BNB cryptocurrency forecast for 2025-2035 — latest news and outlook

about cryptocurrencies.

Got a question about crypto? Fire it over to our crypto AI assistant. Dive into the analysis right now.

| Year | Price Range (USD) | Average Price (USD) | Key Drivers and Risks |

|---|---|---|---|

| 2026 | $600 – $1,200 | ~$900 | Post-2025 rally kicks in; token burns, DeFi boom on BNB Chain (TVL up 40%). But watch out for SEC regs hitting Binance lawsuits, or a BTC peak pullback. |

| 2027 | $700 – $1,500 | ~$1,100 | Ecosystem upgrades like OpBNB L2; Asia adoption surges, NFT market heats up. Risks? Geopolitics (Binance sanctions), Ethereum L2 crowding in. |

| 2028 | $800 – $1,800 | ~$1,300 | Synergy with BTC halving; Binance Pay goes global. Downsides: too centralized (CZ/Binance reliance), EU's MiCA rules tightening. |

| 2029 | $900 – $2,100 | ~$1,500 | Cycle peak; burns over 50% supply, DeFi TVL tops $10B. Risks include crypto winter, CFTC/SEC legal headaches. |

| 2030 | $1,000 – $2,500 | ~$1,800 | Matures as real utility; AI/Web3 integrations, cap over $300B. Threats from altcoins like Solana, decentralization shifts. |

| 2031 | $1,200 – $3,000 | ~$2,100 | Transition phase; fiat inflation, Launchpad boom. Global crises or migration to decentralized chains could hurt. |

| 2032 | $1,400 – $3,500 | ~$2,500 | New halving cycle; BNB as global payment token. Energy debates (PoSA vs PoS), Binance audits loom large. |

| 2033 | $1,600 – $4,000 | ~$2,800 | Bull peak; mass adoption (50%+ CEX volume). Ecosystem hacks, G20 regs are the big worries. |

| 2034 | $1,800 – $4,500 | ~$3,200 | Consolidation; L2 tweaks, metaverses on BNB. Market saturation, new L1 rivals could stall it. |

| 2035 | $2,000 – $5,000 | ~$3,500 | Institutional push; cap over $500B, Asia dominance. Quantum threats, Binance losing edge—real long-shot risks. |

Our crypto AI at ASCN.AI crunched this BNB price outlook:

«BNB price forecasts are a hot topic for investors and traders tracking this coin's ups and downs. Keeping a close eye on its price and the factors driving it helps make smarter calls in this wild crypto market.»

BNB's current USD price—fresh data for today

Right now, BNB's hovering around $330. That's the market's mood in a nutshell—demand and supply balancing out. Gives you a snapshot of where the coin stands, its market cap, and how it stacks up against the competition.

BNB price history at a glance

Over the last 30 days, BNB's seen steady gains with some bumps—up 5-10% range. Kicked off July around $280, ended the month above $330. That's roughly 15% monthly bump, signaling investors warming back up to Binance's coin.

This kind of reliable climb? Shows real trust in BNB and its growing ecosystem.

Zoom out further—it's blown past mid-2024 levels when it was under $300. Market's taking it seriously now.

BNB price forecast for tomorrow and next month

Short-term BNB outlook? Based on market vibes, news flow, and tech indicators. Could pump or dip a bit—depends on the broader crypto scene and Binance-specific shakes.

What drives BNB up or down?

Market conditions call a lot of shots for BNB. Big ones: overall crypto trends, trading volumes, liquidity, and demand for Binance stuff. Tech support/resistance levels? Traders and bots obsess over those.

Volume spikes and those key levels often dictate the next move—plenty of analysts nod to that.

Binance news, BNB Chain updates, new listings, or reg changes? They can fuel a rally or spark outflows quick.

Rip scenarios and volatility plays

Three main paths for BNB short-term:

- Bull case: Breaks $350 on BSC cap growth and good partnership buzz.

- Sideways: Sticks to $320-340 without big catalysts.

- Bear case: Drops under $300 on bad news, fading crypto hype, exchange wobbles.

Latest BNB news shaking things up

Fresh Binance and BNB ecosystem updates directly nudge the price. July brought BNB Chain expansions, fresh DeFi tools, and project launches.

Those chain upgrades and partnerships? They're beefing up the coin's resilience and cap.

Binance linking arms with big investors and finance players—shows the growing pull of BNB's world.

Analysts are eyeing short-term USD strength too, which ripples to BNB given its dollar ties and global econ links.

Top news bites with takes

Reports highlight BNB's moderate uptick from user influx and BSC activity. But second-half-of-year volatility? Pretty standard fare.

ASCN.AI experts point to DeFi momentum and smart contract surges on BNB Chain as key stabilizers.

What forums and socials say about BNB

BNB crowd's split. Bulls bet on chain expansions and faster txns. Bears fret over altcoin fatigue and reg clamps.

Macro events and rule changes amp up the short-term swings.

Forums paint a mixed bag—fits the volatility, opening doors for pumps or dumps.

Community bulls vs bears

Optimists see $350+ soon on momentum. Pessimists warn of a slide to $280-300 if markets sour.

«BNB Chain growth vs outside risks? That's the price dance.»

Investor tip: Buy BNB now?

BNB investing? Decent upside with manageable risks. Weigh Binance ecosystem wins against market chop.

Risks vs rewards

Dangers: crypto chaos, regs shifting, USD moves. Upsides: cap growth, more BNB uses, trading swings for quick or mid-term plays.

Smart buys lean on tech charts, Binance roadmaps, and AI tools like ASCN.AI for on-chain signals and news alerts. React fast.

This is general info—not financial advice. Talk to a pro.

BNB price vs other top coins

| Crypto | Price (USD) | 1-Month Gain (%) | Market Cap (B USD) |

|---|---|---|---|

| BNB | 330 | +15 | 52 |

| BTC | 30,200 | +7 | 580 |

| ETH | 1,900 | +12 | 230 |

| ADA | 0.38 | +5 | 12 |

| SOL | 23.5 | +20 | 8 |

Charts show BNB leading major alts last month—outpacing ADA and BTC, though SOL edged it.

BNB FAQ: Top questions on price and outlook

What's BNB at right now?

Around $330 today—mirrors market swings and token demand.

BNB growth ahead?

Tied to BNB Chain builds, user growth, upgrades. Right conditions? Could hit $350.

Buy BNB today?

Weigh risks vs gains. Solid for long-haul holds.

How's BNB stack up?

Holds strong in top ranks—steady gains, hefty cap like other big alts.

How we forecast BNB prices

BNB predictions mix tech/fundamentals, on-chain metrics, social buzz. Stats, ML, expert gut-checks.

Tech indicators plus on-chain data sharpen the edge on price moves.

ASCN.AI's method? Market stats, on-chain flows, news streams—for spot-on BNB calls.

« Nailing BNB forecasts means blending tech, fundamentals, and sentiment.»

Crypto market overview with charts

Crypto's on a recovery tear. Total cap over $1.3T, BNB grabbing about 4% slice.

USD strength's impact on BNB

BNB tracks the dollar tight—most trades in USD. Stronger buck? Crypto dips, BNB included, stats back it.

Charts line up: USD rallies, BNB softens. Though BNB Chain internals and partnerships can cushion.

«BNB outlooks need the full picture—macro, network quirks, market mood.»

Real-world ASCN.AI win

ASCN.AI's on-chain digs spotted BNB key levels amid spikes and dumps. Clients jumped on arb ops, cut risks sharp.

ASCN.AI Falcon Finance crash case | $1000 in 2 prompts

Oct 11 night flash crash | Profit playbook

Wrapping up

BNB looks steady for growth today, tomorrow, next month—tech and fundamentals line up. But track news, BNB Chain progress, macro shifts for winning trades.

Cutting-edge tools deliver the data fast, sharpening your crypto moves.

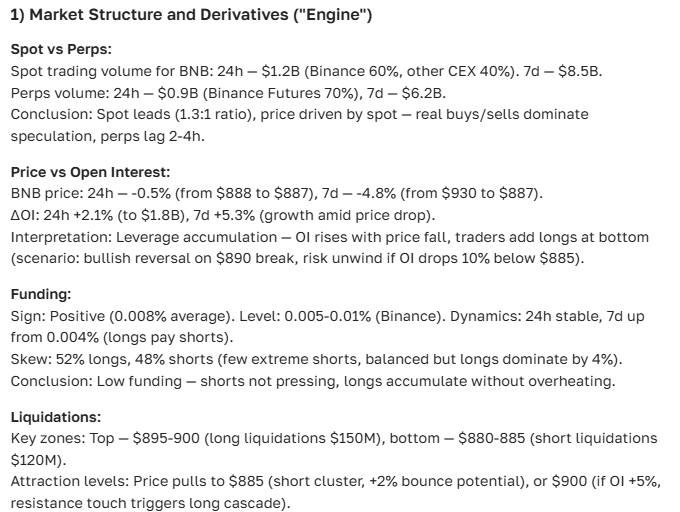

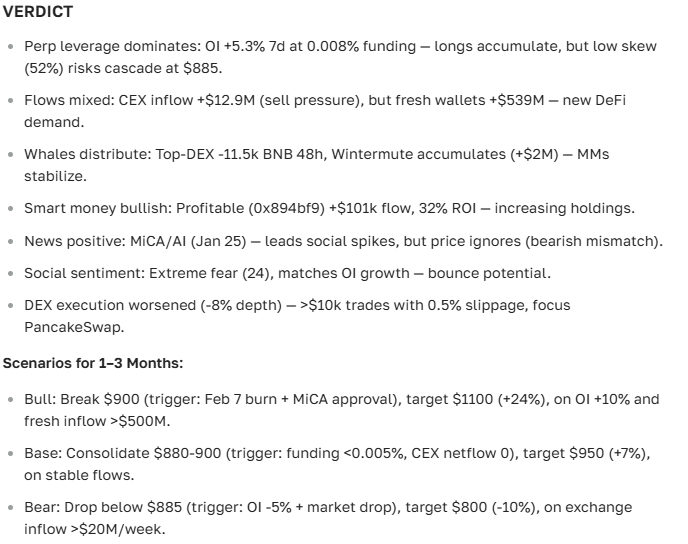

Here's the verdict from our crypto AI:

Disclaimer

This is general info, not financial advice. Crypto investing packs high risks. Consult qualified pros before jumping in.