Bitcoin cryptocurrency forecast for 2025-2035: what investors can expect

about cryptocurrencies.

Got a question about crypto? Fire it off to our crypto AI assistant. Kick off your analysis right now.

| Year | Price Range (USD) | Avg Price (USD) | Key Drivers & Risks |

|---|---|---|---|

| 2026 | $90,000 – $250,000 | ~$150,000 | Post-2025 peak; ETF inflows, big institutions jumping in. Risks: pullback, regs (US elections). |

| 2027 | $150,000 – $350,000 | ~$220,000 | Building to 2028 halving; DeFi boom, worldwide pickup. Risks: geopolitics, sanctions. |

| 2028 | $200,000 – $500,000 | ~$300,000 | Halving (April); supply crunch, rally time. Risks: miners dumping, wild swings. |

| 2029 | $300,000 – $700,000 | ~$450,000 | Cycle top; CBDC tie-ins, remittances. Risks: "crypto winter," EU's MiCA rules. |

| 2030 | $400,000 – $1,000,000 | ~$600,000 | Super cycle wrap; BTC as "digital gold" (> $5T cap). Risks: alts stealing shine, quantum threats. |

| 2031 | $500,000 – $1,200,000 | ~$750,000 | Transition phase; fiat inflation, Web3 push. Risks: recession, crises. |

| 2032 | $600,000 – $1,500,000 | ~$900,000 | Halving; global reserve talk (G20). Risks: mining energy drama. |

| 2033 | $800,000 – $2,000,000 | ~$1,200,000 | Bull peak; mass adoption (50%+ countries). Risks: hacks, forks. |

| 2034 | $1,000,000 – $2,500,000 | ~$1,500,000 | Consolidation; AI-blockchain mashups, L2s. Risks: market saturation. |

| 2035 | $1,200,000 – $3,000,000 | ~$1,800,000 | Institutional lock-in; country reserves. Risks: quantum computers. |

Our crypto AI assistant crunched this Bitcoin outlook:

«Forecasting Bitcoin's price and outlook isn't easy—the market's all over the place with so many moving parts. But digging into Web3 data and on-chain metrics lets us nail down solid estimates and keep investors in the loop.»

«Our forecasts pull from unique Web3 data and on-chain signals, bumping up Bitcoin price prediction accuracy.»

Today's Crypto Prices and Swings

Right now, crypto prices are shaped by a mix of global and local vibes. Demand, supply, macro stuff—it's all in play. Bitcoin, the market king by cap, leads the charge. Alts tag along.

Prices flip every second. Traders watch the action live.

Top Coins: Prices and Gains

| Coin | Price (USD) | 24h Change (%) | Market Cap (USD) |

|---|---|---|---|

| Bitcoin (BTC) | 87,000 | +1.8 | 1.74T |

| Ethereum (ETH) | 2,930 | +1.2 | 350B |

| Binance Coin | 315 | +0.9 | 53B |

| XRP | 0.75 | +3.5 | 37B |

| Cardano (ADA) | 0.38 | +2.0 | 13B |

| Solana (SOL) | 22.4 | +1.8 | 9B |

| Polkadot (DOT) | 6.4 | +1.2 | 9B |

| Dogecoin (DOGE) | 0.075 | +4.0 | 10B |

| Avalanche (AVAX) | 16 | +3.0 | 11B |

| Terra (LUNA) | 2.3 | +3.8 | 3.2B |

Bitcoin's edging up about 2% today. Ethereum's steady with just over 1%. Alts like XRP and Doge are popping harder—3.5% and 4%.

«Bitcoin's market is climbing thanks to better macro conditions and institutions piling in.» — BTC Positive/Negative Factors Analysis, ASCN.AI (2024).

The market's bouncing back from that recent dip. On-chain stats show cash flowing into BTC—wallets with 1000+ BTC bulked up 2.3% in a week.

Dollar's Grip on Crypto Prices

The dollar's moves hit Bitcoin and others straight on. Most trades are in USD. Over the last six months, dollar index and BTC have this steady inverse dance.

«Dollar vs. Bitcoin correlation's held for half a year—they zig when the other zags.» — Crypto vs. Fiat: How AI Spots the Gap, ASCN.AI (2024).

Charts make it clear: dollar drops, Bitcoin climbs. Investors shift to alts when fiat weakens. Dollar fades—crypto becomes the safe spot.

ASCN.AI's Web3 flows and on-chain data back this up. DXY under 103? BTC averages 3-5% weekly gains. More at: Crypto vs. Fiat: How AI Spots the Gap.

Crypto Price Forecasts: What's Ahead?

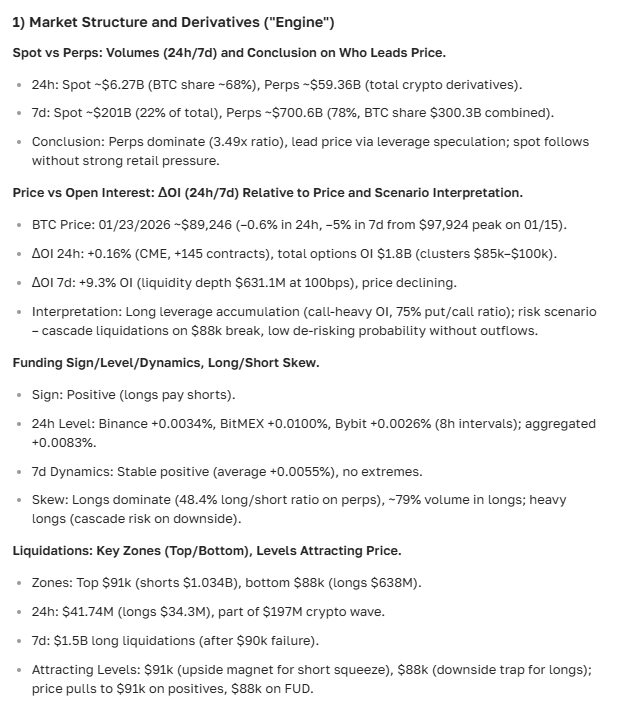

What Drives Ups and Downs?

Bitcoin's price swings hinge on news, regs, tech upgrades, and whale moves.

- Funds scooping BTC? Prices jump.

- Tighter rules? Trust dips, corrections hit.

- Protocol tweaks boost long-term value.

- Whale buys or sells amp the volatility.

«Fund news and institutional ETF launches shake up Bitcoin's market big time.» — BTC Positive/Negative Factors Analysis, ASCN.AI (2024).

Fresh ETF launches are giving the market a lift. But volatility's still king—news can flip things fast. Wintermute's weekly note flags retail shifting from alts to BTC and ETH ahead of holidays, liquidity thinning out.

US regs are ramping up: SEC's eyeing spot ETF apps, potentially pulling in $50-100B from institutions yearly. Europe's rolling out MiCA for clearer crypto ops.

Market Mood: Fear & Greed Index

Crypto's fear and greed gauge is stuck in "extreme fear" territory. As of Dec 24, 2024, it's at 24/100—folks leaning toward dumps.

Dec 23 trading saw US Bitcoin spot ETFs bleed nearly $188M net. Third straight outflow day for BTC funds. ETH ETFs lost $95M.

Scary, right?

Wintermute experts point to crypto digging into institutions, corps, and users—laying groundwork for mid-term price pops. Key bit: BTC has to lead for riskier stuff to follow.

History shows extreme fear often flips to rallies. Back in 2023, index at 21-26 in Jan/Mar led to 40% BTC gains in two months.

Long-Term BTC Outlook: 5-20 Years

Long-haul BTC forecasts lean on growth models. Conservative 5% yearly bump from here:

| Year | Projected Price (USD) | Price Change (%) |

|---|---|---|

| 2026 | 91,265 | +5.0 |

| 2030 | 110,933 | +27.6 (from 2025) |

| 2035 | 141,582 | +62.9 (from 2025) |

| 2040 | 180,698 | +107.9 (from 2025) |

Optimistic 10% annual growth:

| Year | Projected Price (USD) | Price Change (%) |

|---|---|---|

| 2026 | 95,700 | +10.0 |

| 2030 | 127,435 | +46.6 (from 2025) |

| 2035 | 205,211 | +136.1 (from 2025) |

| 2040 | 330,374 | +280.1 (from 2025) |

Heads up: These are trend-based models, skipping black swans, reg shifts, tech leaps. Hashrate (mining power) tracks BTC price tight—VanEck says odds favor gains next six months.

Stock-to-Flow model, factoring halving scarcity, eyes $200K-$300K by 2028. Critics call it too simple, but 2020-2024 data correlates strong (0.87).

Expert Takes and Forecasts

«Bitcoin powers through key levels with conviction—long-term, it's still climbing.»

Market's betting on a slow grind past $100K soon, assuming no harsh bans and institutions keep buying.

Glassnode analysts note long-term holders (155+ day inactive addresses) at record 14.8M BTC. Less supply floating means squeezes and rallies ahead.

Latest Crypto News and Price Impact

Big Events and Announcements

US regulators dropped anti-money-laundering rules for crypto clarity—sparked a quick dip. But big funds poured into BTC, keeping the uptrend alive.

BlackRock added $1.2B BTC in December, hitting $28B AUM in crypto. Fidelity rolled out institutional ETH custody and staking at 4.5% APY.

Dive deeper on regs: How US Policy & Econ Shape Crypto.

Forum Buzz and Community Reactions

Dubai's Blockchain Life forum hashed out crypto's future and macro ties. Big talk on AI tools for market scans.

«AI tools spot hidden trends and let you react fast to crypto shifts.» — Bitcoin & AI in 2025, ASCN.AI (2024).

Crowd loved BTC growth calls and market-wide bets. Lots on buying dips now. Forum-goers said newbies miss cues relying on headlines alone. Tools like ASCN.AI aggregate on-chain, news, even Telegram vibes in seconds.

Check: How AI & Blockchain Transform Crypto Analysis.

Investment Tips: Buy Crypto Now?

Risks vs. Opportunities

Crypto investing's volatile as hell. Risks: regs clamping down, tech glitches, market fiddling. Upside: growth in digital assets like BTC.

Risk Scenarios:

- Sudden Regs: Bans or strict KYC/AML could tank prices 20-40%.

- Tech Weak Spots: Network attacks or bugs trigger panic sells.

- Whale Games: Big holders shake prices for profit.

Common Investor Goofs:

- Buying tops on FOMO hype.

- No stop-losses or risk plans.

- All eggs in one basket.

- Ignoring fundamentals and news.

Weigh forex moves and whale signals before jumping in. On-chain says whales (1000+ BTC) up 4.7% last 30 days—often precedes pumps.

More: All About Crypto in 2025.

Top Picks for Next Month

| Coin | Growth Forecast (%) | Support Factors |

|---|---|---|

| Bitcoin (BTC) | +15 | Institutional demand surge |

| Ethereum (ETH) | +12 | Upgrades, DeFi tokenomics |

| Binance Coin | +8 | Exchange ecosystem boost |

| Solana (SOL) | +10 | Tech updates, partnerships |

| Cardano (ADA) | +7 | Ecosystem expansion |

«Institutional buys, tech upgrades, partnerships fuel top cryptos.» — All About Cardano, ASCN.AI (2024).

Narrows your portfolio picks nicely. ETH shines with Dencun cutting L2 fees 90%. Solana's NFT/DeFi action up 35% in transactions monthly.

Automating Crypto Forecasts

Tech now automates market digs with on-chain, news feeds, AI. Traders react quick, decisions sharp.

Key Automation Plays:

- API Data Grabs: Platforms like ASCN.AI hand over market stats, on-chain, news via API.

- Trading Bots: Auto-trade on strategies with MAs, RSI, MACD.

- On-Chain Tracking: Watch whales, exchange flows, network shifts for trend flips.

- AI News Scrubbers: ML and NLP gauge sentiment, uncover signals.

ASCN.AI in Action:

ASCN.AI blends Web3 data, on-chain, news for spot-on BTC calls. On Falcon Finance dump, two prompts flagged downside signals—clients dodged losses fast.

«Falcon Finance crash? ASCN.AI spotted sell signals in two prompts, helping cut losses quick.» — ASCN.AI Falcon Finance (FF) Case | $1000 in 2 Prompts, ASCN.AI (2024).

Full case: ASCN.AI on Falcon Finance Drop.

Beginner Step-by-Step:

- Pick Solid Platforms like ASCN.AI, Glassnode, Messari for data.

- Set Alerts for whales, hashrate shifts, reg news.

- Deploy Bots for indicator-based trades.

- Backtest Strategies on past data first.

- Update Models as market evolves.

Python bots (ccxt, pandas, ta-lib) nail scalping, arb, trends. Backtests show MA + RSI yielding 12-18% yearly on wild rides like Solana.

FAQ: Common Crypto Questions

What’s "Rip" Mean in Crypto?

"Rip" or "ripnut" is slang for a sharp price plunge. Think sudden 20-50% drop with crazy volatility. Traders say a coin "ripped" when it tanks fast.

How Fast Do Prices Change?

Real-time, second-by-second. Hinges on news, events, whales. BTC can swing $1K-$2K hourly on big announcements.

Trusted News Sources?

Stick to project sites, top analytics like Glassnode, vetted aggregators, moderated crypto forums.

Market Crashing Hard? What Now?

- Stay calm, no rash moves.

- Scan news for the trigger.

- Hit stop-losses to cap pain.

- Hedge with derivatives if needed.

- Diversify to spread risk.

Wrap-Up

Bitcoin forecast looks upbeat short-term amid macro tailwinds and institutional hunger. Volatility and risks linger, but $100K+ feels in reach medium-term. Long-range 5-20 year views see big lifts if fundamentals hold.

Smart investing means eyeing regs, news, solid sources. Dodge pitfalls, manage risks, automate with on-chain and AI.

ASCN.AI's your 24/7 crypto sidekick—fuses on-chain, news, metrics for sharp calls. Sub at $29/month, skip pricey tool stacks.

ASCN.AI's BTC verdict:

SAR Case: Dodging Losses with ASCN.AI

Falcon Finance token crash? ASCN.AI experts nailed downside signals in two prompts—clients reacted fast, losses trimmed. Platform scanned on-chain, news, whale action to call the dump pre-drop.

Another win: Oct 11 flash crash night. ASCN.AI's Web3 data and alerts let folks cut losses and flip volatility for gains. Breakdown: Oct 11 Night | Flash Crash Profit Case.

Proves the platform's chops for live crypto action.

Final Thoughts

Today's BTC forecast draws from deep dives on market drivers, news, Web3 gold. Near-term growth looks solid if conditions stay friendly. 5-20 year paths point huge, but watch volatility, regs, tech hurdles.

Track news close, use trusted feeds, skip emotions, automate for better shots.

Thanks for tapping ASCN.AI — expertise that delivers on crypto.

Disclaimer

This info's general, not financial advice. Crypto carries high risk. Consult pros before moves.