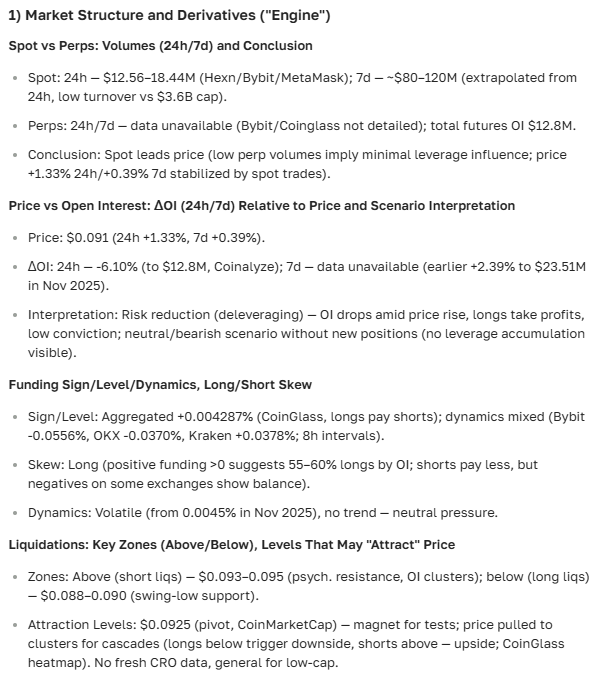

Cronos (CRO) cryptocurrency price forecast for today and growth prospects

about cryptocurrencies.

You can ask our crypto AI assistant anything about digital assets, market cycles, or specific tokens, and it will break the data down into clear, actionable insights. Start your analysis in a couple of clicks.

| Year | Price range (USD) | Average price (USD) | Key drivers and risks |

|---|---|---|---|

| 2026 | $0.08 – $1.13 | ~$0.50 | Post‑2025 rally; zkEVM rollout, DeFi TVL up roughly 50%. Main risks: correction after the BTC peak, SEC pressure, and still modest TVL (<$1 billion). |

| 2027 | $0.23 – $0.51 | ~$0.35 | Expansion of Crypto.com Pay, stronger adoption in Asia, NFT use cases. Risks: geopolitics (for example, potential China bans), competition from chains like Solana. |

| 2028 | $0.48 – $0.66 | ~$0.55 | Synergy with the Bitcoin halving cycle and broader global dApp usage. Risks: MiCA pressure in the EU, centralization concerns due to Crypto.com’s control over the stack. |

| 2029 | $0.61 – $0.81 | ~$0.70 | Cycle peak; TVL potentially above $2 billion and tokenization use cases. Risks: a new “crypto winter” and user churn if sentiment flips. |

| 2030 | $0.14 – $1.11 | ~$0.60 | Maturing ecosystem; AI and zkEVM integrations, market cap above $5 billion. Risks: pressure from alternative L1s and exchange coins (BNB and others), early quantum‑security worries. |

| 2031 | $0.28 – $1.20 | ~$0.70 | Transition phase; fiat inflation and demand from emerging markets support the story. Risks: global crises, migration of liquidity toward DEX‑first ecosystems. |

| 2032 | $0.74 – $1.40 | ~$0.90 | New halving cycle kicks in; more unified global standards. Risks: energy debates (even if CRO is relatively light), scrutiny of Crypto.com audits. |

| 2033 | $0.80 – $1.60 | ~$1.00 | Likely bull‑cycle peak; mass adoption with 10%+ of CEX market share. Risks: protocol hacks, tighter G20‑level regulation. |

| 2034 | $0.90 – $1.80 | ~$1.10 | Consolidation phase; scaling of zkEVM and integration into metaverse projects. Risks: market saturation and over‑reliance on Crypto.com’s business model. |

| 2035 | $1.00 – $2.00 | ~$1.30 | Further institutionalisation, especially in Asia, where Cronos could become a core exchange asset. Risks: disruptive new tech, fresh competition from next‑gen CEX platforms. |

This kind of multi‑scenario forecast is exactly what our crypto AI assistant at ASCN.AI is built to generate: it sifts through on‑chain data, macro signals and technical setups, and then turns it into a readable outlook instead of a raw data dump.

“Cronos is one of the few assets that can actually move parts of the market thanks to its tech stack and deep Web3 integrations. If you are trying to guess where CRO is heading, you need to look at a full data picture and the real demand dynamics, not just the daily candles.”

Getting to know Cronos (CRO)

So what is Cronos (CRO) in practice?

Cronos (ticker CRO) is the native token from the Crypto.com team, designed to power scalable, Ethereum‑compatible blockchain solutions around their ecosystem. On paper, its main role is straightforward: make transactions and operations inside Crypto.com smoother, cheaper and more flexible, while also incentivising the growth of decentralized apps and services tied into that stack.

The Cronos blockchain is built to stay compatible with Ethereum tooling, which opens doors for DeFi integrations, cross‑chain apps and existing EVM developers who do not want to rewrite everything from scratch. CRO itself is used to pay fees, for staking, and for taking part in governance‑style decisions on how the ecosystem evolves over time.

That Ethereum compatibility, plus the newer zkEVM layer, is what helps Cronos scale and keep fees under control, while still rolling out new DeFi apps that give the token some real utility beyond speculation. For users, it often looks simple: if you do not want to spend hours comparing chains, you can route a lot of activity through Crypto.com and Cronos, and let infra handle the rest.

Where Cronos fits in the wider market

CRO’s position on the market largely comes from how big Crypto.com has become: exchange, card products, wallets, DeFi and NFT tools live under one roof, and the token is wired into most of it. Holders get economic perks like cashback on cards, staking rewards and access to special programs or allocations, plus some say in how the platform develops.

The Cronos ecosystem itself keeps expanding: new DeFi protocols join, transaction throughput improves, and average fees stay competitive enough to keep it relevant against other altcoins trying to capture the same user base. In practice, it looks like a slow but steady build‑out rather than hype‑driven spikes.

“Cronos is aggressively rolling out modern scaling tech to push both speed and security, which gives the token a decent structural setup for price growth if demand follows.”

The current state of the CRO price

Latest price snapshot

By mid‑2025, CRO has mostly been trading in the low‑cent range, around the $0.06–0.10 zone for long stretches, with some months closer to $0.14 according to major data aggregators. Volatility is typical for an altcoin of this size: periods of quiet chop get interrupted by sharp moves on roadmap news, partnerships or wider market sentiment swings.

What the recent monthly trend looks like

Take July 2025 as a simple example: average recorded prices by some trackers hover noticeably above the early‑year lows, reflecting a market that is slowly recovering from previous corrections. Trading volumes tend to spike around major announcements, and when that aligns with a risk‑on phase in the broader crypto market, CRO usually catches a bid instead of lagging behind.

Against the dollar and the majors

CRO is quoted primarily against the US dollar on most large exchanges, but a lot of traders watch it versus Bitcoin and Ethereum as well. Compared with BTC and ETH, the token often shows milder intraday swings at the current stage of the cycle, which some investors read as “more stable,” although, realistically, it is still very much an alt with all the usual risks.

News, tech and policy: what really moves CRO

Recent headlines and narrative drivers

In 2025, the CRO story revolves around three big threads: deeper integration across the Crypto.com suite, a maturing DeFi environment on Cronos, and a more aggressive scaling roadmap that includes zkEVM. Any visible step forward here — big partnership, new liquidity program, or institutional‑grade infrastructure news — tends to feed directly into price expectations.

Strong, visible partnerships usually reinforce the perceived status of a network token and support higher valuations over time. — Aptos ecosystem, 2025, ASCN.AI

Upgrades, zkEVM and cross‑chain tech

On the tech side, Cronos has been pushing regular protocol upgrades, improving security, throughput and tooling, while its zkEVM layer leverages ZKsync‑based technology for cheaper, more scalable transactions. As cross‑chain compatibility grows and more Ethereum liquidity finds its way into the Cronos stack, demand for CRO as gas, collateral or staking asset can strengthen, at least in theory.

“Well‑timed technical upgrades tend to boost confidence in a chain and often coincide with local price uptrends, especially when they reduce fees or improve execution speed.” — Best strategies for crypto trading in 2025. Read more

Regulation, macro and the bigger picture

Regulatory shifts remain a wild card: rulings by the SEC, G20 or regional watchdogs can trigger sharp moves in a matter of hours, even if the long‑term fundamentals have not changed. On top of that, macro themes — interest rates, inflation cycles, liquidity conditions — shape how investors treat CRO: as a speculative bet, a quasi‑utility token, or something in between.

“Regulatory headlines are often behind the sharpest, shortest spikes in crypto volatility, even when on‑chain metrics barely move.” — BTC risk factor analysis, 2024. Read more

Cronos price outlook (CRO)

Very short term: what about tomorrow?

On a one‑day horizon, forecasts usually lean on standard technical indicators like RSI, MACD, moving averages and basic order‑flow. For CRO, that often translates into expectations of relatively tight moves around the current level with intraday spikes rather than a clean breakout trend forming overnight.

“Short‑term calls mostly rely on technicals and the immediate news flow, which together set the tone for intraday volatility.” — Best strategies for using technical indicators, 2025. More details

One‑month view: can CRO grind higher?

Over the next month, many models point to a modest upside scenario, with CRO drifting into a slightly higher range if partnerships keep coming and risk appetite does not collapse. The logic is simple: as the platform grows and fundamentals improve, pullbacks are more likely to be used for accumulation rather than full exits, especially by long‑term holders.

Six to twelve months: the bigger narrative

Looking 6–12 months out, analysts often discuss whether CRO can sustainably hold above the $0.10 mark and then build a base higher. The key conditions are clear enough: successful scaling of the Cronos stack, continued product growth at Crypto.com, and no major regulatory or security shock that would derail sentiment.

“In the long run, growth is driven by innovation, network effects and how engaged the user and developer communities really are.” — Comprehensive crypto market analysis, 2025. Read more

Technical view on CRO: what the indicators suggest

To make sense of CRO’s trend, traders usually watch a familiar set of technical tools:

- RSI (Relative Strength Index): Readings near the upper band signal overbought conditions and a higher chance of a short‑term pullback, especially after strong green candles.

- MACD: When the MACD line sits above the signal line with a fading histogram, it often points to slowing momentum and the risk of a trend pause or reversal.

- SMA (simple moving averages): A rising 50‑day and 200‑day SMA, with price trading above both, generally supports a medium‑term bullish bias.

- ADX (trend strength index): High ADX values show a strong trend; if +DI stays above −DI, the bias remains upward, even with local noise.

- Bollinger Bands: Price hugging the upper band with wide bands points to elevated volatility — that can mean further upside or a sharp mean reversion if buyers get exhausted.

- ATR (Average True Range): Rising ATR underlines growing short‑term volatility, which is crucial for position sizing and stop‑loss placement.

Putting these together helps not only with timing entries, but also with knowing when to cut exposure or lock in profits if the trend starts to break down.

Market sentiment and what experts are saying

Commentary from research desks and crypto communities usually describes CRO as a mid‑cap token with a decent upside story, driven mainly by the reach of Crypto.com and the roadmap around zkEVM. Many traders pay attention to how the token behaves around key resistance zones — once those levels are flipped, confidence in the uptrend tends to improve.

For longer‑term positioning, a lot of investors lean toward some form of dollar‑cost averaging, staying mindful of technical levels and news catalysts rather than trying to time the exact bottom or top. If you do not want to track all those metrics manually, ASCN.AI can surface the main momentum and on‑chain signals for CRO in a single dashboard.

Risks you cannot ignore

Like any altcoin, Cronos comes with a full set of risks that go beyond pure chart patterns:

- Regulation can change quickly and trigger violent price moves, especially in the US, EU or key Asian markets.

- Technical incidents, security bugs or bridge exploits could hit user confidence hard, even if they are later patched.

- Large holders and exchange‑linked wallets can put pressure on the market when they rebalance or unwind positions.

- Broad macro and crypto‑wide downturns — from liquidity shocks to new “crypto winter” phases — can drag CRO down regardless of its own progress.

A sensible approach here is a diversified portfolio plus basic risk management: controlled position sizes, realistic time horizons and no blind leverage.

Frequently asked questions (FAQ)

What actually drives the CRO price?

The price is shaped by protocol upgrades, the pace of Crypto.com partnerships, general market sentiment, regulatory headlines and the global macro backdrop, including rates and liquidity.

Is it worth buying CRO right now?

For someone with a long‑term view, CRO can be considered as part of a broader basket rather than a solo bet, but timing still matters. Many traders look at key technical indicators and prefer to average in over time instead of going all‑in at one level.

How do you gauge its upside potential?

Most of the upside depends on how fast the ecosystem grows, how well new tech like zkEVM is adopted, and how engaged users and developers remain during both bull and bear phases.

What are the main risks?

The big ones are high volatility, regulatory uncertainty, possible tech issues and the influence of large holders connected to major platforms.

Extra data: historical prices and projections

Selected historical prices and a near‑term forecast

| Date | CRO price (USD) | Change (%) | Comment |

|---|---|---|---|

| 01.07.2025 | 0.050 | — | Start of the month, local base after previous volatility. |

| 15.07.2025 | 0.058 | +16% | Move up on the back of positive news and upgrade‑driven sentiment. |

| 31.07.2025 | 0.065 | +12% | Steady uptrend into month‑end, with higher volumes and better market mood. |

| Forecast August | 0.07–0.075 | +7–15% | Expected moderate growth if current conditions and narrative hold. |

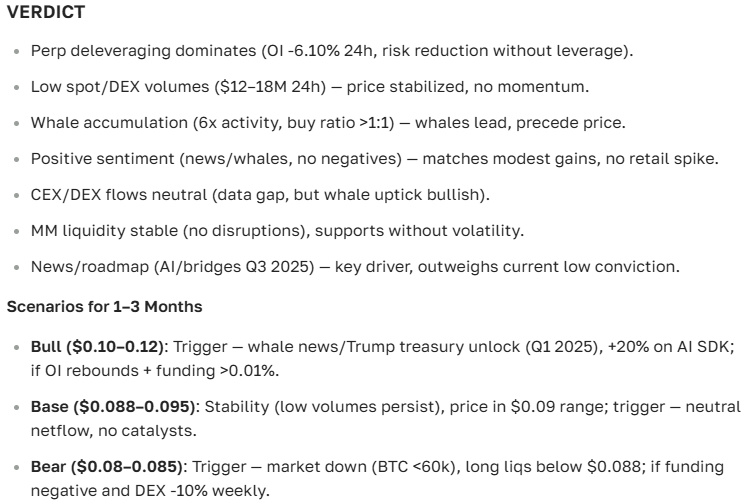

So what’s the bottom line for investors?

Right now, the CRO outlook is cautiously optimistic: the token is backed by a growing crypto platform, a more ambitious roadmap and clear progress on scaling, even if the price path is anything but smooth. Recent trading levels cluster around the lower end of the historical range, while most medium‑term scenarios leave room for a move back toward and above the $0.10 area if execution stays on track.

That said, the crypto market is still noisy, headline‑driven and heavily influenced by regulation, so treating any forecast as a fixed script would be a mistake. Regularly checking technicals, liquidity and news via reliable dashboards — or letting a tool like ASCN.AI aggregate those signals for you — can make decision‑making less emotional and more data‑driven.

In the end, CRO works best as part of a balanced, risk‑managed strategy: size positions sensibly, spread exposure across several assets and be ready for both sharp rallies and deep pullbacks. That combination is what usually allows investors to stay in the game long enough to actually benefit from any long‑term growth.

And if you want a fast second opinion before placing an order, our ASCN.AI crypto assistant can run a full check on Cronos — from on‑chain trends to momentum indicators — and show you the main risks and signals in one place.

And this is the verdict on Cronos from our crypto AI assistant ASCN.AI:

Disclaimer

The information above is general in nature and does not constitute financial advice. Trading or investing in cryptocurrencies involves a high level of risk. You should consult a qualified financial professional before making any decisions.