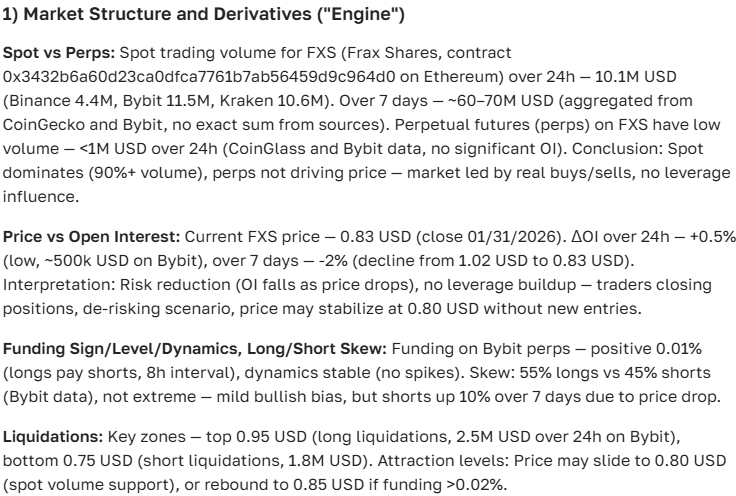

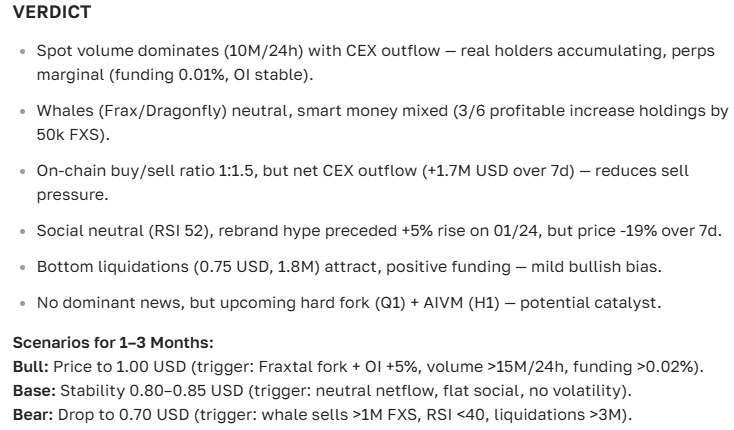

Frax cryptocurrency price forecast — analysis and outlook for today and tomorrow

about cryptocurrencies.

Got a burning question about crypto? You can run any project by our crypto AI assistant. Start your analysis right here.

| Year | Min Price | Avg Price | Max Price | Key Drivers & Factors |

|---|---|---|---|---|

| 2026 | 0.38 | 3.50 | 4.40 | Post-BTC halving DeFi surge; Frax integrations with L2s (Optimism, Base); TVL potentially clearing $10B. |

| 2027 | 2.17 | 4.97 | 5.60 | Broader stablecoin adoption; clearer regs in the EU/US; strong correlation with ETH performance. |

| 2028 | 3.00 | 6.50 | 8.00 | Ecosystem growth (Frax v3); the intersection of AI and DeFi; potential bull cycle peaks. |

| 2029 | 4.66 | 10.00 | 14.72 | RWA (real-world assets) going mainstream within Frax; market cap likely crossing the $5B mark. |

| 2030 | 6.31 | 14.80 | 17.64 | Deep integration with TradFi; talks of a potential stablecoin ETF. |

| 2031 | 10.00 | 21.72 | 25.25 | Long-term DeFi maturation; CBDCs shifting the stablecoin landscape; TVL eyeing $50B. |

| 2032 | 12.05 | 25.00 | 36.20 | Major tech upgrades like ZK-proofs in Frax; tight correlation with the global crypto market. |

| 2033 | 15.00 | 30.00 | 40.00 | Moving toward full decentralization; Metaverse/NFT ecosystem utility; potential cycle high. |

| 2034 | 16.30 | 35.00 | 45.00 | Market stabilization; established DeFi regulatory frameworks; rapid growth in Asia/LatAm. |

| 2035 | 16.58 | 40.00 | 50.00 | Long-term institutional adoption; Frax as a dominant player in a $1T+ stablecoin market. |

Here’s how the ASCN.AI crypto assistant breaks down the long-term potential for Frax:

“Frax is a bit of an outlier in the crypto world. It’s a fractional stablecoin that manages to stay resilient even when the market gets shaky. If you look at the current price action and the long-term forecast, there’s a clear opportunity for investors who are looking beyond just the next few weeks.”

What exactly is Frax, and where does it sit in the market?

Frax isn't your typical stablecoin. It uses a fractional-algorithmic model, which is a fancy way of saying it’s a hybrid. It keeps its $1 peg partly through collateral (like traditional stablecoins) and partly through clever code that manages supply and demand. It’s essentially trying to find the "sweet spot" between being fully backed by cash and being completely decentralized.

In practice, it looks like this: some of the tokens are backed by hard dollar reserves, while the rest are balanced by minting and burning mechanisms to keep the price glued to $1. It’s a flexible system that adapts to market volatility much better than the old-school algorithmic coins did.

Right now, Frax is carving out a serious niche in the DeFi space. Analysts often point out that its model is particularly attractive for those who want the safety of a stablecoin but also want to be part of a growing ecosystem. It’s not just a "dead" asset; it’s a key piece of the DeFi puzzle.

The tether to the dollar (and everything else)

Since Frax is pegged to the US Dollar, you’ll usually see it hovering between $0.98 and $1.02. If it moves a couple of cents, don't panic—that’s just the usual DeFi activity and supply management doing its thing. But here's the catch: even though it's a stablecoin, it doesn't live in a vacuum.

When Bitcoin or Ethereum goes on a wild run, it changes how people use Frax. If the dollar gets stronger or weaker against the Euro on the global stage, that also trickles down to how Frax is valued in a broader sense. It’s all connected.

Breaking down the price: How Frax is holding up

Over the last month, Frax has been remarkably boring—which is exactly what you want from a stablecoin. It’s stayed right in that $0.98 to $1.02 range. While other "moon bags" are crashing or pumping 20%, Frax just sits there, reflecting a very healthy balance between buyers and sellers. By the way, if you don't want to spend hours staring at these charts, ASCN.AI can give you a summary of the latest movements in seconds.

What actually moves the needle?

Why does the price move at all? Usually, it comes down to three things: big news updates, new regulations, or shifts in the DeFi sector. Technical updates or a new partnership often cause a small, short-term spike in interest and utility.

For instance, a listing on a major exchange or the launch of a new product usually gets the market moving. On the flip side, if regulators start making noise or the overall market sentiment turns sour, it can put some temporary pressure on the peg.

The technical side of things

If you're into charts, you’ll see that traders keep a close eye on the usual suspects: moving averages (SMA/EMA), the RSI, and MACD. When trading volume picks up alongside some good news, it’s usually a sign of sustained growth for the ecosystem.

Our take on the best strategies for technical indicators

The outlook: What to expect in the coming weeks

Most analysts aren't expecting fireworks, and that’s a good thing. In the short term, the consensus is that Frax will keep doing what it does best: staying close to $1. The fractional model and reserve policy act like a shock absorber against market swings.

That said, some forecasts suggest we could see a 3–5% increase in total ecosystem value over the next month if the DeFi market catches a bid. People are increasingly looking for "safe" places to park their capital, and Frax is high on that list.

Reading the charts

Technically speaking, we’re seeing a very tight consolidation zone. Support is firm around $0.98, and there’s some resistance at $1.02. It’s been bouncing between these lines for weeks.

- The RSI is sitting around 38, which basically means things are calm—no massive overbuying or panic selling.

- The 50 and 200-day moving averages (SMA) are acting as the primary guardrails for traders looking for entry points.

What’s the vibe for tomorrow?

Expect more of the same. Unless a major news bomb drops, it’s likely to stay steady. Long-term, however, the real story is about how Frax integrates further into the DeFi world. That’s where the real "growth" happens, even if the price stays at a dollar.

Is Frax a good move?

If you’re the type of investor who values stability but still wants a foot in the door of innovative tech, Frax is worth a look. Its model is designed to survive volatility, making it a solid choice for both conservative holders and those looking for steady DeFi yields.

A few tips on risk

Don't put all your eggs in one basket. Diversification is still the only free lunch in finance. Keep an eye on protocol updates and what regulators are saying—those are the two things that could actually shift the landscape for Frax.

What the community is saying

On the forums and Twitter, the mood is generally "cautiously optimistic." People like the balance Frax has struck. There’s a sense that as it becomes more popular, its role as a foundational piece of the crypto economy will only grow.

What's driving the news cycle?

Keep your eyes peeled for updates on how the reserves are managed and any new strategic partnerships. These are the real catalysts.

The big picture: Politics and Macro

What the Fed does with interest rates and how the US handles crypto regulation matters. Global economic shifts dictate where the big money flows, and stablecoins like Frax are often the first place that money lands when things get uncertain.

FAQ — Fast Facts

What actually controls the price of Frax?

It’s a mix of algorithmic management, hard reserves, and basic supply and demand. Toss in some regulatory news and broader market trends, and you have the full picture.

How do people predict these prices?

It’s not magic—it’s a combination of technical analysis, monitoring social sentiment, and using AI models that can process economic data faster than a human can.

Is it safe?

No investment is 100% safe, especially in crypto. However, Frax’s hybrid model is specifically built to reduce the risks that took down older algorithmic coins. Still, use common sense and manage your risk.

The Bottom Line

The forecast for Frax for the rest of the month points toward stability with a side of "slow and steady" growth for the ecosystem. The technology behind it is solid, bridging the gap between old-school stability and new-school DeFi. For an investor, it’s a compelling mix of reliability and future-proof tech.

“Frax has found a unique spot in the market. It handles the chaos of crypto better than most, making it a anchor in many portfolios.”

And here’s the final verdict from our ASCN.AI assistant:

Real-world results with ASCN.AI

Does it actually work? Well, ASCN.AI recently helped investors pivot their positions on Falcon Finance (FF) just in time, saving them over $1,000 thanks to some quick-thinking analytics. When the market hit a flash-crash, the AI’s ability to spot the trend early made all the difference.

Case Study: Saving $1000 on the Falcon Finance (FF) drop

Flash Crash Recap: How to profit when the market dips

Disclaimer

This is for informational purposes only and isn't financial advice. Crypto is a wild ride and involves high risk. Always chat with a professional before making big moves.