Fetch.ai (FET) Cryptocurrency Price and Exchange Rate Forecast for 2025-2035

about cryptocurrencies.

You can ask any crypto-related question to our AI assistant. Start your analysis right now.

| Year | Low estimate (USD) | Average estimate (USD) | High estimate (USD) | Notes & sources |

|---|---|---|---|---|

| 2025 | 1.31 | 1.48 | 1.99 | BlockDAG: based on partnerships and AI momentum; Flitpay is more aggressive ($5–10 in a bull run). |

| 2026 | 0.23 | 0.38 | 4.32 | Kraken: ~5% annual growth; CoinLore points to a bullish breakout. |

| 2027 | 0.26 | 0.40 | 1.00 | Binance estimate: $0.50–1.00 driven by adoption; extrapolated. |

| 2028 | 0.30 | 0.45 | 2.00 | Flitpay / BlockDAG extrapolation: deeper AI integration. |

| 2029 | 0.35 | 0.55 | 3.00 | Extrapolation: steady growth plus ASI merger narrative. |

| 2030 | 4.10 | 4.80 | 5.60 | BlockDAG: AI becoming mainstream; Flitpay’s $29–45 forecast is highly optimistic. |

| 2031 | 4.50 | 5.50 | 7.00 | Extrapolated ~15% yearly growth (Kraken / BlockDAG assumptions). |

| 2032 | 5.00 | 6.50 | 9.00 | Extrapolation tied to AGI-related updates. |

| 2033 | 5.50 | 7.50 | 12.00 | Extrapolation: broader mainstream adoption. |

| 2035 | 10.00 | 15.00 | 25.00 | Long-term AI boom scenario (Flitpay / BlockDAG), highly speculative. |

This is the kind of analysis our crypto AI assistant produces:

“Fetch.ai brings together blockchain, Web3, and artificial intelligence, forming a distinct ecosystem of decentralized agents that automate real-world processes. We track key metrics and market trends to deliver the most grounded price outlook possible.”

Getting to know Fetch.ai

Fetch.ai is built around a fairly ambitious idea: combine blockchain with artificial intelligence and let autonomous digital agents handle tasks without intermediaries. In practice, these agents can negotiate, exchange data, and optimize workflows on their own. Logistics, finance, supply chains — those are the usual examples, but the scope is wider than it first appears.

The Fetch.ai token (FET) has carved out a visible spot among AI-focused blockchain projects. This isn’t just another speculative altcoin. It’s an ecosystem that keeps expanding, attracting users and quietly testing real commercial use cases.

AI does the heavy lifting here — automating routine operations and squeezing out inefficiencies. That’s what gives Fetch.ai a bit of an edge compared to projects chasing similar goals.

Current price and how it got here

Right now, Fetch.ai trades around $0.34–$0.36. Price action has been relatively calm, with moderate volatility and a slight bias toward strength as investor interest picks up.

Market cap has pushed past $500 million, which, for many traders, signals that demand isn’t just theoretical — there’s real activity behind it.

Recent price behavior

July delivered a slow but steady climb, from roughly $0.28 up to local highs near $0.37. Volatility stayed within a comfortable range, suggesting a fairly balanced tug-of-war between buyers and sellers. For short-term forecasts, that kind of structure is actually helpful.

Fetch.ai price outlook

The near-term forecast keeps FET in the $0.34–$0.36 zone. With no major headlines shaking the market, analysts expect sideways movement, give or take about 2%.

The real catalysts, as usual, are AI-related news and progress on real-world integrations. That’s what keeps Fetch.ai on investors’ radar.

“Fetch.ai’s upside is closely tied to expanding partnerships and the rollout of AI-driven solutions across different industries.”

Looking one month ahead

Over the next 30 days, many forecasts point to a gradual move toward $0.40–$0.43, assuming the broader market doesn’t sour. Continued adoption and stronger positioning within the blockchain space support that scenario.

That said, pullbacks are always on the table. Much depends on overall market mood and risk appetite.

As analysts put it:

“Rising demand for AI tools and fresh partnerships are propping up Fetch.ai’s current momentum. A move toward $0.45 by month’s end looks realistic if no negative surprises hit the market.”

What pushes the price — and what could derail it

FET’s valuation hinges on a handful of core factors:

- Ongoing ecosystem development and regular updates;

- Real adoption in business processes and a growing user base;

- Overall crypto market sentiment, especially toward AI-driven projects;

- Announcements of major partnerships or integrations.

Binance Research notes that AI innovation and ecosystem expansion tend to play an outsized role in sustaining long-term growth for projects like this.

Still, risks remain:

- Market volatility and macroeconomic pressure;

- Competition from other AI-blockchain platforms;

- Regulatory uncertainty and potential legal shifts.

The balance between these forces ultimately shapes how confidently the price can move higher.

News flow and market sentiment

- July 2025: Fetch.ai announced a partnership with a major logistics operator, sparking renewed investor interest;

- A recent protocol upgrade improved transaction speeds, supporting demand;

- The launch of new AI agents expanded automation capabilities across the network.

Developments like these tend to reinforce trust and drive activity — both good signs for price stability.

For ongoing updates, the ASCN.AI news blog is often the fastest way to stay in the loop.

What experts are saying

Within the AI and Web3 niche, Fetch.ai is generally viewed favorably. Most experts expect steady — not explosive — growth, grounded in solid tech and realistic market dynamics.

“AI-driven analytics help spot trends early and reduce risk in crypto investing.”

Community sentiment and forum chatter

The community stays busy debating integrations, technical upgrades, and price scenarios. On crypto forums and Telegram channels, you’ll find everything from deep dives to quick trading tips.

Common community takes

- Accumulating on pullbacks toward $0.30–$0.32;

- Closely tracking partnership announcements and major updates;

- Avoiding leverage due to persistent volatility.

Those themes pop up again and again — caution and timing matter.

Is now a good time to buy Fetch.ai?

Reasons some investors are buying:

- Distinct technology and an experienced team;

- Consistent growth and institutional interest;

- Long-term upside in the AI-blockchain sector.

Reasons others are waiting:

- High volatility across the crypto market;

- Intensifying competition;

- Dependence on macro trends and regulation.

Technically, support sits near $0.31, with resistance around $0.39. A clean breakout above resistance could strengthen the bullish case.

Practical investment notes

- Consider entries near support levels;

- Diversify — don’t go all in on one asset;

- Stay alert to news and react quickly.

No magic tricks here. Just disciplined decision-making.

Frequently asked questions

What is Fetch.ai?

A platform for building decentralized AI agents on blockchain, powered by the FET token.

How might the price move short term?

Most forecasts suggest a cautious climb toward $0.40 over the next month, barring negative events.

Is Fetch.ai worth buying now?

Many traders focus on support levels and positive news flow when deciding on entries.

What does “rip” mean in this context?

A sudden, sharp price surge — usually upward — often triggered by major news.

What technical indicators matter for Fetch.ai?

Traders commonly watch SMA, RSI, MACD, and candlestick patterns when analyzing FET.

Fetch.ai compared to similar projects

| Metric | Fetch.ai (FET) | Chainlink (LINK) | Ocean Protocol (OCEAN) |

|---|---|---|---|

| Price, $ | 0.35 | 7.50 | 0.40 |

| Market cap | $500M | $3.2B | $400M |

| 24h volume, $ | $45M | $120M | $15M |

| Monthly growth | +15% | +8% | +12% |

| Sector | AI blockchain | Oracles | Data marketplaces |

Technical signals and trading context

- SMA: 50-day around $0.26, 200-day near $0.44, with the long-term average expected to rise into early 2026;

- RSI: roughly 38.8 — neutral territory, no extreme conditions;

- MACD: momentum is fading, though a trend shift is possible;

- Bollinger Bands: about 22% width, pointing to moderate volatility;

- Stochastic: %K below %D in oversold territory, hinting at a potential bounce;

- ADX: near 28, indicating a strong directional trend (+DI above –DI).

Candlestick patterns

Traders often look to candlesticks for sentiment clues:

- Bullish: hammer, bullish engulfing, piercing line, morning star, three white soldiers;

- Bearish: harami, dark cloud cover, evening star, shooting star, hanging man.

Recognizing these patterns helps fine-tune entry and exit timing.

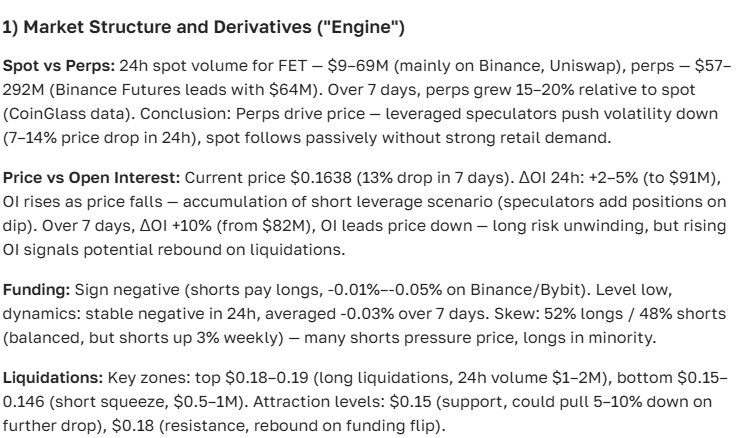

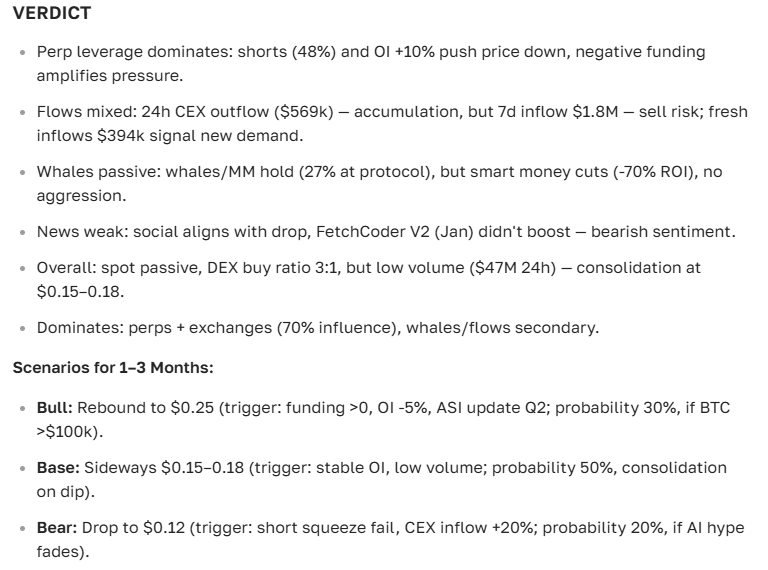

This is the verdict our crypto AI assistant gives on Fetch.ai:

A real ASCN.AI SAR case

Back in October 2024, when Falcon Finance (FF) saw a sharp price drop, the ASCN.AI team produced a focused analytical report using just two prompts. Clients were able to react quickly and limit losses. It’s a good example of how AI-driven analysis helps navigate volatility — a lesson that applies just as well to Fetch.ai (ASCN.AI case study on the Falcon Finance drop).

Investment disclaimer

Important: This material is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry significant risk, including the potential loss of all invested capital. Always do your own research and consult professionals before making investment decisions.