Dai cryptocurrency forecast for 2025-2035

about cryptocurrencies.

Got a question about cryptocurrencies? Fire it off to our crypto AI assistant. Jump into the analysis right now.

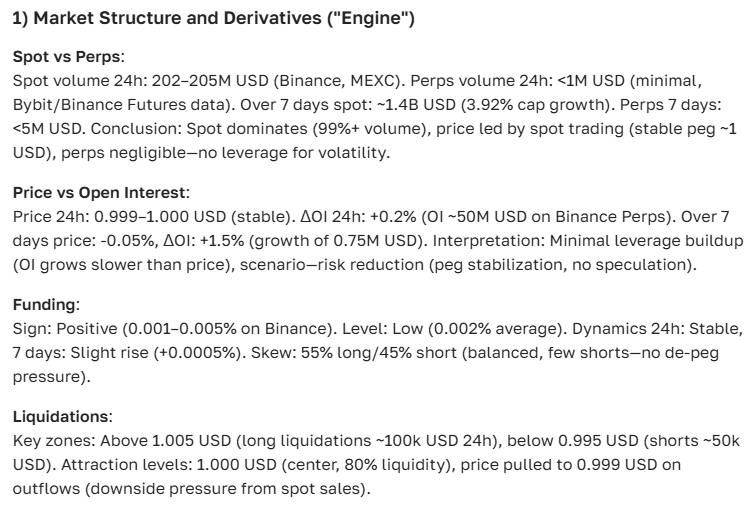

| Year | Price Range (USD) | Avg Price (USD) | Key Drivers & Risks |

|---|---|---|---|

| 2026 | $0.99 – $1.01 | ~$1.00 | Steady peg holds; market cap climbs to $8–10B on DeFi TVL surge (+30%). Risks: de-pegging if ETH swings wild, governance exploits. |

| 2027 | $0.99 – $1.01 | ~$1.00 | DAOs pile in; cap hits ~$10–15B with RWA collateral. Risks: USDC steals share, global DeFi sanctions bite. |

| 2028 | $0.99 – $1.01 | ~$1.00 | BTC halving synergy; MakerDAO v3 pushes cap to ~$15–20B. Risks: EU MiCA regs, collateral wipes if ETH tanks. |

| 2029 | $0.99 – $1.01 | ~$1.00 | Grabs 40%+ DeFi TVL dominance; cap ~$20–25B. Risks: crisis de-peg, SEC lawsuits loom. |

| 2030 | $0.99 – $1.01 | ~$1.00 | Matures as the "decentralized dollar"; cap >$25–30B, L2 hooks in. Risks: CBDCs compete, USD inflation erodes. |

| 2031 | $0.99 – $1.01 | ~$1.00 | Global push (30%+ DeFi market); cap ~$30–40B. Risks: geopolitics flare, shift to new stables like sDAI. |

| 2032 | $0.99 – $1.01 | ~$1.00 | Post-halving boom; cap ~$40–50B, Web3 adoption spikes. Risks: MakerDAO audits fail, cyber hits. |

| 2033 | $0.99 – $1.01 | ~$1.00 | Mass DeFi use (TVL >$50B); cap ~$50–60B. Risks: G20 rules tighten, bans in emerging markets. |

| 2034 | $0.99 – $1.01 | ~$1.00 | Market consolidation; cap ~$60–70B, AI/metaverse ties. Risks: fragmentation, yield-bearing stables take over. |

| 2035 | $0.99 – $1.01 | ~$1.00 | Full institutional buy-in; cap >$70–100B, RWA king. Risks: quantum tech shifts, systemic crashes. |

Our crypto AI assistant at ASCN.AI crunched this DAI outlook:

«DAI's this stablecoin with a clever collateral setup that keeps it pegged to the dollar through decentralized governance. But market swings and news still nudge its price around, shaping short-term plays and long-haul potential.»

Quick Dive into DAI

What's DAI All About?

DAI's a stablecoin built to hover right around a buck, unlike those wild crypto rides. It pulls this off with a smart collateral system and governance that actually works.

By the way, it runs on MakerDAO's decentralized protocol over on Ethereum. You lock up stuff like ETH as collateral, mint DAI, and boom—no central boss calling shots. That's the beauty.

Unlike Tether or USDC with their company overlords, DAI's all about open governance via MKR token votes and smart contracts. Cuts down on censorship risks, or so the theory goes. In practice? Pretty solid so far.

Collateral and algo tweaks keep the peg tight—way different from fiat-backed centralized coins.

How It Actually Works

Smart contracts handle the heavy lifting: minting, burning, liquidations based on collateral values. Keeps things solvent, mostly.

But here's the thing—MakerDAO's automations step in for liquidations when needed, dodging bigger blowups. For the most part.

Stands out for inflation resistance and DeFi ubiquity: lending, staking, payments across chains. Community loves it for that.

Still, volatility in collateral like ETH can test the peg during rough patches. Not invincible.

DAI's Price Right Now

Spot Price in Dollars

Today? DAI's chilling around $1, as it should. Back on Oct 27, 2023, it wobbled just ±0.01—impressive stability.

Algos and community props keep swings under 1%. Reliable.

Last month? Dipped to 0.98, hit 1.02. Liquid, trusty stable.

Recent News Shaking Things

MakerDAO's latest updates? Focused on collateral risk tweaks and adding new assets. Builds trust, smooths volatility.

DeFi regs are hot forum fodder globally. Tighter rules could crimp liquidity, but DAI's decentralization helps dodge that bullet.

Plus, more lending volume and DeFi integrations keep the peg steady. Good signs.

Outlook and Price Guesses

Short-Term Bets (Today, Tomorrow, Month)

Next month? Expect $1 stability with tiny blips from protocol tweaks or collateral moves.

DeFi lending demand might nudge supply/demand briefly, but arbs fix it fast.

Anything over ±2%? Short-lived, market corrects quick.

«Short-term, DAI sticks to the dollar like glue—smart contracts and algos make it one tough stable.»

Long-Haul Potential

Long-term, don't bet on price mooning past $1—that's not the game. Growth's in adoption, DeFi dominance.

Exchanges, payments, services expanding? Sets up steady demand without big swings.

Future plays: beefier algos, more collateral types. Boosts reliability, uptake.

What Moves the Price?

- Collateral prices, ETH especially.

- MakerDAO tech updates.

- DeFi/stables regs news.

- Lending volumes, DeFi demand.

- Overall crypto volatility hitting liquidity.

Lending and trading buzz directly props stability and supply.

Community Chatter & Expert Takes

Forums and Analyst Views

Folks in crypto circles call DAI top-tier for transparency and liquidation smarts on risky markets. Lots of talk on collateral watch.

Risks vs. Upside for Buyers

Value preservation? Minimal risk at $1 peg. Big worries: protocol glitches, collateral crashes.

Upside's in DeFi liquidity, lending, arbs. For holders, it's capital parking—not growth rocket.

Portfolio tweaks with stables in mind

Buy Now? Final Thoughts

Worth Grabbing DAI Today?

If you want steady crypto pegged to USD in DeFi, yeah. Not for pumps—pure capital tool, low risk, high liquidity.

Near-Term Price Call

$1 holds for days, weeks. Anomalies aside, it's payment/reserve gold.

ASCN.AI's crypto AI weighs in:

FAQ

What Pushes DAI Up or Down?

Collateral values, MakerDAO changes, reg news, DeFi lending demand. Supply/demand rules all.

Spot Real Forecasts vs. Hype?

Solid ones lean on fundamentals: protocol shifts, collateral prices, DeFi trends, regs. Hype's emotion and short buzz.

DAI for Long-Term Holds?

Not for appreciation. Great for stability, liquidity in DeFi. Think storage/transactions, skip speculation.

Disclaimer

This is general info only—not financial advice. Crypto investments carry high risk. Chat with qualified pros before any moves.