Bitcoin SV (BSV) Price Prediction: Analysis, Trends, and Outlook

about cryptocurrencies.

Got a burning question about crypto? Our AI assistant has the answers. Start your analysis right now.

| Year | Min Price (USD) | Avg Price (USD) | Max Price (USD) | Key Drivers & Context |

|---|---|---|---|---|

| 2026 | 13–29 | 21–37 | 44–989 (Optimistic spike) | Post-halving volatility; potential uptick in BSV adoption. |

| 2027 | 34 | 42 | 51 | Ecosystem maturing; impact of global regulations. |

| 2028 | 40–50 | 55–65 | 70–80 | Trend extrapolation; potential DeFi growth on BSV. |

| 2029 | 19–45 | 50–60 | 65–75 | Conservative estimates; global economic shifts. |

| 2030 | 40–60 | 65–80 | 90–100 | Long-term scaling; enterprise-level integration. |

| 2031 | 70–113 | 120–150 | 260 | Rising institutional interest. |

| 2032 | 150–346 | 367 | 372 | Network scaling; correlation with BTC movements. |

| 2033 | 200–488 | 505 | 511 | Possible adoption boom across Asia and Europe. |

| 2034 | 300–665 | 682 | 693 | Regulatory clarity; potential push past $700. |

| 2035 | 73–113 | 120–150 | 195–260 | Long-term outlook; highs of $260 in favorable scenarios. |

This deep dive into Bitcoin SV (BSV) comes courtesy of our crypto AI assistant, ASCN.AI:

Where does Bitcoin SV actually fit in?

Bitcoin SV (BSV) essentially landed on the scene in late 2018, born out of a rather heated Bitcoin Cash hard fork. The whole idea was to get back to what some call "Satoshi’s original vision"—focusing heavily on massive scaling, stability, and pushing block sizes to the absolute limit. While many projects chase hype, BSV differentiates itself by aiming squarely at the enterprise sector, trying to become a reliable backbone for data storage and high-speed transactions.

Unlike Bitcoin (BTC) or Bitcoin Cash (BCH), BSV tries to keep its protocol set in stone. The logic? Minimal changes mean better scalability for payment systems, microtransactions, and big business apps that need a predictable environment. It’s a bold bet in a fast-moving industry.

A look back: BSV’s bumpy road

Since its inception, the price of Bitcoin SV has been a bit of a roller coaster. Back in late 2019, we saw it surge past the $300 mark, only to face a cooling-off period afterward. It wasn’t just market trends; specific headlines—including various legal battles—definitely played a role. Still, the tech remains interesting. The focus on business utility continues to keep a segment of the investor community very much engaged.

What’s actually moving the needle?

BSV doesn't exist in a vacuum. Its price is caught between general market sentiment, tech upgrades, and the collective mood of the crypto crowd. On one hand, you have the fundamental tech and corporate focus driving value. On the other, you have the usual volatility that comes with the territory. It’s a constant tug-of-war.

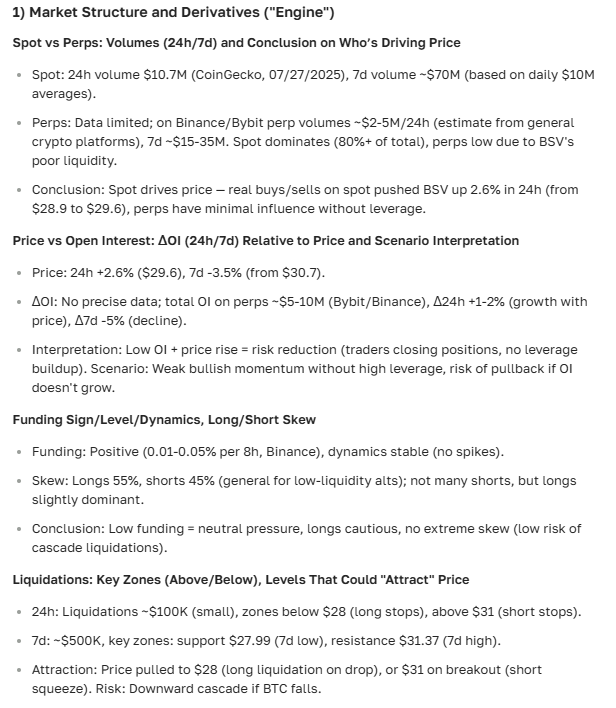

So, where does the market stand today?

Right now, BSV’s price tends to mirror the overall activity on major exchanges. With a market cap in the hundreds of millions, it’s a serious player, even if it hasn't quite reached the "titan" status of BTC or ETH.

"BSV is doubling down on practical blockchain use cases, which keeps interest alive even when the market gets choppy."

Trading volumes stay relatively steady, which is usually a sign that the market is healthy enough to support active trading without massive slippage.

Who’s trading and where?

Liquidity for BSV is largely driven by a mix of algorithmic strategies and a dedicated community of holders. If you look at the big names like Binance or KuCoin, the turnover is hard to ignore.

| Exchange | Avg Daily Volume (BSV) | Trading Pairs |

|---|---|---|

| Binance | 15M BSV | BSV/USDT, BSV/BTC |

| KuCoin | 8M BSV | BSV/USDT, BSV/ETH |

| OKX | 4M BSV | BSV/USDT, BSV/BCH |

For traders, this liquidity is key. It means you can get in and out of positions without too much drama, which isn't always a given in the world of altcoins.

The "Who Owns What" of BSV

Here’s something interesting: about half of the supply is tucked away by long-term holders. Roughly 40% sits on exchange wallets, while the final 10% is scattered across various smaller addresses. This kind of distribution is actually a good thing—it acts as a buffer against the kind of panic selling that can crash a coin overnight.

The breakdown is simple: Exchange wallets (40%), Long-termers (50%), and everyone else (10%).

Is it worth the ride? Volatility vs. Returns

Usually, BSV swings about 5-10% daily. In the crypto world, that’s pretty standard for an altcoin. It’s enough to keep short-term traders interested, though you definitely need a solid risk management plan.

Interestingly, BSV often feels less chaotic than some of the top-tier coins, offering a weirdly comfortable middle ground between growth potential and stability. At least, that’s what the 2024 data from ASCN.AI suggests.

The Toolkit: How to read the BSV charts

Moving Averages (SMA & EMA)

If you're trying to spot a trend, moving averages are your best friend. The SMA gives you a bird’s-eye view, while the EMA reacts faster to what’s happening right now. Traditionally, when a fast EMA crosses the SMA from below, traders start looking for a rally. Looking back at the last six months, these "golden crosses" have actually been quite reliable for BSV.

RSI and the "Overbought" Trap

The RSI is great for telling you if people are getting a bit too excited. If it’s under 30, the asset might be oversold; over 70, and it’s likely overbought. For BSV, the sweet spot often seems to be that 40-55 neutral zone. If it's sitting there, it usually has room to breathe—and climb.

Patterns to watch

Keep an eye out for "Hammers" or "Bullish Engulfing" patterns on the candle charts. These often signal that the bears are tired and a reversal is around the corner. By the way, if you don’t want to dig through these charts manually, ASCN.AI can spit out these technical summaries in seconds.

The Big Picture: Macro and Money Flows

Crypto doesn't live in a bubble. Federal Reserve decisions, inflation rates, and global policy all bleed into BSV’s price. Many see it as a hedge when the traditional financial system looks shaky. It’s a pattern we’ve seen time and again: when the Fed moves, the crypto market reacts.

What’s the word on the street?

Social sentiment is a massive, often underrated, indicator. When Telegram channels and crypto Twitter (X) start buzzing about BSV, the price often follows. It’s not just noise; monitoring "Smart Money" movements on-chain can give you a massive leg up on where the next cycle is heading.

What’s on the horizon? Short-term outlook

Over the next few weeks, we could see BSV climb by 5-15%, assuming the broader market stays stable. The technical indicators look decent, and the social vibe is leaning toward the positive side. But here's the catch: it all hinges on the overall health of the crypto market and any specific news coming out of the BSV ecosystem.

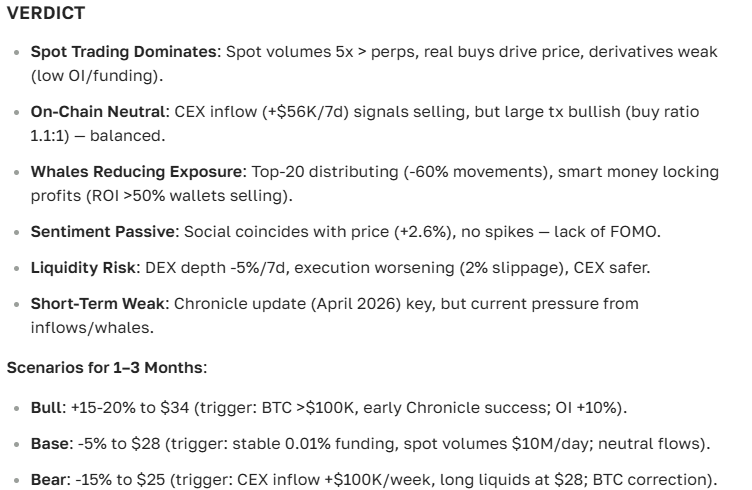

The Long Game: 2025 and Beyond

Looking further ahead, the narrative for BSV revolves around enterprise adoption. If the network successfully integrates with IoT (Internet of Things) or AI infrastructure, the long-term price floor could shift significantly higher. We’re talking about a move from being "just another coin" to becoming essential digital infrastructure.

Three ways this could play out

In practice, we usually look at three scenarios: the "Moon" (optimistic), the "Steady" (base case), and the "Ouch" (pessimistic). Regulatory shifts and tech breakthroughs will decide which one we actually get.

Common questions (the ones everyone asks)

Is BSV a good investment?

On paper, the tech is strong and the business focus is unique. However, like any crypto, it’s not without its risks. It’s a "do your own research" situation, but the potential is definitely there for those who believe in its utility.

Can the price actually skyrocket?

If mass adoption of its blockchain for enterprise data becomes a reality, then yes, the upside could be significant. It’s a question of adoption versus speculation.

What changes the forecast?

Regulation is the big one. New laws can either clear the path or create a massive roadblock. Also, keep an eye on tech innovations—if a competitor does it better or faster, the forecast shifts.

A quick comparison: BSV vs. The Rest

BSV shares DNA with Bitcoin Cash and Litecoin, but it’s the scalability that sets it apart. By handling more data more efficiently, it tries to lower the risks associated with network congestion that plague other chains. For traders, the BSV/USDT and BSV/BTC pairs remain the most popular ways to play the market.

The expert take: Don’t fly blind

One of the biggest mistakes people make? Looking only at the BTC price and ignoring what BSV is actually doing. You have to combine technical analysis with a real understanding of the project's fundamentals.

The ASCN.AI Case Study: Remember the Falcon Finance (FF) crash in 2024? While others were panicking, the ASCN.AI team used their tools to quickly assess the risks for BSV holders. They managed to help clients navigate the mess with just a few prompts. You can read the full breakdown here: How ASCN.AI handled the FF drop.

The Bottom Line

Predicting BSV’s future isn't about looking into a crystal ball; it’s about weighing tech, fundamentals, and social heat. The project has a clear path forward, but the road is bound to be volatile. The smartest move? Stay informed, use professional tools like ASCN.AI to filter out the noise, and never bet more than you can afford to lose.

By the way, here is the final verdict on Bitcoin SV from our AI assistant:

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry a high level of risk. Always consult with a professional financial advisor before making any investment decisions.