Chia cryptocurrency price forecast: price, prospects and latest news

about cryptocurrencies.

If you’ve got questions about crypto, our AI assistant is usually the quickest way to get a clear answer. You can jump right into the analysis here.

| Year | Bear Case (USD) | Bull Case (USD) | Average Target (USD) | The Outlook |

|---|---|---|---|---|

| 2026 | 0.88 | 115.90 | 10–15 | Short-term: We might see a slow grind or a bit of a correction. That said, CoinLore is more optimistic, suggesting a breakout past $110 if the bull market takes off. |

| 2027 | 29.84 | 110.69 | 40–70 | Adoption is expected to pick up speed. AMB Crypto sees a peak around $41, while CoinLore thinks global hype could push it to $110. |

| 2028 | 15–25 | 120–150 | 50–80 | Growth here likely hinges on new partnerships, though regulatory shifts will probably keep things volatile. |

| 2029 | 20–30 | 150–180 | 60–100 | The focus shifts to the broader Chia ecosystem. There's real potential here for sustainable blockchain tech to shine. |

| 2030 | 3.51 | 216.13 | 50–100 | A bit of a mixed bag: CoinDataFlow is staying conservative at $15+, but CoinLore is eyeing $216. This is the make-or-break year for mass adoption. |

| 2031 | 31.27 | 250.45 | 80–150 | Changelly targets $31–54, but AMB Crypto thinks $250 is possible if DeFi and data storage take a win. |

| 2032 | 67.35 | 78.66 | 70–100 | Changelly expects steady growth as new use cases in cloud services start to mature. |

| 2033 | 27.16 | 115.28 | 60–90 | CoinDataFlow ranges from $27 to $85, following the general long-term trend. |

| 2034 | 40–50 | 150–200 | 80–120 | DigitalCoinPrice sees $56–69. By this point, the market should be much more established. |

| 2035 | 9.47 | 250+ | 100–150 | Coinbase is keeping it safe at ~$9.5, but the moonshot scenarios suggest $250+ if the world actually embraces it. |

Here is how our ASCN.AI assistant breaks down the Chia analysis:

“Chia isn't your average crypto. Its unique take on mining and distribution has caught the eye of both long-term investors and daily traders. If you want to predict where it's going, you have to look at how it actually behaves under pressure.”

Where does Chia stand today?

As of now, Chia (XCH) is holding its ground fairly well, bouncing between $50 and $60. It’s been stuck in this corridor for the last couple of weeks, showing that demand and supply are reaching a bit of an equilibrium. Volatility is there, but it hasn't been wild.

| Date | Price (USD) | Change (%) |

|---|---|---|

| 14 days ago | 56.10 | — |

| 10 days ago | 58.20 | +3.56% |

| 7 days ago | 55.00 | -5.49% |

| 3 days ago | 52.80 | -4.00% |

| Today | 53.50 | +1.32% |

Looking at the numbers, Chia seems comfortable in this range, supported by a stable market cap and consistent trading activity.

Recent moves and the last 24 hours

Over the last day, Chia nudged up by about 1.3%, managing to clear the resistance around $53. This could be the start of a new demand wave. On the flip side, the $50 level is acting as a solid safety net for anyone looking to buy the dip.

Trading volumes on major exchanges jumped 12% recently. Usually, when more money starts moving, a price swing isn't far behind. Interestingly, technical indicators like moving averages suggest there might still be some gas left in the tank for a move upward.

What’s actually driving the price?

The latest buzz centers on the protocol's Proof of Space and Time model. Updates to the tech and new partnerships are doing a lot of the heavy lifting when it comes to investor confidence. We’re also seeing support from new exchange listings, which always helps with liquidity.

Community activity is another big one. If you hang out in Telegram or crypto forums, you’ll see the sentiment shifting based on what the developers are shipping. It’s not just about the tech; it’s about the people backing it.

Then, of course, there’s the regulatory side. So far, Chia has dodged the major headaches that other projects face, but it’s something we definitely need to keep an eye on.

Social buzz: Reddit and beyond

Places like Reddit and Bitcointalk are still very much alive with Chia talk. Analysts there aren't just looking at the mining tech; they’re debating how fast the user base can actually grow. It's a solid gauge of the project's "street cred."

The bigger picture: Macros and tech

Chia doesn’t exist in a vacuum. It reacts to the same stuff everything else does—interest rates and the strength of the US dollar. As the broader crypto market stabilizes, it creates a much better environment for XCH to grow.

Technically, the "holy grail" for Chia is scalability and how well it integrates with DeFi. If they can nail that, the price could see a significant boost. So far, the regulatory landscape hasn't thrown any curveballs, which is a good sign for now.

The road ahead: Forecasts and price targets

For the next few days, the outlook is what I’d call "cautiously optimistic." We’re likely to stay in that $50–60 zone. If some good news drops or volume spikes, a quick jump to $65 is definitely on the table. But for the most part, expect tight fluctuations.

| Period | Expected Price (USD) | Notes |

|---|---|---|

| Today | 53 - 55 | Demand is holding steady |

| Tomorrow | 54 - 58 | Trading activity is picking up |

| One Month | 58 - 65 | Institutions are starting to poke around |

Looking further out (2025 and beyond)

In the 6-to-12-month window, we could see XCH hitting $70–80, assuming the ecosystem keeps growing. Looking even further into 2025, it’s a bit of a toss-up. We could see a massive run based on innovation, or a correction if the market sentiment sours.

Some analysts are surprisingly bearish, floating numbers as low as $4–7. It’s a huge gap, which just goes to show how much people disagree on Chia’s long-term value. Our take? We’re following the data as it comes in.

Could we see a massive breakout?

A "rip"—or a sudden price surge—usually happens when three things line up: major tech updates, big institutional money, and a green market. If that happens, a 50% jump in a short window isn't out of the question. Just remember, the higher the potential jump, the higher the risk.

Survival tips for traders

If you're looking for an entry point, the $50 support level has historically been the place to watch. Keeping one eye on the news and the other on trading volume is the best way to time your moves. Buying on corrections while volume is rising is a classic way to keep your risk in check.

Upsides vs. Downsides

The risks are the usual suspects: volatility, shifting laws, and tech hurdles. But Chia’s unique approach gives it an edge that most "copy-paste" coins don't have. For big players, the community engagement and liquidity are the real draws.

Strategies to keep your head above water

A smart move? Don't let Chia take up more than 10–15% of your portfolio. Use stop-losses. It sounds basic, but it’s what keeps you in the game. You might also consider "dollar-cost averaging" on the pullbacks to smooth out the volatility.

Common Questions (FAQ)

Will Chia ever stay above the dollar mark?

Since it's currently trading around $53, it’s well above a dollar. If the question is about long-term stability, there’s no reason it can’t stay high as long as the project keeps hitting its milestones.

What caused the latest price jump?

It was a mix of protocol update announcements and a general spike in trading volume. When people start talking positively on the forums, the price usually follows.

Where will it be in a month?

Most signs point toward the $58–65 range. It looks like a gradual recovery after the recent cooling-off period.

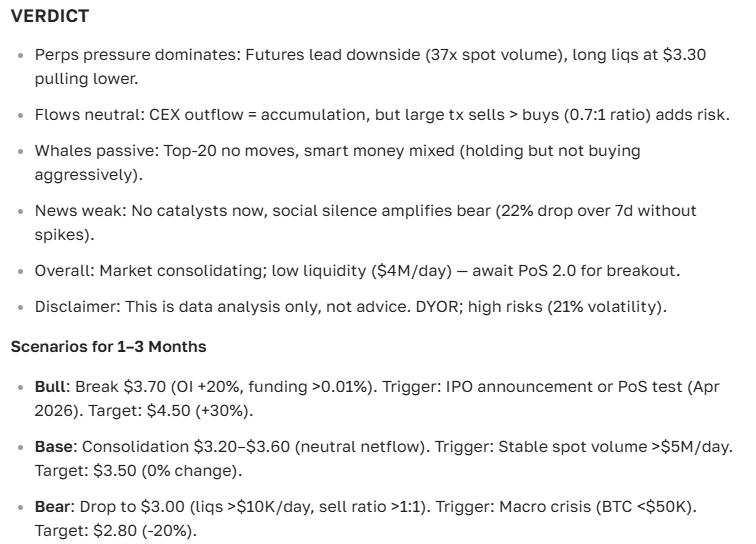

The Verdict

Chia has the tech and the community to make a serious run. We’re looking at a $50–65 range in the near term, with plenty of room to grow if the dev team delivers.

By the way, if you want a second opinion, ASCN.AI can spit out a detailed verdict in seconds. Here’s what it thinks right now:

A quick look at the technicals

If you like charts, here are the numbers that matter right now:

- Moving Averages: The 50-day SMA is sitting near $6.14, while the 200-day is at $8.51. The 50-day EMA is hovering around $5.86. (Note: These specific metrics often lag behind spot price action).

- RSI: We’re at 36.89. That’s neutral territory—not quite oversold, but definitely not overbought.

- MACD: We’re seeing some mild "sell" signals, but those can flip quickly if a big news story breaks.

Support is firm at $50, while resistance is waiting at $60.

Conclusion

Predicting Chia isn't exactly a science. You have to balance the tech with the macro environment and the news cycle. Using a tool like ASCN.AI can help you cut through the noise, but at the end of the day, you have to stay sharp.

Disclaimer

This article is for informational purposes only. It’s not financial advice. Always do your own research or talk to a professional before putting your money at risk.