Hyperliquid cryptocurrency price prediction: price and prospects for today and the future

about cryptocurrencies.

Got a burning question about where the market is headed? You can always bounce ideas off our crypto AI assistant at ASCN.AI to start your analysis right now.

| Year | HYPE Price (Base, USD) | HYPE Price (Bull, USD) | HYPE Price (Bear, USD) | TVL ($B USD) | Trading Vol ($T USD/yr) | What’s driving this? |

|---|---|---|---|---|---|---|

| 2026 | 45–55 | 60–70 | 20–30 | 5–7 | 10–15 | Token unlocks will definitely spark some selling pressure, but whale activity and staking could push OI past $15B. Keep an eye on Hyperliquid’s lead in the Perp DEX space. Major risk: US/EU regulators waking up. |

| 2027 | 70–90 | 120–150 | 30–45 | 10–15 | 20–30 | The ecosystem starts branching out (HiHYPE, HAUS). If they bridge successfully with Solana/Eth and the post-halving bull run kicks in, things look bright. The real threat? Stiff competition from big CEXs. |

| 2028 | 110–140 | 200–250 | 45–70 | 20–30 | 40–60 | DeFi finally hits the mainstream. We're looking at TVL over $20B as new protocols join the party. HYPE turns into a serious utility token for data feeds. Watch out for a potential macro recession, though. |

| 2029 | 160–200 | 300–400 | 70–100 | 35–50 | 70–100 | Global rules (MiCA/SEC) should finally stabilize the chaos. Institutional money starts flowing in. The nightmare scenario? Another 2025-style hack or bad debt spiral. |

| 2030 | 230–300 | 500–700 | 100–150 | 60–80 | 120–180 | Hyperliquid cements itself as a top-tier DEX with OI over $50B. AI and oracles get baked into the core. It’s a classic bull cycle, but market overheating is a very real danger here. |

| 2031 | 320–400 | 700–1000 | 150–220 | 90–120 | 200–300 | DeFi matures. HYPE likely sits comfortably in the top 50 by market cap. New features like cross-chain perps become the norm. Main risk: Heavy-handed regulatory bans. |

| 2032 | 450–550 | 1000–1500 | 220–300 | 130–170 | 300–450 | Scaling the L1 pays off, with TVL crossing the $100B mark. Big institutional inflows. The catch? Traditional Web3 giants might try to eat their lunch. |

| 2033 | 600–750 | 1500–2000 | 300–450 | 180–250 | 450–700 | Full decentralization achieved. HYPE becomes the gold standard for perps, especially in Asia and Africa. Geopolitical shifts are the only big wild card left. |

| 2034 | 800–1000 | 2000–3000 | 450–650 | 250–350 | 700–1000 | Integration with CBDCs and TradFi. Open Interest climbs past $100B. Only technical meltdowns could really derail the momentum at this point. |

| 2035 | 1100–1400 | 3000–5000 | 650–900 | 350–500 | 1000–1500 | Hyperliquid effectively owns 20-30% of the DeFi market. Long-term growth fueled by DAOs and the metaverse. Risk: Simple market saturation. |

This is the kind of deep dive our AI assistant at ASCN.AI provides for Hyperliquid:

“Predicting the future of Hyperliquid isn’t just about staring at price charts. You have to weigh the tech breakthroughs against the community’s vibe and the latest news. It’s the full picture that actually tells you where the value is.”

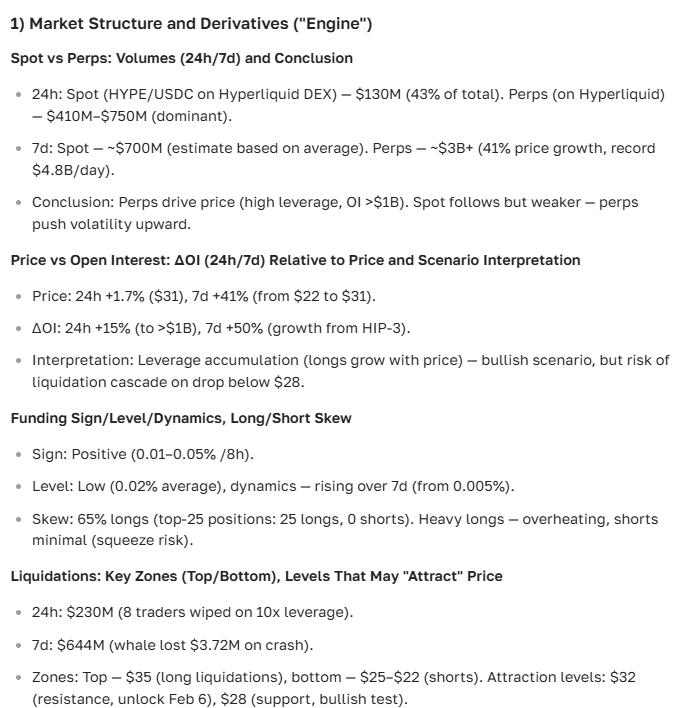

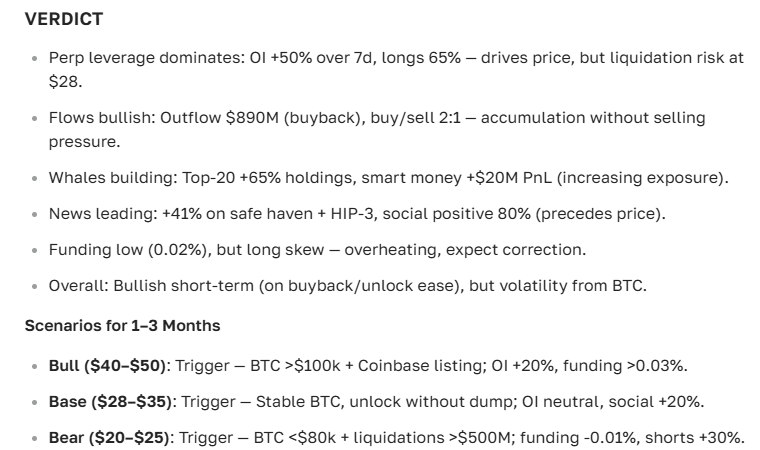

Where do we stand right now? Current price and vibes

Hyperliquid (HYPE) has been behaving exactly like you’d expect a high-cap altcoin to behave—lots of swings. Over the last month, we’ve seen it bounce between $0.015 and $0.027. It’s a classic tug-of-war between quick rallies and sharp pullbacks.

In practice, these 6% to 15% monthly shifts are par for the course. It usually boils down to whatever is trending on Twitter or what the latest headlines say.

Source: Binance Cryptocurrency Analytical Review, 2025

https://ascn.ai/en/blog/analytical_review_of_cryptocurrencies_on_the_binance_platform

The numbers: USD value and key stats

As of today, HYPE is sitting at roughly $0.022. The market cap is hovering north of $125 million, with about $5 million changing hands every day. This level of liquidity is actually quite decent—it means you can jump in or out of a position without getting absolutely wrecked by slippage.

| Metric | Current Value |

|---|---|

| Price (USD) | $0.022 |

| Market Cap | $125M+ |

| 24h Trading Volume | ~$5M |

| Liquidity | Moderate/Healthy |

That $5 million daily volume suggests there’s enough depth to handle larger orders without the price going into a tailspin.

Short-term outlook: What happens next?

If you’re looking at today or tomorrow, don't expect any wild fireworks. We’ll likely see HYPE hang around the $0.021 to $0.023 range. It’s mostly just noise and day-trader activity for now.

Tomorrow? We might see a modest 3% bump if the news cycle stays quiet and positive, potentially pushing us toward $0.024. But honestly, it’s a coin flip based on the broader market sentiment.

This outlook combines current trading volumes with the general "mood" of the market right now. If you don't want to spend all day staring at order books, ASCN.AI can spit out these sentiment numbers in a few clicks.

Source: "How AI and Blockchain are Changing Crypto Analysis", 2025

https://ascn.ai/en/blog/iskusstvennyj_intellekt_v_kripte

Looking a month ahead

There’s a growing sense of optimism in the altcoin space. If Hyperliquid can punch through that $0.025 resistance level, $0.030 is the next logical stop. History shows that when conditions are right, these alts can easily pull off a 20-30% run in a few weeks.

Source: Everything You Need to Know About Solana in 2025, 2025

https://ascn.ai/en/blog/znat_o_solana_v-2025_godu

A few things could fuel this move:

- Upgrades to the Hyperliquid protocol itself;

- A sudden spike in community hype (the name helps!);

- The general "rising tide" effect if Bitcoin and Eth are doing well.

On the flip side, keep an eye on the $0.018 floor. If the market takes a hit or regulators start acting up, that’s where we’ll likely land.

So, what’s actually moving the needle?

Hyperliquid doesn't exist in a vacuum. A few key things keep the price moving:

- The Tech: New features or better protocol efficiency usually lead to a price pump;

- The "Vibe": What investors are saying on Discord and Telegram matters more than people admit;

- The Whales: One big buy or sell order can move this market significantly;

- The Big Picture: Macro trends and what the big institutional funds are doing;

- Social Media: Forums and Twitter threads often create self-fulfilling prophecies.

Interestingly, many debate whether HYPE is immune to "fake news" spikes. So far, the jury is still out on that one.

Recent news: What’s the word on the street?

July 2025 was a busy month for the project, and a few things really helped solidify its position:

- They rolled out a fresh set of DeFi tools on the platform;

- Security got a major boost with new smart contract audits;

- Some big-name institutional players started sniffing around for partnerships.

This kind of news gives investors a reason to hold rather than trade, which is exactly what you want to see for long-term growth.

Source: Aptos Ecosystem: How Partnerships Influence Price, 2025

https://ascn.ai/en/blog/aptos_ecosystem_how_partnerships_influence_the_price

Constant tinkering

The dev team hasn't been sitting idle. They’ve been pushing for faster transactions and better market-making systems. While that sounds like technical jargon, it’s what actually makes the platform usable and the token valuable.

What is the community saying?

If you browse the forums, people are mostly talking about three things:

- Whether the price is about to "rip" (a favorite term for a breakout);

- How safe the token actually is for a long-term bag;

- How well it’s going to play with other protocols in the future.

The Trader's Take

Most long-term investors see HYPE as a solid way to diversify. Day traders, meanwhile, love the liquidity for quick arbitrage plays.

"Hyperliquid is a no-brainer for a balanced portfolio."

"It’s got the potential to rip hard if the stars align, but you’ve got to keep your stop-losses tight."

The Big Question: Should you buy Hyperliquid?

Full disclosure: This isn't financial advice. Crypto is a wild ride, so only put in what you’re okay with losing.

The Good and the Bad

Why people are buying:

- The tokenomics actually make sense for long-term holders;

- The roadmap is clear and they actually hit their deadlines;

- The entry price is low enough to be attractive for smaller investors.

The risks involved:

- It’s volatile—very volatile;

- The regulatory landscape is a shifting target;

- You have to stay on top of the tech updates or you’ll miss the exit.

In this market, risk is just part of the deal. You’ve got to be ready for the swings.

Source: Bear and Bull Markets in Crypto, 2025

https://ascn.ai/en/blog/medvezhij_i_bychij_rynok_v_kriptovalyute

Expert consensus

The general advice? Don’t FOMO in at the top. Wait for a consolidation phase and keep your eye on the technical indicators.

"Hyperliquid looks great on paper for the long haul, assuming the team keeps their head down and keeps building."

Crunching the numbers: Technical Analysis

The Relative Strength Index (RSI) is basically a "heat" gauge. Above 50 means buyers are in control; below 50 means sellers are winning.

On the weekly chart, the RSI is sitting at 36. That’s technically bearish, but it also means we’re getting close to "oversold" territory. For some, that’s a signal that a bounce is coming.

Moving Averages

Moving Averages (MA) help filter out the day-to-day noise. The big one to watch is the crossover between the 50-day and 200-day lines.

- Short-term above long-term? Bullish.

- The opposite? Bearish.

For HYPE, we’re in a neutral spot. The 50-day just crossed the 200-day from below, and the price is holding above both. It’s a "wait and see" moment.

MACD

The MACD is showing some bearish momentum right now. The signal line is under zero, and the histogram is in the red, which suggests that sellers are still pushing the price down for the moment.

Support and Resistance: The Lines in the Sand

The playground for HYPE is currently between $0.018 and $0.025. If we break $0.025, the path to $0.030 is wide open. If we lose $0.018, things could get messy.

FAQ — What people are asking about HYPE

Is today a good day to buy?

The upside is there, but make sure you’ve checked the morning’s news first. Volatility is high.

Will it "rip" in the next 30 days?

It’s possible. If the community gets behind a specific catalyst and the market stays green, a breakout is likely.

Where are the key price levels?

Support is strong at $0.018. Resistance is heavy at $0.025.

Can I automate my trades?

Yes, Hyperliquid has a solid API. It works well with trading bots and even "vibe-coding" setups if you want to build something custom.

What makes it different from other DeFi projects?

It’s a mix of unique tokenomics and a very fast dev cycle. They tend to ship updates much faster than their competitors.

The Bottom Line

Hyperliquid looks like it has plenty of room to grow, especially if the tech continues to improve. The current price point is a decent entry for anyone with a moderate risk appetite looking for gains over the next few months.

A quick checklist for investors:

- Stay glued to the technical indicators;

- Look for arbitrage opportunities—they exist;

- Don't chase green candles (don't buy the peak);

- Diversify. Seriously.

And here’s the final verdict from our AI assistant at ASCN.AI:

Real-world Case: The ASCN.AI Experience

When Falcon Finance had its flash crash, we saw a very similar volatility pattern. Traders using ASCN.AI were able to react in real-time, locking in profits before the bottom fell out. It’s a perfect example of why having an AI tool in your corner can save your portfolio when things get chaotic.

You can read the full breakdown here: ASCN.AI and the Falcon Finance Drop

Disclaimer

Everything written here is for information only—not financial advice. Crypto is risky. Talk to a professional before you put your money on the line.