Bitcoin Cash (BCH) Price Prediction for 2025-2035 — Price, News, and Outlook

about cryptocurrencies.

You can ask any question about cryptocurrencies to our crypto AI assistant. Start your analysis right now.

| Year | Price range (USD) | Average price (USD) | Key drivers and risks |

|---|---|---|---|

| 2026 | $250 – $600 | ~$400 | Post‑2025 rally; CashTokens adoption, payments +30%. Risks: correction after BTC peak, SEC regulations, low TVL. |

| 2027 | $300 – $700 | ~$500 | Network upgrades (SmartBCH v2); emerging markets, remittances. Risks: geopolitics, competition from Solana, internal disputes. |

| 2028 | $350 – $800 | ~$550 | Synergy with BTC halving; global payments (BitPay). Risks: MiCA in the EU, miner centralization. |

| 2029 | $400 – $900 | ~$650 | Cycle peak; TVL >$1B, asset tokenization. Risks: “crypto winter”, loss of developer interest. |

| 2030 | $450 – $1,100 | ~$750 | Maturity as a payments L1; AI integration, market cap >$15B. Risks: altcoins (LTC), quantum threats. |

| 2031 | $500 – $1,200 | ~$800 | Transition phase; fiat inflation, Africa/Asia adoption. Risks: global crises, migration to BTC L2. |

| 2032 | $550 – $1,400 | ~$900 | New halving cycle; global standards, PoW improvements. Risks: mining energy, audits. |

| 2033 | $600 – $1,500 | ~$1,000 | Bullish peak; mass usage (20%+ of payments). Risks: network hacks, G20 regulations. |

| 2034 | $650 – $1,700 | ~$1,100 | Consolidation; scalability >1M TX/day, metaverses. Risks: market saturation, competition from CBDCs. |

| 2035 | $700 – $2,000 | ~$1,200 | Institutionalization; dominance in P2P payments. Risks: tech shifts, BTC dominance. |

Here’s how our crypto AI‑assistant ASCN.AI frames this Bitcoin Cash analysis:

“Forecasting Bitcoin Cash’s price requires close attention to market signals and Web3 data that combine on‑chain metrics with sentiment. That’s what gives investors and traders the most relevant picture.”

Getting started with Bitcoin Cash

What is Bitcoin Cash?

Bitcoin Cash is an independent cryptocurrency that emerged in 2017 after a hard fork from Bitcoin. The core idea behind BCH was to tackle Bitcoin’s scalability issues by increasing the block size, which speeds up transaction processing and cuts fees. In practice, this lets Bitcoin Cash keep the security and decentralization of the original chain while handling far more traffic.

Compared with most altcoins, BCH is built more like digital cash: fast confirmations and relatively low transaction costs are the main selling points.

Bitcoin Cash pushed the block size up to 32 MB, so it can pack in many more operations and keep user fees down.

History and key traits of BCH

The Bitcoin Cash concept crystallized in August 2017, when part of the Bitcoin community pushed to raise the block size from 1 MB to 8 MB and beyond. That move boosted the network’s throughput, which is exactly why BCH feels more suited for everyday payments.

Key characteristics of Bitcoin Cash include:

- A larger block‑size cap (now 32 MB), which supports much higher throughput;

- Lower transaction fees than the original Bitcoin;

- Regular protocol upgrades to tighten security and expand functionality;

- An active, hands‑on community of developers and users focused on real‑world use.

How Bitcoin Cash differs from Bitcoin and other cryptos

Bitcoin Cash is a Bitcoin fork that keeps most of the underlying architecture, but takes a different route on scaling. While Bitcoin leans heavily on security and keeps blocks small, BCH leans into capacity—faster confirmations and cheaper operations are the trade‑off.

| Cryptocurrency | Block size | Main use case | Transactions per second (TPS) |

|---|---|---|---|

| Bitcoin (BTC) | 1 MB | Store of value | ~7 |

| Bitcoin Cash (BCH) | 32 MB | Medium of exchange | >100 |

| Ethereum (ETH) | Dynamic | Smart contracts | ~30 |

| Litecoin (LTC) | 1 MB | Fast payments | ~56 |

BCH stands out as a payments‑oriented coin, and that directly shapes its long‑term prospects and price outlook.

Bitcoin Cash price today and recent moves

Live BCH price snapshot

Bitcoin Cash’s price right now is a textbook example of crypto volatility. The rate bounces around with shifts in demand, big news, and overall market cap swings.

Over the last month, BCH has seen both rallies and pullbacks that mirror broader crypto trends and a few sector‑specific events.

Cryptos like BCH can easily swing 10% or more in a single day, so tracking the price closely and reacting quickly matters a lot.

Dollar moves and currency effects

Bitcoin Cash’s price is tightly linked to the US dollar, since most trading happens in USD. Macro factors—central‑bank policy, inflation, and global economic conditions—indirectly nudge BCH’s value.

When the dollar strengthens, crypto caps, including BCH, often take a hit. That’s why it pays to keep an eye on currency correlations if you’re trading or investing.

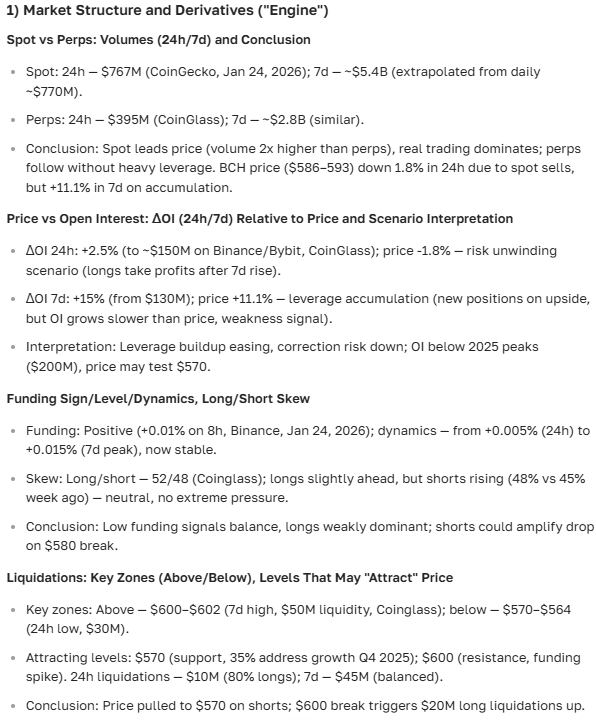

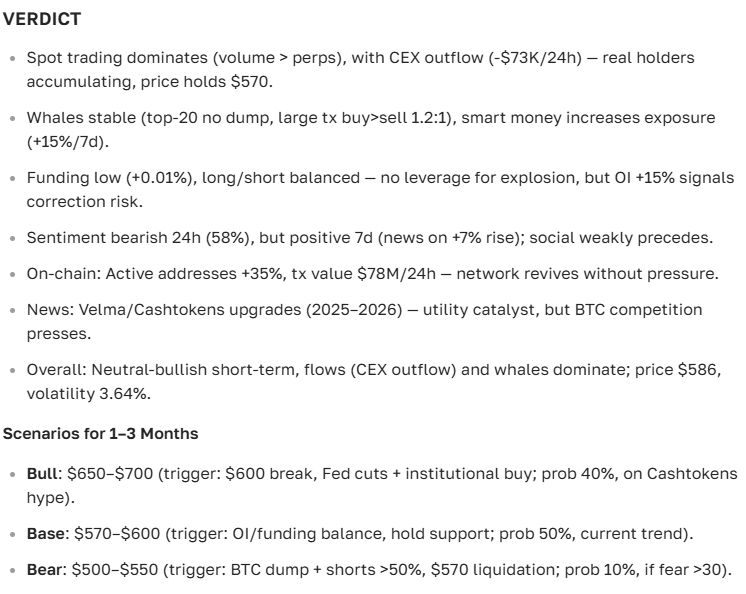

Short‑term Bitcoin Cash price outlook

Forecast for today and tomorrow

Near‑term BCH projections are built from on‑chain data, market trends, and chatter on DEXs, CEXs, social media, and blockchain nodes. If sentiment stays positive and the community is active, you can expect swings of roughly +/- 3–5% unless some big external shock hits.

Monthly outlook

Looking out a month, the view shifts to protocol upgrades, regulatory shifts, and broader market trends, including BCH integrations into DeFi and Web3.

According to ASCN.AI’s internal estimates, Bitcoin Cash could gain 5–15% by month‑end if conditions stay favorable and the market holds up.

Possible “rip” and sharp moves

“Ripping” means a sudden spike or crash in BCH’s price over a short window. Triggers can be news, whale trades, or protocol changes. These moves often hit 10% in just a few hours, so traders need to stay on their toes.

News and events that move BCH

Latest crypto‑market news

The crypto market reacts fast to any major headline. For Bitcoin Cash, the big ones are protocol upgrades, new partnerships, DeFi and NFT integrations, and moves by institutional players.

Technical updates tend to boost investor confidence and can push BCH’s cap higher.

Regulatory shifts and tech upgrades

Regulation has a real bite on prices, including Bitcoin Cash. New restrictions or, conversely, regulatory support can spark sharp moves.

At the same time, tech upgrades shore up security and can give the price and adoption a healthy lift.

Analysis and advice: is Bitcoin Cash worth buying?

Growth potential analysis

Bitcoin Cash still looks interesting for anyone who wants a fast, low‑cost way to pay. Growing use in Web3 and even parts of the Ethereum ecosystem supports a positive medium‑term narrative. If the broader market stays calm, BCH could be a decent bet for the next few months.

Community and forum sentiment

Forum and community chatter usually shows cautious optimism around BCH: many expect some upside, but they also warn about wild swings. That lines up with ASCN.AI’s internal sentiment scan, which flags a generally positive mood.

Historical price action and charts

Year‑long BCH price chart

Over the past year, Bitcoin Cash’s price has been all over the place: rallies followed by sharp corrections. At times, the coin has jumped 80–120% in relatively short stretches. Holding key support levels (around $150) and breaking resistance (around $300) helps traders spot the next trend.

Reading historical patterns

Historically, BCH tends to react faster to news than many altcoins. Those support and resistance zones act as early signals for new trends.

Frequently asked questions (FAQ)

| Question | Answer |

|---|---|

| How will BCH’s price move in the near term? | In the short run, expect swings of a few percent from the current level, depending on market sentiment and news. |

| What does “rip” mean for BCH? | A sharp spike or drop in price over a short period, usually triggered by news, whale trades, or protocol changes. |

| How do news events affect crypto prices? | Positive news tends to push caps higher; negative news can trigger sell‑offs. |

| Can Bitcoin Cash reach $500? | Yes—given its scalability and low fees, BCH can realistically clear that level in the near future. |

| Could BCH hit $1,000? | It’s possible with strong adoption and tech progress, maybe around 2028–2029. |

| What are BCH’s long‑term growth prospects? | If the project stays adaptable and keeps community support, BCH could surpass $2,000 by 2040 and keep climbing. |

ASCN.AI case study: trading the 11 October 2024 flash crash

In October 2024, during a sharp flash crash, ASCN.AI’s team spotted a drop in activity among large BCH holders and a spike in negative social sentiment. That early warning helped traders close positions in time and limit losses. Once the market stabilized, BCH rebounded about 8% in just one week.

More details: Flash‑crash profit case study

Risks and warnings

Crypto markets, including Bitcoin Cash, are notoriously volatile and prone to wild swings. Investors should carefully weigh the risks, stay on top of news and regulation, and remember that forecasts are not guarantees.

Disclaimer: This information is for general guidance only and does not replace advice from a qualified financial professional.

What an investor should do now

- Monitor on‑chain data and crypto‑community sentiment so you can react quickly to market shifts;

- Use technical analysis with indicators like SMA, EMA, RSI, and candlestick patterns;

- Factor in macroeconomic conditions and the dollar’s strength when sizing crypto positions;

- Apply solid risk management and prepare multiple scenarios;

- Lean on professional analytics tools such as ASCN.AI to get cleaner, more reliable data.

Internal links and extra reading

Wrapping it up

Bitcoin Cash still holds an edge thanks to high throughput and low fees. Combined with ongoing upgrades and a generally positive market mood, that sets the stage for moderate price gains over the next few months and years.

Blending on‑chain metrics, sentiment, and technical indicators helps build more balanced forecasts and keeps risk in check.

For smarter trading and investment decisions, it helps to use professional analytics tools and keep a close eye on major news and regulatory developments.

That’s the verdict our crypto AI assistant ASCN.AI delivers:

Disclaimer

The information provided is general in nature and does not constitute financial advice. Investing in cryptocurrencies involves a high degree of risk. Always consult qualified financial professionals before making any investment decisions.