 | 0.056 |

| 2029 | 0.05 | 0.11 | 0.165 |

| 2030 | 0.043 | 0.083 | 0.123 |

| 2031 | 0.05 | 0.08 | 0.11 |

| 2032 | 0.077 | 0.14 | 0.21 |

| 2033 | 0.18 | 0.37 | 0.55 |

| 2034 | 0.14 | 0.23 | 0.32 |

| 2035 | 0.17 | 0.27 | 0.38 |

| 2036 | 0.28 | 0.53 | 0.78 |

2025: The Short Term

Expect a slow climb toward $0.07, driven mostly by DeFi hype and tech tweaks.

2026–2030: The Medium Term

If the roadmap is executed well, we could see prices hitting the $0.12–$0.16 range as the user base grows.

2031–2036: The Long Game

If Komodo holds its ground and the industry matures, $0.50–$0.80 is definitely on the table.

FAQ: What people are asking

Is Komodo actually a good investment?

If you're looking to diversify and have a long-term horizon, KMD has the technical chops to make it worth considering.

Could the price explode?

If they hit all their tech milestones and the market stays healthy, breaking the $1 mark isn't impossible.

Where will KMD be in 5 years?

With steady development, the tech could easily support a valuation in the "multi-dollar" range, though that's far from guaranteed.

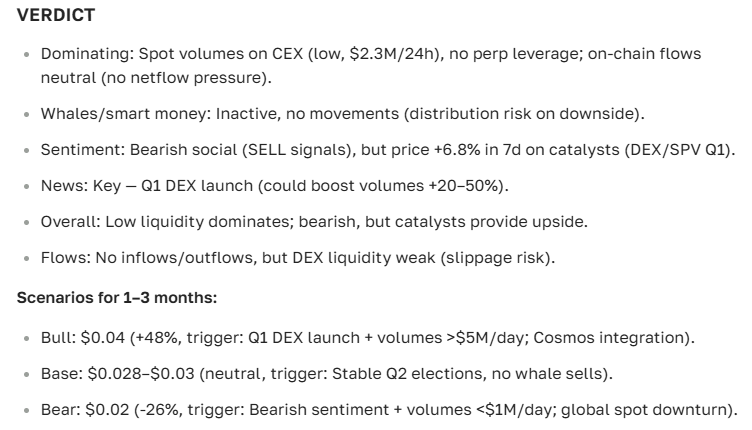

The Verdict

Komodo has a rock-solid foundation. While volatility is part of the package, the technical trajectory is promising. If you're trading this, use tools like ASCN.AI to filter out the noise and watch the data in real-time.

By the way, here’s the final word from our ASCN.AI assistant:

Conclusion

KMD’s future is a mix of tech innovation and market sentiment. It’s a project that shows real potential if you know how to navigate the risks.

Disclaimer

This is for informational purposes only—not financial advice. Crypto is risky. Always talk to a professional before putting your money on the line.