DigiByte (DGB) Cryptocurrency Price Forecast for Today and the Future

about cryptocurrencies.

Got a burning question about crypto? You can bounce ideas off our crypto AI assistant at ASCN.AI. Why not start your analysis right now?

| Year | Lows (USD) | Mid-range (USD) | Potential Highs (USD) | The Context / Key Drivers |

|---|---|---|---|---|

| 2026 | 0.0036 – 0.0085 | 0.0066 – 0.0087 | 0.0094 – 0.0103 | Expect a neutral or slightly bearish vibe due to current volatility; growth hinges on a broader market recovery. |

| 2027 | 0.0037 – 0.0064 | 0.0064 – 0.12 | 0.0094 – 0.12 | We could see a real breakout if DigiByte doubles down on security; optimistic models even suggest a push toward $0.12. |

| 2028 | 0.0015 – 0.0190 | 0.0190 – 0.0218 | 0.0229 | Some forecasts hint at a 229% jump from current levels, though it really depends on real-world adoption. |

| 2029 | 0.0273 | 0.0283 | 0.0328 | Growth starts picking up speed as the ecosystem matures; we’re looking at an average climb of 30–40%. |

| 2030 | 0.0389 | 0.0403 | 0.0471 | A steady bullish trend seems likely here. A break toward $0.05 is possible if global adoption hits its stride. |

| 2031 | 0.0037 – 0.0582 | 0.0598 | 0.0683 | This wide range reflects market uncertainty, but the optimistic end sits comfortably near $0.07. |

| 2032 | 0.0879 – 0.0884 | 0.0903 – 0.0942 | 0.1024 | Significant gains ahead, at least if we extrapolate from previous market cycles. |

| 2033 | 0.1289 | 0.1325 | 0.1506 | The trend continues. If the market is favorable, hitting $0.15 isn't out of the question. |

| 2034 | 0.15 – 0.20 | 0.18 – 0.22 | 0.25 | Moderate growth of 20–30% seems realistic, mostly driven by technical innovations within the network. |

| 2035 | 0.20 – 0.50 | 0.35 – 0.60 | 0.72 – 5.00+ | The long-term bull case: a massive $5.00+ in a mass-adoption scenario, though a bearish $0.20 is still on the table. |

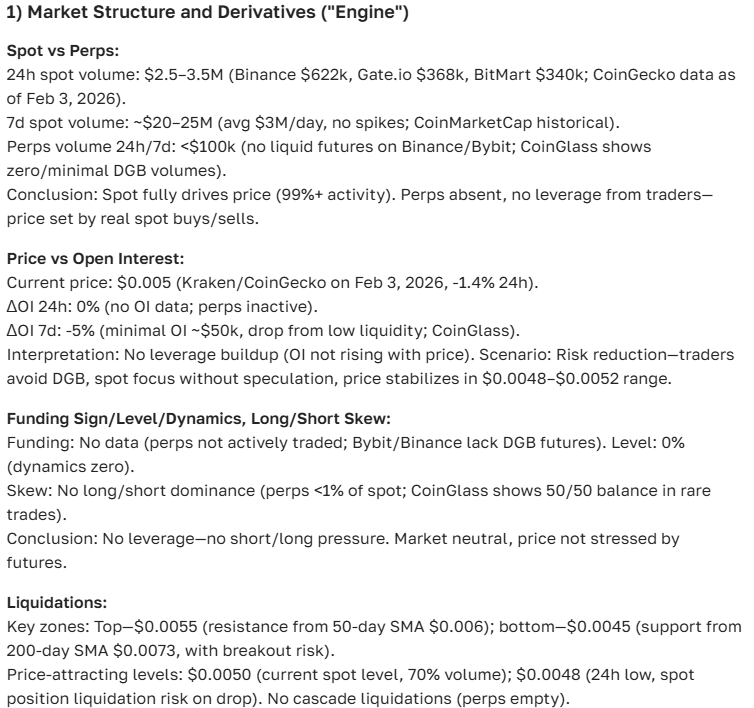

Here’s the breakdown for DigiByte as seen through the lens of the ASCN.AI assistant:

“DigiByte is one of those projects with genuine technical depth. It’s shown a lot of resilience, holding its ground even when the rest of the market feels like a rollercoaster. To really get where DGB is going, you have to look beyond the headlines and watch the global macro shifts.”

What’s actually moving the needle for DigiByte right now?

The roadmap for DigiByte is always tangled up with the latest industry shifts. Things like technical patches, new partnerships, and feature integrations directly dictate how the price behaves in the short term. Interestingly, throughout the summer of 2025, the coin has maintained a modest but very consistent uptrend, largely thanks to a dedicated community and some solid security upgrades.

Over the last month, investor interest has noticeably spiked. You can see it in the noise coming out of major forums like Blockchain Life. People are talking more about how DigiByte fits into the DeFi and NFT space, which creates a much healthier investment backdrop. When you combine strategic partnerships with actual tech improvements, you get a much stronger price floor.

The Bigger Picture: Macro Factors and Market Sentiment

You can't talk about DigiByte without mentioning the global economy. When traditional markets get shaky or inflation starts biting, people naturally start looking at decentralized assets. It’s a classic flight-to-safety move.

In July 2025, while everyone was waiting to see what the central banks would do next, DigiByte saw a nice little bump in demand. It’s not just about the money, though—the tech matters. As the pool of crypto investors grows, DGB’s transparent emission model and high transaction speeds become a lot more attractive. It’s the kind of utility that keeps a project relevant for the long haul.

Checking the Pulse: Current Price and Market Health

As of today, DigiByte is sitting at roughly $0.045. We’ve seen some minor wiggles in the charts over the last few weeks, but compared to other coins with similar market caps, DGB is holding up quite well. It doesn't seem to fold as easily during market-wide dips.

The price has been bouncing between $0.042 and $0.05 recently, with the peaks usually lining up with specific news events. A 7% monthly gain might not seem "moon-worthy" to some, but it shows a steady, sustainable interest rather than a speculative bubble.

With a market cap hovering between $600 and $700 million, the coin remains a solid top-60 contender. That’s a clear sign that the demand is real and the project has staying power.

The Numbers: Price Performance at a Glance

| Timeframe | Start Price ($) | End Price ($) | Change (%) | Market Cap ($M) |

|---|---|---|---|---|

| Today (July 2025) | 0.045 | 0.045 | 0 | 650 |

| Last 7 Days | 0.044 | 0.045 | +2.27 | 655 |

| Last 30 Days | 0.042 | 0.045 | +7.14 | 670 |

| Last 3 Months | 0.038 | 0.045 | +18.42 | 700 |

These figures pretty much confirm that DigiByte is steadily cementing its position.

Where do we go from here? The Growth Outlook

The future of DGB really comes down to how well the network scales and how many people actually use it. It’s fast, it’s secure, and it’s scalable—on paper, that makes it a perfect tool for both daily payments and as a store of value.

As the devs push out updates to harden the network, the underlying value tends to follow. It’s a simple relationship: better tech plus a growing market usually equals a higher price. Right now, our tools at ASCN.AI identify $0.04 as the key support level to watch. As long as we stay above that, the outlook remains quite healthy for the rest of 2025.

Tech Upgrades and Ecosystem Growth

Recent updates have focused heavily on protocol optimization. By making the network more decentralized and easier to integrate with DeFi protocols, the team is tackling the scaling "headaches" that plague other blockchains.

Long-term, this means lower fees and a much broader range of uses, from basic transfers to more complex Web3 services. Usually, when utility goes up, the market cap follows suit as new investors take notice.

What the Analysts are Saying

If you browse the forums, the mood is "cautiously optimistic." Even with the usual crypto volatility, the consensus for the next year points toward growth. The community seems to appreciate that the developers aren't just chasing hype but are actually building.

By the end of July 2025, some are calling for a push toward $0.06 or $0.07 if the market stays friendly. ASCN.AI’s on-chain metrics back this up. For a deeper dive, you can check out our Binance-focused analytical review.

“When you see active addresses climbing alongside regular code commits, you're looking at a project with genuine upside potential.”

Smart Moves: Investment Strategies for DigiByte

Experienced traders usually tell you the same thing: don't chase the green candles. Instead, look for entry points during minor corrections, ideally near that $0.04 support mark. It’s a simple way to manage risk.

If you’re looking for a quick trade, keep an eye on the news cycle. Significant updates often trigger a short-term pump. But if you’re in it for the long haul, "averaging in" (DCA) is almost always the smarter play. It takes the emotion out of the hourly price swings.

Managing the Risks

Let's be real: crypto is risky. You’ve got market volatility and the potential for technical delays. The best way to sleep at night is to diversify—don't bet the whole farm on one coin. Keep an eye on the news, but don't let it dictate every move you make.

FAQ — Your Questions Answered

What actually drives the DGB price?

It’s a mix of project-specific news, the general mood of the crypto market, and big-picture economic trends. Community activity and new tech integrations also play a huge role.

Why does the price sometimes jump out of nowhere?

These "rips" usually happen because of a sudden news break, a big "whale" making a move, or a new listing on a major exchange. It’s just the nature of the beast in crypto.

Is DigiByte actually going to grow?

The indicators look good. With the current roadmap and solid support levels, DGB has a very fair shot at gaining more ground over the coming months.

The Bottom Line

Overall, the outlook for DigiByte is looking up. The tech is evolving, and the market seems to be rewarding that. If you’re looking for a project with real technical substance and a community that actually cares, DGB is worth a look. Just remember to play it smart and keep your portfolio diversified.

Here is the final verdict from our ASCN.AI assistant:

Extra Insights

A common mistake people make is treating DGB exactly like Bitcoin. While they share some DNA, DigiByte has its own quirks and on-chain metrics that you need to follow if you want the full picture.

Side-by-side: DGB vs. The Competition

| The Specs | DigiByte (DGB) | Litecoin (LTC) | Cardano (ADA) | Bitcoin Cash (BCH) |

|---|---|---|---|---|

| Market Cap ($M) | 650 | 4500 | 15000 | 3700 |

| Price ($) | 0.045 | 95 | 0.40 | 120 |

| Avg Daily Vol ($M) | 30 | 180 | 600 | 120 |

| Consensus | PoW | PoW | PoS | PoW |

| Tx Speed | Very Fast | Average | Average | Average |

A quick case study: The Falcon Finance Dip

Early in 2025, when Falcon Finance took a hit, ASCN.AI was quick to provide users with a roadmap on how to handle their declining assets. It helped a lot of people save their capital by reallocating at the right time. We apply that same data-heavy approach to DigiByte, making sure you stay ahead of the curve. You can read more about that in our Falcon Finance case study.

Wrapping Up

The forecast for 2025 remains positive. Between the tech and the community, the ingredients for a price increase are all there. Just keep your eyes on the updates and maybe let a tool like ASCN.AI do some of the heavy lifting for you.

Disclaimer

This is for informational purposes only and isn't financial advice. Crypto is a wild ride with high risks. Always talk to a professional before putting your money on the line.