Hedera (HBAR) Price Prediction for 2025-2035: Complete Overview and Analysis

about cryptocurrencies.

You can ask our crypto AI assistant anything about digital assets, market cycles, or specific tokens. If you’d rather skip manual research, just start an instant analysis here.

| Year | Price range (USD) | Average price (USD) | Key drivers and risks |

|---|---|---|---|

| 2026 | $0.08 – $0.50 | ~$0.25 | Post-2025 rally; HTS v2, enterprise TVL +40%. Risks: pullback after the BTC peak, SEC regulations, pressure from Polkadot and similar ecosystems. |

| 2027 | $0.10 – $0.60 | ~$0.30 | Governance council expansion; RWA/NFT adoption, big-name partnerships (including players like Boeing). Risks: geopolitics, perceived centralization (39-member governing council). |

| 2028 | $0.12 – $0.70 | ~$0.35 | Halving-driven tailwind from Bitcoin; global dApps, Smart Contracts 2.0 in full use. Risks: MiCA pressure in the EU, modest retail TVL (<$1B). |

| 2029 | $0.15 – $0.80 | ~$0.40 | Cycle peak; TVL >$2B, active asset tokenization. Risks: a new “crypto winter”, fading developer interest. |

| 2030 | $0.20 – $1.00 | ~$0.50 | Maturing ecosystem; AI/RWA integration, market cap >$5B. Risks: competing L1s and altcoins (Algorand and others), early quantum-security concerns. |

| 2031 | $0.25 – $1.20 | ~$0.60 | Transition phase; fiat inflation, growing role of emerging markets. Risks: global crises, migration to more decentralized L1 alternatives. |

| 2032 | $0.30 – $1.40 | ~$0.70 | Fresh halving cycle; global aBFT standards. Risks: energy debates (even if costs are low), scrutiny and audits of the governing council. |

| 2033 | $0.35 – $1.60 | ~$0.80 | Late bull phase; broad-based adoption (20%+ of enterprise DeFi). Risks: ecosystem hacks, G20-level regulation waves. |

| 2034 | $0.40 – $1.80 | ~$0.90 | Consolidation; scalability beyond 10k TPS, metaverse and gaming rails. Risks: market saturation, overreliance on the council model. |

| 2035 | $0.50 – $2.00 | ~$1.00 | Institutional phase; strong foothold in corporate Web3. Risks: new technological paradigms, disruption from next‑gen protocols. |

This is the kind of long-horizon breakdown of Hedera you’ll get from the ASCN.AI crypto assistant in a couple of seconds.

“Hedera is a one‑off story in the crypto space: its own tech stack, high throughput, and a security model that, at least on paper, can support a long runway for HBAR’s value. Our take is that the token has solid room to grow over the coming years, but investors shouldn’t ignore the risk side of the equation.”

Getting to know Hedera Hashgraph and HBAR

So what is Hedera Hashgraph, really?

Hedera is often put in the same basket as blockchains, but under the hood it runs on its own Hashgraph consensus instead of a classic chain of blocks. In practice, it uses a directed acyclic graph, which lets the network process transactions in parallel and agree on their order fast and deterministically. This design is what allows Hedera to target up to 10,000 transactions per second for simple transfers while keeping fees tiny and finality quick.

The core trick is Hashgraph itself. It combines a “gossip about gossip” protocol with virtual voting, so nodes can agree on timestamps and ordering without wasting resources on heavy mining. For end users this boils down to fast confirmation, predictable fees, and a network that is hard to stall with spam or simple attacks.

HBAR is the fuel of this whole setup: you pay in it for transactions and services, and it also backs network security through staking. Governance sits with a global council of large companies and institutions, which, despite debates about centralization, is meant to give the system a clear legal face and long-term stability.

How the project got here

The Hedera network went live in 2018 around the Hashgraph vision developed by co‑founders including Leemon Baird, whose work underpins the consensus model. Over the next few years the project moved from a relatively unknown startup into an enterprise‑flavored public DLT with a growing base of developers and corporate pilots.

Initial funding came via token sales and later investment rounds, and a noticeable chunk of that capital went into tooling, compliance, and ecosystem support rather than pure marketing. As the roadmap expanded, Hedera added smart contracts, token services, NFTs, and various DeFi and enterprise integrations on top of the core ledger. The team also put emphasis on transparency, regularly releasing network and governance updates through the foundation and council channels.

HBAR in numbers: supply, utility, liquidity

HBAR is the native token of the Hedera network and underpins every on‑chain action: transfers, smart contract calls, token operations, and more. The total supply is capped at 50 billion HBAR, all of which were minted at genesis and are being released on a predefined schedule. Part of the supply is allocated to ecosystem development, council incentives, and long‑term network growth.

On the market side, the token trades on major centralized exchanges, sits in the mid‑cap segment by market capitalization, and has enough liquidity for both retail and mid‑size institutional flows. Staking and node incentives help align holders with network security, while the fee structure keeps transaction costs low in fiat terms.

Historically, HBAR has shown smaller drawdowns than some high‑beta altcoins in sharp market corrections, which many analysts attribute to its enterprise angle and less speculative user base. That doesn’t make it “safe” in any traditional sense, but volatility tends to be somewhat more contained compared to many newer L1 experiments.

Previous highs and how the price behaved

HBAR’s all‑time high was set in 2021 at around $0.57, in the middle of the broader crypto bull run and during a period of heavy attention on the network’s foundation and enterprise focus. The token then followed the usual pattern: a steep correction as capital rotated out of altcoins, followed by long consolidation phases with spikes on major partnership or ecosystem news.

By 2023–2024, the price was trading in a significantly lower range than the peak, roughly in the low‑cent to mid‑cent area, while the team continued to ship upgrades and integrations. Many market watchers see that ATH as a reference point rather than a near‑term target, given the stricter regulatory backdrop and more mature competition.

Where HBAR stands now

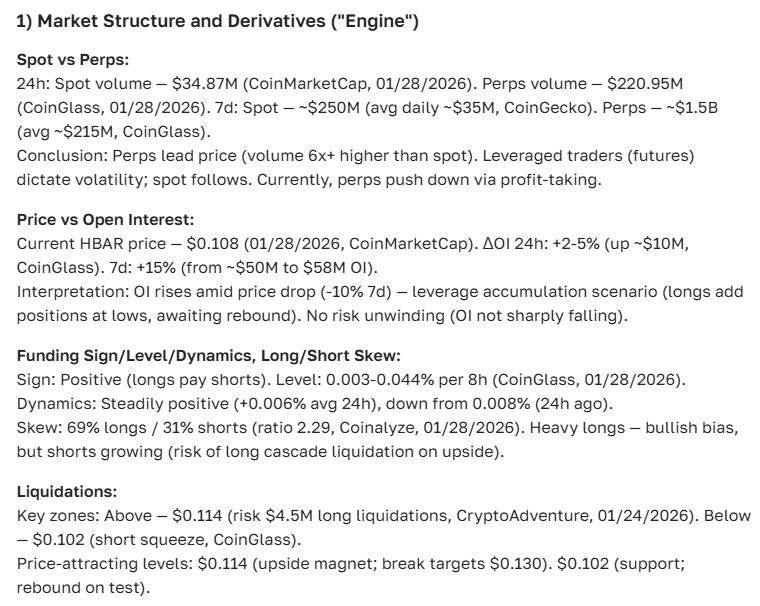

Short-term view: today

At present, HBAR trades in the lower sub‑dollar band, with intraday moves mostly following overall crypto sentiment and Bitcoin’s direction. Liquidity is sufficient for active trading, but the tape doesn’t look like a classic meme coin chart — flows are steadier, and books are deeper on the main venues. In calm sessions, the price often chops inside a narrow range, with occasional pushes on ecosystem headlines.

Looking at tomorrow

In the very short term, the outlook typically hangs on macro risk sentiment, Bitcoin volatility, and any fresh news around Hedera’s partnerships or regulations. If the broader market stays constructive, analysts usually leave room for a mild upside extension, but most models treat 24‑hour forecasts as noise rather than a tradable “prediction.”

Zooming out to a month

Over a one‑month horizon, scenario ranges widen: under a supportive market and positive Hedera newsflow, many traders consider a move toward the upper part of the recent trading band realistic, while sharp risk‑off events could erase several days of gains in a single session. That’s why, for swing setups, community discussions usually revolve around key support and resistance levels rather than fixed price targets.

“HBAR seems ready to retest important resistance areas, and if the current momentum holds, that could open up decent entry points for those planning to accumulate and hold for several years.”

What actually moves the Hedera price

News, launches, and real-world events

Over the last few years, every major technical release, DeFi launch, or enterprise pilot on Hedera has shown up more or less directly in trading activity and spot demand for HBAR. Listings in new financial products and on additional exchanges also tend to nudge volumes higher, even if the price reaction is short‑lived.

On top of that, regulatory clarity in key regions has often acted as a sentiment booster, whereas uncertainty or enforcement headlines against the sector weigh on the token, even when Hedera itself is not the main target. Periods without negative news usually translate into a more constructive backdrop for the asset.

Community pulse and forums

Within the Hedera community, users consistently highlight fast finality, low fees, and high TPS as the things that actually keep them on the network. Conversation spikes when a new partnership, a mainnet upgrade, or a fresh grant program is announced, and this online buzz frequently overlaps with short bursts of speculative interest on exchanges.

Wider market cycles and investor psychology

Like most altcoins with real infrastructure ambitions, HBAR is still heavily tied to Bitcoin and the global risk appetite cycle. When BTC trends up and narratives around Web3 infrastructure and tokenization are strong, Hedera tends to outperform its own long‑term averages; in ugly macro weeks, correlations jump and HBAR trades more like a high‑beta tech asset.

Many long‑term holders say they treat HBAR more as a structural position than a quick flip, which dampens some of the intraday noise but doesn’t fully eliminate the typical crypto drawdowns in major risk‑off phases.

Tech edge and market positioning

Hashgraph’s aBFT consensus and DAG structure give Hedera a clear angle versus traditional blockchains, especially on speed and deterministic finality. High theoretical throughput, parallel transaction processing, and low energy usage are the selling points that usually attract enterprise discussions and government pilots.

Liquidity on major exchanges, a functioning DeFi and tokenization stack, and the growing set of real‑world use cases all feed into the long‑term valuation story. New dApps or integrations that actually generate on‑chain activity tend to have a more durable impact on price than purely narrative partnerships.

Global capital flows and crypto allocations

Institutional capital flowing into crypto infrastructure and Web3 rails is a key piece of the puzzle, and Hedera sits right in that intersection of DLT, tokenization, and enterprise applications. When funds rotate more aggressively into smart‑contract platforms and alternative settlement layers, HBAR usually benefits from that shift alongside its peers.

Partnerships and integrations: why they matter

Collaborations with large technology firms, financial institutions, and payment providers are not just good marketing; they validate that the network can operate under real compliance and performance constraints. Successful integrations into marketplaces, DeFi platforms, and infrastructure projects grow the base of users who need HBAR for fees and staking.

Big, public deals, especially when they involve tokenization, identity, or regulated markets, often lead to a repricing of Hedera’s long‑term potential in analyst models.

Macro and regulation in the background

Regulatory risk remains a constant overhang for most crypto assets, and HBAR is no exception. On the flip side, clearer frameworks in the US, EU, and Asia allow more conservative institutions to start experimenting with on‑chain infrastructure, which indirectly helps Hedera’s adoption story.

Broader macro variables — inflation trends, rate expectations, and equity market risk sentiment — continue to shape how much risk investors are willing to take on in crypto at any given moment. When the environment is more supportive, tokens with credible tech and governance structures tend to capture a disproportionate share of new inflows.

Is Hedera worth a spot in a portfolio?

Does it make sense to buy HBAR now?

From an analyst’s point of view, HBAR can make sense for investors who understand that they are buying exposure to a specific infrastructure thesis rather than a meme narrative. Current price levels, sitting well below the 2021 peak, look reasonable to those who believe Hedera will keep onboarding real‑world use cases and institutional partners over the next cycle.

The platform’s technology and the direction of its roadmap are the main arguments in its favor, while the council governance model and competition from other L1s are the usual counterpoints in community debates.

Upside scenarios — and what can go wrong

Potential upside in most mid‑term forecasts comes from continued ecosystem growth, tokenization projects, and broader institutional adoption of DAG‑based systems. The risk set, though, is familiar: high volatility, rapid repricing during macro stress, regulatory shifts, and the chance that another platform captures the key enterprise narratives first.

For that reason, many portfolio strategies treat HBAR as one slice in a diversified basket rather than a single high‑conviction bet, with position size adjusted to its risk profile.

Practical tips and common sense

- Track major news around Hedera, technical indicators, and macro conditions instead of trading purely off gut feeling.

- Set clear risk limits, use stop‑losses where appropriate, and store coins in secure, reputable wallets.

- Watch partnership announcements, governance news, and core protocol upgrades — those often precede structural changes in activity.

- Build a view in multi‑month or multi‑year terms rather than relying only on ultra‑short‑term forecasts.

How it stacks up against other major networks

Compared with Ethereum or Solana, Hedera leans on Hashgraph rather than a traditional blockchain, and that brings very different performance and governance trade‑offs. Its consensus mechanism aims for high throughput and fast finality with low fees, while Ethereum prioritizes neutrality and decentralization and Solana optimizes for raw speed with a different set of assumptions.

In terms of price behavior, HBAR tends to move with the market but sometimes shows a different rhythm than the biggest L1s, which some investors see as a diversification benefit.

Thinking about potential returns

If Hedera keeps executing on its roadmap, the network could remain a steady, infrastructure‑style play, with the token capturing value from transaction fees, staking demand, and ecosystem growth. Historical price action and the current maturity level suggest a profile of moderate long‑term return potential, punctuated by sharp moves around key catalysts.

How people try to forecast HBAR

Technical analysis in practice

Moving averages like the SMA and EMA are widely used on HBAR charts to spot medium‑term trends and potential entry points when price crosses above or below them. A bullish crossover after a long consolidation is often read as a sign the market is ready for another leg up, although, as always, confirmation from volume helps.

The Relative Strength Index (RSI) usually hovers in the neutral band when the market is balanced and pushes into overbought or oversold zones only during strong trend moves. For HBAR, traders often watch RSI together with moving averages to filter out false signals.

Momentum tools like MACD and other oscillators help identify shifts before they become obvious on price alone, giving early hints that a correction is losing steam or that a rally is overheating. On HBAR pairs, positive MACD crossovers after deep pullbacks have historically drawn in short‑term speculators.

Candlestick patterns — from classic bullish engulfing setups to “morning star” formations — are used to refine entries, especially around key support levels mapped from previous cycles.

Fundamentals and growth models

On the fundamental side, many analysts still anchor their frameworks to Bitcoin’s halving cycles and liquidity waves when modeling altcoin performance. Hedera, as an infrastructure project, tends to benefit when BTC strength spills over into interest in L1s and tokenization.

Trading volumes and capital flows into HBAR across spot and derivatives venues offer an extra layer of insight into who is active in the market at any given time — retail, funds, or a mix of both. Higher sustained volume, especially on larger exchanges, is often read as confirmation that a narrative has legs.

Charts, profit calculators, and a bit of automation

For active traders, charting platforms and PnL calculators are standard tools to stress‑test scenarios and build risk‑reward profiles for different timeframes. If you don’t want to crunch all that by hand, ASCN.AI can pull technical indicators, recent order‑flow data, and key levels into a digestible view for HBAR and related pairs.

When indicators like SMA and EMA start to align in an uptrend, RSI stays out of extremes, and MACD confirms momentum, many models flag this as a constructive setup for incremental exposure rather than an all‑in bet.

What other analysts are saying

A range of online analytics platforms and research desks project moderate HBAR upside into the next cycle, with some targets stretching into the mid‑teen cent area under favorable conditions. The common thread across most reports is that the platform’s stability, growing ecosystem, and enterprise focus are the main long‑term drivers of value.

HBAR forecasts over time

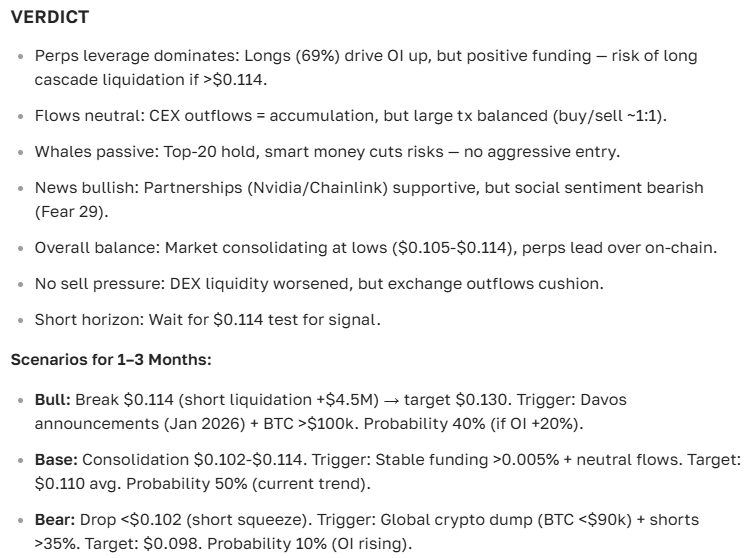

Short horizon: week to quarter

Over the next few weeks to a quarter, most scenario maps keep HBAR inside a relatively wide range, with the path inside that channel driven largely by news and the broader market tape. For traders, that translates into mean‑reversion and breakout strategies rather than fixed price “predictions.”

Medium term: 1–3 years

On a 1–3 year view, a gradual grind higher is the base case in many analyses, assuming Hedera keeps shipping upgrades, attracting developers, and landing real commercial integrations. The actual trajectory will, of course, depend on the macro cycle, regulation, and how intense competition gets among L1s and L2s.

Long term: 5–10 years and beyond

Looking out toward the early 2030s, long‑run scenarios hinge on whether Hedera can secure a lasting role in tokenization, enterprise settlement, and regulated Web3 infrastructure. If those pieces line up, the argument is that HBAR could re‑rate meaningfully higher than today’s levels; if not, returns may lag the broader market.

| Year | Price range, $ | Comment |

|---|---|---|

| 2025 | $0.15 – $0.20 | Early, more sustainable growth phase with network upgrades and ecosystem expansion starting to show up on‑chain. |

| 2026 | $0.25 – $0.30 | Broader ecosystem build‑out, more users and applications, deeper liquidity on major exchanges. |

| 2027–2028 | $0.40 – $0.60 | Stronger market position if DeFi, tokenization, and corporate use cases continue to scale on Hedera. |

| 2029–2031 | $0.70 – $1.00 | Scenario where mass adoption and enterprise integrations significantly lift on‑chain volumes and fee demand. |

| 2032–2036 | $1.00 – $2.00 | Long‑horizon case tied to global recognition of DAG‑based DLT and Hedera’s role in that segment, if it maintains its current lead. |

Quick Q&A on HBAR’s outlook

Where could 1 HBAR be in 5 years?

Many medium‑term models place HBAR somewhere in the upper mid‑cap band by the end of the decade, assuming the project continues to execute and the market rewards real usage over pure hype.

What about Hedera specifically in 2026?

For 2026, expectations generally cluster around a moderate re‑rating versus current levels if user growth and TVL expand steadily and macro conditions don’t derail risk assets entirely.

And the 10‑year view?

Over 10 years, the spread of possible outcomes widens sharply: in the more optimistic paths, Hedera secures a durable niche in regulated Web3 infrastructure; in the bearish ones, it risks being overshadowed by newer technologies or stricter regulation.

Is HBAR a reasonable buy for 2025?

For investors with a multi‑year horizon and tolerance for crypto volatility, HBAR can be a reasonable candidate as part of a diversified allocation, especially if they believe in enterprise‑grade DLT and DAG‑based designs.

Long-term prospects in a nutshell?

In the long run, HBAR’s fate is tied to how widely Hashgraph and Hedera’s stack are adopted in real‑world workflows, from payments to supply chains and tokenization. If adoption keeps spreading and governance stays credible, the token’s role in that ecosystem gives it a meaningful claim on the value created there.

Extra tools and comparisons

How Hedera compares to other major networks

| Metric | Hedera (HBAR) | Ethereum (ETH) | Solana (SOL) | Polygon (MATIC) |

|---|---|---|---|---|

| Consensus technology | Hashgraph (aBFT DAG‑based consensus with gossip‑about‑gossip and virtual voting). | Proof of Stake (Ethereum mainnet with rollups on top). | Proof of History combined with Proof of Stake. | Proof of Stake securing an EVM‑compatible chain. |

| Speed, TPS | Up to 10,000 TPS in theory for simple transactions; real‑world peaks in the low thousands. | Roughly 30–60 TPS on L1, with higher effective throughput via rollups. | 2,000+ TPS in practice, with higher bursts reported under stress tests. | Up to several thousand TPS depending on network conditions. |

| Fees | Very low, stable in dollar terms for standard operations. | Higher on‑chain fees, especially in periods of congestion. | Generally moderate, though can spike under heavy load. | Low fees, one of the main selling points for users and dApps. |

| Market capitalization | Mid‑cap asset, below the largest smart‑contract platforms but within the broader top‑tier group. | One of the largest crypto assets by market cap, second only to Bitcoin. | Large‑cap L1 with a strong presence in DeFi and NFTs. | Mid‑ to large‑cap scaling solution tied closely to the Ethereum ecosystem. |

| Development and support | Active development backed by a governing council and foundation structure. | Very high developer activity and a massive open‑source community. | Active ecosystem with frequent upgrades and strong community engagement. | Active development focused on scaling solutions and new L2‑style initiatives. |

Wrapping it up

Where this leaves HBAR

Hedera Hashgraph and HBAR sit in an interesting niche: enterprise‑oriented, technically distinct from classic blockchains, and backed by a formal governance council. The price story from here looks like a balance between solid fundamentals and the usual crypto uncertainties around regulation, competition, and macro shocks.

What to watch going forward

The key things to keep an eye on are ecosystem growth, real‑world integrations, and how the regulatory landscape evolves around tokenization and enterprise DLT. And if you don’t want to track all those threads manually, ASCN.AI can help cut through the noise with on‑demand, data‑driven HBAR analysis in just a few clicks.

Incidentally, this is the verdict delivered by our crypto AI assistant ASCN.AI:

Disclaimer

None of the scenarios above are investment advice or a guarantee of future performance. Every investor has to weigh the risks, do their own homework, and, ideally, consult professionals before allocating capital to HBAR or any other crypto asset.