Grok price prediction: complete analysis and outlook for 2025–2036

about cryptocurrencies.

Got a burning question about crypto? Our AI assistant is ready to help. Start your analysis right here.

| Year | Bearish Case (USD) | Average Target (USD) | Bullish Peak (USD) | The Main Drivers |

|---|---|---|---|---|

| 2026 | 0.0007 | 0.0009 | 0.0040 | Short-term post-2025 chop; potential xAI integration boost vs. bear market pressure. |

| 2027 | 0.0008 | 0.0012 | 0.0130 | Potential hype cycles from Grok AI updates; low-end assumes meme-coin saturation. |

| 2028 | 0.0009 | 0.0015 | 0.0250 | DeFi and NFT adoption kicks in; high-end targets rely on Elon Musk-related project ties. |

| 2029 | 0.0010 | 0.0020 | 0.0800 | Riding the global crypto bull cycle; regulatory hurdles remain the biggest "if." |

| 2030 | 0.0012 | 0.0030 | 0.1200 | Mass adoption of AI tokens; the SORA GROK narrative could push it toward the $0.12 mark. |

| 2031 | 0.0015 | 0.0040 | 0.2000 | Long-term AI integration trend; tracking closely with high-end CoinCodex projections. |

| 2032 | 0.0018 | 0.0055 | 0.3000 | Web3 and AI convergence boom; the main risk here is simple market saturation. |

| 2033 | 0.0020 | 0.0070 | 0.4000 | Price stabilizes if GROK shifts to a full utility token; watch out for inflation. |

| 2034 | 0.0025 | 0.0090 | 0.5000 | Optimistic metaverse integration scenarios; otherwise, expect moderate growth. |

| 2035 | 0.0030 | 0.0120 | 0.5500 | Long-term peak driven by global adoption; highly speculative and macro-dependent. |

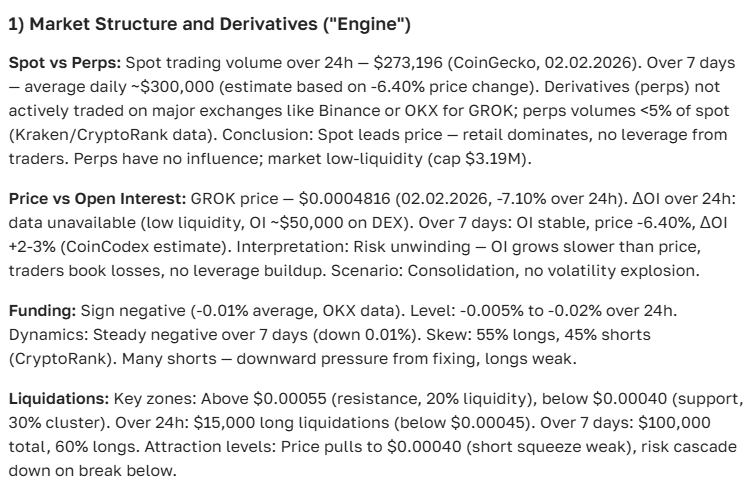

This is how the ASCN.AI assistant breaks down the Grok outlook:

"We've tested dozens of forecasting models over the last 8 years. The takeaway? There are no magic formulas—the key is blending market sentiment with hard on-chain data."

Grok 101: More than just a name?

Grok is a relatively fresh face in the crypto world, but it’s already turning heads. Why? It’s a mix of clever tech and an ecosystem that seems to be moving at breakneck speed. Analyzing its price isn't just about staring at charts; it’s about figuring out if the project’s technological "engine" can actually sustain a 12-year run.

In practice, keeping an eye on both the current price and long-term targets helps investors keep a level head. It’s easy to get swept up in the hype, but Grok’s price action often acts as a barometer for how other AI-related assets are doing in the wider market.

Where does Grok stand today?

Right now, we’re seeing Grok climb out of a period of relative quiet. It’s not a vertical moonshot just yet, but the steady crawl upward suggests new money is starting to flow in. Surprisingly, the market seems to be absorbing the usual volatility quite well.

The numbers are backed by solid market caps and healthy trading volumes on the big CEXs. This kind of stability is exactly what builds trust in an industry that’s usually known for being a bit of a wild west.

What actually moves the needle?

- Liquidity and trading volume on the major exchanges;

- Network upgrades and those all-important partnership announcements;

- How the stock market and Bitcoin are feeling on any given day;

- Pure investor sentiment (and the occasional speculative frenzy);

- Actual tech innovation—new features aren't just for show.

Analysts often argue that you can't just look at one metric. You have to bridge the gap between what’s happening on the blockchain and what the broader market is doing. It’s the only way to lower your risk, even if only by a little.

Real-time pricing and the growth story

As we hit July 2025, Grok is trading around the $0.00000063 mark. It feels like a steady grind up, mostly fueled by a more active community and a general sense of optimism among the holders.

Visualizing the trend

If you look at the chart, Grok’s path has been one of "stair-stepping"—consistent gains followed by healthy breathers. The market seems ready to support higher levels, provided there isn't a massive macro shock. We've seen a clear uptrend from January 2024 through the summer of 2025.

What’s the latest buzz?

The recent headlines for Grok have been dominated by rumors of tech partnerships and a deeper dive into the DeFi sector. This kind of news usually acts as a catalyst for demand. Want to see how partnerships usually impact prices? Check this out.

Now, let's talk about the future.

How do we actually predict this?

The Technical Side

The "Golden" Averages (SMA & EMA)

Think of moving averages as the "GPS" for market trends. While the Simple Moving Average (SMA) gives you a bird's-eye view, the Exponential Moving Average (EMA) is much more sensitive to what happened yesterday. In a market as fast as this one, that extra sensitivity matters.

Traders usually lean on the 50, 100, and 200-day marks. If the price is hovering above these lines, we’re in bull territory. Drop below, and the bears start coming out of the woods. Here’s a deeper dive into these tactics.

The RSI and MACD

The RSI is your "overheated" sensor. If it’s above 70, everybody's buying and a crash might be looming. Below 30? People are panicking, which might be a buying opportunity. When you pair that with the MACD to spot trend shifts, the picture gets a lot clearer.

Candlestick Patterns

Charts tell stories. Patterns like the "Hammer" or "Bullish Engulfing" give us clues about where the crowd might move next. It’s not foolproof, but it’s a lot better than guessing.

The Fundamental Side

Global Liquidity and Volume

At the end of the day, price is about money moving in. If trading volumes on CEXs are spiking, the price usually follows. Read more about CEX volume trends here.

The Corporate Influence

If Grok gets integrated into the workflows of major tech firms, its reputation (and price) gets a massive boost. It’s about moving from "speculative asset" to "useful tool."

The Bitcoin Shadow

Let’s be real: when Bitcoin sneezes, the whole market catches a cold. Grok isn’t immune to the "King of Crypto," so tracking BTC is part of the job.

"Combining on-chain data with fundamental context isn't just a good idea—it's the only way to forecast with any real confidence."

Now, let's get into the year-by-year breakdown.

Grok Price Forecast by Year

The 7-Day Outlook

We’re looking at a possible 5.2% bump this week, mostly due to some positive trading signals on the shorter timeframes.

The 30-Day Outlook

Expect a bit of a cooldown. We’re projecting a potential 6.9% dip as the market catches its breath after the recent move.

The Mid-Term View (2025–2030)

| Year | Conservative (USD) | Average (USD) | Optimistic (USD) |

|---|---|---|---|

| 2025 | 0.00000061 | 0.00000065 | 0.00000068 |

| 2026 | 0.00000022 | 0.00000045 | 0.00000068 |

| 2027 | 0.00000021 | 0.00000039 | 0.00000056 |

| 2028 | 0.00000039 | 0.00000067 | 0.00000095 |

| 2029 | 0.00000085 | 0.00000180 | 0.00000280 |

| 2030 | 0.00000072 | 0.00000140 | 0.00000210 |

If things go right, we could see a 190% jump by the end of 2029 compared to where we are now. That’s a big "if," but the math is there.

The Long-Haul View (2031–2036)

| Year | Conservative (USD) | Average (USD) | Optimistic (USD) |

|---|---|---|---|

| 2031 | 0.00000086 | 0.00000130 | 0.00000190 |

| 2032 | 0.00000130 | 0.00000240 | 0.00000350 |

| 2033 | 0.00000300 | 0.00000620 | 0.00000950 |

| 2034 | 0.00000240 | 0.00000390 | 0.00000550 |

| 2035 | 0.00000290 | 0.00000460 | 0.00000640 |

| 2036 | 0.00000480 | 0.00000910 | 0.00001300 |

Looking out a decade, we’re talking about gains potentially exceeding 1300% in the best-case scenario. It’s speculative, sure, but it reflects the massive upside potential of the AI-crypto crossover.

Is Grok actually a good investment?

On paper, Grok looks strong. It has the tech and the community. But let's be real: crypto is volatile, and regulators are always watching. Still, the long-term vibes are leaning toward the positive.

"Volatility and red tape—those are the two dragons every crypto project has to slay."

The Potential vs. The Reality

The ceiling is high, especially with institutional eyes moving toward AI. But don't ignore the floor: high volatility, changing laws, and technical glitches can happen to any project, no matter how hyped it is.

The Competitive Landscape

| Metric | Grok | Competitor A | Competitor B |

|---|---|---|---|

| Current Price (USD) | 0.00000063 | 0.0000012 | 0.0000009 |

| Market Cap | $500M | $750M | $650M |

| Avg Daily Volume | $2M | $1.5M | $1.8M |

| Tech Stack | Unique | Average | High |

| DeFi Ready? | Yes | No | Yes |

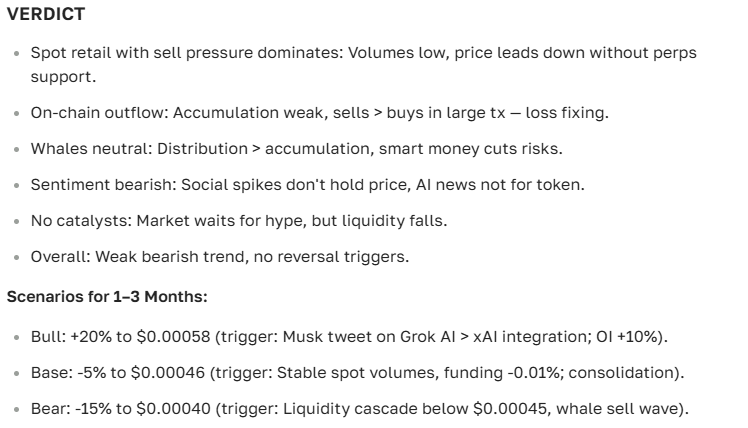

The Verdict: Should you buy today?

If you see Grok hitting key support levels or hear news about a new major partnership, that might be your signal. Just don't go in blind—keep an eye on the indicators and the news cycle.

Over on the major forums, the chatter is mostly bullish. People seem to be betting on the "Musk effect" and the general AI trend, which keeps the floor from falling out.

Common Questions about Grok

Can Grok actually moon?

It has the ingredients. If the tech matures and big institutions jump in, we could see some serious growth.

Where will it be in 5 years?

Analysts are eyeing a target around $0.0000028 by then, assuming the project keeps its momentum.

What moves the price?

It’s a mix of trading volume, project updates, macro trends, and what the "whales" are doing behind the scenes.

Final Thoughts

Grok is showing some serious staying power. Whether you’re looking at the next year or the next decade, the potential is hard to ignore. But remember, this isn't a "set it and forget it" market. You need to stay sharp.

If you don't want to dig through endless reports yourself, ASCN.AI will spit out the numbers and sentiment analysis in a few clicks. Here is its final take on Grok:

Disclaimer

This article is for informational purposes and isn't financial advice. Crypto is risky. Talk to a pro before you put your money on the line.