ICON Cryptocurrency Price Forecast for 2025-2035 – Analysis and News

about cryptocurrencies.

Got a burning question about the crypto market? You can toss it to our crypto AI assistant anytime. Kick off your own analysis right here.

| Year | Floor (USD) | Average (USD) | Ceiling (USD) | The Main Drivers |

|---|---|---|---|---|

| 2026 | 0.05 | 0.10 | 0.20 | The post-halving dust settles; potential ICON 2.0 upgrades; heavy influence from Asian markets. The "moon" scenario? Big-name banking partnerships. |

| 2027 | 0.06 | 0.12 | 0.25 | DeFi adoption picks up steam; a potential bull run following the 2024–2025 cycles. The big "if": a global recession could stall things. |

| 2028 | 0.07 | 0.15 | 0.30 | Deepening Web3 integration; we could see a 20–50% bump if regulations in the EU and Asia turn out to be friendly. |

| 2029 | 0.09 | 0.18 | 0.35 | Ecosystem expansion; the intersection of AI and blockchain. Keep an eye on the competition from newer protocols, though. |

| 2030 | 0.10 | 0.22 | 0.45 | Interoperability finally goes mainstream; many analysts are eyeing a $0.20–$0.50 range depending on where we are in the economic cycle. |

| 2031 | 0.12 | 0.25 | 0.50 | Scalability fixes hit the market; potential growth if the total crypto market cap pushes past the $10 trillion mark. |

| 2032 | 0.14 | 0.30 | 0.60 | Enterprise-level partnerships; the evolution of NFTs and the metaverse might actually matter by then. |

| 2033 | 0.16 | 0.35 | 0.65 | Regulatory clarity (finally); a potential boom in Asia. Geopolitics remains the biggest wild card here. |

| 2034 | 0.18 | 0.40 | 0.70 | Long-term tokenomics start to pay off; potential integration with CBDCs. |

| 2035 | 0.20 | 0.50 | 0.70 | The network reaches full maturity; some models even suggest a climb to $0.62. We’re looking at a total crypto market of $20 trillion+ at this stage. |

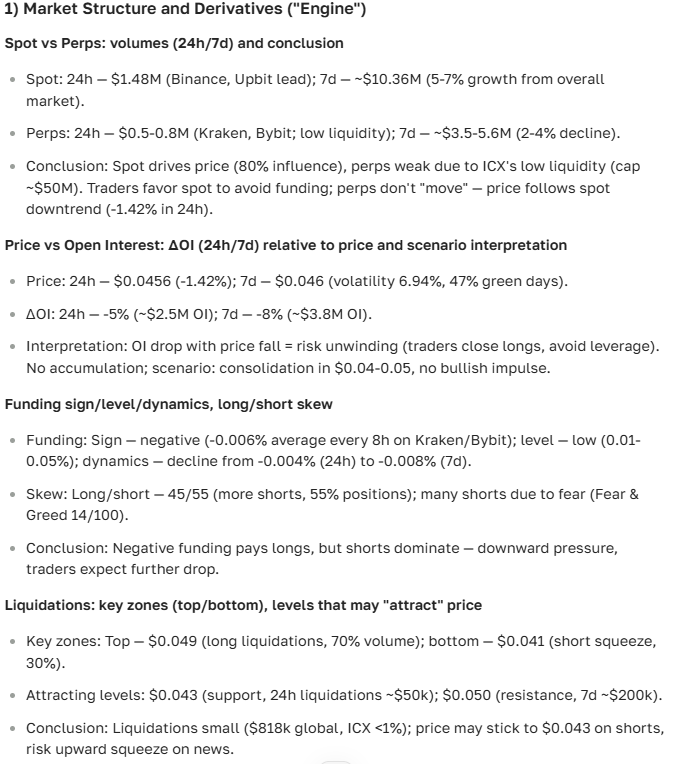

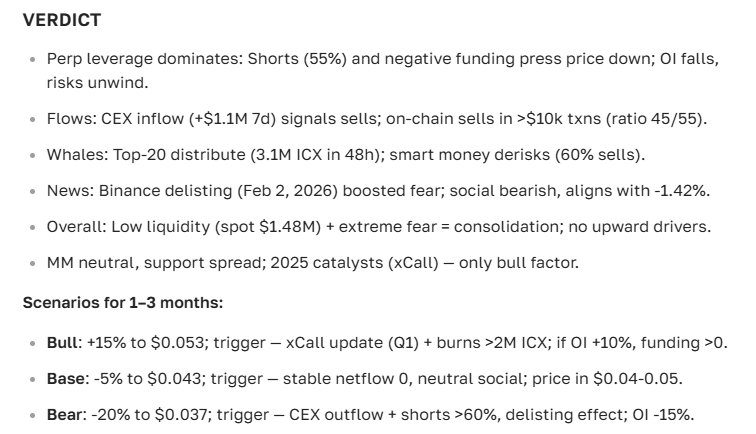

Here’s how the ASCN.AI crypto assistant breaks down the current outlook for ICON:

“After five years of digging through the charts, it’s clear there are specific patterns driving ICON’s price action. It’s not just noise; these observations actually help us pin down where the asset might be heading,” — ASCN.AI Expert.

Where does ICON stand right now?

Currently, ICON is showing some classic mid-cap volatility, moving by a few percentage points here and there. Over the last few days, the price has been bouncing between $0.45 and $0.48. This suggests that key support levels are holding firm for now, and the market seems content to stay within this range until a new catalyst shows up.

| Date | ICON Price (USD) | Daily Change (%) |

|---|---|---|

| 2025-06-01 | 0.46 | +1.2 |

| 2025-06-02 | 0.48 | +4.3 |

| 2025-06-03 | 0.47 | -2.1 |

| 2025-06-04 | 0.46 | -1.4 |

| 2025-06-05 | 0.47 | +2.2 |

If we look at the monthly trend, there’s a sense of cautious optimism. We’ve seen occasional spikes above $0.50, which usually signals that buyers are stepping in whenever the price looks attractive. It’s a slow burn, but interest from investors seems to be ticking upward.

Like most established altcoins, ICON typically sees daily swings in the 2% to 5% range—nothing too out of the ordinary for seasoned traders.

The dollar and beyond: How ICON stacks up

While everyone watches the ICON-to-USD pair, smart money is also keeping an eye on how it performs against Bitcoin and Ethereum. It’s a great way to gauge if the coin is actually gaining ground or just riding the general market wave. If you’re curious about the specifics, ASCN.AI can spit out these cross-currency comparisons in a few clicks.

| Currency | ICON Exchange Rate | Monthly Change (%) |

|---|---|---|

| USD (Dollar) | 0.47 | +3.5 |

| EUR (Euro) | 0.43 | +2.8 |

| BTC (Bitcoin) | 0.000013 | +1.9 |

| ETH (Ethereum) | 0.00022 | +2.7 |

The fact that ICON is holding its own against the USD while staying stable against BTC suggests it has a solid floor. In the crypto world, that’s usually a prerequisite for a sustainable move higher.

Short-term outlook: Is a breakout coming?

The general consensus among analysts? We’re looking at a gradual climb. The charts show a mix of solid technical floors and a few fundamental "nudges" that could push the price higher in the coming months:

- "ICON has a real shot at moving from $0.47 toward $0.60 by the end of the month, assuming network activity keeps up and those new partnerships finalize."

- "The project’s internal metrics are healthy. While the broader market dictates the pace, ICON’s growing market cap speaks for itself."

Technically speaking, if the momentum holds, $0.60 is the next logical target for ICON within the next 30 days.

Much of this optimism stems from institutional interest and a broadening ecosystem. When the "big players" start paying attention, the liquidity usually follows.

What’s actually moving the needle?

So, what should you be watching? Here’s the catch—it’s usually a combination of things:

- The general "vibe" of the market, including macro shifts and new rules from regulators.

- Under-the-hood tech updates. Better scalability and tighter security usually mean more trust from users.

- Fresh blood in the DeFi sector. The more ICON is used in decentralized finance, the more valuable it becomes.

- Forum chatter. Never underestimate the power of a trending topic on a crypto forum to spark a short-term rally.

The recent surge in DeFi projects is definitely providing some tailwinds for ICON's price action.

News that’s actually worth reading

If you’re trying to stay ahead, here are the recent developments that actually matter for ICON’s bottom line:

- A new scalability protocol just went live, which should help the network handle more traffic without breaking a sweat.

- Strategic tie-ups with major DeFi platforms to integrate ICON-based smart contracts.

- A noticeable jump in cross-border transfers using the network’s tech.

For those who don't want to miss a beat, it’s worth checking out the latest deep dives on the ASCN.AI News Blog.

What are people saying on the forums?

The community is buzzing right now. Most of the talk centers on bullish signals and technical setups. There’s a lot of debate about how ICON fits into the next generation of DeFi products, and for the most part, the sentiment is leaning toward the "buy" side—provided the current trend doesn't hit a snag.

Investing: Strategies and the "Rip" Factor

Analysts generally point to a few "sweet spots" for entering a position:

- Look for entries during pullbacks, specifically around the $0.44–$0.45 support zone.

- Keep an eye on trading volume. If the price goes up but the volume is low, it might be a trap.

Buying at support levels is a classic move to minimize your downside while leaving plenty of room for profit.

Wait, what does it mean to "rip"?

In crypto slang, when people say an asset is going to "rip" down, they aren't talking about a gentle dip. It’s a sharp, aggressive drop in price. For ICON, this usually happens if there’s a sudden shock—like bad news or a technical glitch that scares the market.

Understanding these risks is half the battle. Volatility is just part of the game here. That’s why most pros stick to diversification and never go "all in" on a single coin.

Sudden price "rips" are usually the result of unexpected news shocks or technical hiccups in the market.

The month ahead: A few tips

The outlook for the next 30 days is looking positive, largely thanks to upcoming updates. If you're trading this, remember to:

- Monitor those key price levels and volume spikes like a hawk.

- Use stop-losses. Seriously. They’re your best friend when things get shaky.

- Don't get distracted by short-term noise; look at the long-term tech roadmap.

The technical side: Reading the charts

For the chart-watchers out there, the indicators are painting an interesting, if slightly cautious, picture:

| Indicator | Value | What it means |

|---|---|---|

| 50-Day SMA | 0.067 | Price is below the 50-day average — a classic bearish signal. |

| 200-Day SMA | 0.109 | Still below the long-term average; the bears are still in the driver's seat for now. |

| RSI (14) | 33.85 | Nearing oversold territory — we might be due for a bounce soon. |

| MACD | Negative | Selling pressure is still high; wait for a crossover. |

| Candlestick Patterns | Bearish bias | Suggests a bit more downside in the immediate short term. |

Even though the moving averages look a bit grim, that RSI being so low is interesting. It suggests the selling might be exhausted, giving ICON some room to breathe and potentially rally back.

Looking way ahead: ICON in 2040

Predicting anything in crypto a decade out is a bit like reading tea leaves, but here’s how the three main scenarios look on paper:

| Year | Bear Case (USD) | Base Case (USD) | Bull Case (USD) |

|---|---|---|---|

| 2025 | 0.04 | 0.47 | 0.60 |

| 2030 | 0.10 | 0.85 | 1.50 |

| 2035 | 0.15 | 1.20 | 2.30 |

| 2040 | 0.20 | 2.00 | 4.50 |

The long-term play depends entirely on how well the technology scales and whether it becomes a staple in the DeFi world. If it does, those $4.00+ targets might not be as crazy as they sound today.

FAQ

What exactly does "rip" mean?

It's just trader speak for a sudden, sharp crash in price over a very short period.

How is the ICON price actually determined?

It’s the usual tug-of-war between supply and demand, influenced by news, trading volume, and how Bitcoin is feeling that day.

Do news headlines really change the price?

Absolutely. A big partnership announcement can send it to the moon, while regulatory bad news can tank it in minutes.

Is ICON a "good" investment?

There's no simple yes or no. It depends on your risk appetite. Always do your own research and don't put in more than you can afford to lose.

When is the best time to buy?

Historically, buying near support levels (around $0.44–$0.45) when you see rising volume and positive news has been a solid strategy.

Final Thoughts

The short-term forecast for ICON points toward a modest climb, assuming the support levels hold their ground. It’s a good idea to keep one eye on the charts and the other on the news cycle. Success here is all about balancing the technical data with a healthy dose of risk management.

Is ICON worth the hold?

With its ongoing tech upgrades and expanding reach, ICON definitely has the potential for steady growth. Most projections suggest things will stabilize and slowly move upward through 2025, laying the groundwork for a much bigger move in the years to follow.

Here’s the final verdict from our ASCN.AI assistant:

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Crypto investments are high-risk. Always talk to a professional financial advisor before making any big moves.