Jupiter price prediction: comprehensive overview and analysis for 2026-2035

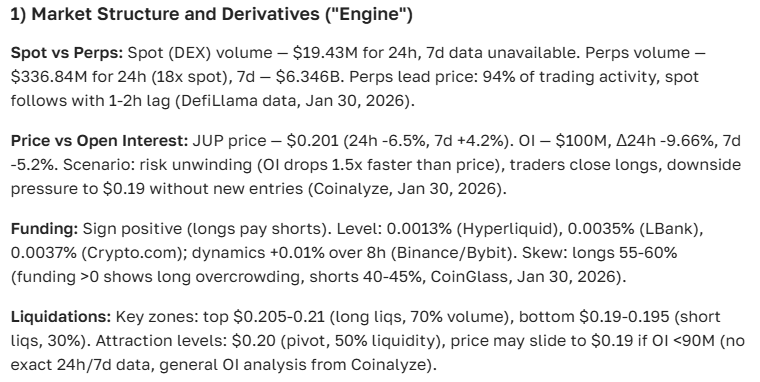

about cryptocurrencies.

Got a burning question about crypto? Our AI assistant is ready to help. Start your analysis right here.

| Year | Min Price (USD) | Max Price (USD) | Average Price (USD) | The Driving Factors |

|---|---|---|---|---|

| 2026 | 0.15 | 0.55 | 0.35 | Growth in Jupiter’s TVL (currently ~$2B) and deeper Solana integrations. The catch? Post-BTC halving volatility and SEC scrutiny on DeFi. Still, we might see a 50–150% jump from where we are now. |

| 2027 | 0.20 | 0.65 | 0.45 | More people staking JUP and new liquidity pools. Solana’s massive scaling (TPS > 100k) helps, but competition from Uniswap v4 remains a real threat. |

| 2028 | 0.25 | 0.80 | 0.55 | Solana’s ecosystem continues to scale; rumors of a JUP 2.0 launch might stir the market. On the flip side, keep an eye on macro inflation and economic downturns. |

| 2029 | 0.30 | 1.00 | 0.65 | Solidifying its spot as the top Solana DEX with over 20% market share. Gaming and NFTs on Solana could be the "X-factor" here. Watch out for protocol forks, though. |

| 2030 | 0.35 | 1.50 | 0.80 | Entering a long-term bull cycle with potential new CEX listings. We’re looking at a possible 300–700% ROI from 2026 levels. Regulation (like MiCA) is the biggest hurdle. |

| 2031 | 0.40 | 2.00 | 1.00 | Deep Web3 integration and the rise of mobile-first DeFi. Institutional money starts flowing into Solana in a big way. Environmental concerns over PoS could be a talking point. |

| 2032 | 0.50 | 2.50 | 1.30 | Expanding into cross-chain territory with Ethereum bridges. JUP might even become a go-to utility token for metaverses. Market consolidation is the main risk here. |

| 2033 | 0.60 | 3.00 | 1.60 | DeFi reaches maturity. JUP likely lands in the top 50 by market cap. Growth in emerging markets drives adoption, though geopolitical tension remains a wildcard. |

| 2034 | 0.70 | 4.00 | 2.00 | Yield farming and governance get a massive tech overhaul. Expect a potential 500%+ gain compared to 2030, assuming Solana’s tech stays stable. |

| 2035 | 0.80 | 5.50 | 3.00 | The "DeFi 2.0" era. JUP becomes a staple asset. If billions are using blockchain by then, these numbers make sense. The real threat? Draconian bans or a total shift to CBDCs. |

Here’s how our AI assistant at ASCN.AI breaks down the Jupiter outlook:

“Jupiter combines technical edge with a growing market cap, making it a serious contender for both short-term traders and long-haul investors. We’re tracking its pulse closely, weighing the tech against the hype to give you a clear picture of where it’s going.”

Where is Jupiter heading? A look at the forecast

Jupiter isn’t just another ticker symbol; it’s a project trying to solve the real-world headaches of decentralized finance and smart contracts. Naturally, investors are watching the JUP price like hawks. It’s more than just a number—it’s a reflection of market trust and the project's actual utility. If you want to make smart moves in crypto, you have to understand what’s actually moving the needle.

The price acts as a barometer for how the asset handles market chaos and bigger economic shifts. For the most part, it’s a measure of how well the team is sticking to their roadmap while trying to scale the whole ecosystem.

So, what actually moves the price?

In practice, it usually comes down to three big things:

- Tech upgrades. When the developers roll out new features, it draws people in. Better speed and tighter security usually translate to a higher market cap.

- The classic supply and demand dance. This is where the volatility happens. Trader activity and exchange liquidity can send the price on a rollercoaster in a matter of hours.

- The "Big Picture." We're talking about new laws, inflation, and global tech trends. When the SEC sneezes, the whole crypto market catches a cold, and Jupiter is no exception.

These factors don't work in isolation. They’re all tangled up, shaping how much capital flows in and what people expect next.

A quick look back

Jupiter has come a long way since its early testing days. It started with low stakes and early believers, followed by the typical "crypto volatility" phase—sharp spikes followed by corrections whenever news broke or the macro environment shifted.

The biggest rallies usually happened right after major updates or when the DeFi sector started heating up. Looking at the history, it’s clear: when the tech grows, the price eventually follows.

Where JUP stands right now

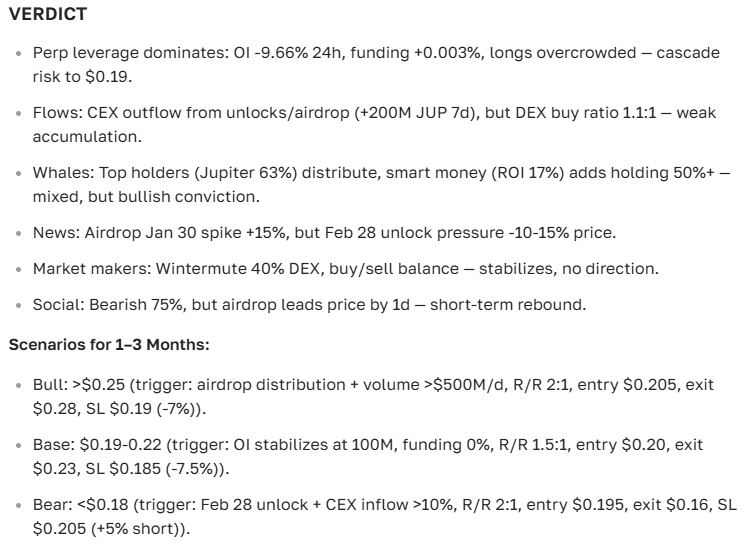

As of July 2025, Jupiter is trading at $0.19. It’s showing some decent resilience despite the usual market noise. Over the last month, we’ve seen a slow but steady climb, with the token pushing through some tough resistance levels.

It’s not a vertical line up, but the "buy the dip" mentality seems strong here, which suggests investors are still feeling pretty optimistic about the project's future.

How it stacks up against the big players

When you compare JUP to the Dollar, Euro, or Bitcoin, you see a familiar story. It tracks closely with the broader market. It’s holding its own against the USD, though its pairing with Bitcoin is a bit more erratic—which is totally normal for an altcoin in this space.

The latest buzz: What’s hitting the news?

Between 2024 and 2025, the dev team hasn't been sitting idle. They’ve managed to boost transaction speeds and harden the network’s security. That makes the token a lot more attractive for power users. Plus, new partnerships are making the ecosystem feel a lot more "grown-up." If you want the full story on these alliances, you can check out our deep dive on how partnerships affect price.

The Macro View

Let's be real: things like interest rate hikes and global inflation matter. When the traditional financial system feels shaky, people start looking at digital assets as a lifeboat. Any big moves by "whales" or shifts in global regulation will cause ripples in Jupiter’s price, leading to those short-term swings we all love (or hate).

Short-term outlook: Today, Tomorrow, and Next Month

Looking at tomorrow? We might see a small 1-3% bump. The news cycle is positive, and demand is steady. Indicators suggest we’re about to test the next resistance level. By the way, if you’re into the nitty-gritty of charts, we have a guide on the best technical indicator strategies.

The Weekly View

Over the next seven days, we’re anticipating a 3-7% climb. New investors are trickling in, and the project feels stable. Of course, a sudden market-wide correction could throw a wrench in that, but the trend looks healthy.

The Monthly View

By the time the month wraps up, we could be looking at $0.21–$0.22. This assumes the community keeps growing and the new features get rolled out without a hitch. Just keep an eye on those macro headlines.

What the charts are saying

Moving Averages (SMA, EMA)

The charts are screaming "upward trend." The 50-day EMA is comfortably above the 200-day, which is usually a sign that the bulls are still in control for the long haul.

Relative Strength Index (RSI)

The RSI is hovering between 55 and 65. Translation? It’s not overbought yet. There’s still plenty of "room to run" before things get too heated and a correction becomes inevitable.

Patterns and Oscillators

We’re seeing a "bullish engulfing" pattern on the candles. For those who speak "trader," that’s often a green light for more upward movement.

The Mid-Term: 2024 to 2030

By the end of 2024, JUP will likely settle into the $0.17–$0.22 range. It’s all about execution now—updates, community growth, and platform stability. Moving into 2026-2030, we could see a more aggressive trend, potentially hitting anywhere from $0.20 to $0.67 as DeFi and NFTs become even more mainstream.

Growth Patterns

Expect periods of boring consolidation followed by bursts of high volatility. That’s just the nature of the beast. Jupiter is currently in the middle of a growth phase, and if it holds its ground, the upside looks solid.

The Long Game: 2031-2040

If we look a decade or more into the future, the numbers get interesting. If Jupiter stays relevant and keeps its tech edge, we could see prices between $0.60 and $3.00. It’s a big "if," but the potential for mass adoption in fintech is there.

2040: The Moonshot?

By 2040, if the digital economy is the standard, JUP could theoretically hit $0.39 to $4.00. It’s a favorite target for long-term "HODLers" who believe in the total digitization of finance.

Macro and Tech Foundations

The shift toward decentralized services is a massive tailwind. As long as Jupiter keeps innovating, it should maintain its competitive edge against the sea of other altcoins.

Risks and Rewards: The Honest Truth

Jupiter is a fascinating asset, but don’t go in blind. It’s a mix of cutting-edge tech and a growing fan base, but the risks are real. If you’re not a fan of volatility, this might not be for you.

The Catch

What could go wrong? A few things:

- The crypto market is notoriously moody (high volatility).

- Governments could get heavy-handed with regulations.

- The tech could have bugs or vulnerabilities.

- A newer, shinier project could steal Jupiter's lunch.

Regulation remains the biggest "gray cloud" over the whole sector.

How does it compare?

Jupiter holds its own against other altcoins by focusing on a specific niche. Compared to "safe" traditional stocks, it’s much more volatile. That means higher potential rewards, but it also means you could lose your shirt if you’re not careful.

FAQ: People also ask...

What’s the price going to be next week?

We’re looking at a possible 3-7% rise. For the month, $0.21–$0.22 seems realistic if the market stays steady.

Can it hit a new high in 2025?

It’s possible. If the roadmap stays on track, $0.22 is a very reachable target by the end of 2025.

Where will JUP be in 10 years?

Predictions suggest around $0.39, but that depends entirely on how the broader crypto market matures.

What’s the main thing driving the price?

Tech updates and DeFi partnerships are the big ones. But don't ignore trading volume and the general vibe of the global economy.

What mistakes do JUP investors usually make?

Emotional trading is the big killer. People overreact to short-term dips and ignore the long-term tech fundamentals. If you want to stay sane, use a tool like ASCN.AI to get objective data instead of following the hype.

The Final Verdict

The outlook for Jupiter is cautiously optimistic. It has the tech and the potential to be a mainstay in a high-growth portfolio. Just remember to play it smart and don’t invest more than you can afford to lose.

Using these forecasts wisely

Don't just blindly follow a chart. Use these predictions to shape your own strategy—whether that's buying and holding or looking for a short-term exit. Always balance the data with your own risk tolerance.

“Jupiter is that rare mix of tech maturity and market "room to grow." It’s definitely one to keep on your radar.”

And here is the final take from our AI assistant, ASCN.AI:

Real-world cases from ASCN.AI

- The Falcon Finance (FF) Crash | How 2 prompts saved $1000 — See how quick analytics can save you from a disaster.

- The Oct 11 Flash Crash Case Study — How to profit when the market goes sideways in the middle of the night.

Disclaimer

This article is for informational purposes only and is not financial advice. Crypto investments are high-risk. Always talk to a professional before making any big financial moves.