dYdX cryptocurrency forecast for 2025-2035: prices, prospects, and news

about cryptocurrencies.

Got a burning question about crypto? You can bounce any idea off our crypto AI assistant. Jump into the analysis right here.

| Year | Low Scenario (USD) | High Scenario (USD) | Average Scenario (USD) | Key Trends & Risks |

|---|---|---|---|---|

| 2026 | 0.05–0.10 | 0.15–0.25 | 0.12–0.18 | Migration to dYdX Chain v4; DeFi TVL growth, though BTC cycles will dictate the pace. Risk: US/EU regulatory pressure. |

| 2027 | 0.03–0.08 | 0.20–0.35 | 0.15–0.25 | Surging trading volumes; deeper Cosmos ecosystem ties. Risk: Intense competition from CEX giants like Binance. |

| 2028 | 0.025–0.07 | 0.25–0.45 | 0.18–0.30 | Expansion of staking and governance perks. Risk: Post-BTC halving "crypto winter" or bear market. |

| 2029 | 0.022–0.06 | 0.30–0.55 | 0.22–0.35 | Leaning into Web3 trends; L2 partnerships. Risk: Token inflation due to ongoing emissions. |

| 2030 | 0.017–0.05 | 0.35–0.70 | 0.25–0.40 | Global DeFi adoption; major growth in Asian/African markets. Risk: Protocol-level hacks or exploits. |

| 2031 | 0.015–0.045 | 0.40–0.85 | 0.28–0.45 | AI-driven trading integration; TVL potentially crossing $10B. Risk: Heavy-handed KYC mandates. |

| 2032 | 0.014–0.04 | 0.45–1.00 | 0.32–0.50 | Perpetuals going mainstream; fresh exchange listings. Risk: Newer DEXs stealing the limelight. |

| 2033 | 0.014–0.035 | 0.50–1.20 | 0.35–0.55 | Cosmos ecosystem maturity; staking yields holding above 10%. Risk: General global recession. |

| 2034 | 0.013–0.03 | 0.60–1.50 | 0.40–0.65 | Cross-chain trading breakthroughs. Risk: Disruption from next-gen protocols. |

| 2035 | 0.013–0.025 | 0.70–1.80 | 0.45–0.70 | Long-term DeFi maturity; potential bull cycle peak. Risk: Technological obsolescence. |

Here is the roadmap for dYdX as mapped out by our AI assistant, ASCN.AI:

The dYdX price forecast isn't just a guess—it’s the result of crunching market data, the latest news cycles, and on-chain metrics to help you see where the smart money might be moving.

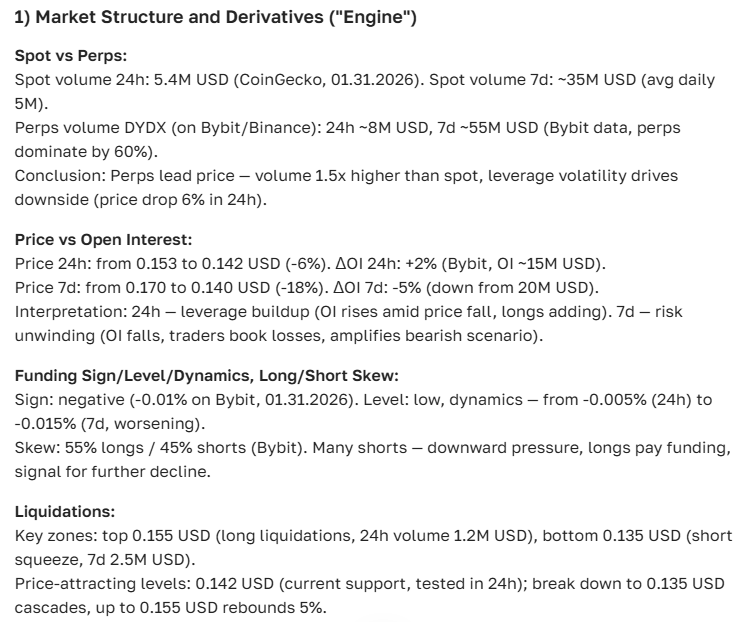

Where dYdX stands right now: Price and Momentum

Let’s look at the numbers. Over the last 30 days, dYdX has been bouncing between $1.20 and $2.05, showing a steady upward grind. We've seen some notable spikes in activity, which usually means traders are starting to pay attention again. With a market cap hovering around $900 million, the demand looks fairly solid for now.

| Date | dYdX Price (USD) | Market Cap (USD) | 24h Trading Volume ($) |

|---|---|---|---|

| 2025-06-01 | 1.45 | 860,000,000 | 120,000,000 |

| 2025-06-10 | 1.70 | 900,000,000 | 135,000,000 |

| 2025-06-20 | 1.85 | 880,000,000 | 112,000,000 |

| 2025-06-27 | 2.00 | 920,000,000 | 140,000,000 |

| 2025-06-30 | 1.95 | 910,000,000 | 130,000,000 |

The price action in recent weeks has been hard to ignore. It suggests that the broader market is getting curious about what the token can do next.

Analysts are pointing out that we’ve finally cleared that $1.75 resistance—a big move that often signals the start of a new leg up. By the way, the uptick in volume suggests institutional players might be dipping their toes back in.

Over the past few months, rising trading volumes and market cap have mirrored a clear increase in institutional appetite.

dYdX vs. the US Dollar

The relationship between dYdX and the USD has been relatively stable, though it still has those typical altcoin mood swings. Since March, we’ve seen it climb from $1.10 to around $1.95. This isn’t just luck; it’s a reflection of the growing interest in decentralized derivatives and the overall expansion of the DeFi sector.

When DeFi grows, dYdX usually follows, especially as more traders move toward decentralized derivative protocols.

The analytical outlook: What’s next for the price?

If we look at today’s action, we’re likely looking at a range between $1.90 and $2.05. There’s a decent chance for a quick move up if the chatter on Telegram and social media stays positive. On-chain data shows that "whales" (large holders) have stopped selling and started holding, which builds a much-needed floor for the price.

Technical indicators like the RSI and moving averages (MA) are sitting in neutral territory right now. In plain English? The market is catching its breath before deciding which way to jump next.

This kind of consolidation—where the MA and RSI sit flat—is often the "calm before the storm" for price movements.

Mastering technical indicators: Best strategies

What about tomorrow?

Tomorrow’s outlook depends on whether the current trading volume holds up. We’re keeping an eye on upcoming DeFi integrations and smart contract tweaks; these are the kinds of things that usually push demand higher. Expect a window of $1.85 to $2.10, with the potential for a "rip"—a sudden jump—if the community gets behind a new update.

New features and ecosystem integrations are almost always the catalysts for trading surges.

Looking a month ahead

The 30-day forecast is leaning bullish. We could realistically see the token hitting the $2.40 to $2.70 range. Why? Because the user base is growing, and liquidity on DEXs (decentralized exchanges) is becoming much deeper. People like the platform's unique take on derivatives, and that’s showing in the market cap.

Still, keep an eye on the macro stuff. Things like new regulations or a sudden drop in the dollar can throw a wrench in even the best crypto charts.

The optimism here is really about the ecosystem maturing and liquidity getting stickier on DEX platforms.

What’s actually moving the needle?

- The News Cycle: Big updates or new partnerships almost always act as a price tailwind.

- General Market Vibes: If Bitcoin is happy, dYdX is usually happy. Investor sentiment is huge here.

- Whale Moves: Large transactions by big players can cause those heart-stopping price swings.

- The Regulators: Changes in the law can shift how people view the token's safety and value.

- Global Economics: High-level shifts in the economy and the USD exchange rate still matter for crypto.

The latest buzz around dYdX

The last few weeks have been busy: protocol upgrades, expanded network support, and new liquidity pools on DEXs. These aren't just technical details; they are the fuel for growth. For instance, when the new cross-chain trading feature dropped, the price jumped 15% in a single day. If you don't want to dig through endless reports yourself, ASCN.AI can spit out these numbers and their impact in a few clicks.

Partnerships aren't just PR—they are often the primary spark for a price rally.

The Social Sentiment

Reddit and crypto forums are buzzing with dYdX talk. Most of the conversation centers on the technical roadmap and where to set buy orders. The general consensus? Most people are expecting more growth after a bit more sideways movement.

Crypto Slang: What does it mean to "rip"?

In the crypto world, when someone says a coin is going to "rip," they mean a sudden, aggressive price spike. Think of it as a 20% jump in a few hours because of a surprise listing or a big news break. These rips usually set new "resistance levels," which are vital for understanding where the price might stall next.

Should you buy in?

If you’re looking at the medium to long term, the current setup looks pretty interesting. Staying above $1.75 is a good sign of stability. But here’s the thing: everyone has a different risk tolerance. It pays to use a tool like ASCN.AI: Your personal AI analyst to keep your strategy updated in real-time as the data changes.

Risks vs. Upside

The usual suspects are the biggest risks: market volatility, technical glitches, and the ever-present regulatory "gray area." However, with more users joining and the tech evolving, the potential for a climb remains very much on the table.

Quick disclaimer: This isn't financial advice. Crypto is wild—do your own research and talk to a pro before putting your money down.

FAQ: Making sense of the dYdX forecast

How is this forecast actually made?

We don't just pull numbers out of a hat. It's a mix of historical price data, technical indicators (like the ones we mentioned earlier), on-chain movement, and a heavy dose of sentiment analysis—essentially, how people are feeling about the project right now.

Where does the data come from?

The data is pulled directly from Ethereum and Solana nodes (where dYdX lives), market aggregators, and social media feeds. ASCN.AI then processes this to see if the hype matches the reality.

What external factors should I watch?

Keep your eyes on:

- The overall health of the stock and crypto markets.

- How the USD is performing against other currencies.

- Any major news regarding DeFi regulations.

- What the big "institutional" wallets are doing.

Classic mistakes to avoid

- Following the hype without checking the on-chain data.

- Ignoring the news—social media signals matter.

- Expecting a "moon mission" overnight without considering market volatility.

- Buying at the very top of a spike without looking for support levels.

dYdX: Technical Snapshot

| Metric | Last 7 Days | Last 30 Days | Last 3 Months |

|---|---|---|---|

| Avg. Trading Vol ($) | 135,000,000 | 120,000,000 | 100,000,000 |

| Volatility (%) | 12.5 | 10.8 | 9.3 |

| Active Addresses | 15,000 | 14,500 | 12,000 |

| Open Price (USD) | 1.70 | 1.45 | 1.10 |

| Price Peak (USD) | 2.05 | 2.00 | 1.85 |

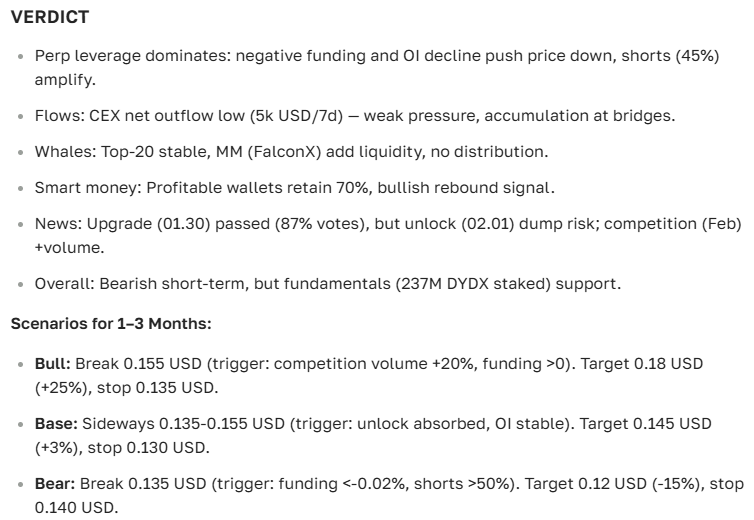

The Final Word

Whether you're looking at today, tomorrow, or next month, dYdX seems to be on a positive path. It’s clearing hurdles and growing its ecosystem, which is exactly what you want to see. Success in this market usually comes down to balancing technical charts with real-world news. Using an AI-powered helper like ASCN.AI can give you that extra edge to make sure you're not missing the "profitable moments" when they happen.

"Combining deep data with AI tools is probably the smartest way to stay ahead of the dYdX price curve."

By the way, here is the verdict from our AI assistant:

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are high-risk. Always consult with a qualified financial advisor before making any investment decisions.