Bittensor Cryptocurrency Rate Forecast: Price, Outlook and Analytics

about cryptocurrencies.

Got a burning question about crypto? Our AI assistant is ready to help. You can jump into the analysis right here.

| Year | Conservative (Min) | Base Case (Average) | The "Moon" Scenario (Max) | What’s driving the price? |

|---|---|---|---|---|

| 2026 | $230–$300 | $400–$500 | $600–$700 | Post-2025 halving vibes and the AI ecosystem boom; the cycle peak is usually where things get interesting. |

| 2027 | $300–$400 | $500–$600 | $700–$900 | DeAI adoption starts hitting the mainstream; we could see a 20-30% jump over the base forecast. |

| 2028 | $350–$500 | $700–$900 | $1,000–$1,300 | Network expansion for Bittensor; global AI regulations will likely play a massive role here. |

| 2029 | $400–$600 | $900–$1,200 | $1,300–$1,700 | Cross-chain integrations and a potential cyclical peak in the broader market. |

| 2030 | $450–$700 | $1,200–$1,500 | $1,800–$2,500 | The AI market matures; a halving around 2030 should help put the brakes on inflation. |

| 2031 | $500–$800 | $1,500–$2,000 | $2,500–$3,500 | Mass adoption of decentralized AI; positive news cycles could easily trigger 30%+ rallies. |

| 2032 | $600–$1,000 | $2,000–$2,800 | $3,500–$5,000 | Solidifying its spot as a leading AI blockchain; big-name partnerships could be the catalyst here. |

| 2033 | $700–$1,200 | $2,800–$4,000 | $5,000–$7,000 | Global integration and macro factors; if we extrapolate, we’re looking at 25-40% growth. |

| 2034 | $800–$1,500 | $4,000–$5,500 | $7,000–$10,000 | Long-term ecosystem growth meets regulatory stability. |

| 2035 | $1,000–$2,000 | $5,500–$8,000 | $10,000–$15,000 | DeAI hits full maturity; TAO potentially leads the entire AI-crypto niche. |

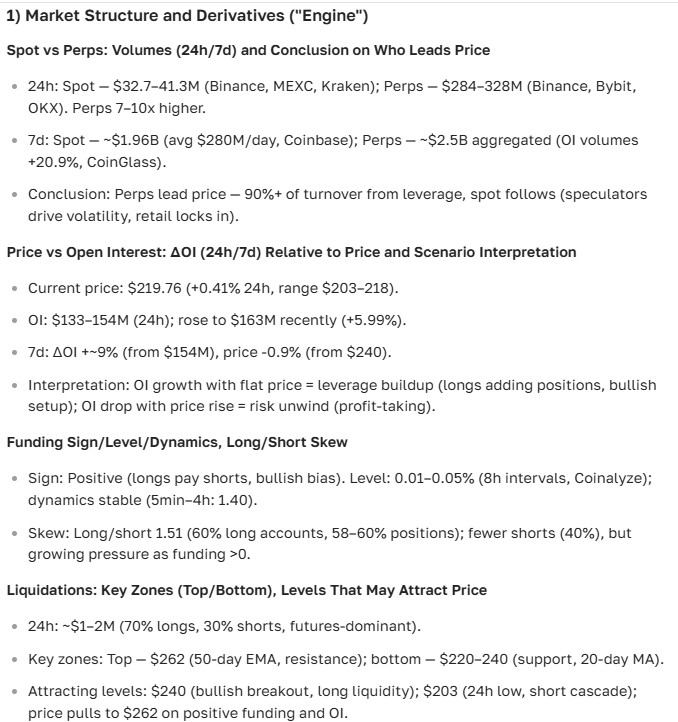

Here is the breakdown for Bittensor as provided by our ASCN.AI assistant:

“When we map out the future of Bittensor, we look closely at its unique tech stack and how the Web3 world is shifting. It’s the best way to separate the hype from the actual growth potential of TAO.”

What is Bittensor (TAO) all about?

Bittensor sits right at the busy intersection of crypto and artificial intelligence. Its token, TAO, is the lifeblood of a decentralized network where users get paid for helping train and evolve AI models. Unlike the closed doors of Silicon Valley, Bittensor is building an ecosystem that rewards open, collaborative AI development.

The core idea is simple: take the power away from giant corporations and hand it back to the community. By distributing control over how AI learns, TAO has carved out a niche as a promising asset with plenty of room to grow.

By the way, the way Bittensor handles its tokenomics is a huge draw for decentralized AI networks—it’s basically designed to pump up the project's overall value over time.

If you're still wrapping your head around the basics, it’s worth checking out the fundamentals of blockchain.

— ASCN.AI Blog

A quick history: How it started

The project kicked off back in 2020 with a pretty ambitious goal: marry blockchain with machine learning to speed up decentralized apps. It turns out that putting AI on a blockchain opens up a lot of doors for efficiency that just weren't there before.

Jack Kok, a specialist in AI and cryptography, took the helm. Over the last few years, the team has hit some big milestones—launching the mainnet, getting key nodes online, and fine-tuning the protocol for AI-specific tasks.

The community has grown steadily, and investors are starting to notice. That steady influx of interest is exactly what’s been keeping TAO’s momentum going.

Where does it sit in the market?

Fast forward to July 2025, and Bittensor’s market cap is sitting around $150 million. That’s a clear signal that the appetite for AI-crypto mashups is very real. AI-related altcoins have been showing some serious strength lately, and TAO is no exception.

Currently, TAO is hanging out in the top 500. It’s got decent liquidity—stable enough for most traders—and the price swings have been relatively manageable. If you’re looking at this for a mid-to-long-term play, that kind of stability is actually a good sign.

Everything seems to be lining up.

Current TAO price action and dollar dynamics

Looking at the July 2025 charts, we’ve seen some interesting moves. We had a nice rally toward the middle of the month, followed by a bit of a pullback (along with the rest of the market), and then a quick recovery thanks to some fresh integration news.

The last 6 months at a glance

| Month | Start Price (USD) | End Price (USD) | Change (%) |

|---|---|---|---|

| February | 0.85 | 0.90 | +5.9% |

| March | 0.90 | 0.95 | +5.6% |

| April | 0.95 | 0.88 | -7.4% |

| May | 0.88 | 1.00 | +13.6% |

| June | 1.00 | 1.10 | +10.0% |

| July | 1.10 | 1.05 (as of July 25) | -4.5% |

Where is the price headed next?

Right now, TAO is hovering around $1.05. It’s being pulled by the usual market forces—macro trends, platform updates, and whatever is happening in the AI sector today. The ongoing buzz around Web3 and AI acts like a safety net, helping to prevent any catastrophic dips.

Interestingly, the price is tightly pegged to the US dollar, which gives TAO a bit more stability than your average micro-cap coin. New partnerships are usually the "spark" that triggers short-term price jumps.

What about tomorrow?

We’re likely looking at some minor volatility, maybe +/- 2-3%. It’s pretty standard stuff for a project in this phase—traders reacting to daily news bites. Most "growth" coins see about 2-5% swings daily, so there’s nothing to panic about here.

The monthly outlook

Looking a month out, we could see TAO hitting the $1.20–$1.35 range. This assumes the network keeps expanding and the demand stays steady. The broader AI sector is being propped up by institutional money, and Bittensor is in a prime spot to catch that tailwind.

Plenty of big players are using TAO to diversify their bags, though you can’t ignore the usual crypto risks. It’s a wild market, after all.

Diving into the Technicals

We use the 50, 100, and 200-day moving averages to see where TAO is actually going:

- On the 4-hour chart, we’re in a clear uptrend with a rising 50-day SMA.

- The daily chart looks bullish, but we’re bumping up against the 200-day SMA resistance. Expect some sideways movement (consolidation) there.

- The weekly chart is still holding strong above the 50-day SMA, and the RSI is chilling in the neutral 30–70 zone.

RSI and MACD signals

The RSI isn't screaming "overbought" yet, which is good. The MACD is looking a bit flat, suggesting some uncertainty in the short term—definitely a "wait and see" moment for a clear signal.

The "Line in the Sand" (Support & Resistance)

Support is holding firm between $0.90 and $1.00. If we want to see more upside, we need to clear the resistance at $1.20 and $1.35. If it breaks through those, we might be off to the races.

Pardon, got a little turned around there. Let's keep going.

What actually moves the price of Bittensor?

Whenever they plug in a new decentralized learning module or announce a collab with a big AI player, the price usually reacts well. Partnerships are essentially the fuel for TAO’s demand.

Supply and Demand basics

TAO has a limited supply. When you combine that with people actually needing the token to use the network, you get a solid floor for the price. It’s a classic balance of fixed supply vs. growing interest.

The Dollar factor

Since it’s priced in USD, the strength of the dollar matters. When the dollar is stable, altcoins like TAO have a much easier time avoiding wild, erratic swings.

What’s the word on the street?

If you head over to the crypto forums, the vibe is mostly positive. Analysts seem to love the tech potential here, and the community is generally betting on TAO for the long haul. In this space, community sentiment is often a leading indicator of where the price goes next.

So, is it a buy?

If you’re a fan of AI and have a long-term horizon, Bittensor is definitely one to watch. But—and this is a big "but"—crypto is volatile. You have to keep your eyes on the news cycle.

Investing in AI crypto isn't a "set it and forget it" thing; it requires some smart risk management. It’s always a good idea to talk to a pro before you dive in. This isn't financial advice, just our take on the data.

Disclaimer: This is not a personal investment recommendation.

Wait, what does "to rip" mean?

In crypto-speak, when a coin "rips," it means the price is shooting up fast. For example, back in June 2025, TAO "ripped" 20% right after a major update. These spikes are usually news-driven, though sometimes they’re just pure speculation.

FAQ

How is the price of Bittensor set?

It’s all about the exchanges. The price is a living reflection of supply, demand, market trends, and whatever news is breaking about the platform.

What are the risks?

The usual suspects: volatility, tech bugs, regulatory shifts, and the general health of the crypto market. Plus, TAO is still tied to the dollar's performance.

Where can I get some TAO?

You’ll find it on most major central exchanges and a handful of DEXs (decentralized exchanges).

A real-world case: Using ASCN.AI for market analysis

ASCN.AI is basically a shortcut for investors. Instead of spending hours digging through data, the AI helps you track TAO and make faster, more informed calls.

Check out how ASCN.AI handled the Falcon Finance dip here.

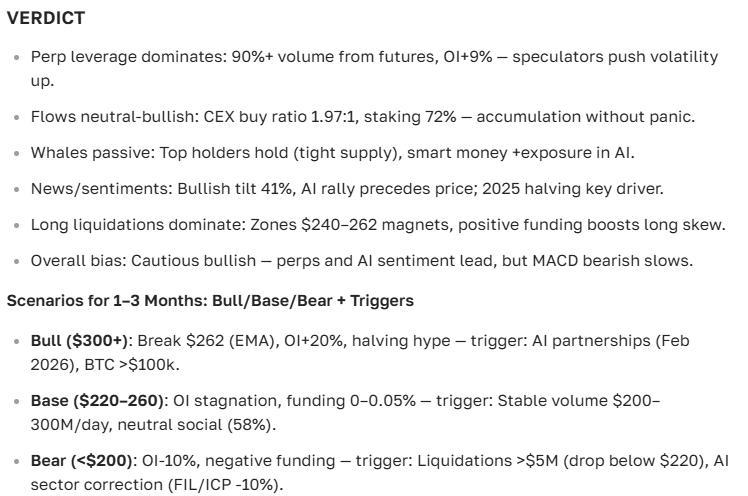

The Verdict: Future Outlook

The long-term outlook for Bittensor looks bright, mostly because it’s solving real problems in the AI and Web3 space. If you’re okay with a bit of risk and like the tech, TAO is a solid contender.

The trick is to stay updated and use the right tools to react when the market shifts.

“Bittensor is effectively merging AI potential with blockchain dynamics—it’s opening up a whole new frontier.”

That’s the final word from our ASCN.AI assistant:

The long-term numbers (2025–2036)

| Year | Floor Price (USD) | Average Price (USD) | Ceiling Price (USD) |

|---|---|---|---|

| 2025 | 255.05 | 269.39 | 283.73 |

| 2026 | 92.48 | 187.41 | 282.34 |

| 2027 | 89.02 | 161.45 | 233.87 |

| 2028 | 160.67 | 277.10 | 393.53 |

| 2029 | 352.94 | 756.99 | 1,161.03 |

| 2030 | 300.16 | 584.01 | 867.87 |

| 2031 | 354.89 | 573.57 | 792.26 |

| 2032 | 541.71 | 1,005.66 | 1,469.61 |

| 2033 | 1,258.82 | 2,586.67 | 3,914.52 |

| 2034 | 1,012.03 | 1,639.55 | 2,267.08 |

| 2035 | 1,196.53 | 1,933.86 | 2,671.18 |

| 2036 | 1,980.64 | 3,753.63 | 5,526.61 |

A quick Technical Analysis cheat sheet

If you're trading, keep these indicators on your radar:

- SMA (Simple Moving Average): Good for seeing the "big picture" price over time.

- EMA (Exponential Moving Average): More sensitive to recent moves—helps you spot a trend change early.

- RSI (Relative Strength Index): Tells you if the market is getting too greedy (overbought) or too scared (oversold).

- MACD: Shows you the strength and direction of the current momentum.

Combine these with candle patterns like the "Hammer" or "Evening Star," and you’ll have a much better shot at spotting a reversal.

The risks of the game

Investing in TAO isn't without its headaches. You’ve got volatility, tech risks, and the ever-changing world of crypto regulation. The best way to survive? Diversify your portfolio and don't ignore the news.

Disclaimer

This info is for general purposes only and is not financial advice. Crypto is high-risk. Always talk to a professional before making any big moves.